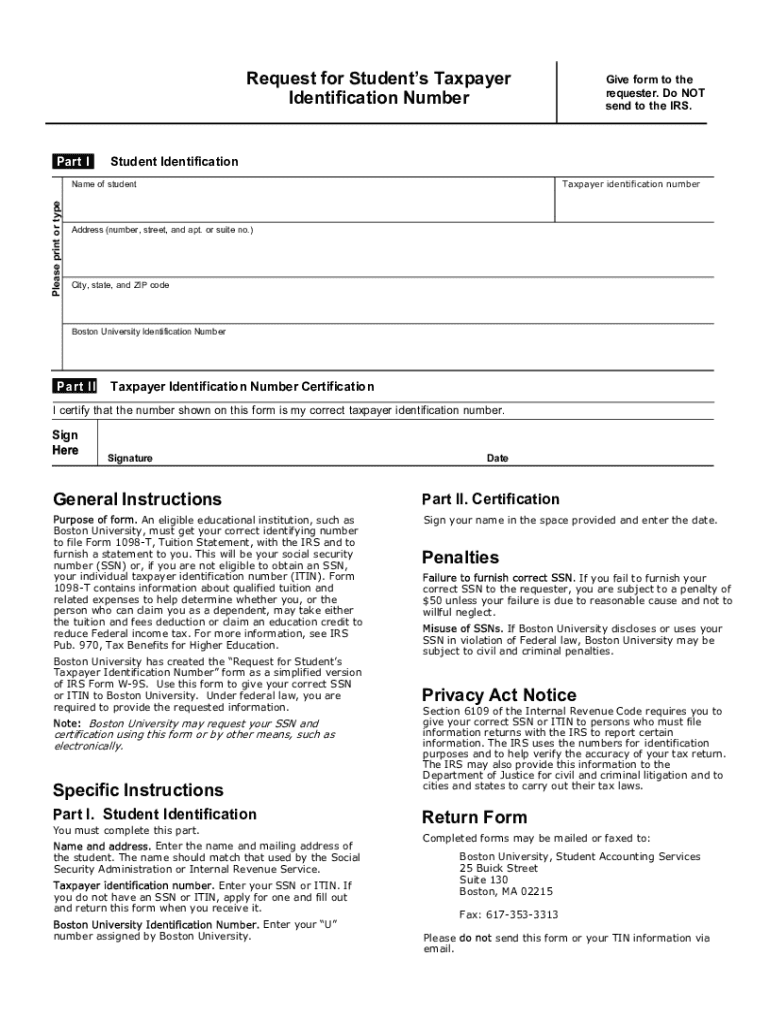

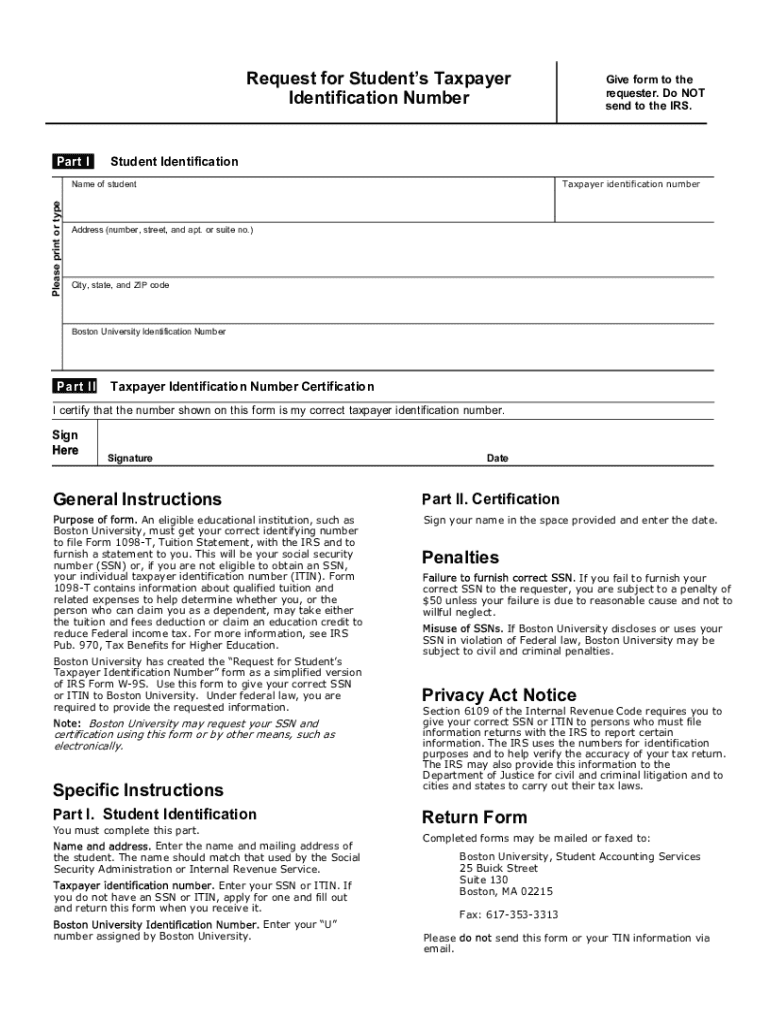

Get the free Request for Student's Taxpayer Identification Number Form.New Address

Get, Create, Make and Sign request for student039s taxpayer

How to edit request for student039s taxpayer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out request for student039s taxpayer

How to fill out request for student039s taxpayer

Who needs request for student039s taxpayer?

Request for Student039's Taxpayer Form: A Comprehensive How-to Guide

Understanding the importance of the taxpayer form

The taxpayer form is a fundamental document that holds significant importance for Student039. It's not just a piece of paper; it is crucial for establishing financial accountability. For students, this form is vital for managing educational finances, ensuring compliance with federal regulations, and maximizing available financial aid. Student039 needs to request this form as it may influence eligibility for grants, scholarships, and other financial aid programs, making it a crucial component of their educational journey.

Timely submission of the taxpayer form brings several benefits. For one, it aids in the preparation of tax returns, which can lead to substantial refunds, providing much-needed financial support for students. Furthermore, it is often a prerequisite for determining the eligibility for various forms of financial assistance including federal loans, state grants, and institutional scholarships. Missing out on these opportunities due to late submission can have long-lasting effects on Student039’s financial stability.

Types of taxpayer forms relevant to students

For Student039, understanding the various taxpayer forms is essential. The most common forms are the IRS Form 1040 and the simplified 1040-EZ. These forms cater to different income levels and complexities. Form 1040 allows for a comprehensive report of income, deductions, and credits, while 1040-EZ is designed for simpler tax situations. It is crucial for students to use the correct form to avoid processing delays.

