Get the free Non-Participating Tobacco Manufacturers Certificate Of ...

Get, Create, Make and Sign non-participating tobacco manufacturers certificate

How to edit non-participating tobacco manufacturers certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-participating tobacco manufacturers certificate

How to fill out non-participating tobacco manufacturers certificate

Who needs non-participating tobacco manufacturers certificate?

Understanding the Non-participating Tobacco Manufacturers Certificate Form

Overview of the non-participating tobacco manufacturers certificate form

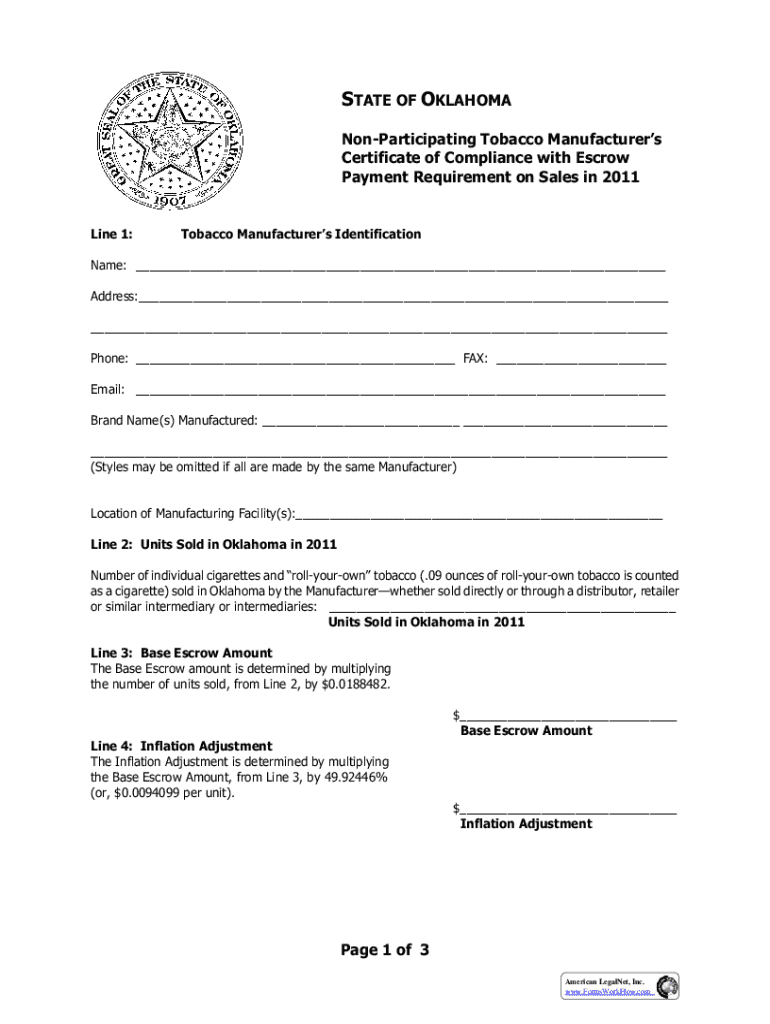

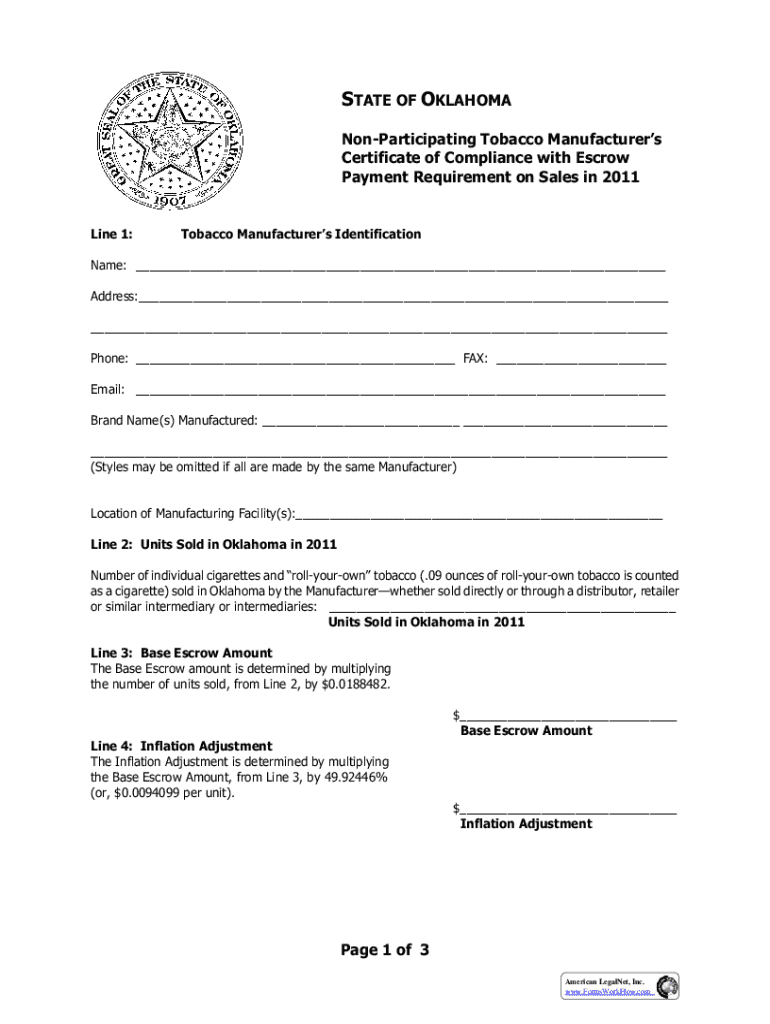

The non-participating tobacco manufacturers certificate form serves as a crucial document for businesses engaged in the manufacture and sale of tobacco products without being a part of state settlement agreements. This certificate aims to ensure that such manufacturers comply with local and federal regulations, thereby protecting public health and providing accountability.

The importance of this certificate cannot be overstated; it not only aids regulatory bodies in monitoring tobacco sales but also affects financial responsibilities, such as escrow payments. Understanding its nuances is fundamental for any manufacturer navigating the tobacco industry.

