Get the free OE3 State Tax Form08-25

Get, Create, Make and Sign oe3 state tax form08-25

Editing oe3 state tax form08-25 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oe3 state tax form08-25

How to fill out oe3 state tax form08-25

Who needs oe3 state tax form08-25?

Comprehensive Guide to the oe3 State Tax Form 08-25

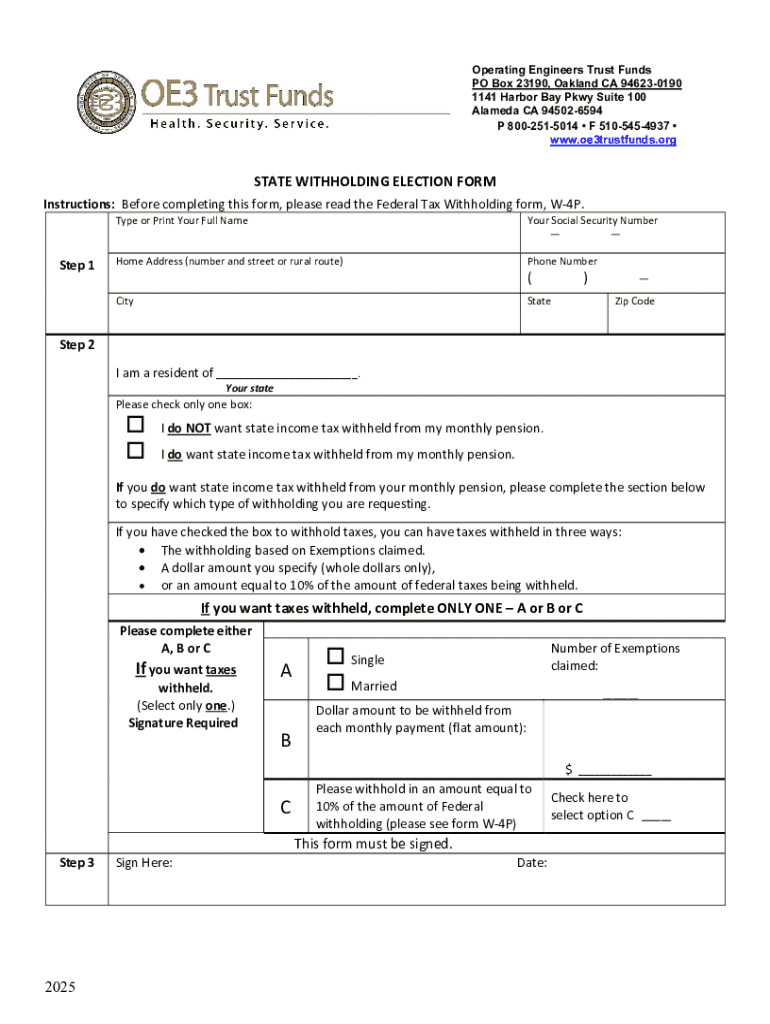

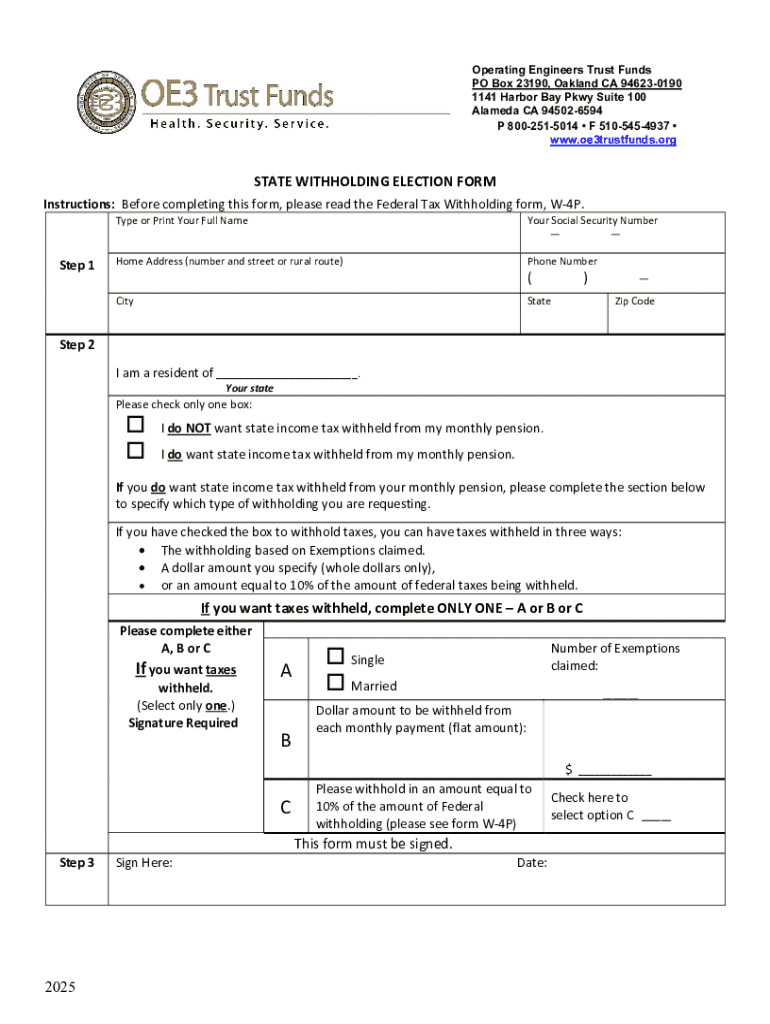

Overview of the oe3 state tax form 08-25

The oe3 State Tax Form 08-25 is a crucial document used by individuals and entities for reporting income and calculating state taxes owed. This form is essential for ensuring compliance with state tax laws and is typically required by state tax agencies during the annual filing season.

Understanding its importance cannot be understated; filing the oe3 State Tax Form 08-25 accurately affects one’s tax obligations and potential refunds. Users must correctly manage this form to avoid any penalties or issues with tax authorities.

Who needs to use the oe3 state tax form 08-25?

The oe3 State Tax Form 08-25 is designed for a diverse audience, including individual taxpayers, small businesses, and nonprofit organizations engaged in business activities within the state. Different groups may have varying requirements depending on their income sources and structure.

Key features of the oe3 state tax form 08-25

Examining the key features of the oe3 State Tax Form 08-25 reveals its structured layout designed to facilitate accurate reporting. The form includes several sections that focus on different aspects of income, expenses, and deductions. Each segment plays a pivotal role in outlining one's financial activities over the tax year.

