Get the free Interest and penalties on late taxes - Personal income tax

Get, Create, Make and Sign interest and penalties on

How to edit interest and penalties on online

Uncompromising security for your PDF editing and eSignature needs

How to fill out interest and penalties on

How to fill out interest and penalties on

Who needs interest and penalties on?

Understanding Interest and Penalties on Form: A Comprehensive Guide

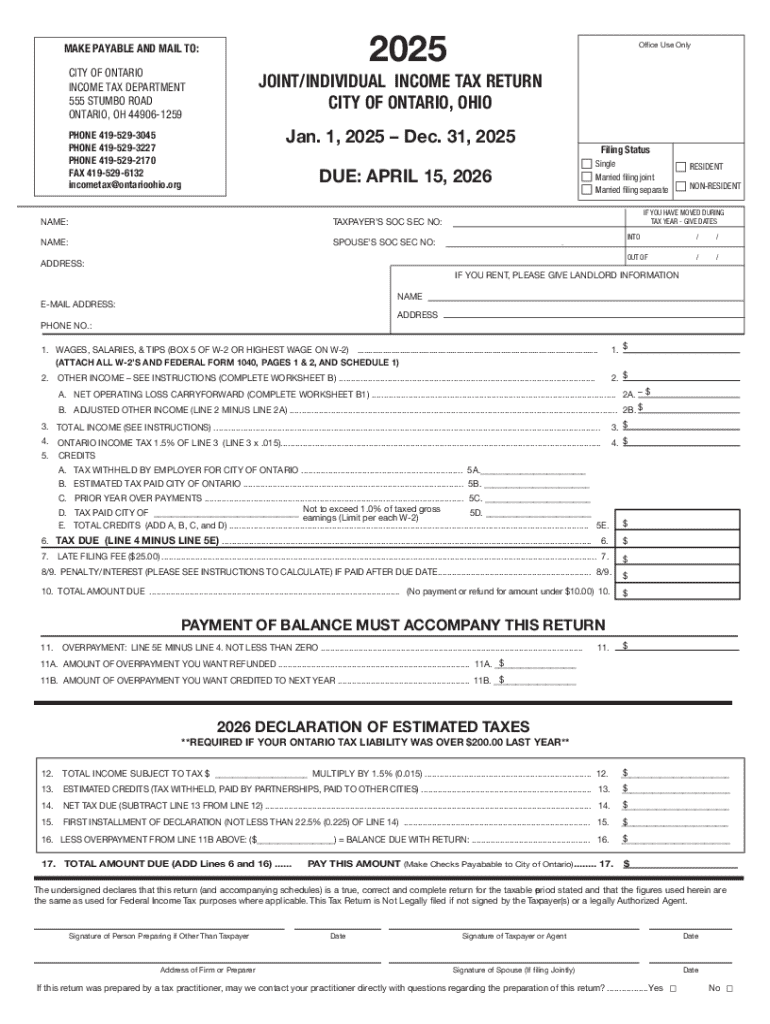

Understanding the concept of interest and penalties

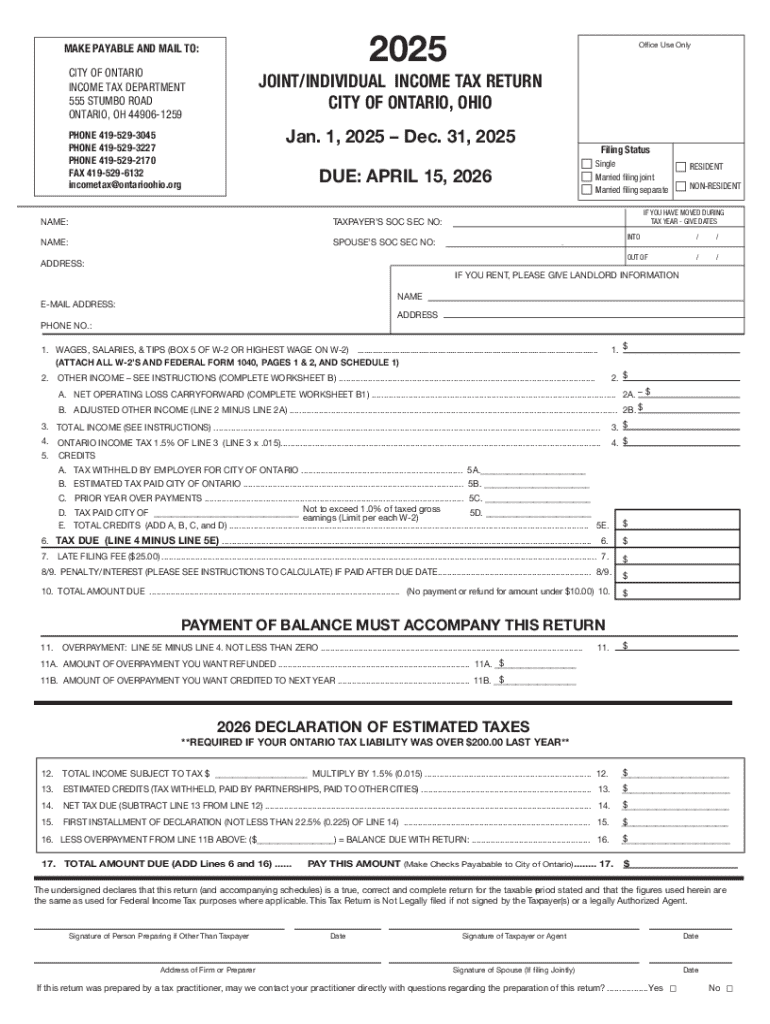

Interest and penalties refer to additional charges that may be imposed when there are issues related to taxation or obligations due to various actions, such as late payments or inaccurate filings. Interest is typically charged based on the overdue balance, while penalties are set amounts defined by regulations for specific situations, such as late submissions. These fees can accumulate quickly, significantly impacting individuals and businesses alike.

Awareness of interest and penalty charges is critical for managing your financial responsibilities effectively. Understanding how these charges arise and accumulate can save taxpayers from potential losses, making it imperative to stay informed. Ignoring deadlines or the importance of accuracy in forms can result in overwhelming amounts owed to tax authorities. Therefore, being proactive is key.

How interest and penalties are calculated

Calculating interest and penalties involves several methods and factors, making it essential for taxpayers to grasp these concepts thoroughly. Generally, interest is calculated based on the outstanding balance from the due date until the payment date. Penalties, on the other hand, are predetermined amounts that depend on the specific infraction. Different scenarios may lead to different calculations.

For example, if an IRS tax payment of $1,000 is due on April 15, and the payment is made three months late, the taxpayer may face interest and a late fee. Interest could accrue at a specific annual percentage, and the exact penalty amount would depend on IRS regulations at the time.

Common types of interest and penalties

Several types of interest and penalties can arise related to taxation and filings. Understanding these can help taxpayers avoid unexpected financial burdens.

The IRS perspective on interest and penalties

The IRS has detailed policies regulating interest and penalties, designed to encourage timely and accurate tax payments. Understanding these regulations is fundamental to avoiding unnecessary charges. The IRS updates its penalty structures periodically, which can lead to variations in amounts owed over time.

One common misconception is that penalties are arbitrary; however, they follow specific guidelines outlined in the Internal Revenue Code. Taxpayers who stay updated on these changes can make more informed decisions regarding their filings and payments.

Filing your form: how to avoid interest and penalties

Filing your forms accurately and on time is crucial in avoiding unnecessary interest and penalties. Begin by carefully completing all the required information on your tax forms, ensuring accuracy throughout. Common errors—like mathematical mistakes, incorrect personal information, or omissions—can lead to excessive charges.