Another important form for students is Form 1098-T, which reports tuition payments and qualifying expenses to the IRS. This form can play a pivotal role in determining eligibility for education credits. Additionally, students may also need to be aware of state-level taxpayer forms that might be relevant based on their educational institution's location. Each form serves a specific purpose and understanding these can ensure accurate reporting and maximization of financial benefits.

Steps to request Student039's taxpayer form

Requesting Student039's taxpayer form is a systematic process that involves several essential steps to ensure a smooth experience. The first step is to confirm Student039's association with the educational institution. This typically means checking current enrollment status, which may include full-time or part-time status, and verifying any eligibility requirements set by the institution.

Next, it’s crucial to collect the necessary personal information. Required documentation usually includes the Social Security Number, financial records, and any previous correspondence from the school regarding financial matters. Being aware of important dates and deadlines for submission can greatly streamline the process and prevent unnecessary delays.

After gathering the necessary information, the next step is to choose the right channel to submit the request. Many institutions provide an online portal for easy requests. If this option is unavailable, alternatives such as email or phone calls may need to be considered. Drafting a clear and concise request is essential.

Drafting the request

When drafting the request for Student039's taxpayer form, clarity and urgency are key. A sample email template might begin with a polite greeting and follow with a concise statement of purpose: 'Dear [Financial Aid Office/Registrar], I hope this message finds you well. I am writing to request a copy of the IRS taxpayer form for Student039, as it is essential for compiling our tax information for this academic year.'

In the request, ensure to include essential elements such as: Student039’s full name, identification number, the specific form being requested, and any deadlines for submission that may apply. Being thorough yet respectful in the message greatly enhances the likelihood of a prompt response. After sending the request, it's important to follow up if no response is received within a reasonable timeframe.

