Get the free Arizona Form 2025 Arizona Partnership Income Tax Return ...

Get, Create, Make and Sign arizona form 2025 arizona

How to edit arizona form 2025 arizona online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona form 2025 arizona

How to fill out arizona form 2025 arizona

Who needs arizona form 2025 arizona?

Arizona Form 2025: A Comprehensive Guide to Your Tax Filing Needs

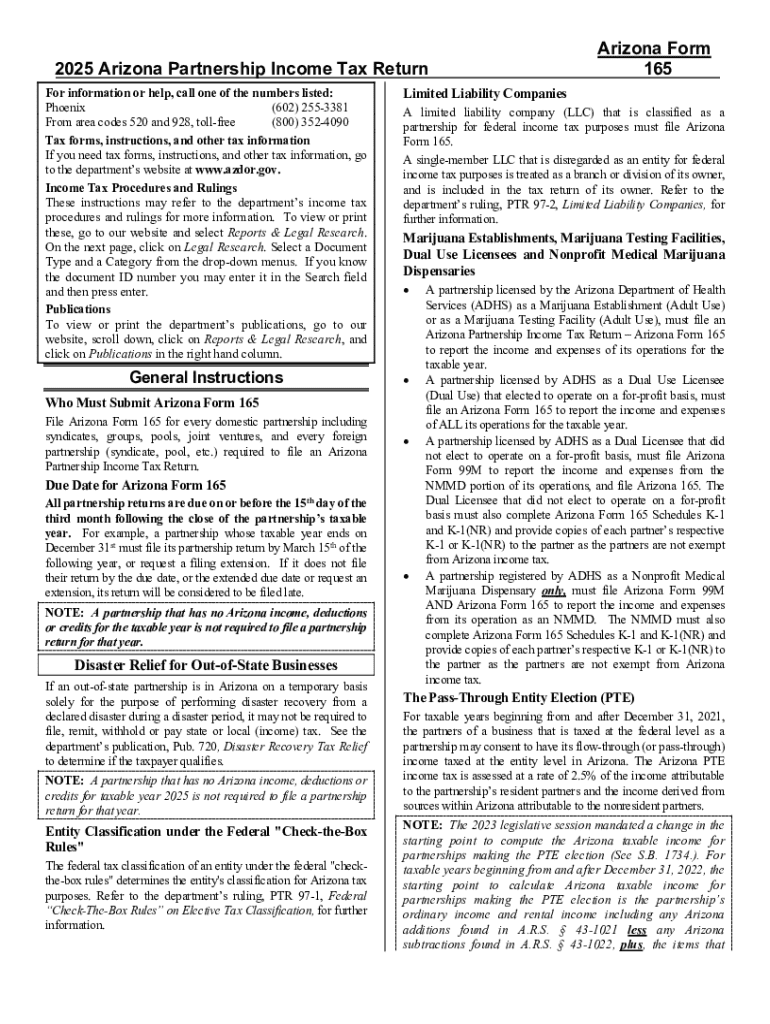

Understanding Arizona Form 2025

Arizona Form 2025 is a pivotal document in the state's tax filing system, specifically designed for individual taxpayers. This form serves multiple purposes, primarily facilitating the submission of income tax returns to the Arizona Department of Revenue. For taxpayers, filling out this form accurately ensures compliance with state tax laws and the correct calculation of any taxes owed or refunds due.

In 2025, several significant updates have been made to Form 2025. Notably, enhancements have been introduced to streamline the process, making it easier for taxpayers to gather information and submit their returns. These changes are critical for ensuring that all taxpayers understand their tax obligations while taking advantage of available credits and deductions.

Key sections of Arizona Form 2025

Arizona Form 2025 is structured into several main sections, each focusing on different aspects of a taxpayer’s information and financial status.

Preparing to fill out Arizona Form 2025

Before diving into the completion of Arizona Form 2025, it’s essential to gather necessary documents and information. Taxpayers need to have their identification documents ready, including a government-issued ID and proof of Arizona residency, which could be a utility bill or lease agreement.

Additionally, financial documents play a critical role. Having your W-2s, 1099s, and other relevant income statements is vital. Efficiently gathering this information beforehand can greatly smooth out the filing process and reduce the likelihood of mistakes.

Step-by-step guide to completing Arizona Form 2025

Completing Arizona Form 2025 can be made much simpler by following a detailed, step-by-step approach.

Common mistakes to avoid include entering incorrect figures, neglecting to sign the form, or overlooking applicable deductions. Always double-check your entries before submission.

Editing and making changes to Arizona Form 2025

If you need to update your information on Arizona Form 2025 after submission, it’s important to understand the steps involved. You can typically correct minor errors by submitting an amended return. Ensure you reference the specific changes made to avoid complications.

For those using pdfFiller, editing tools are readily available. You can utilize cloud-based features to amend your form quickly, and collaboration options allow team members to contribute their insights or corrections effectively. This ensures your information remains up-to-date without the headache of manual changes.

Signing and submitting Arizona Form 2025

After completing Arizona Form 2025, the next step involves signing and submitting your return. Electronic signatures are a convenient option many taxpayers opt for, making the process quicker and more efficient.

Be mindful of important deadlines for submission to avoid late penalties, especially during peak tax season.

