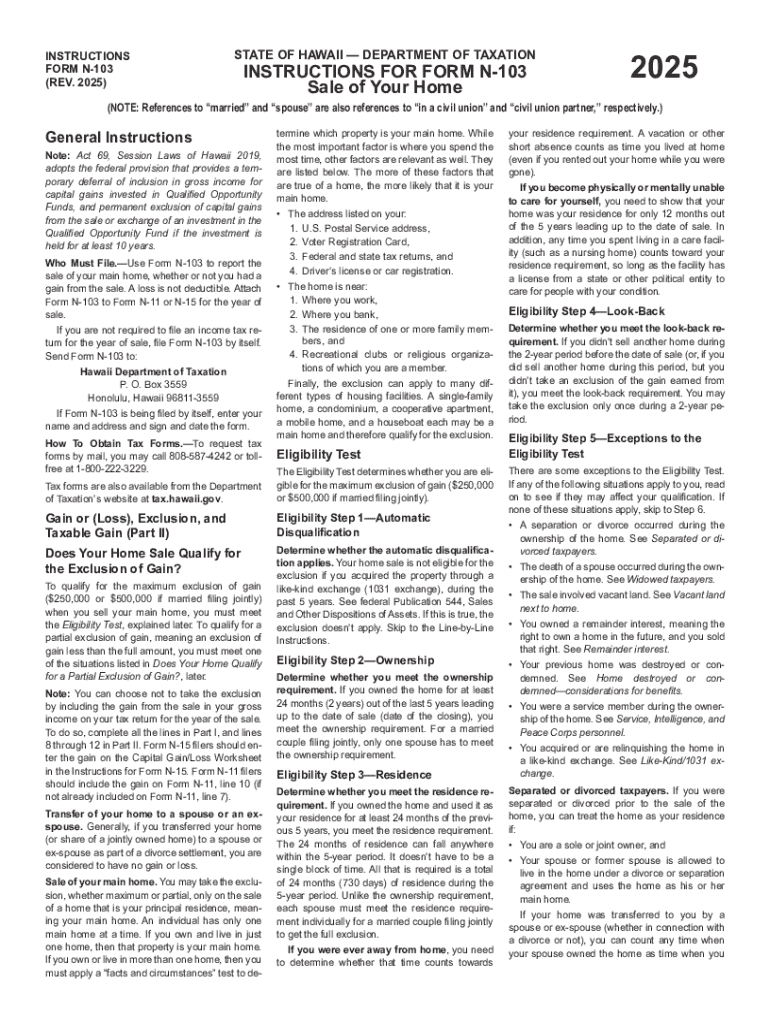

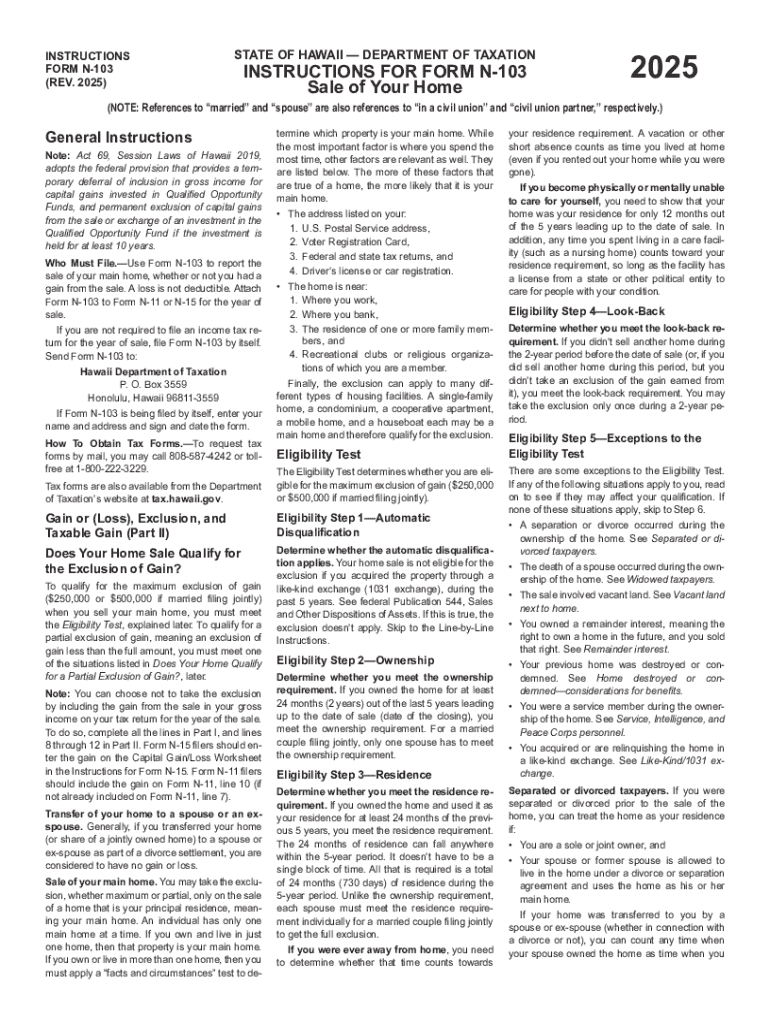

Get the free Instructions N-103, Rev. 2025, Instructions for Form N-103. Forms 2024

Get, Create, Make and Sign instructions n-103 rev 2025

Editing instructions n-103 rev 2025 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions n-103 rev 2025

How to fill out instructions n-103 rev 2025

Who needs instructions n-103 rev 2025?

Comprehensive Guide to Instructions N-103 Rev 2025 Form

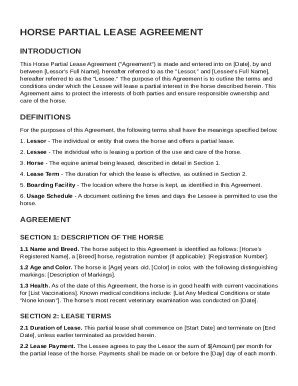

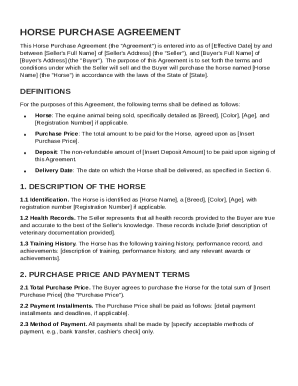

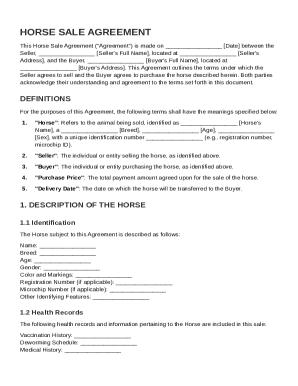

Overview of the Instructions N-103 Rev 2025 Form

The Instructions N-103 Rev 2025 Form is a crucial document designed for various administrative purposes within specific jurisdictions. It acts as a guide for users required to provide pertinent information in a standardized format, ensuring ease of processing and compliance with established guidelines.

The importance of this form cannot be understated. It serves not only to streamline documentation but also to uphold legal standards and facilitate interactions with government agencies. For individuals and organizations alike, understanding the nuances of this form can significantly impact the efficiency of their filings.

The Instructions N-103 Rev 2025 Form is particularly relevant for anyone engaged in activities or transactions that require formal documentation. This can include individuals pursuing tax credits, certifying eligibility for programs, or filing claims that necessitate detailed disclosures.

Context and applicability

Various situations will prompt the need for the Instructions N-103 Rev 2025 Form. These typically involve claims or requests for benefits within specific legal frameworks. Individuals filing tax documentation, for example, may need this form as part of the broader submission process.

Awareness of key dates and deadlines is vital. Many jurisdictions dictate a finite window during which the Instructions N-103 Rev 2025 Form can be submitted. Missing these deadlines might lead to penalties or delays in processing.

Regardless of geographical location, understanding the regulations surrounding this form ensures compliance. Different states or jurisdictions may have unique requirements related to the Instructions N-103 Rev 2025 Form; thus, verifying local mandates is essential.

Step-by-step instructions for completing the Instructions N-103 Rev 2025 Form

Filling out the Instructions N-103 Rev 2025 Form may seem daunting, but by following these straightforward steps, users can navigate the process with confidence.

