Get the free Third Quarter Fiscal 2020 North America Retail

Get, Create, Make and Sign third quarter fiscal 2020

Editing third quarter fiscal 2020 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out third quarter fiscal 2020

How to fill out third quarter fiscal 2020

Who needs third quarter fiscal 2020?

A Comprehensive Guide to the Third Quarter Fiscal 2020 Form

Understanding the third quarter fiscal 2020 form

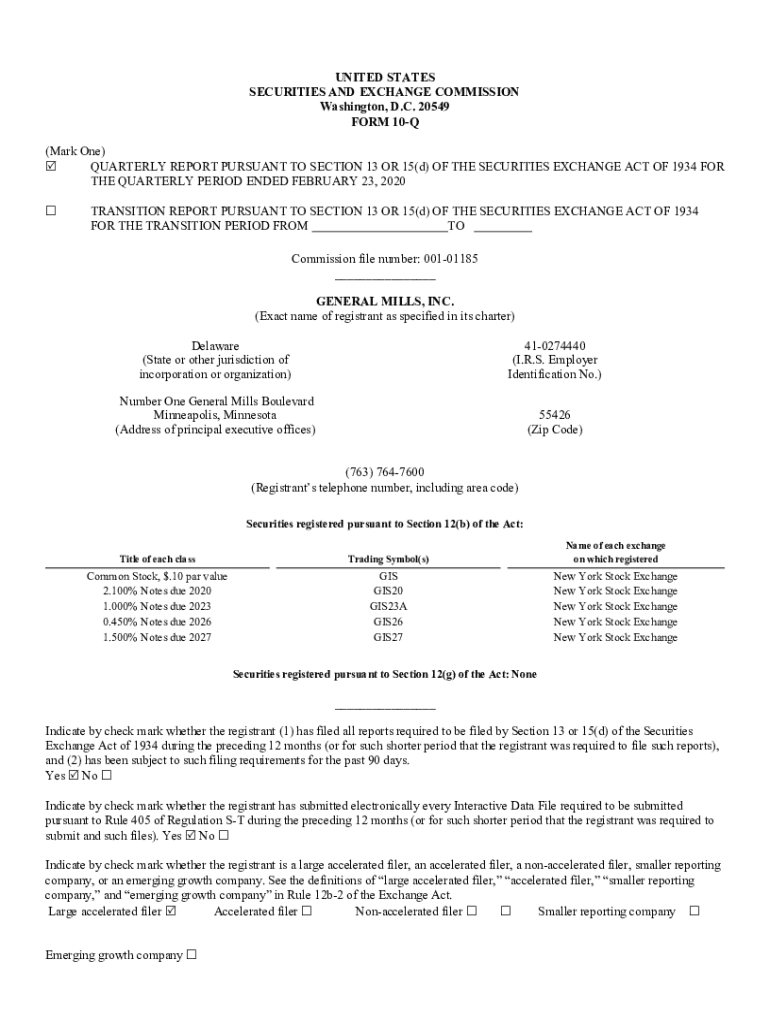

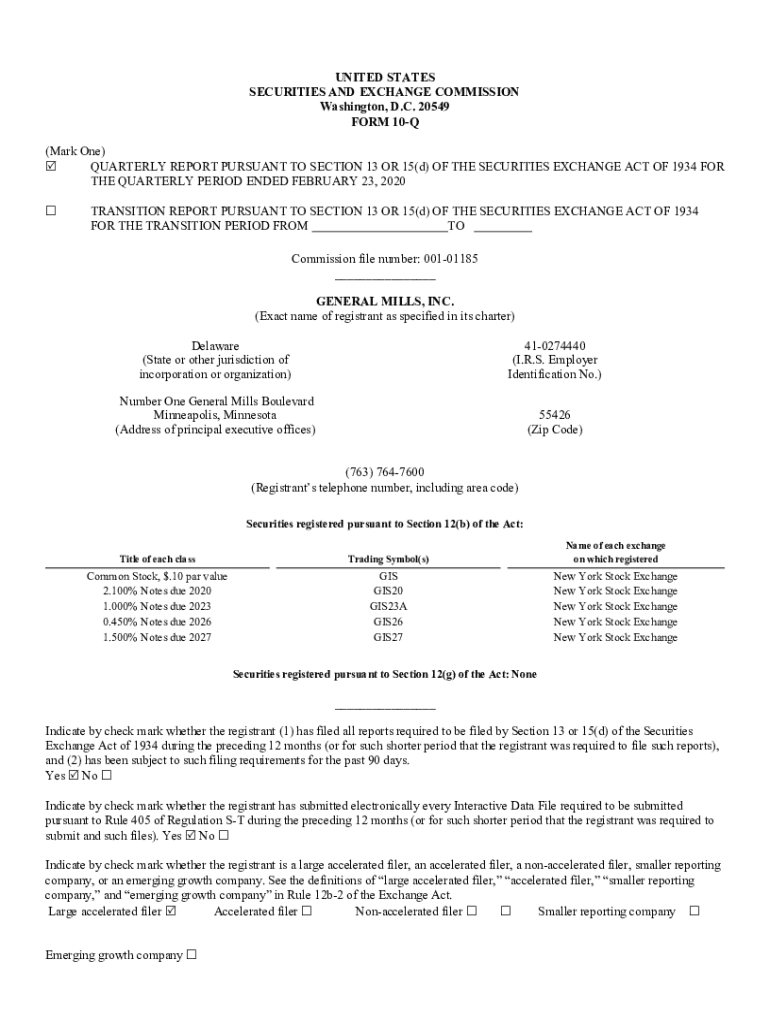

The third quarter fiscal 2020 form serves as an essential tool for businesses to report financial and operational developments that occurred within the third quarter of the fiscal year. Quarterly reporting is vital for investors and stakeholders to evaluate performance and make informed decisions. It allows companies to reflect on their strategies and navigate the ever-changeable landscape, especially crucial amidst the challenges posed by the pandemic.

