Get the free 2025 Tax Document Prep Checklist: Essential Forms and ...

Get, Create, Make and Sign 2025 tax document prep

Editing 2025 tax document prep online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 tax document prep

How to fill out 2025 tax document prep

Who needs 2025 tax document prep?

2025 Tax Document Prep Form: How-to Guide

Understanding the 2025 tax document preparation process

The 2025 tax document preparation process is crucial for individuals and teams aiming to file accurate tax returns. This year brings updates and changes from previous years, emphasizing the need for a thorough understanding of the tax landscape. With financial records and documentation piled high, getting familiar with the necessary forms is the first step toward an effective filing season.

Accurate tax filing in 2025 is not just a legal obligation; it affects your financial health and future planning. The implications of errors could lead to audits or unwanted penalties from the IRS. Moreover, understanding the nuances of the 2025 tax laws can unlock potential savings through eligible credits and deductions.

New tax laws and regulations may come into play for 2025, impacting how residents approach their documentation. Key changes might include updated income tax brackets, new deductions, or credits aimed at specific groups, such as low-income families or retirees. Staying informed on these alterations ensures that taxpayers maximize their benefits while minimizing tax liabilities.

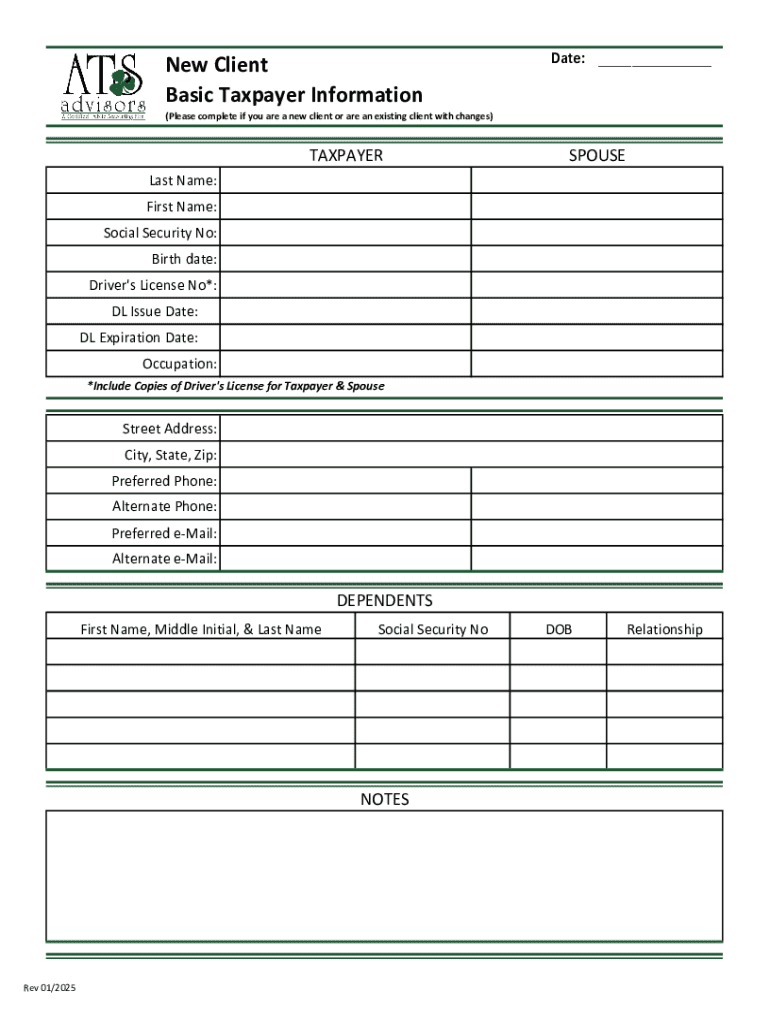

Essential components of the 2025 tax document

The 2025 tax document is composed of several key sections, each requiring careful attention to detail. Understanding how to navigate these components will significantly enhance your preparation experience. At a minimum, you will encounter the following sections in your tax prep form:

Each filing status—such as Single, Married Filing Jointly, or Head of Household—will dictate specific rules and deductions applicable to your case. It’s essential to verify which status resonates with your tax situation.

Alongside the completed form, you will need to gather commonly required documents like W-2s and 1099s, receipts for deductions you plan to claim, and Form 1098 for mortgage interest. Having this documentation ready simplifies the form-filling process and aids in maximizing your deductions.

Preparing to fill out your 2025 tax document

Preparation is key in the tax document filing process. Before diving into the 2025 tax document prep form, you should gather all necessary documentation. Make a checklist to ensure no important document is left behind. Essential docs typically include W-2s and 1099s, depending on your employment or income sources, and receipts for any deductions you intend to claim.

Mortgage interest documentation, typically presented in Form 1098, is also critical if you own a home. In addition to income reports, retaining records of business expenses, medical costs, or educational expenses can unveil significant tax deductions. Maintaining your financial files well-organized not only streamlines this process but can also safeguard against identity theft, ensuring your sensitive information is secure.

Furthermore, setting up an efficient workspace for document preparation cannot be overstated. Choose a quiet location with minimal distractions, gather your necessary supplies (like pens and calculators), and have your computer handy if you're filing electronically. This organized approach will facilitate a smoother tax preparation journey.

Detailed instructions for completing each section

Completing your 2025 tax document may seem overwhelming, but breaking it down into manageable sections can make a significant difference. Starting with the personal information section, ensure that all names and SSNs are spelled correctly; accuracy here is key to preventing processing delays.