Commonly required information typically encompasses employment income, business revenue, and relevant deductions that affect taxable income. Being diligent in filling out these sections ensures that users can maximize any potential tax benefits while maintaining compliance.

In-depth analysis of the form fields

Delving deeper into the form fields, users will notice sections dedicated to personal identification, income breakdowns, and a list of possible deductions. Each field must be completed with precise figures reflective of the user’s financial activities. Misrepresentations or omissions can lead to severe tax repercussions.

Step-by-step guide to filling out the oe3 state tax form 08-25

Successfully filling out the oe3 State Tax Form 08-25 begins with thorough preparation. Collecting all necessary financial documentation, such as W-2s, 1099s, and previous year tax returns, significantly streamlines the process. Users should also gather any receipts related to deductible expenses.

Next, initiating the form requires understanding the layout and flow. Each section should be filled sequentially, ensuring all figures align with the financial documentation provided. Special attention should be paid to common mistakes, such as miscalculating income totals or neglecting to sign the form.

Walkthrough of each section of the form

When navigating the oe3 State Tax Form 08-25, users will typically encounter multiple sections. It can be insightful to approach it step-by-step.

It is advisable for users to review their entries carefully to avoid common pitfalls. This may include verifying Social Security Numbers or double-checking arithmetic errors against supporting documents.

