Get the free Audited Financial Statements December 31, 2022

Get, Create, Make and Sign audited financial statements december

How to edit audited financial statements december online

Uncompromising security for your PDF editing and eSignature needs

How to fill out audited financial statements december

How to fill out audited financial statements december

Who needs audited financial statements december?

Understanding Audited Financial Statements for December

Understanding audited financial statements

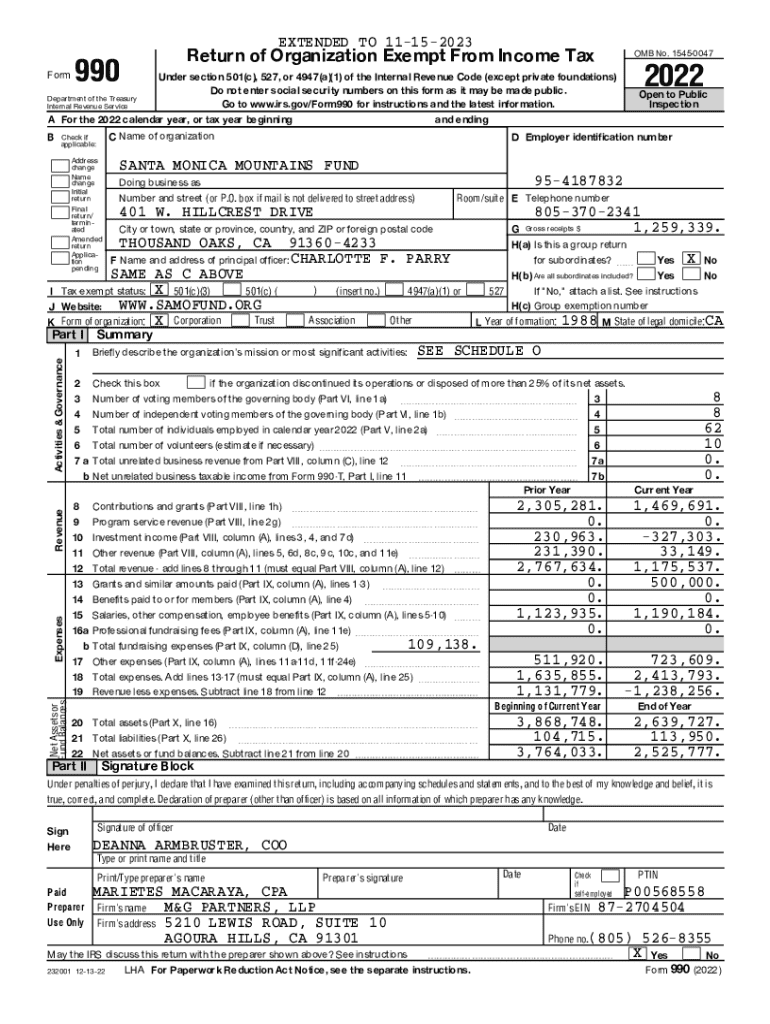

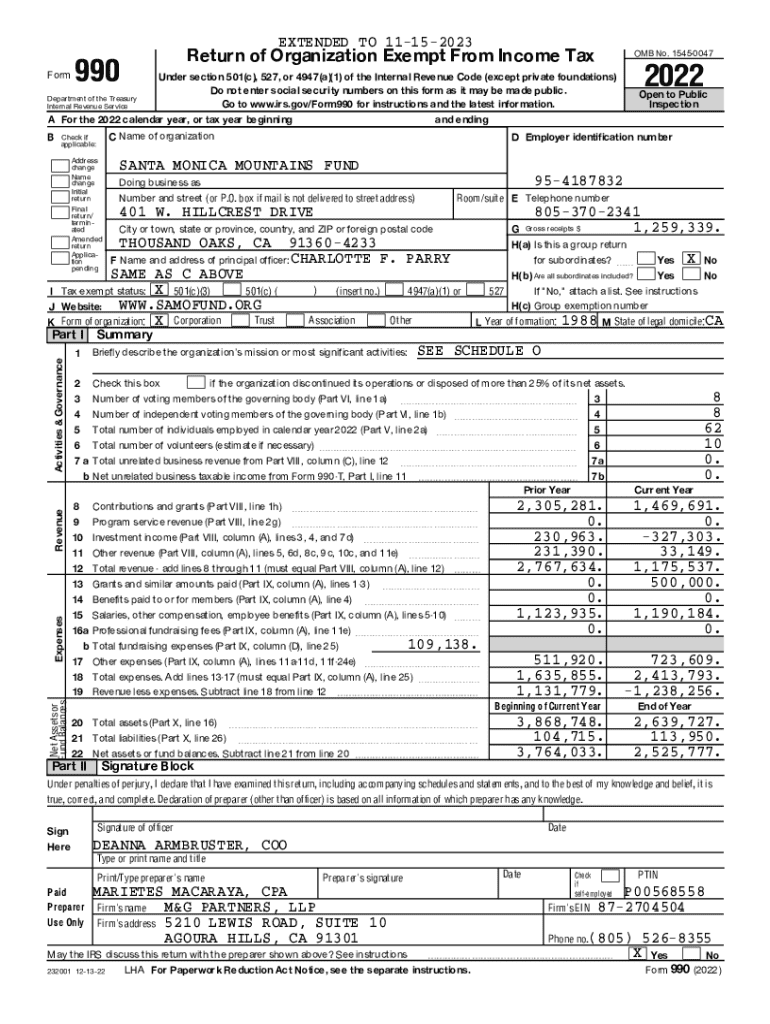

Audited financial statements consist of a company’s financial reports that have been examined and validated by an independent certified public accountant (CPA). These documents typically include an income statement, a balance sheet, and a cash flow statement, combined with an audit opinion letter that discusses the accuracy and reliability of the presented financial data.

