Get the free Taxpayer email address

Get, Create, Make and Sign taxpayer email address

Editing taxpayer email address online

Uncompromising security for your PDF editing and eSignature needs

How to fill out taxpayer email address

How to fill out taxpayer email address

Who needs taxpayer email address?

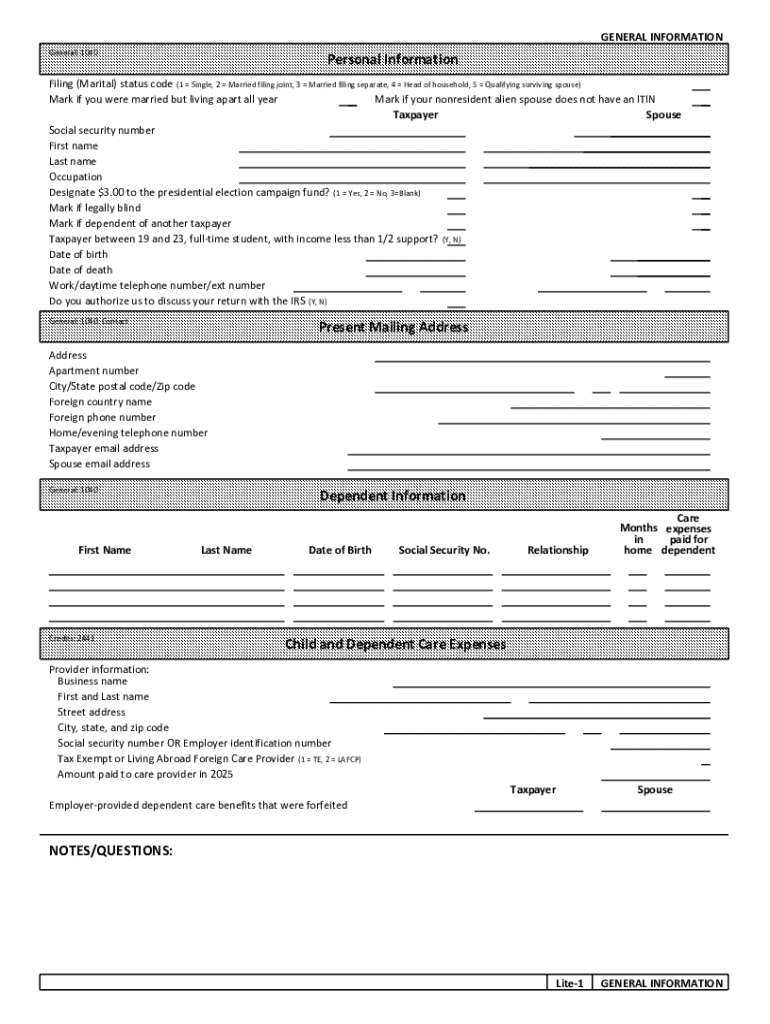

Understanding the Taxpayer Email Address Form

Understanding the taxpayer email address form

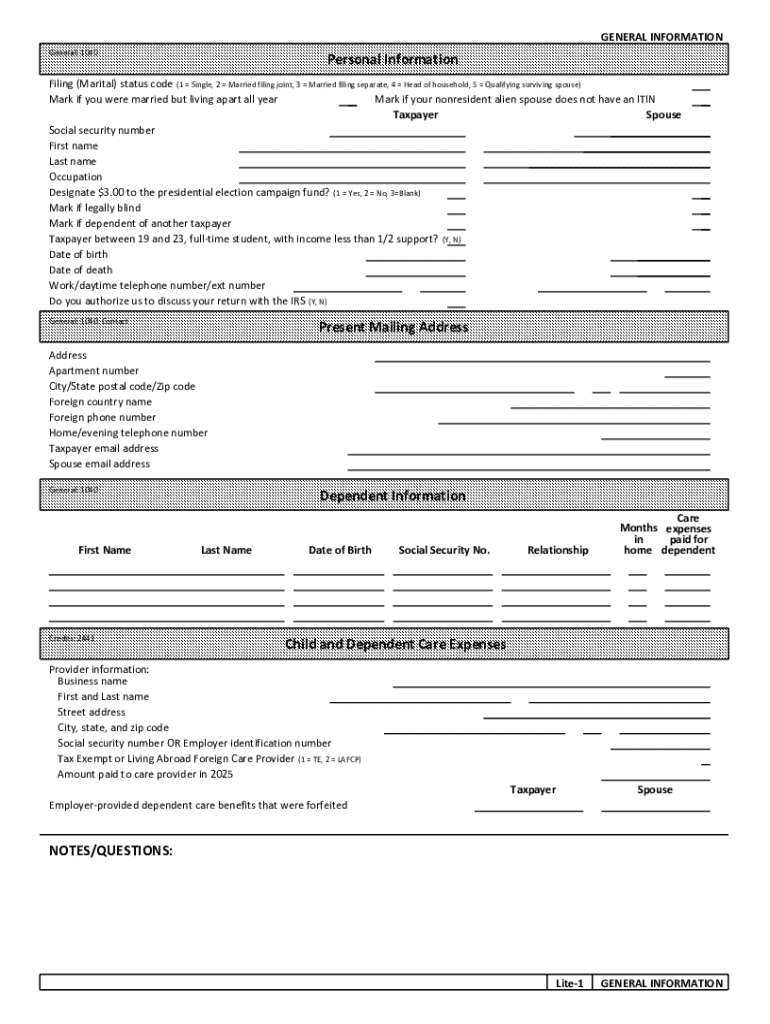

The taxpayer email address form serves a crucial role in the tax filing process. By providing your email address, you grant tax authorities a digital avenue to send important updates, documents, and notifications related to your tax returns. This form is instrumental in ensuring timely communication and helps taxpayers stay informed about their filing status, potential audits, or any changes in tax regulations. Accurate email input not only enhances communication efficiency but also aids in safeguarding your tax-related information.

Moreover, in an era increasingly reliant on digital communications, having a dependable email address affixed to your tax documents ensures that you receive updates without delays. Hence, verifying the accuracy of the provided email address is paramount. A slight error may prevent you from accessing critical information regarding your tax obligations.

Who needs to complete this form?

The taxpayer email address form is designed for both individual taxpayers and business entities. Individuals filing personal tax returns must include their email address to receive pertinent information related to their tax status. On the other hand, corporations and business entities also benefit from executing this form. Providing an email address ensures efficient communication with the IRS and state tax authorities, enhancing the precision of business tax records and transactions.