Key stakeholders involved in this regulatory framework include state governments, health organizations, and notably, the manufacturers themselves. The non-participating tobacco manufacturers certificate form is thus a linchpin in ensuring that health policies aimed at tobacco control are enforced.

Who needs the certificate?

Non-participating manufacturers can be defined as those tobacco producers who have not agreed to the master settlement agreement and, as such, lack the endorsement that typically accompanies participating manufacturers. The criteria for classification may include factors such as annual sales volumes, the specific types of tobacco products manufactured, and operational licenses.

Being classified as a non-participating manufacturer carries significant implications. It often results in heightened regulatory scrutiny and mandates additional compliance measures, specifically the financial responsibilities that come with maintaining escrow agreements. Therefore, obtaining the non-participating tobacco manufacturers certificate form is vital for legal operations and to manage marketing efforts without running afoul of state regulations.

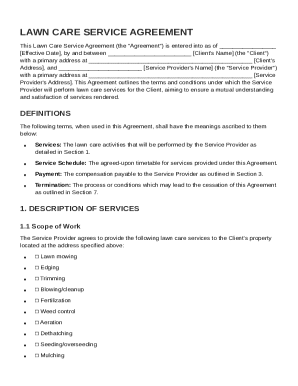

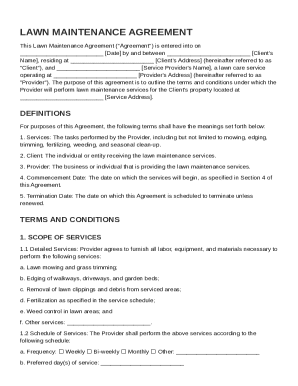

Steps to fill out the certificate form

Before beginning to fill out the non-participating tobacco manufacturers certificate form, you must prepare by gathering specific documents and information that are necessary for its completion. This may include company identification, business financial details, and details regarding compliance with state and federal laws.