The importance of audited financial statements in December cannot be overstated. This time frame often marks the end of a financial year for many companies, making it crucial to ensure that their financial records reflect a true and fair view of their performance. Stakeholders, including investors, banks, and suppliers, rely on these statements to make informed decisions regarding the business.

Components of audited financial statements

Audited financial statements are typically divided into four core components. Each component holds vital significance in providing a comprehensive picture of a company's financial position as of December 31.

Income statement

The income statement summarizes the company’s revenues and expenses over the financial year. Particularly in December, year-end adjustments play a critical role in ensuring that all income and expenses have been accurately recorded and reported. Revenues recognized in December, such as sales from holiday shopping, can significantly impact total yearly results. Accurate recording is essential to reflect true performance.

Balance sheet

The balance sheet provides an overview of a company's assets, liabilities, and equity at year-end. As of December 31, businesses often experience seasonal impacts that can dramatically alter their financial position. For instance, companies might see inflated inventory levels due to post-holiday returns, affecting asset assessment.

Cash flow statement

The cash flow statement captures all cash inflows and outflows during the financial year. In December, businesses may engage in various cash flow management activities to prepare for the next year. Important measures include adjusting creditor terms and managing accounts receivable, influencing liquidity and operational sustainability.

Audit opinion letter

The audit opinion letter, issued by the CPA, determines whether the financial statements are free from material errors. The implications of this document are significant; an unqualified opinion signifies that the financial records are accurate, while a qualified opinion warns of potential issues. This evaluation is crucial for stakeholders assessing the company’s health.

The process of preparing audited financial statements in December

Preparing audited financial statements in December involves a systematic approach to ensure completeness and accuracy. Gathering financial data is the first step, where all year-end transactions, including sales, expenses, and adjustments, are compiled. This step is critical, as inaccuracies at this stage can propagate through the financials.

Documenting internal controls

Establishing robust internal controls is essential in ensuring compliance with accounting standards. This might include policies for authorizing expenditures, approving journal entries, and tracking inventory. By documenting these controls thoroughly, companies can assure stakeholders that proper checks and balances are in place, reducing the likelihood of discrepancies.

Engaging with auditors

Selecting the right audit firm is crucial. Companies should look for auditors with industry-specific experience and a solid reputation. Preparing for auditor meetings requires organizing documentation in advance and being ready to address requests. Open communication during this process not only fosters trust but also leads to more effective audits.

Filling out the December audit form

Completing the December audit form involves a meticulous approach to documentation. Each section of the form must be filled out accurately to ensure compliance with financial reporting standards. It’s essential to provide clear and correct figures, as errors can lead to misinterpretation of financial health.

Step-by-step guide to completing the form

A systematic breakdown of the form can effectively guide the completion process. To ensure each section reflects accurate data, focus on the following areas: income figures, asset valuations, liabilities disclosures, and cash flow inputs. This diligence is critical as even small errors can lead to significant discrepancies in audited financial statements.

Editing and managing your financial statements

Utilizing tools like pdfFiller can streamline the editing of financial statements. Users can easily make adjustments, ensuring that all data remains accurate and up-to-date. Collaborative tools allow multiple team members to provide input, facilitating a more inclusive process. Making changes directly within the platform reduces the risks associated with printing and re-scanning documents.

Signing and finalizing documents

Once the audited financial statements are finalized, adding eSignatures can expedite the approval process. Utilizing cloud storage solutions not only secures documents but also makes retrieval and sharing a breeze, enabling teams to maintain a clear audit trail.

Analyzing the implications of your financial statements

Interpreting the results from the December audit involves focusing on key performance indicators, such as revenue trends and expense patterns. Understanding variances from previous years is crucial; businesses can identify underlying issues or opportunities for growth. Regular analysis of these elements helps companies adjust strategies proactively.

Strategic decisions based on financial data

Financial data gleaned from audited statements can guide strategic decisions. For example, if a company is experiencing increasing costs without corresponding revenue growth, management may need to reassess supplier contracts or operational efficiency. This insight is vital for shaping actionable steps toward future planning.

Communicating findings to stakeholders

Effectively communicating the findings of the audit to stakeholders is essential. Transparency fosters trust and can improve relationships with banks, investors, and internal management. Using clear, understandable metrics can help demystify complex financial data.

FAQs about audited financial statements for December

Commonly asked questions regarding the completion and analysis of the audited financial statement often arise during the December period. Key inquiries may include how auditors assess compliance and what specific documentation is necessary for reporting. Ensuring all relevant regulations are adhered to can prevent complications.

Unique concerns might involve specific industry requirements or the handling of seasonal inventory. Addressing these questions early ensures that the audit process is smoother, minimizing year-end stress.

Conclusion on the importance of accurate audited financial statements

Accurate audited financial statements are vital for a business’s financial integrity. They provide essential insights into operations and facilitate informed decision-making for companies. Best practices for December audits include regular data review, maintaining proper internal controls, and open communication with auditors, ensuring that stakeholders have the accurate information they require.

By leveraging comprehensive document management tools like pdfFiller, companies can streamline the entire audit process, from preparation to finalization. Such platforms enhance collaboration, ensuring that all financial statements meet compliance standards and reflect true business performance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my audited financial statements december directly from Gmail?

Can I sign the audited financial statements december electronically in Chrome?

How do I edit audited financial statements december on an Android device?

What is audited financial statements december?

Who is required to file audited financial statements december?

How to fill out audited financial statements december?

What is the purpose of audited financial statements december?

What information must be reported on audited financial statements december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.