Get the free 2025 Tax Rate Calculation Worksheet - School Districts with Chapter 313 Agreements. ...

Get, Create, Make and Sign 2025 tax rate calculation

How to edit 2025 tax rate calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 tax rate calculation

How to fill out 2025 tax rate calculation

Who needs 2025 tax rate calculation?

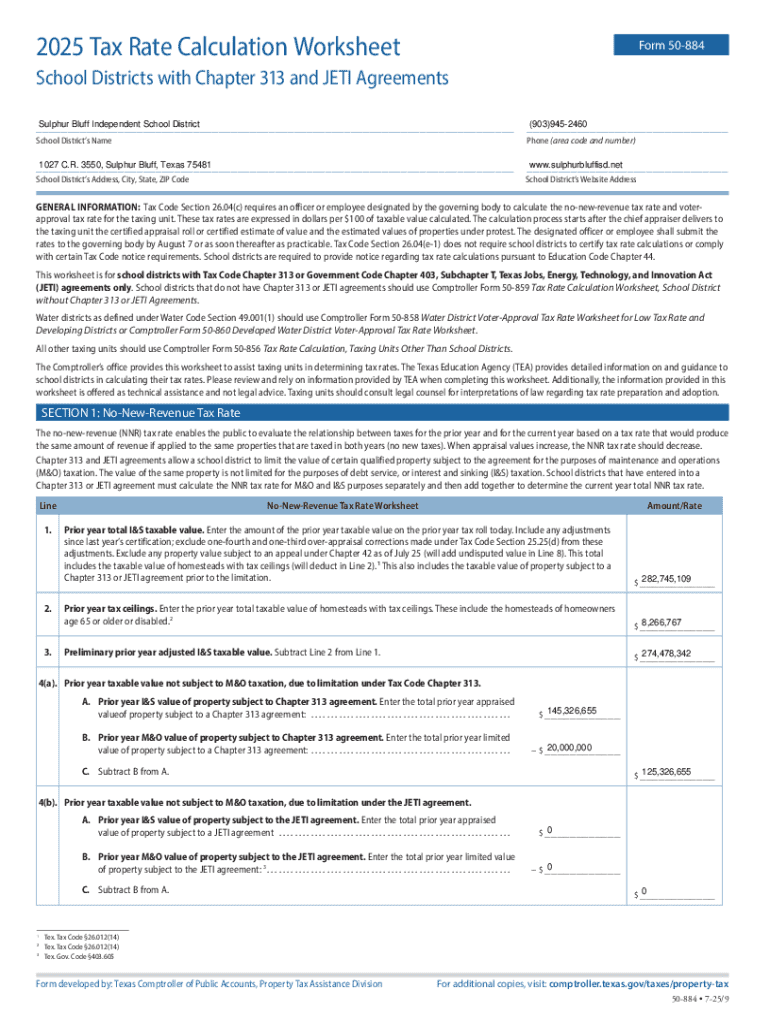

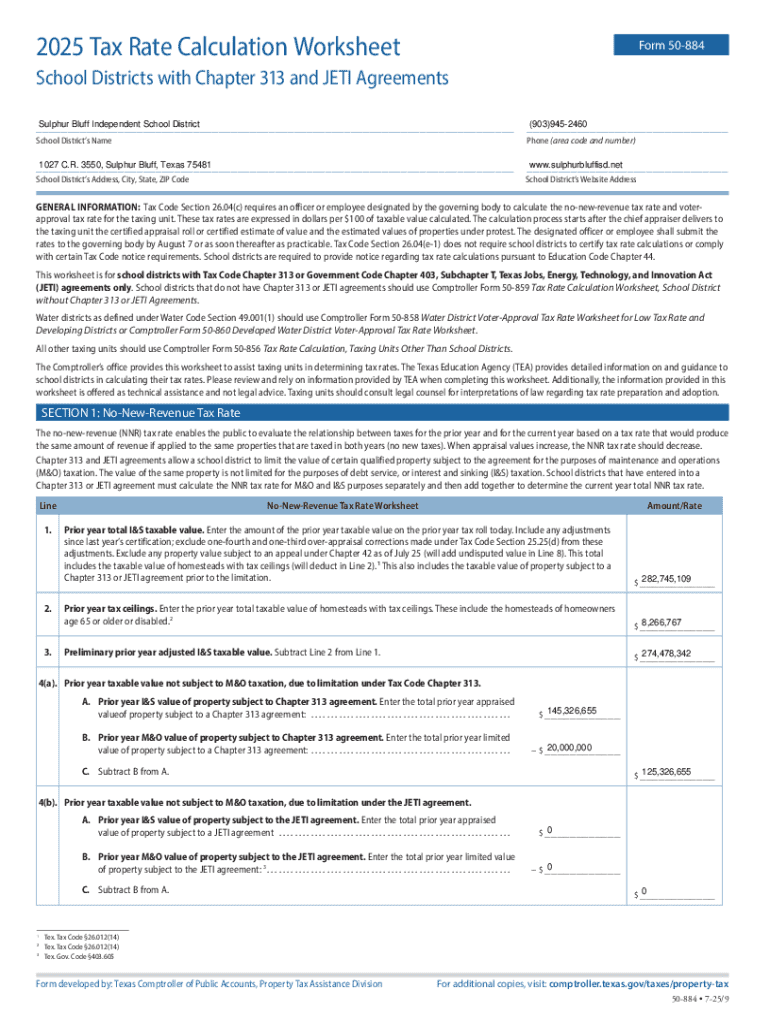

Understanding the 2025 Tax Rate Calculation Form

Understanding the 2025 tax rate calculation form

The 2025 tax rate calculation form is integral for accurate reporting of income, deductions, and credits for individuals and businesses alike. With the recent legislative updates impacting tax rates, it's crucial to familiarize yourself with both the form and the underlying changes. The 2025 tax year sees notable shifts in tax regulations that could affect the amount you owe or the refund you expect.

