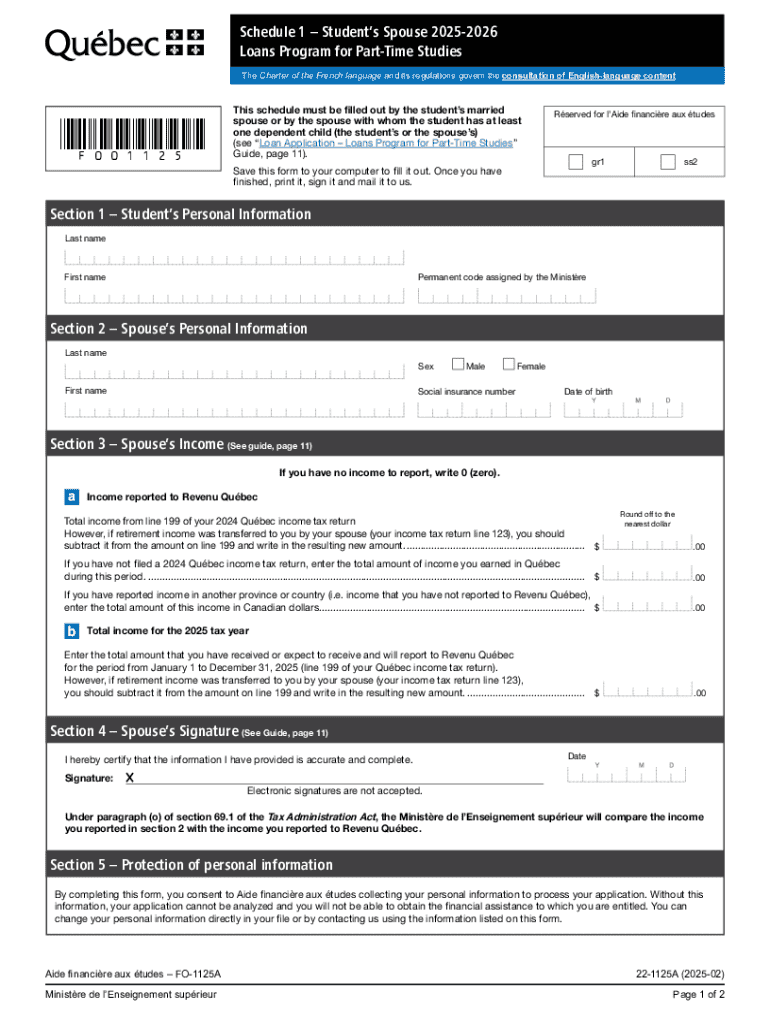

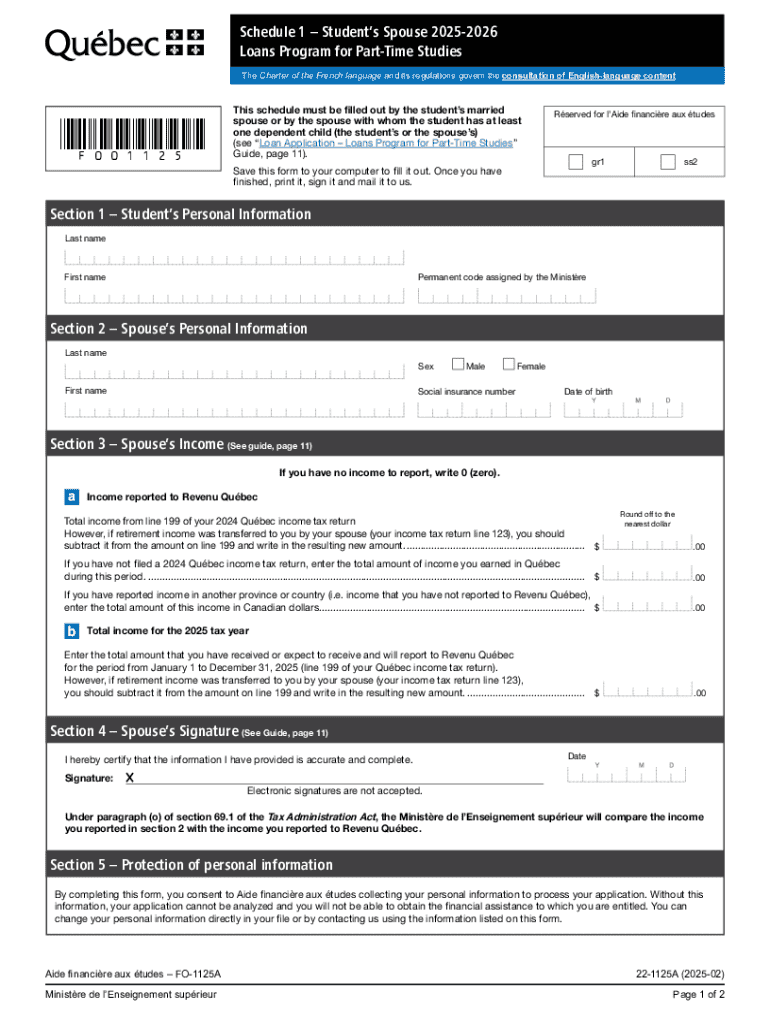

Get the free 1125 - Schedule 1Students Spouse. Schedule to be completed by the student's spo...

