Get the free New Schedule E Excel Worksheet For 2025

Get, Create, Make and Sign new schedule e excel

Editing new schedule e excel online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new schedule e excel

How to fill out new schedule e excel

Who needs new schedule e excel?

New Schedule E Excel Form: Your Comprehensive Guide for 2025

Understanding Schedule E: An overview

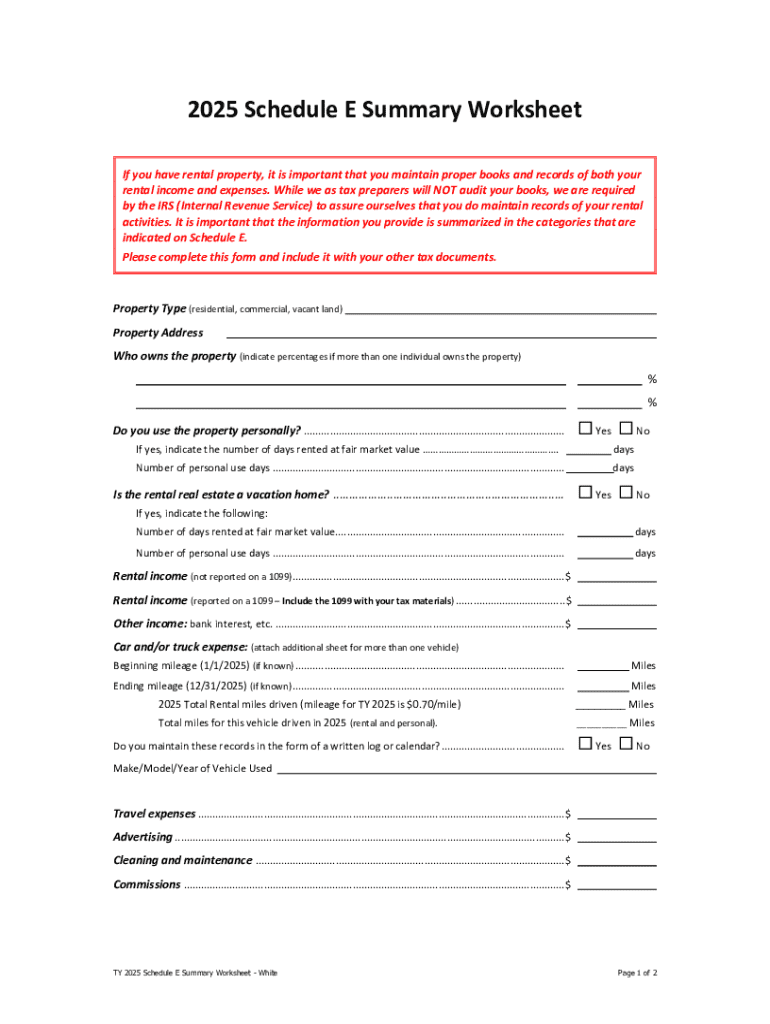

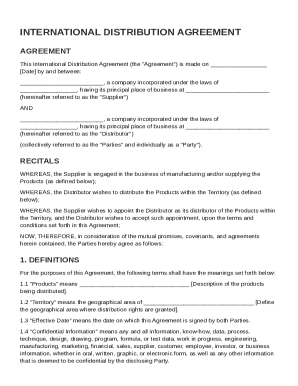

Schedule E is a critical component of the U.S. tax filing process, primarily used by individuals and businesses to report income and losses from various sources, notably rental real estate, partnerships, and S corporations. Its primary purpose is to provide the IRS with detailed information regarding income generated from real estate properties, making it a vital tool for landlords and real estate investors. The accuracy of this form is essential not only for compliance but also for tax planning strategies.

Anyone who earns rental income or receives a share of income from partnerships, S corporations, trusts, or estates may be required to file Schedule E. This includes a range of filers, from individual property owners renting out units to more complex entities like partnerships and corporations. Hence, understanding who needs to file is crucial in accurately completing your return.

The new Schedule E Excel form for 2025

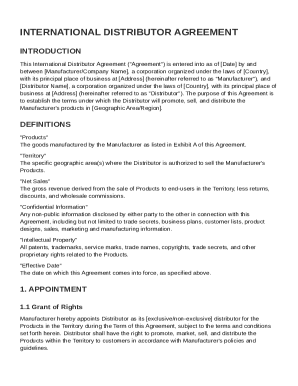

The 2025 version of the Schedule E Excel form comes with several noteworthy changes that streamline the reporting process. These updates are designed to enhance usability, improve accuracy, and facilitate better record-keeping. One crucial update is the integration of more robust calculations built directly into the form, minimizing the potential for human error and making tax preparation simpler and quicker.

Additionally, the format has been optimized for use on digital platforms, making it more accessible for those who prefer to fill out their tax documents electronically. The benefits of transitioning to an Excel form are numerous, particularly for taxpayers managing large amounts of data.

Features of the new Schedule E Excel form

The new Schedule E Excel form is equipped with a suite of interactive tools that significantly enhance the taxpayer experience. Automatic calculations reduce the need for manual math, which not only saves time but also helps prevent errors in reporting income and deductions related to rental real estate and other sources. Features like dropdown menus and input validations guide users through the completion process, ensuring that each entry meets IRS requirements.

Moreover, the form's compatibility with popular tax software programs allows users to import and export data seamlessly. This integration fosters a smoother workflow which is especially beneficial for tax professionals managing multiple clients' returns.