Additionally, staying on top of deadlines is imperative. Marking deadlines on your calendar can make payment plans easier to manage. Payment due dates may differ from filing dates, so remain vigilant throughout the year.

Options for abatement of penalties

While penalties are uncomfortable, understanding the options available for their abatement can provide relief. For instance, taxpayers can seek abatement if they meet established criteria. Factors like first-time penalties or demonstrating reasonable cause can be essential for successful requests.

Filing for abatement requires necessary documentation, such as proof of timely past compliance, and understanding timing considerations to enhance approval chances. Completing this process with a credible approach can alleviate the impacts of penalties.

Interactive tools for managing forms and avoiding penalties

Utilizing interactive tools such as those available on pdfFiller can greatly enhance your document management. The platform offers features geared towards facilitating better management of forms and reducing the likelihood of errors that lead to penalties.

Moreover, pdfFiller provides access to templates and simplifies tracking document versions and signatures. By making document management more efficient, users can strategically avoid pitfalls that lead to penalties and financial loss.

Frequently asked questions about interest and penalties

Navigating issues around interest and penalties can raise many questions. Addressing common inquiries helps demystify the processes involved and provides clarity. Issues such as how to calculate penalties in specific scenarios or the procedures for filing an appeal are frequent concerns.

Additional tips for successful form management

Effective form management involves strategic organization and communication with authorities. Keeping documented records sorted can save valuable time and reduce stress when deadlines approach.

Leveraging technology, such as pdfFiller, can substantially improve the management of documents. This approach not only streamlines the filing process but also empowers users with tools that simplify oversight and foster compliance.

Summary of key takeaways

Navigating interest and penalties on form is a crucial aspect of fiscal responsibility. Awareness and understanding of how charges accumulate, how to avoid them, and what processes exist for their mitigation are key to managing one’s tax obligation effectively.

Staying informed on current laws and utilizing innovative tools like pdfFiller can significantly reduce the burdens of paperwork. Taking a proactive approach ensures compliance and minimizes the likelihood of incurring penalties or interest charges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my interest and penalties on in Gmail?

How do I make changes in interest and penalties on?

How do I edit interest and penalties on on an iOS device?

What is interest and penalties on?

Who is required to file interest and penalties on?

How to fill out interest and penalties on?

What is the purpose of interest and penalties on?

What information must be reported on interest and penalties on?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.