Get, Create, Make and Sign 1125 - schedule 1students

Editing 1125 - schedule 1students online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1125 - schedule 1students

How to fill out 1125 - schedule 1students

Who needs 1125 - schedule 1students?

Understanding the 1125 - Schedule 1 Students Form: A Comprehensive Guide

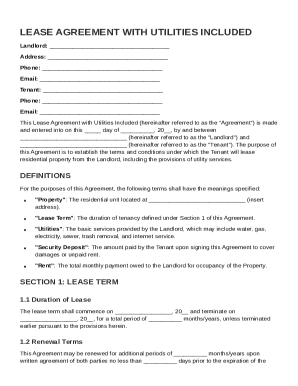

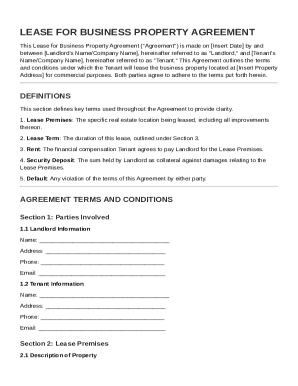

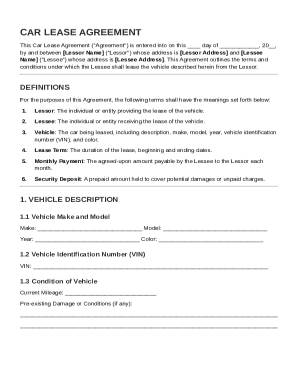

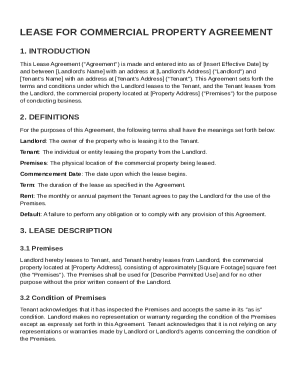

Overview of the 1125 - Schedule 1 Students Form

The 1125 - Schedule 1 Students Form is an essential document designed for students in Canada to claim education-related tax credits. This form not only facilitates tax filing for students but also maximizes their eligibility for various benefits, significantly easing the financial burden of education. Understanding its purpose is critical for making the most out of available student tax deductions and credits.

Among the key information required to complete this form are personal details, educational institution data, and specifics about incurred costs. Each of these elements plays a crucial role in determining the amount of tax credits available to a student. Accurate completion of the form can lead to substantial financial benefits, making it an essential task for many students.

Eligibility criteria

To qualify for the 1125 - Schedule 1 Students Form, individuals must meet certain criteria related to their educational status. Firstly, students need to distinguish between full-time and part-time enrollment. Generally, full-time students are those enrolled in a program that takes at least 60% of a full course load, while part-time students take less than this.

Age limits also come into play; students aged 16 to 25 typically qualify for more significant benefits. Moreover, the duration of studies matters, as those pursuing post-secondary education can claim different types of credits as opposed to those in secondary education. Common scenarios that necessitate filing this form include students who are completing eligible courses at recognized institutions, but it may vary based on personal circumstances.

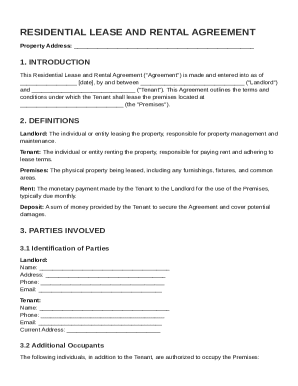

Detailed breakdown of the Schedule 1 Students Form sections

Section : Personal information

The first section of the Schedule 1 Students Form requires basic personal details such as your name, address, and Social Insurance Number (SIN). Attention to detail is key here; errors can lead to delays or rejections in your application.

Section : Education details

In Section II, students must provide education details, including the name of the institution, the program of study, and its duration. Only recognized educational institutions are valid for claims, and supporting documentation like proof of enrollment or tuition receipts should be ready to avoid any complications.

Section : Tax credits and deductions

Section III focuses on available tax credits for students. These credits typically include the Tuition Tax Credit, which allows students to reduce their taxable income based on tuition fees paid. In this section, understanding how to calculate claimable amounts is crucial, using receipts and official documents as supporting records.

Section : Signature and declaration

Finally, Section IV emphasizes the importance of signing the form. An unsigned document is deemed incomplete, potentially leading to processing issues. This section also includes a declaration that the information is accurate, and any misrepresentation can have serious legal consequences.

