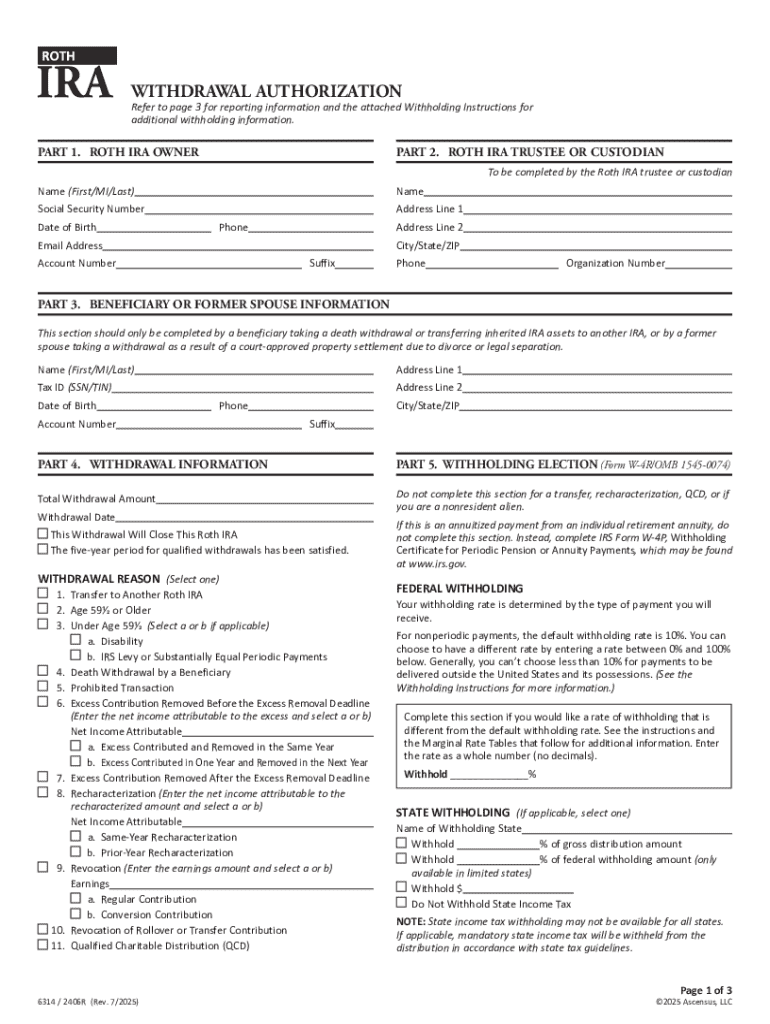

Get the free 6314 Roth IRA Withdrawal Authorization (7/2025)

Get, Create, Make and Sign 6314 roth ira withdrawal

How to edit 6314 roth ira withdrawal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 6314 roth ira withdrawal

How to fill out 6314 roth ira withdrawal

Who needs 6314 roth ira withdrawal?