Filling out the taxpayer form

Once Student039 acquires the taxpayer form, it’s imperative to fill it out accurately. Understanding the key sections of the form is essential for ensuring all required information is reported correctly. Common pitfalls include missing signatures, incorrect Social Security Numbers, and failing to account for all income sources. Taking the time to review the form before submission can help mitigate these issues.

Utilizing digital tools such as pdfFiller can significantly streamline the process of filling out taxpayer forms. With features that allow for easy edits, users can fill in necessary fields efficiently, and with templates available for rapid completion, pdfFiller becomes a powerful ally in this process. Ensuring the form is filled out accurately reflects positively on Student039’s financial record.

Collaborating on taxpayer form management

Once the taxpayer form is accurately filled out, sharing it with relevant parties becomes the next important step. Sharing securely via platforms like pdfFiller ensures that sensitive information is protected. Users can manage permissions and determine who can view or edit the document, which is essential for maintaining confidentiality while collaborating with financial advisors or family members.

Another crucial aspect is signing the form, as many institutions require an electronic signature for official documents. pdfFiller offers a simple step-by-step process to add an electronic signature, making it easy for Student039 to finalize the document quickly and efficiently, thereby accelerating the overall handling of tax-related matters.

Managing form submission and tracking

After submitting the taxpayer form, it's prudent to manage the submission effectively. Keeping thorough records of submissions, including confirmation emails or tracking numbers, is a best practice. This can help mitigate disputes and serve as proof of timely submission. pdfFiller's tracking capabilities allow users to monitor changes and keep tabs on the document status, which adds an extra layer of convenience.

Once submitted, following up with the institution is advisable if no confirmation is received within a specific timeframe. Retaining a copy of the submitted form for personal records is essential, not only for personal tracking but also for reference in future tax evaluations or financial discussions.

Troubleshooting common issues

As with any administrative process, encountering issues during tax form submission can be daunting. Common challenges include delayed processing times or forms being rejected due to inaccurate information. Addressing these issues promptly is vital to prevent cascading effects on financial aid and tax liabilities. Familiarizing oneself with reasons for rejections, such as incorrect information or missing signatures, can help in successfully navigating the process.

Utilizing resources provided by pdfFiller can assist students in overcoming these hurdles. Their customer support resources offer guidance in real-time, while tutorials and help sections within the platform provide insights into common issues and solutions. Grasping these tools enhances the user experience, making it easier to manage taxpayer form-related queries.

Staying informed about tax regulations and updates

Staying up-to-date with changes in tax regulations is paramount for Student039, especially when dealing with taxpayer forms. Regular updates from the IRS and financial aid offices ensure that students remain compliant and informed about potential changes that could affect their financial standings. Additionally, pdfFiller strives to keep users informed through a wide array of resources and alerts, ensuring that students can act promptly to any regulatory changes.

Understanding the shifting landscape of tax regulations helps mitigate risks and allows Student039 to maximize available benefits. Joining mailing lists from relevant financial institutions or subscribing to updates from organizations such as the IRS can ensure timely access to critical information.

Conclusion - The streamlining power of pdfFiller

In summary, the process of requesting and managing Student039's taxpayer form is multifaceted but manageable, especially when leveraging a comprehensive document management solution like pdfFiller. Its capabilities not only simplify form completion and collaboration but also enhance overall organization and tracking, which are crucial for preparing tax documents efficiently. Utilizing these tools empowers students to navigate their financial responsibilities with greater confidence.

With the challenges posed by tax regulations and the importance of financial documentation, pdfFiller stands as an essential ally for students. By streamlining the paperwork involved with taxpayer forms, students like Student039 can focus more on their education and less on administrative hassles—ultimately furthering academic and financial success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit request for student039s taxpayer online?

How do I make edits in request for student039s taxpayer without leaving Chrome?

How do I complete request for student039s taxpayer on an Android device?

What is request for student039's taxpayer?

Who is required to file request for student039's taxpayer?

How to fill out request for student039's taxpayer?

What is the purpose of request for student039's taxpayer?

What information must be reported on request for student039's taxpayer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.