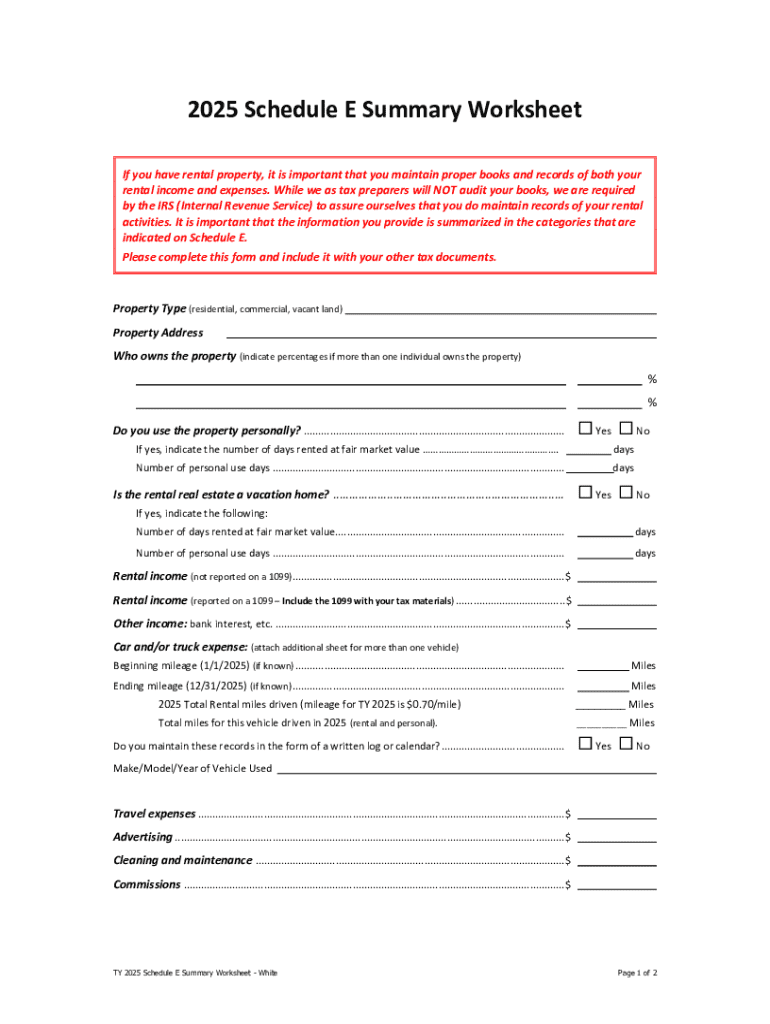

Step-by-step instructions for filling out the new Schedule E Excel form

To get started with the new Schedule E Excel form, the first step is to download it from pdfFiller’s website. The interface is user-friendly, making navigation straightforward. Familiarizing yourself with the layout will prove beneficial, especially as you begin to input your financial details.

Next, let’s break down each section of the form to understand the required information and inputs.

Lastly, take special care in reviewing your entries for accuracy. Common mistakes include miscalculating deductions and mishandling reported income, which can lead to discrepancies and potential audits.

Editing and customizing your Schedule E Excel form

pdfFiller offers robust editing tools that allow you to annotate, highlight, and add comments to your Schedule E form. This makes it easier to track changes or collaborate with your tax preparer or partners. The collaborative editing features enable multiple users to work on the same document, ensuring everyone involved has access to the most current information.

Furthermore, after you’ve completed and reviewed your Schedule E Excel form, you can save it in various formats suitable for submission. Best practices for sharing this completed form include using secure methods to protect sensitive financial information.

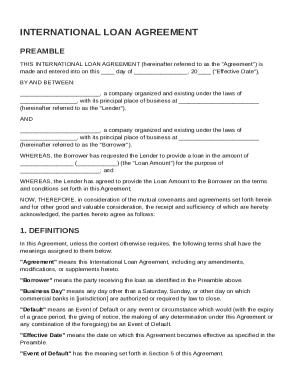

eSigning your Schedule E form

Incorporating eSignatures into your Schedule E form is seamless with pdfFiller. You can easily add electronic signatures, making it compliant with IRS standards for tax documentation. The process of adding a digital signature is straightforward—just select the eSignature option, and follow the prompts to sign.

Post-signing, it’s essential to manage your documents effectively. Tracking the status of signed forms allows you to know when they've been successfully executed, and utilizing pdfFiller’s cloud storage ensures easy access to your completed documents whenever necessary.

Additional considerations for filing your Schedule E

Filing your Schedule E correctly involves being aware of crucial deadlines. Generally, the tax return due date for individual filers is April 15, with the possibility of extensions available; however, understanding state-specific timelines is equally important, as these can vary significantly.

Moreover, each state may have unique requirements when it comes to how Schedule E is filled out or submitted. Familiarizing yourself with your state’s tax guidelines ensures compliance and mitigates potential issues.

Leveraging resources for a smooth filing experience

pdfFiller isn’t just about offering document solutions; it's a comprehensive platform that supports users beyond filling out tax forms. With features specifically designed for document management, users can streamline their filing processes and enhance productivity.

In case you need additional assistance, pdfFiller’s customer support is readily available. They provide resources ranging from live chat support to detailed tutorial videos, ensuring you have help when filling out the new Schedule E Excel form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute new schedule e excel online?

How do I make changes in new schedule e excel?

How do I edit new schedule e excel straight from my smartphone?

What is new schedule e excel?

Who is required to file new schedule e excel?

How to fill out new schedule e excel?

What is the purpose of new schedule e excel?

What information must be reported on new schedule e excel?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.