Your complete guide to the 6314 Roth IRA withdrawal form

Understanding the 6314 Roth IRA Withdrawal Form

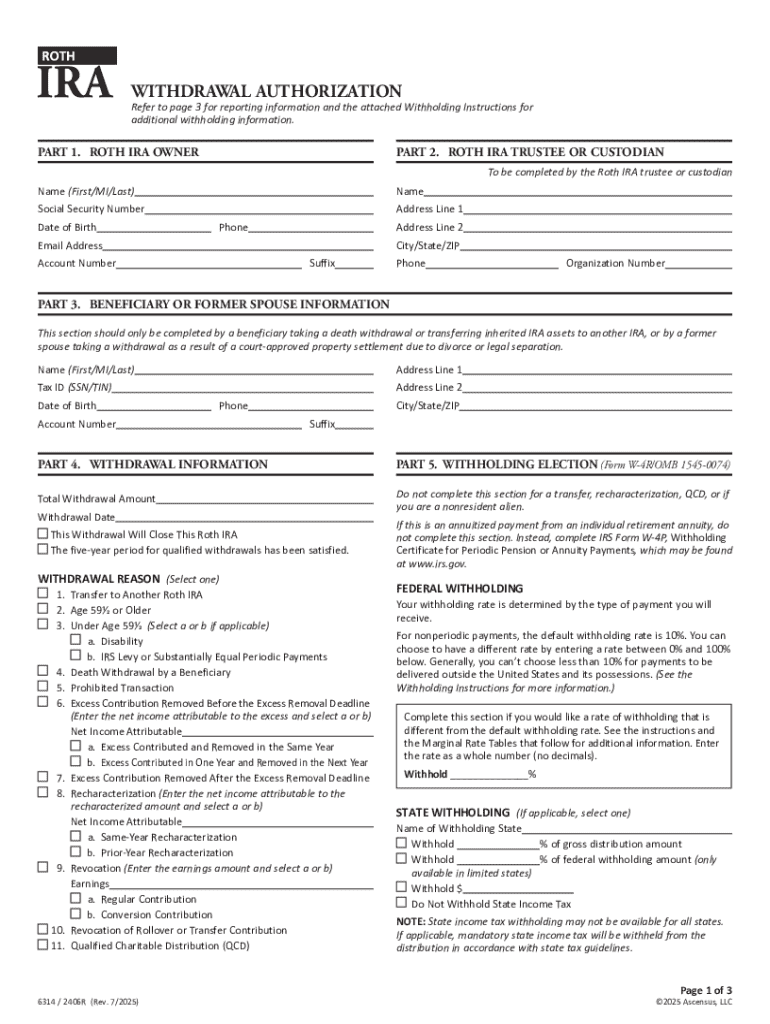

The 6314 Roth IRA Withdrawal Form is a critical document used for facilitating withdrawals from Roth IRA accounts. This specialized form simplifies the process of obtaining your retirement funds, whether you're taking out contributions, earnings, or even rolling over to another account. Utilizing the proper form for these transactions is essential to ensure compliance with IRS regulations and to avoid unnecessary fees or penalties.

One of the main advantages of a Roth IRA lies in the tax-free growth and tax-free withdrawals, provided certain conditions are met. This makes the Roth IRA an attractive option for retirement savings. The 6314 form not only helps streamline your withdrawal process but also guarantees that you’re properly documenting your request to avoid complications later.

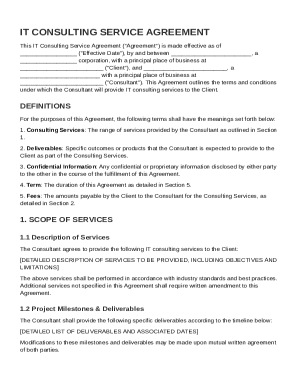

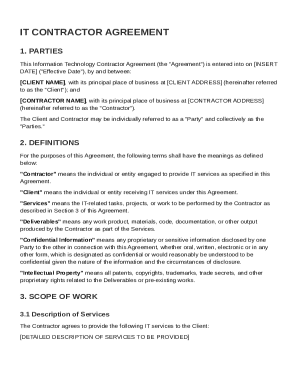

Key components of the 6314 Roth IRA withdrawal form

Understanding the components of the 6314 Roth IRA Withdrawal Form is essential for a successful submission. Here are the key elements you need to be aware of:

Step-by-step guide to filling out the 6314 Roth IRA withdrawal form

Filling out the 6314 Roth IRA Withdrawal Form can seem daunting, but breaking it down into manageable steps simplifies the process considerably. Follow these straightforward instructions:

Interactive tools for filling out your Roth IRA withdrawal form

Filling out forms is easier than ever with the right tools. Several online platforms simplify the process of completing the 6314 Roth IRA Withdrawal Form.

Common mistakes to avoid when using the 6314 Roth IRA withdrawal form

Avoiding mistakes on your 6314 Roth IRA Withdrawal Form is paramount. Failing to adhere to proper guidelines may result in delays or rejected requests.

FAQ about the 6314 Roth IRA withdrawal form

Navigating the 6314 Roth IRA Withdrawal Form can prompt specific questions. Here are some frequently asked questions to consider.

Who should use the 6314 Roth IRA withdrawal form?

The 6314 Roth IRA Withdrawal Form is suitable for various individuals:

Legal and tax implications of withdrawing from a Roth IRA

Withdrawing funds from a Roth IRA can have significant tax implications. It’s vital to understand the criteria required to make withdrawals that are tax-free.

Additional support for completing your Roth IRA withdrawal

Assistance is readily available for those needing help with the 6314 Roth IRA Withdrawal Form.

Managing your Roth IRA post-withdrawal

Understanding the impact of withdrawals on your Roth IRA is essential for maintaining a balanced retirement plan. Once you complete a withdrawal, it’s vital to assess your contributions moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 6314 roth ira withdrawal to be eSigned by others?

How do I edit 6314 roth ira withdrawal on an iOS device?

How do I edit 6314 roth ira withdrawal on an Android device?

What is 6314 roth ira withdrawal?

Who is required to file 6314 roth ira withdrawal?

How to fill out 6314 roth ira withdrawal?

What is the purpose of 6314 roth ira withdrawal?

What information must be reported on 6314 roth ira withdrawal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.