Tracking your Arizona Form 2025 submission

Confirmation of receipt is a critical step in ensuring your Arizona Form 2025 update has been accepted. Taxpayers can often check for confirmation through the Arizona Department of Revenue’s online portal.

For added peace of mind, there are tools available for tracking the status of your submission. If any issues arise, contacting the department’s support team will prove essential to resolving your queries.

Managing your Arizona Form 2025 with pdfFiller

Utilizing pdfFiller for document management provides myriad benefits especially tailored for handling forms like Arizona Form 2025. Secure storage of your forms ensures you can always access important documents while minimizing risks of data loss.

Moreover, the easy retrieval and editing access offered by pdfFiller simplify the entire tax filing process. The advantages of cloud-based solutions enhance teamwork by allowing multiple users to collaborate on documentation with ease, improving productivity and accuracy.

FAQs about Arizona Form 2025

Common questions regarding Arizona Form 2025 often revolve around specific filing requirements and troubleshooting submission issues. Keep in mind that the respective deadline for the filing of income tax returns typically falls in mid-April, so prepare your documentation well in advance.

For additional assistance, reach out to the Arizona Department of Revenue or utilize online resources that provide clarity on specific terms and necessary actions if you encounter challenges with your filings.

Additional tips for successful document management

Organizing your documents is paramount for ensuring a smooth tax filing experience. Keep your forms, receipts, and other financial documents stored in a designated area, both physically and electronically.

Interactive tools and resources

pdfFiller offers a range of interactive calculators and tools to assist users in navigating Form 2025. From estimating potential refunds to identifying eligible deductions, these resources simplify the often-complex world of tax filings.

Visual guides and templates are readily available, making the process even more user-friendly and approachable for individuals and teams alike.

Success stories from pdfFiller users

Many pdfFiller users have experienced smooth transitions to the updated Arizona Form 2025 through the platform's robust tools. Testimonials often highlight the ease of use and collaborative features that have improved their overall productivity.

Case studies reveal how teams, utilizing pdfFiller, can work more effectively without the friction traditionally associated with document management, resulting in timely and accurate tax submissions.

Current trends and future outlook for Arizona tax forms

Recent changes in Arizona tax regulations reflect an ongoing evolution in compliance and documentation requirements. As the state aims to modernize its approach to tax administration, taxpayers can expect further enhancements to the forms used for filings.

Staying ahead of these potential updates will benefit taxpayers immensely, facilitating a smoother filing process and ensuring compliance with any new amendments or revisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my arizona form 2025 arizona directly from Gmail?

How do I make changes in arizona form 2025 arizona?

How do I edit arizona form 2025 arizona on an iOS device?

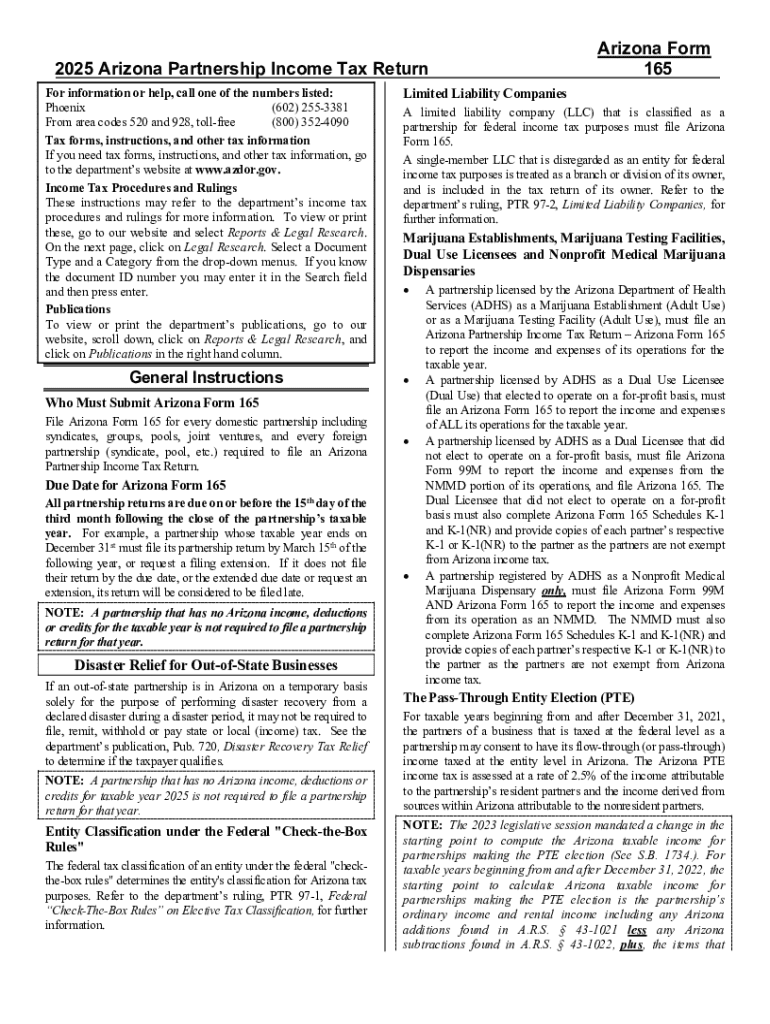

What is Arizona Form 2025?

Who is required to file Arizona Form 2025?

How to fill out Arizona Form 2025?

What is the purpose of Arizona Form 2025?

What information must be reported on Arizona Form 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.