Common mistakes to avoid when completing the form

While filling out the oe3 State Tax Form 08-25, several common mistakes frequently arise. Misunderstanding instructions, incorrect data entry, and insufficient documentation can all lead to issues during review by tax authorities.

To troubleshoot these common issues, maintaining meticulous records and checking entries against tax documentation can be invaluable.

Editing and managing the oe3 state tax form 08-25

Editing the oe3 State Tax Form 08-25 can significantly enhance user experience, especially with tools like pdfFiller. The platform allows users to modify the form directly online, eliminating the need for cumbersome, physical edits.

Collaboration features, such as comments and shared access, make it easier for teams to work collectively on tax filings, which ensures that all necessary input is included, promoting thoroughness and accuracy.

Using pdfFiller for editing the form

With pdfFiller’s editing features, users can seamlessly alter text, add digital signatures, and even annotate documents for clarity. These tools empower individuals to create a cohesive, accurate tax form without the need for extensive software knowledge.

Utilizing these capabilities ensures a smooth experience when managing essential tax documentation.

Saving and storing your form securely

Once the oe3 State Tax Form 08-25 is completed, securely saving the document becomes imperative. pdfFiller provides versatile options for users to store their forms in formats like PDF or Word, which is crucial for maintaining access and ensuring compliance.

Utilizing cloud storage features ensures that the document is safely backed up and easily retrievable when needed. This offers peace of mind, particularly in case of audits or inquiries from tax authorities.

eSigning the oe3 state tax form 08-25

Adding a digital signature via pdfFiller is a straightforward process. It eliminates the need for printing, signing, and scanning, streamlining the entire submission process.

Users can finalize their forms quickly, enhancing both efficiency and compliance with legal standards.

Legal validity of eSignatures

Understanding the legal implications of electronic signatures is essential. Across many states, eSignatures hold the same validity as traditional signatures, making them suitable for tax document submissions.

Submitting the oe3 state tax form 08-25

After filling out and signing the oe3 State Tax Form 08-25, the next important step is to submit it to the relevant state tax authority. Users typically have two main options for submission: electronic or paper filing.

Each method has its pros and cons. Electronic submissions are quicker and reduce the likelihood of lost forms, while paper filing may feel more traditional and tangible to some users.

Different submission options

Users should follow specific instructions provided by their state to ensure compliance and accuracy with the submission guidelines.

Tracking your submission

Tracking the submission of the oe3 State Tax Form 08-25 is a vital step in the filing process. For electronic submissions, state agencies often provide tracking features, allowing users to confirm whether their form was received and is being processed.

In case of any discrepancies or issues, it is essential to maintain communication with the tax authority to rectify any problems promptly.

Troubleshooting common issues

Users may encounter various technical and administrative challenges while using the oe3 State Tax Form 08-25. Document formatting issues, mismanagement of online editing tools, or submission errors can happen to anyone.

For further assistance, users can access help through pdfFiller's customer support or other expert tax filing resources.

Finding support and assistance

When seeking help with the oe3 State Tax Form 08-25, various resources are available. pdfFiller offers dedicated customer support for users needing assistance with its platform, ensuring an efficient filing experience.

Additionally, tax professionals and online forums can provide valuable insights for individuals navigating complex tax situations.

Conclusion: Leveraging pdfFiller for your tax needs

The oe3 State Tax Form 08-25 is an integral part of the tax filing process for many individuals and organizations. Utilizing platforms like pdfFiller can streamline the entire workflow, from editing and signing to securing and submitting the form.

By maximizing the features available on pdfFiller, users can ensure they stay organized and compliant in all their tax-related endeavors. This resource not only simplifies tax filing but also enhances overall document management for future needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my oe3 state tax form08-25 in Gmail?

How do I edit oe3 state tax form08-25 straight from my smartphone?

Can I edit oe3 state tax form08-25 on an Android device?

What is oe3 state tax form08-25?

Who is required to file oe3 state tax form08-25?

How to fill out oe3 state tax form08-25?

What is the purpose of oe3 state tax form08-25?

What information must be reported on oe3 state tax form08-25?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.