Additionally, nonprofit organizations or partnerships need to complete this form to maintain proper lines of communication with tax authorities. Therefore, every taxpayer—be it individual or corporate—should consider filling out the taxpayer email address form as part of their filing obligations.

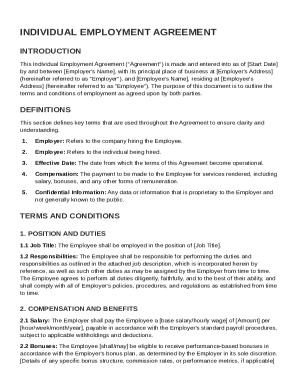

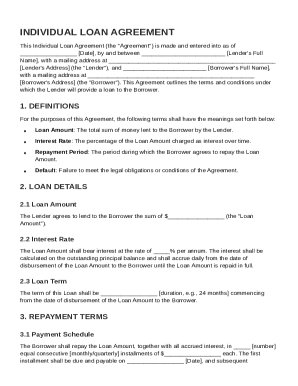

Preparing to fill out the taxpayer email address form

Before tackling the taxpayer email address form, it's crucial to gather all necessary information. Begin by collecting essential personal details such as your name, residential address, and tax identification numbers like your Social Security Number (SSN) or Employer Identification Number (EIN). These elements will form the backbone of your form submission.

Next, focus on the validity and format of your preferred email address. Ensure that you input a functioning email that you can access regularly, as this will be the primary communication channel for any updates or notices. Always verify the email format to avoid submission errors. Having all these details on hand will streamline the process and reduce the likelihood of errors.

Step-by-step instructions for completing the form

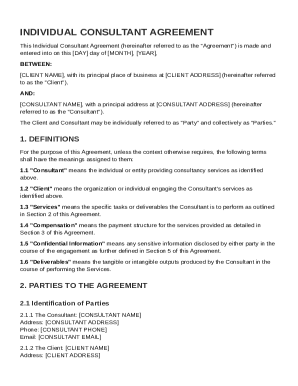

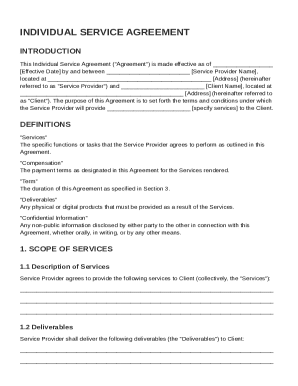

Accessing the taxpayer email address form on pdfFiller is straightforward. Visit pdfFiller’s homepage, navigate to the form section, and search for the taxpayer email address form. PdfFiller provides different formats of the form to cater to varied filing requirements, ensuring you can choose the one that best fits your needs.

