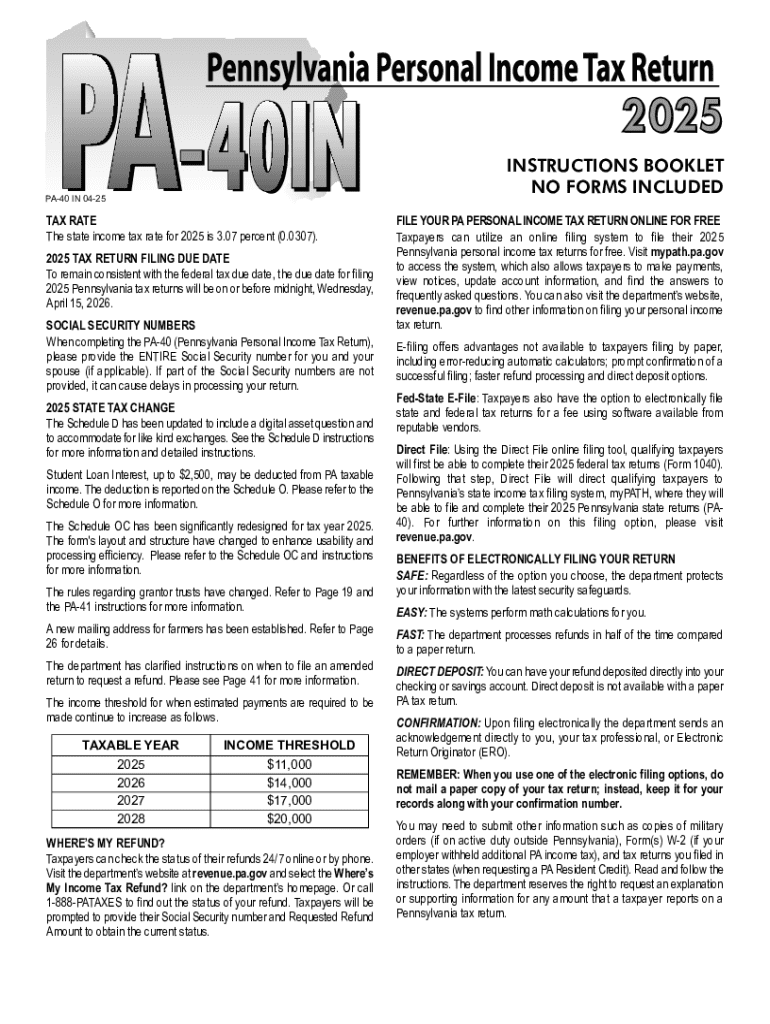

Get the free 2025 Pennsylvania Personal Income Tax Return Instructions (PA-40 IN). Forms/Publicat...

Get, Create, Make and Sign 2025 pennsylvania personal income

How to edit 2025 pennsylvania personal income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 pennsylvania personal income

How to fill out 2025 pennsylvania personal income

Who needs 2025 pennsylvania personal income?