While completing the form, pay close attention to the section-by-section breakdown that includes personal/business information, financial information, and licensing requirements. Common mistakes often include overlooking fields related to financial information or providing inaccurate data, which could lead to issues such as fines or legal repercussions.

Editing and managing your certificate form

Once the certificate form is filled out, managing it effectively is equally important. Utilizing tools such as pdfFiller allows you to edit and sign documents seamlessly. The platform’s features facilitate quick revisions, ensuring that all updates meet compliance standards while also simplifying team collaboration during the document preparation process.

In addition, best practices for managing documents include maintaining version control. Be sure to store the most recent version of the form securely and consider utilizing cloud storage solutions that pdfFiller provides to prevent data loss and ensure easy access.

Submission process

Submitting the non-participating tobacco manufacturers certificate form can be done in multiple ways—either online or via physical mail. Each state has its own submission guidelines, so it’s critical to consult local regulatory agencies to determine the appropriate channel. Most agencies provide dedicated portals or mailing addresses for submissions.

Once submitted, manufacturers should be aware of the expected processing time, which typically ranges from a few days to weeks, depending on state regulations. Following up on the status of your submission can usually be done via the agency's contact options found on their website.

Additional compliance requirements

Acquiring the non-participating tobacco manufacturers certificate is not the only compliance step. Manufacturers may also need to complete additional forms or certifications specific to their operations. Understanding these related forms is essential for full compliance with state and federal regulations.

Failing to meet the certification requirements can result in significant penalties, including fines and potential legal action. Understanding these consequences underscores the importance of diligent completion and oversight of all required documentation.

Frequently asked questions

There are common inquiries related to the non-participating tobacco manufacturers certificate form, such as who to contact for assistance or what to do if a mistake is found post-submission. It's advisable to have clear access to state contacts who can answer questions regarding the process.

A glossary of relevant legal terms can further elucidate any complexities that arise during the completion of the form, ensuring clarity in language used throughout the process.

Contacting support for assistance

Navigating challenges related to document preparation can be overwhelming. However, leveraging pdfFiller’s support diversifies your resources for troubleshooting and guidance. Their knowledgeable customer support team can help clarify doubts about the filling process or technical issues related to the platform.

Utilizing reliable sources when in doubt is essential. Familiarize yourself with the contact details of regulatory agencies for precise inquiries relating to form compliance.

Case studies or user testimonials

Various case studies have demonstrated how effective management of the non-participating tobacco manufacturers certificate form can streamline operations. For example, companies successfully navigating the certification process often reported increased operational efficiency through systematic documentation efforts.

These success stories emphasize that operational efficiency can stem directly from effective document management practices, which further supports compliance efforts and instills confidence in business operations.

Related document templates available on pdfFiller

pdfFiller provides a rich array of related document templates that can assist tobacco manufacturers in navigating their compliance needs. From additional forms for tax exemption to specific licenses, users can benefit from a comprehensive suite of resources tailored to their operational requirements.

Comparing pdfFiller’s offerings with alternative document management solutions reveals a distinct advantage in terms of user-friendly interfaces and comprehensive support, making it an ideal choice for manufacturers navigating complex regulatory landscapes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-participating tobacco manufacturers certificate directly from Gmail?

How can I send non-participating tobacco manufacturers certificate to be eSigned by others?

Can I create an eSignature for the non-participating tobacco manufacturers certificate in Gmail?

What is non-participating tobacco manufacturers certificate?

Who is required to file non-participating tobacco manufacturers certificate?

How to fill out non-participating tobacco manufacturers certificate?

What is the purpose of non-participating tobacco manufacturers certificate?

What information must be reported on non-participating tobacco manufacturers certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.