Step 1: Gathering necessary information

Start by collecting all relevant documents and personal details required to complete the form. This may include identification numbers, financial statements, or records related to the specific transaction or claim. Having these documents organized beforehand will facilitate smoother completion.

Step 2: Understanding each section of the form

The form comprises several critical sections, each with unique requirements.

It's important to avoid common pitfalls, such as leaving sections blank or misrepresenting information, which could cause your submission to be rejected.

Step 3: Filling out the form

Utilize interactive guides and visual aids for filling out these forms. Check the pdfFiller platform for screenshots and instructions that correspond to each field of the Instructions N-103 Rev 2025 Form.

Step 4: Reviewing and editing the form

After completing the form, employ the best practices for reviewing your submission. This includes cross-checking every entry against your original documents. pdfFiller offers efficient editing features that allow you to make changes easily.

Step 5: Sign and submit the form

Before submission, ensure you have signed the document. If you are utilizing pdfFiller, you can conveniently add digital signatures. Delivery can either be electronic through the platform or printed for traditional mail, depending on your jurisdiction's requirements.

Interactive tools and features on pdfFiller

pdfFiller presents users with an array of interactive tools designed to enhance the experience of managing the Instructions N-103 Rev 2025 Form. One notable feature is seamless editing capabilities, enabling users to modify PDFs directly without needing to print and scan.

Moreover, pdfFiller facilitates the process of adding electronic signatures, helping you maintain compliance with digital documentation practices. This tool eliminates the hassle often associated with paperwork, catering to users seeking efficient solutions.

Collaboration tools for teams

For teams, pdfFiller's collaboration capabilities allow multiple users to interact with the Instructions N-103 Rev 2025 Form seamlessly. Features such as sharing and commenting streamline communication, making it easier to reach collective decisions.

Document management solutions

Lastly, pdfFiller’s document management features enable users to organize forms effectively and track submissions. This is particularly beneficial for individuals and organizations that must maintain comprehensive records for compliance and auditing purposes.

Common FAQs about the Instructions N-103 Rev 2025 Form

When handling the Instructions N-103 Rev 2025 Form, several questions frequently arise among users.

Special considerations for users

Accommodating diverse user needs is paramount when dealing with the Instructions N-103 Rev 2025 Form. pdfFiller strives to provide features that enhance accessibility for all users, including multilingual support and tools that facilitate use for those requiring additional assistance.

Equally important is the understanding of the legal implications and compliance involved in filing this form. Each entry is a declaration of truth, which is vital in maintaining the integrity of the documents processed.

Case studies and user testimonials

Real-life experiences with the Instructions N-103 Rev 2025 Form highlight the system's efficiency. Users have previously shared how pdfFiller simplified their form completion process, lowering their stress levels.

From reducing paperwork time to eliminating errors, these testimonials demonstrate the platform's effectiveness. Users emphasize the value they find in having access to everything they need within a single cloud-based system.

Future changes and updates to the Instructions N-103 Rev 2025 Form

Staying informed about changes to the Instructions N-103 Rev 2025 Form is essential as regulatory frameworks evolve. Users should keep an eye out for notifications regarding updates or revisions that may impact their submitting process.

Understanding expected updates will prepare you to adapt your submissions accordingly, ensuring compliance and minimizing disruptions in your workflow.

Related forms and documentation

The Instructions N-103 Rev 2025 Form isn’t the only key document. Familiarity with similar forms can enhance the user experience and streamline various processes. Accessing additional resources, guides, and forms available on pdfFiller can significantly benefit those involved in navigating regulatory filings.

Using pdfFiller for document management beyond the Instructions N-103

Beyond the Instructions N-103 Rev 2025 Form, pdfFiller offers a comprehensive suite of document management solutions designed for various needs. Users can effortlessly create, edit, and manage a wide array of forms.

The platform provides access to essential forms and templates, equipping users to handle different administrative tasks efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit instructions n-103 rev 2025 from Google Drive?

Can I create an eSignature for the instructions n-103 rev 2025 in Gmail?

How do I fill out instructions n-103 rev 2025 using my mobile device?

What is instructions n-103 rev 2025?

Who is required to file instructions n-103 rev 2025?

How to fill out instructions n-103 rev 2025?

What is the purpose of instructions n-103 rev 2025?

What information must be reported on instructions n-103 rev 2025?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.