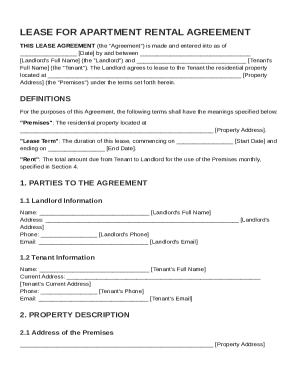

Step-by-step instructions for completing the form

Step 1: Gather required documentation

Before completing the 1125 - Schedule 1 Students Form, it's essential to gather all necessary documentation. Key documents include the T2202 form, which shows tuition fees paid, and receipts for any other eligible educational expenses. Having these documents handy streamlines the process and minimizes errors.

Step 2: Fill out Section

Begin by accurately entering your personal information in Section I. Double-check the entered details against official identification to prevent any discrepancies. Common errors often arise from typographical mistakes or incorrect SIN numbers, so be diligent at this stage.

Step 3: Complete Section with education details

In Section II, detail your educational journey. This includes types of institutions attending — universities, colleges, or vocational schools. Be sure to include the program duration and attach necessary proof, such as a confirmation of enrollment letter. This substantiates your claims and eases processing.

Step 4: Calculate and enter tax credits in Section

For Section III, use your gathered documents to calculate the credits. For instance, if you paid $6,000 in tuition fees, you might claim a certain percentage as a credit. Realizing how much you can claim requires some arithmetic, so ensure calculations are precise to avoid under or over-reporting.

Step 5: Review and sign

Finally, review the entire form for completeness and accuracy before signing. Use a checklist to verify crucial aspects, such as signature presence, correct documentation, and proper calculations. A thorough review can thwart potential issues post-submission.

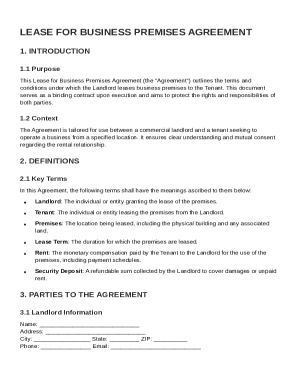

How to submit the 1125 - Schedule 1 Students Form

Submitting via mail

To submit the Schedule 1 Students Form via mail, carefully package your form with any necessary documentation and send it to the appropriate tax office. For most students, the recommended mailing address can usually be found on the official government website. Remember to note submission timelines to ensure you're filing on time to avoid penalties.

Submitting online

Alternatively, students can submit the Schedule 1 Students Form online using tax software or government portals. The advantages of electronic submission include faster processing times and easier tracking of your submission. This digital route is particularly beneficial for those who prefer quick and efficient filing.

Tracking your submission

After submitting your Schedule 1 Students Form, you can confirm receipt by checking your online tax account or contacting the relevant tax office. It’s advisable to keep a record of your submission date for future reference. Expect processing times to vary, with many students seeing results within a few weeks, while others may take longer during peak seasons.

Common issues and solutions

Frequent mistakes while filling out the 1125 - Schedule 1 Students Form often include missing signatures, incorrect SIN numbers, or mismatched educational claims. To amend such errors post-submission, you can file a T1 Adjustment Request to correct any inaccuracies. If you encounter challenges, don't hesitate to contact support for guidance on your form-related questions.

Special considerations for international students

International students have specific regulations that apply when filing with the 1125 - Schedule 1 Students Form. Often, they need to provide additional forms or documentation proving their status, such as a work permit or visa. Understanding these unique requirements is vital for ensuring compliance with Canadian tax laws.

Resources and tools for efficient form management

Employing tools like pdfFiller can significantly enhance the process of completing and managing the 1125 - Schedule 1 Students Form. With features that allow for easy editing, eSigning, and comprehensive document management, students can streamline their filing experience. Furthermore, pdfFiller's cloud storage offers easy access, making collaboration effortless whether you're a student, parent, or sponsor involved in supporting the educational journey.

Interactive tools on pdfFiller help guide users through each section of the form, providing helpful prompts to ensure all necessary information is collected systematically. This level of support minimizes mistakes, making form completion more straightforward and less stressful.

Frequently asked questions (FAQs)

Many students have questions regarding the 1125 - Schedule 1 Students Form. For instance, a common query is whether vacation courses are eligible for tax credits. Generally, courses taken outside of the full-time program can be claimed if they are for credit and recognized by your institution. Other frequent concerns include how to maximize deductions, particularly around tuition and expenses, or how family income may affect eligibility for certain benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 1125 - schedule 1students in Gmail?

How can I edit 1125 - schedule 1students from Google Drive?

Can I create an electronic signature for the 1125 - schedule 1students in Chrome?

What is 1125 - schedule 1students?

Who is required to file 1125 - schedule 1students?

How to fill out 1125 - schedule 1students?

What is the purpose of 1125 - schedule 1students?

What information must be reported on 1125 - schedule 1students?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.