Your Comprehensive Guide to the 2025 Pennsylvania Personal Income Form

Understanding the 2025 Pennsylvania Personal Income Form

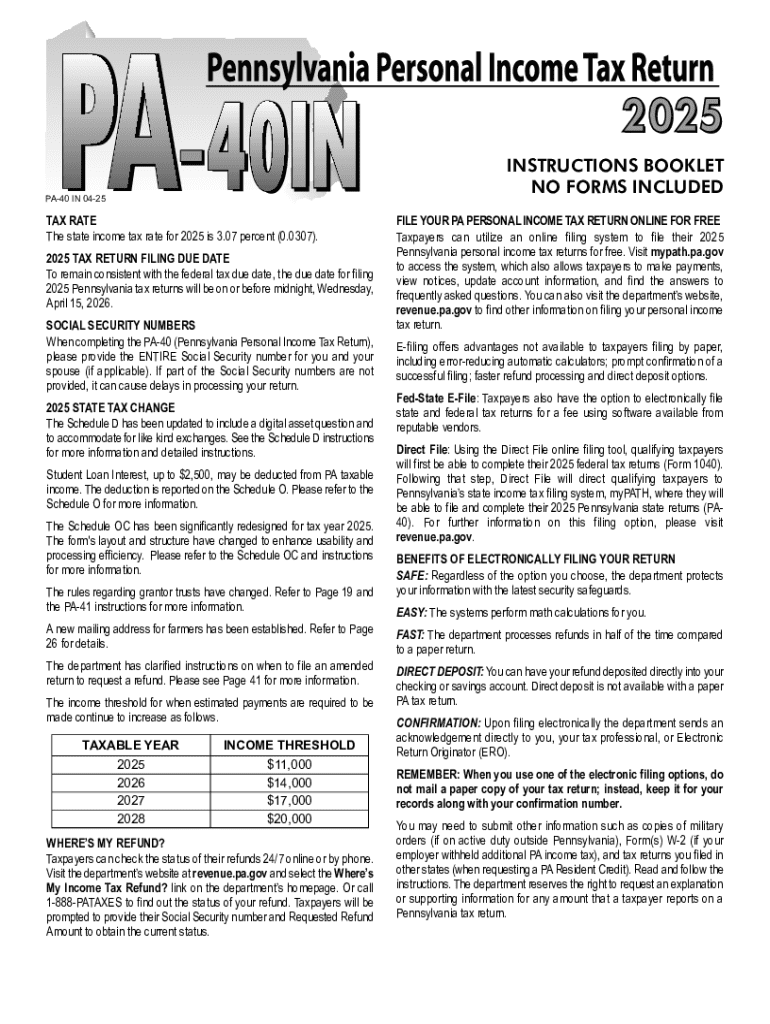

The 2025 Pennsylvania Personal Income Form, also known as PA-40, serves as the primary document through which Pennsylvania residents report their income to the state. This form is essential not only for compliance with state tax laws but also for determining the tax obligations of individuals and businesses in the state. As tax regulations evolve, it is crucial for taxpayers to stay informed about the mechanisms of this form to ensure proper filing.

For the 2025 tax year, there are notable updates that may impact how individuals approach their tax filings. It’s vital to review any changes to tax credits, deductions, and reporting requirements, as these can substantially affect your overall tax liability or refund.

Who needs to file the 2025 PA-40?

Determining whether you need to file the PA-40 is contingent on several factors, primarily your residency status in Pennsylvania. Residents, part-year residents, and nonresidents earning income in Pennsylvania must understand how their status impacts their filing obligations. For example, full-year residents are taxed on all income earned, while nonresidents only pay tax on Pennsylvania-sourced income.

In addition to residency, income thresholds play a critical role in deciding if you must file the 2025 PA-40. Generally, if your total gross income meets or exceeds a specific limit, filing is mandatory. Recent changes to these thresholds should also be monitored, especially for students or individuals with special circumstances, who may have different filing requirements or rights to deduct specific educational expenses.

Gathering required information

Before initiating the filing process, gathering the necessary personal information is crucial. This includes your Social Security number, information about spouse and dependents, and your address. Ensuring that you have accurate details can prevent delays in processing your form.

In addition to your personal details, you'll require various financial documents to report all sources of income. Common documents include W-2s from your employer, 1099s for freelance income, and any other applicable statements. It's also important to identify possible deductions and credits for which you may qualify, as these can significantly reduce your taxable income.

Step-by-step guide to filling out the 2025 PA-40

Filling out the 2025 Pennsylvania Personal Income Form can seem daunting, but breaking it down into manageable sections simplifies the process. Begin by accurately entering your personal information. Ensure all details align with your provided identification documents to avoid discrepancies.

Next, you’ll report your income. This section requires you to detail all income types, including wages, pensions, and any business income. Be aware that certain attachments may be necessary, depending on your financial situation. Continuing, the adjustments to income section allows you to make deductions such as contributions to retirement accounts, which can reduce your taxable income before considering your main deductions and credits.