Once you've accessed the form, begin filling it out starting with the basic personal information section. Here you will provide your name, address, and other relevant personal information. Following this, carefully enter your email address in the appropriate section. It's critical to confirm your email address to ensure it matches the original entry, avoiding mistakes that could lead to communication issues.

If applicable, include any additional comments or instructions that may be needed for the tax authorities. To avoid common mistakes such as typographical errors, it's wise to double-check all the entries before finalizing your submission. Taking the time to correctly detail your information not only remedies complications but also facilitates smoother communications in the future.

Editing and customizing your form

PdfFiller offers a rich suite of editing tools to customize your taxpayer email address form effectively. Utilizing its text editing features, you can add, delete, or modify entries as needed. For clarity, consider using the annotation tools to include specific notes regarding your email preferences or any other relevant information that helps clarify your submission.

Saving your form is also crucial. PdfFiller provides multiple options for storing your forms, whether in the cloud for easy access anytime or locally on your device. Additionally, managing previous versions of your form can be easily done within pdfFiller, allowing you to track changes and maintain an organized filing history.

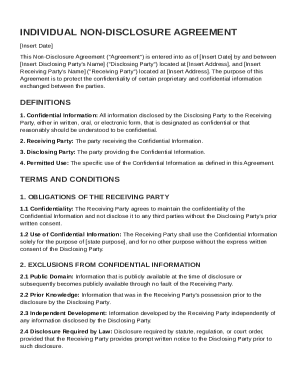

Signing and submitting the form

Before submission, adding your signature to the taxpayer email address form is essential. PdfFiller enables electronic signing, offering a secure and convenient way to validate your documents without the need for physical signatures. To eSign your form digitally, simply select the eSignature option and follow the prompts to create or upload your digital signature.

Once signed, you have several submission options. You can submit your completed form via email or through online portals designated by the IRS or your state tax authority. Tracking your submission status is easily manageable within your pdfFiller account, ensuring that you remain informed about any updates related to your form submission.

Managing your document post-submission

After submitting your taxpayer email address form, it’s important to track your submission records. PdfFiller allows users to easily retrieve submitted forms within their accounts, providing a seamless way to reference previously filed documents. Keeping these records organized can help you prepare for future communications with tax authorities.

In addition to keeping track of your submissions, monitor your email for official communications from the IRS regarding your tax status. Best practices recommend responding swiftly to any inquiries or notifications received in your inbox to avoid potential issues. Remember, being prompt can significantly impact your tax deadlines and obligations.

Troubleshooting common issues

It's not uncommon to experience issues while providing a valid email address. Should your email address be rejected during the submission process, it's advisable to revisit your entry for typos or formatting errors. Ensure your email provider is reliable and that you have access to it, as receiving communication is pivotal for tax-related matters.

Your online security is paramount, especially when accessing forms on platforms like pdfFiller. To maintain security while filling out your documents, ensure that you use secure internet connections and be wary of using public Wi-Fi for sensitive transactions. Adhering to basic cybersecurity principles will protect you from potential threats as you complete your tax-related forms.

FAQs related to the taxpayer email address form

If you have questions regarding the taxpayer email address form, you’re not alone. Many individuals seek clarity on the form's purpose and how it integrates within the broader tax process. One common inquiry is about the necessity of providing an email address and the consequences of not doing so. Form submissions lacking an email address may result in delays or a lack of important notifications, potentially complicating your tax situation.

For those needing further assistance, contacting pdfFiller's support team is straightforward. They are equipped to help with any additional questions or issues encountered while filling out or submitting forms. Leveraging such support helps ensure that you navigate the taxpayer email address form with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit taxpayer email address from Google Drive?

How do I edit taxpayer email address online?

How do I edit taxpayer email address on an iOS device?

What is taxpayer email address?

Who is required to file taxpayer email address?

How to fill out taxpayer email address?

What is the purpose of taxpayer email address?

What information must be reported on taxpayer email address?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.