Key legislative updates for 2025 include adjustments in income thresholds for tax brackets, which can determine how much tax filers will owe based on their income status. For instance, income ranges have been altered to reflect inflation, creating new brackets that may reduce the tax burden for many. Understanding these changes will allow individuals and businesses to plan their finances more effectively.

Key components of the 2025 tax rate calculation form

The 2025 tax rate calculation form is divided into several key sections, each designed to collect vital information for accurate tax reporting. The first section gathers personal information, such as your name, address, and Social Security number, which is crucial for identifying the taxpayer and avoiding errors. Ensure that these details are filled out correctly; even small mistakes can lead to significant delays in processing your return.

Next comes the income reporting section. Here, you must report all sources of income, including wages, dividends, and interest. Self-employed individuals need to be particularly attentive in this area, as they must not only report their income but also account for any business-related expenses. This detailed reporting ensures that deductions and credits are appropriately applied, impacting your taxable income.

Deductions and exemptions play another vital role in calculating your tax liability. For 2025, the choice between the standard deduction and itemized deductions remains essential. New deductions introduced this year may provide additional advantages, especially for those in specific situations, like educators or healthcare professionals. Understanding which option maximizes your deductions can significantly alter your final tax amount.

Step-by-step guide to completing the 2025 tax rate calculation form

Completing the 2025 tax rate calculation form requires proper preparation. Start by gathering all necessary documentation, such as W-2s, 1099s, and records of any deductible expenses. With the rise of digital solutions, tax software can simplify this process, reducing the chances of human error. Alternatively, manual calculations are an option, but they demand precision and familiarity with tax regulations.

As you begin filling out the form, pay close attention to each section. Address common pitfalls, such as omitting required information or miscalculating figures. To ensure accuracy, it’s advisable to double-check entries and utilize worksheets or online tools for calculations. The IRS provides various resources, including interactive tax calculators, to assist taxpayers in determining their liabilities accurately.

Advanced tax strategies for 2025

With the updated tax rates, long-term planning becomes an essential component of fiscal responsibility for both individuals and businesses. One crucial strategy is adjusting your withholding allowances. Failing to do so may lead to underpayment or overpayment of taxes throughout the year, affecting your cash flow and refund status. This adjustment ensures that you’re taxed appropriately according to your anticipated income.

Investments also deserve careful consideration with the 2025 tax landscape. For instance, understanding capital gains implications under new tax rates can guide decisions on when to sell assets. Employing tax-efficient investment strategies, such as holding investments for longer to benefit from reduced tax rates on long-term capital gains, can lead to a more favorable financial outcome.

Interactive tools and resources

Interactive tools enhance the experience of using the 2025 tax rate calculation form on pdfFiller. Tax rate calculators are available to help users estimate their tax obligations effectively and can simplify otherwise complex calculations. Utilizing an online calculator offers various advantages, including instant results and error reductions, helping emplace accurate financial decisions seamlessly.

On pdfFiller, accessing the 2025 tax rate calculation form is straightforward. Navigate the website using its intuitive interface that allows users to fill out the form digitally. Features like cloud storage, eSignature capabilities, and collaborative tools ensure that you can manage your documents efficiently, eliminating the hassle of physical paperwork.

Troubleshooting common issues with the 2025 tax rate calculation form

Even seasoned tax filers can encounter challenges when completing the 2025 tax rate calculation form. Identifying common mistakes early on is crucial. Regularly reviewing completed forms for errors can save time and prevent issues such as delayed processing or incorrect filings. Make use of checklists to compare filled forms against required entries.

If mistakes are identified after submission, the IRS provides guidance on correcting errors, but it’s essential to act promptly. pdfFiller also offers customer support and concierge assistance for users who might have questions or require additional help with their forms. Knowing how to reach out for professional assistance can ease the burden of tax season.

Future tax considerations beyond 2025

Looking ahead, anticipating changes in tax rates and policy shifts is crucial for strategic financial planning. Tax professionals frequently provide insights on how the political landscape can influence upcoming tax legislation. Regularly reviewing these insights allows individuals and businesses to prepare for potential adjustments.

Setting accurate financial goals based on projected tax rate trends enables proactive management of fiscal responsibilities. Building flexibility into your financial strategies ensures that you can adapt as new regulations are adopted or amended. Therefore, keeping abreast of discussions within the tax system and regularly adjusting your strategies is vital.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025 tax rate calculation directly from Gmail?

Can I create an electronic signature for signing my 2025 tax rate calculation in Gmail?

How do I fill out the 2025 tax rate calculation form on my smartphone?

What is 2025 tax rate calculation?

Who is required to file 2025 tax rate calculation?

How to fill out 2025 tax rate calculation?

What is the purpose of 2025 tax rate calculation?

What information must be reported on 2025 tax rate calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.