Using pdfFiller tools for seamless completion

Leveraging tools like pdfFiller can ease the burden of managing forms like the 2025 Pennsylvania Personal Income Form. With its interactive features, you can fill out the necessary fields without the risk of losing your work. The platform’s cloud-based structure allows broad access and the ability to work from any device, ensuring you can make revisions or updates at your convenience.

Moreover, pdfFiller offers capabilities for electronic signatures and collaborative sharing, making it ideal for individuals who may need assistance or wish to share their forms securely with tax professionals. Compliance with document security standards provides peace of mind when handling sensitive financial information.

Double-checking your submission

Getting it right the first time saves stress and time later on. Common mistakes in filing the 2025 Pennsylvania Personal Income Form include incorrect Social Security numbers, incomplete income reporting, and failure to attach necessary documentation. A careful double-check ensures that each part of the form is accurately completed before submission.

Creating a checklist can be an effective strategy to verify every aspect of your form. Ensure all required signatures are included, double-check the arithmetic related to your income and deductions, and confirm that you are aware of the mailing address to which your form needs to be sent. Numerous resources, including locally available tax assistance programs and online platforms, offer guidance if you encounter questions.

Filing your 2025 Pennsylvania Personal Income Form

Once you've completed the form, you have various options to file it with the Pennsylvania Department of Revenue. This includes filing online through the e-file system, mailing a paper form, or submitting it in person at local tax offices. The online option typically provides the fastest processing times and confirmation of receipt. Whichever method you choose, clarity on the submission deadlines will prevent unnecessary penalties.

If you owe taxes, understanding the payment options is important. Pennsylvania provides several methods of payment, including electronic payment options that facilitate faster processing of payments and refunds. Always ensure to track your tax payment statuses to avoid surprises later.

Post-filing: What happens next?

After you've submitted your 2025 Pennsylvania Personal Income Form, you may wonder about the next steps, particularly regarding your tax refund. The Pennsylvania Department of Revenue provides a system to track your refund status, so keep your documentation handy for checking purposes. Most refunds will be processed within a specific timeframe, and knowing this will help you manage your expectations.

Occasionally, you may receive communication for an audit or request for additional documentation, which can seem daunting. It’s important to know your rights and the procedures involved if you need to amend your PA-40. Being prepared for these scenarios can ensure smoother navigation of post-filing duties.

Frequently asked questions about the 2025 PA-40

As you embark on filing the 2025 Pennsylvania Personal Income Form, you may have several questions regarding your unique situation. Common inquiries often include clarifications on specific filing requirements, understanding tax terms, and advice for first-time filers. Each tax season brings new nuances, and being prepared can alleviate the anxiety often associated with filing.

To equip yourself better, consider utilizing guidance from Pennsylvania's tax resources. Whether you seek assistance via local tax preparers or online platforms, finding a clear understanding of your requirements can simplify the process.

Stay informed: Changes to watch for future tax years

Tax regulations are subject to change, and as a taxpayer in Pennsylvania, remaining vigilant about upcoming legislation that may affect your tax obligations is critical. Whether it concerns adjustments in tax rates, new proposals for deductions, or credits, keep yourself updated to ensure compliance and maximize your allowances.

Additionally, engaging with resources, such as workshops and seminars provided by local tax authorities, can be beneficial. Such educational opportunities can enhance your understanding of tax filing processes and equip you with practical insights as you prepare for future tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2025 pennsylvania personal income in Gmail?

How can I fill out 2025 pennsylvania personal income on an iOS device?

Can I edit 2025 pennsylvania personal income on an Android device?

What is 2025 Pennsylvania personal income?

Who is required to file 2025 Pennsylvania personal income?

How to fill out 2025 Pennsylvania personal income?

What is the purpose of 2025 Pennsylvania personal income?

What information must be reported on 2025 Pennsylvania personal income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.