Next, accurately reporting income is crucial. Align each source of income with the appropriate documentation. If you are self-employed or freelance, ensure all income is documented through 1099 forms. Do not forget to input information related to contributions from retirement accounts, as these can impact taxable income. Missing these details could hinder your actual financial picture or lead to an inaccurate return.

In the deductions section, highlight all potential deductions clearly. Keep in mind common items like student loan interest or medical expenses as you navigate this part. Identifying these can significantly reduce your taxable income. Avoid common mistakes, such as double-dipping on deductions or omitting critical identification details, as these errors can delay processing.

Utilizing pdfFiller for an enhanced tax document prep experience

pdfFiller provides a user-friendly platform that enhances the tax document preparation experience significantly. One of the primary benefits of using pdfFiller for the 2025 tax document prep form is the accessibility it offers. With cloud-based access, you can work on your tax document from virtually anywhere, eliminating the constraints of being tethered to a desk.

Moreover, pdfFiller's real-time collaboration features allow teams to work together seamlessly. This is particularly useful for families filing jointly or joint ownership situations. Interactive tools within pdfFiller guide users through the form-filling process, maintaining clarity and reducing errors. Additionally, the eSignature capabilities expedite submission, allowing you to finalize returns without delays.

The plethora of templates available also ensures that every necessary tax form is at your fingertips, making it easier to find specific documents that will cater to your filing needs. Integrating pdfFiller into your preparation process can significantly reduce the stress often associated with tax season.

Tips for finalizing and submitting your 2025 tax document

Upon completing your 2025 tax document, a thorough review is essential to ensure accuracy. Verify calculations, check for any missing signatures, and ensure all required fields are completed. A common pitfall is neglecting to sign the document, leading to immediate rejection of your submission by the IRS.

Once you are satisfied with the accuracy of your return, you can submit it online efficiently. Online submission greatly speeds up the process and enables you to track your submission status, giving you peace of mind. Be aware that upon filing, you can expect a confirmation from the IRS confirming receipt of your return.

Monitoring your submission status can also alert you to any issues arising later. If the IRS requires clarification or additional documents, being proactive in addressing those inquiries is crucial. Remember, prompt response can facilitate smooth communication and timely processing of your tax return.

Additional considerations post-submission

After submitting your 2025 tax document, maintaining organized records is essential. Best practices suggest retaining copies for at least three years, as this period aligns with the IRS’s statute of limitations for audits. Additionally, a safe storage option—digital or physical—ensures that your documents are readily available if needed.

If the IRS has questions regarding your submission, addressing them promptly is necessary. Keep communication clear and concise, and provide requested copies of documentation to clarify any discrepancies. In cases where an error is discovered post-filing, understanding how to amend your tax document is paramount. Fill out Form 1040-X and follow the stipulated procedures for revisions.

Preparation does not stop at submission; staying vigilant about your filing health is equally important. Preserving a clear pathway in managing any potential tax-related communication throughout the year will serve you well.

Frequently asked questions about the 2025 tax document prep form

As individuals embark on the task of preparing their 2025 tax documents, many questions often arise. Common queries tend to revolve around documentation requirements, such as what constitutes sufficient proof of income or eligibility for certain deductions. Familiarity with IRS guidelines can alleviate much of the uncertainty surrounding document preparation.

Another frequent issue relates to submission troubleshooting. Problems with e-filing, such as rejected submissions, can be frustrating. Addressing these requires clear communication and potentially using the online resources available through services like pdfFiller for guidance. Understanding your available resources can empower your filing strategy.

When seeking further assistance, tapping into the right support systems is vital. Utilizing services such as tax professionals or user-friendly platforms can provide requisite guidance, cementing a smoother filing experience.

Preparing for future tax years: insights for 2026 and beyond

Tax documentation is an evolving landscape, and preparing for future tax years is both strategic and essential. Observing trends in tax law changes, such as evolving tax credits or varying rates, will sustain your adaptability. It’s beneficial to keep abreast of updates through legitimate channels to inform your preparation effectively.

In addition, leveraging pdfFiller consistently for long-term document management creates a streamlined process. Having years of documentation accessible and organized can simplify future filings, allowing you to carry forward important information year over year.

Cultivating good practices now establishes a foundation for preparing your taxes in 2026 and beyond, reinforcing your financial well-being.

Success stories: testimonials from users who navigated the 2025 tax season effectively

Hearing from individuals who successfully navigated the 2025 tax season offers encouragement and insight. Many users have praised pdfFiller for its capacity to simplify the tax document preparation process. With streamlined features like real-time collaboration and eSignature capabilities, their experiences reflect enhanced efficiency.

Feedback highlights how the ease of access and user-friendly interface significantly reduced stress associated with tax season. Stories of individuals claiming deductions they might not have identified otherwise reflect the platform's impact on enhancing their filing accuracy and saving potential.

Empirical evidence from these success stories fuels confidence in approaching future tax seasons. The combination of effective document management and a supportive community reinforces the journey toward financial clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 tax document prep without leaving Google Drive?

How can I send 2025 tax document prep for eSignature?

How can I get 2025 tax document prep?

What is 2025 tax document prep?

Who is required to file 2025 tax document prep?

How to fill out 2025 tax document prep?

What is the purpose of 2025 tax document prep?

What information must be reported on 2025 tax document prep?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.