Get the free End of the Year Activities for Upper Elementary

Get, Create, Make and Sign end of form year

Editing end of form year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out end of form year

How to fill out end of form year

Who needs end of form year?

Understanding the End of Form Year Form: A Comprehensive Guide

Understanding the end of form year form

The end of form year form is essential for individuals and businesses alike, marking the conclusion of a financial year. This document serves as a formal submission to tax authorities, ensuring all income, deductions, and credits are accurately reported. For many, these forms facilitate tax return preparations and ensure compliance with federal and state regulations.

The importance of annual form submissions cannot be overstated. They not only reflect your income but also allow you to claim credits and deductions, potentially lowering your tax liabilities. Failing to submit these forms accurately or on time can lead to penalties, interest on unpaid taxes, and complications should an audit occur.

Key dates and deadlines are crucial. Generally, forms such as W-2 and 1099 must be submitted by January 31 of the following year. However, individual states might have different deadlines or requirements, making it essential to be aware of local rules to avoid any trouble.

Types of end of form year forms

Several common end-year forms exist, with the W-2 and various 1099 forms being the most widespread. The W-2, or Wage and Tax Statement, is used by employers to report wages paid to employees and the taxes withheld. Conversely, 1099 forms categorize different types of income received by non-employees, such as freelance work, interest payments, and dividends.

Other essential forms include the 1040, which is the standard individual tax return and K-1 forms for reporting income from partnerships or S-corporations. Understanding when and why to use each form can make tax filing more straightforward.

Choosing the right form involves assessing your employment type, your relationship with income sources, and any tax classifications applicable to your financial activities. This initial step is fundamental in aligning with IRS requirements and ensuring accurate representation of income.

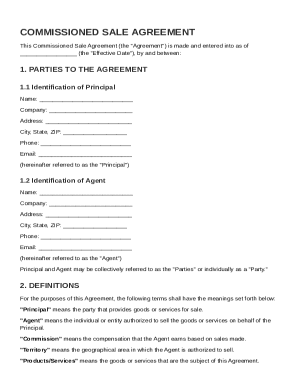

Step-by-step instructions for filling out the end of form year form

Filling out the end of form year form can be an intricate task involving numerous details. Start by gathering all necessary information, which includes social security numbers, employer identification numbers, and financial records from the year. Recommended documents to reference include last year’s tax return, W-2 or 1099 forms received, and bank statements.

Once you have this information, it’s time to fill the form section by section. Begin with the personal information section, ensuring your name and address are correctly entered. Next, move to the income reporting section where you’ll outline all sources of income, followed by the tax withholding section that details what has been withheld for taxes throughout the year. Lastly, don’t forget to include your signature and date to validate the document.

Common mistakes include misentering figures, failing to report all income, or misunderstanding classifications, particularly for freelancers or those with multiple income streams. Taking the time to review your entries is vital in preventing these pitfalls.

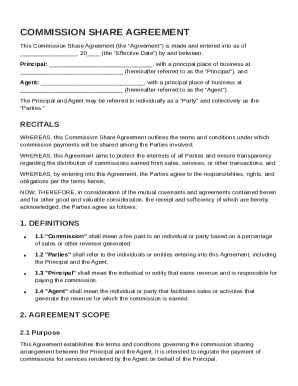

Editing and customizing your form

Utilizing platforms like pdfFiller for editing your end of form year form offers an interactive solution to creating precise documents. The user-friendly interface with tools allows for easy text modifications, field adjustments, and integration of required information on standard templates.

To upload and edit your documents in real time, simply log into the pdfFiller platform, choose the form, and make the necessary changes. This digital process streamlines submissions and reduces the likelihood of errors associated with handwritten forms.

Additionally, adding digital signatures is a vital step. Using pdfFiller, you can create secure electronic signatures that ensure authenticity and compliance with legal standards. Never underestimate the importance of secured signatures to bolster your document's integrity.

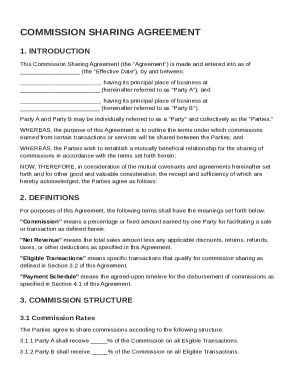

Collaborating with others

Leveraging the collaborative features of pdfFiller allows you to invite team members or advisors for feedback on your end of form year form. This feature not only enhances accuracy but also encourages a comprehensive review process before final submission.

Managing permissions and edits is straightforward, allowing team members to contribute and suggest modifications without the risk of unauthorized changes. This collaborative approach is invaluable for individuals or teams working together on tax forms and ensures everyone is on the same page.

Utilizing version history tracks changes, giving you insights into edits made throughout the process. This feature is especially helpful in environments where modifications can occur frequently, ensuring that you can revert to earlier versions when necessary.

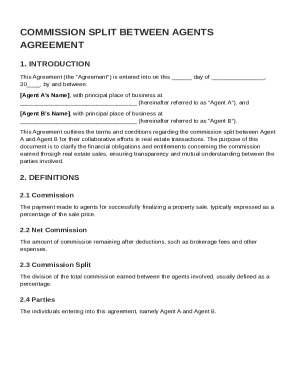

Submitting your end of form year form

Submission methods vary between e-filing and paper filing. E-filing is gaining popularity due to its speed and efficiency, allowing for immediate acknowledgment of receipt. It often reduces errors by using software that checks for common mistakes before submission.

On the other hand, paper filing can still be a necessary option for those preferring a tangible copy or who have unique submission circumstances. Ensure that you send paper copies to the appropriate IRS address based on the type of form and your state of residence. For e-filing, numerous platforms and tax software solutions are available, each with their specific guidelines.

Post-submission considerations

Once your end of form year form is submitted, keeping accurate records is paramount. Recommended practices include storing copies of all submitted forms and documents for at least three years, in line with IRS guidelines. Maintain digital records safely to ensure they are protected against loss.

If you need to amend submitted forms, the process can involve submitting a corrected form. Understanding how to respond to inquiries or audits is equally critical; always be prepared with documentation that can support your claimed income and tax deductions.

Frequently asked questions (FAQs)

Addressing common concerns regarding the end of form year form is crucial for clarity. For instance, if you miss the deadline, consider filing as soon as possible and check if the IRS offers any relief measures to avoid penalties.

Corrections on forms should be approached with care; if errors are discovered post-filing, amend the form using the appropriate process. Additionally, if your financial situation changes after filing, keep detailed records and be aware of how those changes could affect your tax obligations for the year.

Keep exploring related topics

Taxpayer resources available via pdfFiller empower users to delve deeper. You can find extensive guides on tax preparation and filing to further your understanding of the tax landscape. Engaging with these materials can prepare you for the intricacies of your financial obligations.

Understanding evolving tax rules and laws is vital. Resources that detail federal and state regulations offer insights into any changes that may impact your end of form year form submissions. The more informed you are, the better you can manage your tax responsibilities efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my end of form year in Gmail?

How can I send end of form year for eSignature?

Can I sign the end of form year electronically in Chrome?

What is end of form year?

Who is required to file end of form year?

How to fill out end of form year?

What is the purpose of end of form year?

What information must be reported on end of form year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.