This reporting period specifically focuses on fiscal 2020, a year marked by unprecedented events that impacted global economies. Stakeholders, including shareholders, analysts, and regulatory bodies, rely on accurate reporting to assess risks, investments, and market strategies.

Key components of the form

The third quarter fiscal 2020 form encompasses several critical components. The financial performance section delves into revenue figures, net income calculations, and year-over-year comparisons. These benchmarks help stakeholders gauge a company's performance relative to industry standards and previous quarters.

Operational highlights provide insight into the strategic initiatives undertaken during the quarter. Major developments such as shifts in operations due to the pandemic, supply chain disruptions, or expansions into new markets should be emphasized. Furthermore, the form needs to address compliance with accounting standards and regulatory requirements. Accurate compliance fosters transparency and builds trust in corporate governance.

Preparing your data

Compiling accurate data for the form is paramount. Key financial statements must be organized meticulously to reflect the company's current standing. Start by gathering information from internal records, including income statements, balance sheets, and cash flow statements. It’s also beneficial to incorporate market analysis data to contextualize your performance concerning external factors impacting your industry.

Consistency in reporting dates is crucial to ensure comparability. A systematic approach helps in identifying discrepancies or unusual trends. Establishing a data checklist ensures all necessary metrics are accounted for and enables error-free submissions.

Filling out the form

Filling out the third quarter fiscal 2020 form requires careful consideration at each stage. Begin by clearly defining each section according to the guidelines provided. Often, standard entries might include total revenues, cost of goods sold, and operating expenses. It’s important to review each line item to ensure accuracy.

Additionally, interpreting financial statements can often be daunting. Analyzing revenue streams involves exploring sources of income and understanding how they have been affected by economic conditions, such as declines in mail services or increased package volume. Understanding liabilities and equity sections allows companies to present a clear picture of their financial obligations and stakeholder equity.

After completing the form

Upon completion of the third quarter fiscal 2020 form, a rigorous review and editing process is essential. Cross-checking data for any discrepancies ensures the final document is accurate. Tools like pdfFiller can help streamline this process, allowing for easy edits and feedback from necessary stakeholders before submission.

When it comes to submission, best practices must be followed. Utilize digital eSigning options available through pdfFiller for a quick and secure signing process. Maintaining records of submitted forms is vital for future reference and to ensure that any responses from regulatory bodies can be addressed promptly.

Interactive tools for enhanced reporting

Integrating interactive tools can significantly enhance the reporting process for the third quarter fiscal 2020 form. pdfFiller provides a range of cloud-based capabilities that simplify editing and collaboration. Features such as version control allow teams to keep track of changes and maintain compliance seamlessly, ensuring the accuracy of data presented.

Utilizing these interactive tools, teams can work together effectively regardless of their physical location. Collaboration options enable simultaneous input, making it easier to develop comprehensive and accurate reports even when market conditions are fluid and subject to rapid change.

Case studies and examples

Examining real-world applications of the third quarter fiscal 2020 form reveals varied impacts across different industries. For instance, while many companies reported losses due to pandemic-related disruptions, others in the package delivery sector showed dramatic increases in volume, buoyed by an uptick in online shopping. Analyzing these divergent results provides valuable insights on how economic conditions can shape business narratives.

Case studies from major companies demonstrate effective strategies employed to mitigate mail declines and adapt to new operational challenges. Businesses that leveraged technology for efficient supply chain solutions fared better during this tumultuous time. Learning from such instances can guide future strategic initiatives and improve resilience in subsequent fiscal quarters.

Frequently asked questions (FAQs)

When engaging with the third quarter fiscal 2020 form, users often have several queries. For instance, how often should the form be updated? Typically, reports should be prepared quarterly to maintain transparency and aid stakeholders in decision-making. In cases where errors occur after submission, prompt communication with the regulatory body is advisable to rectify discrepancies.

Additionally, various resources are available to assist users in navigating fiscal reporting more efficiently. This can include consulting with accounting professionals or utilizing online platforms that specialize in document creation and management.

Contact information and support

For those in need of assistance with the third quarter fiscal 2020 form, pdfFiller offers comprehensive support services. Technical support is readily accessible via various communication channels to address any inquiries users may have regarding the functionality of the platform or the reporting process.

The user-friendly interface, coupled with knowledgeable staff, ensures a seamless experience. Whether you are looking for help with filling out the form, understanding compliance requirements, or troubleshooting issues, pdfFiller is committed to empowering users in their document management journeys.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the third quarter fiscal 2020 in Chrome?

How do I edit third quarter fiscal 2020 straight from my smartphone?

How can I fill out third quarter fiscal 2020 on an iOS device?

What is third quarter fiscal 2020?

Who is required to file third quarter fiscal 2020?

How to fill out third quarter fiscal 2020?

What is the purpose of third quarter fiscal 2020?

What information must be reported on third quarter fiscal 2020?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.