Get the free Online SCHEDULE K-1 (Form 720S) Revenue ...

Get, Create, Make and Sign online schedule k-1 form

Editing online schedule k-1 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out online schedule k-1 form

How to fill out online schedule k-1 form

Who needs online schedule k-1 form?

Online Schedule K-1 Form: A Comprehensive Guide

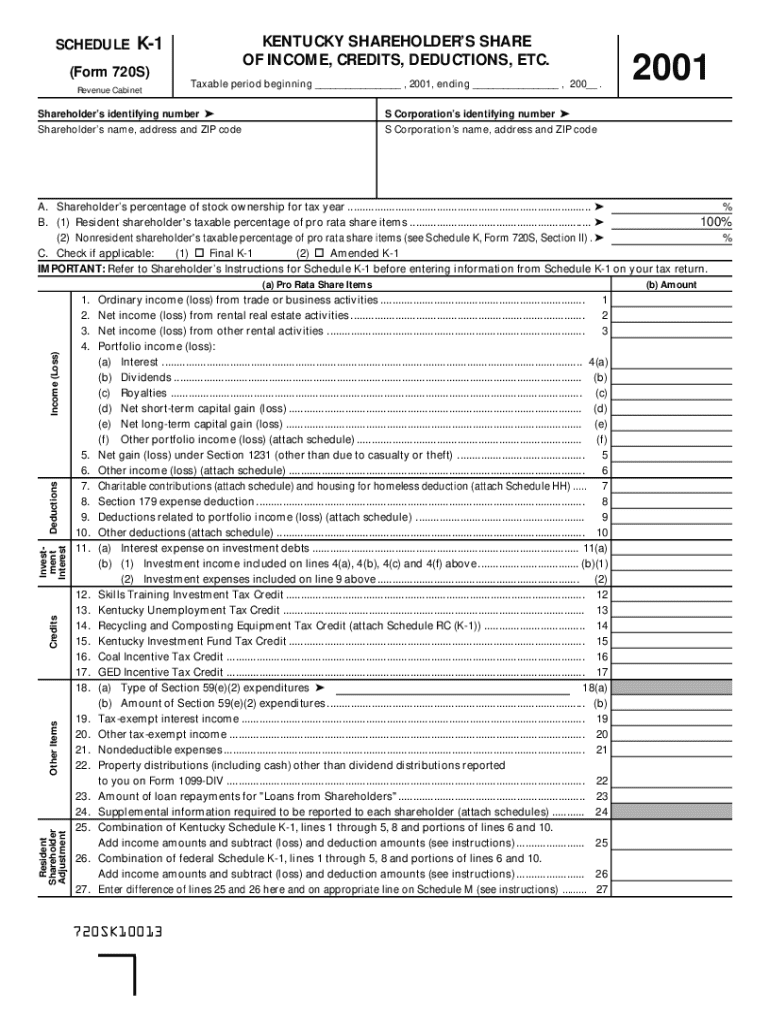

Understanding the Schedule K-1 Form

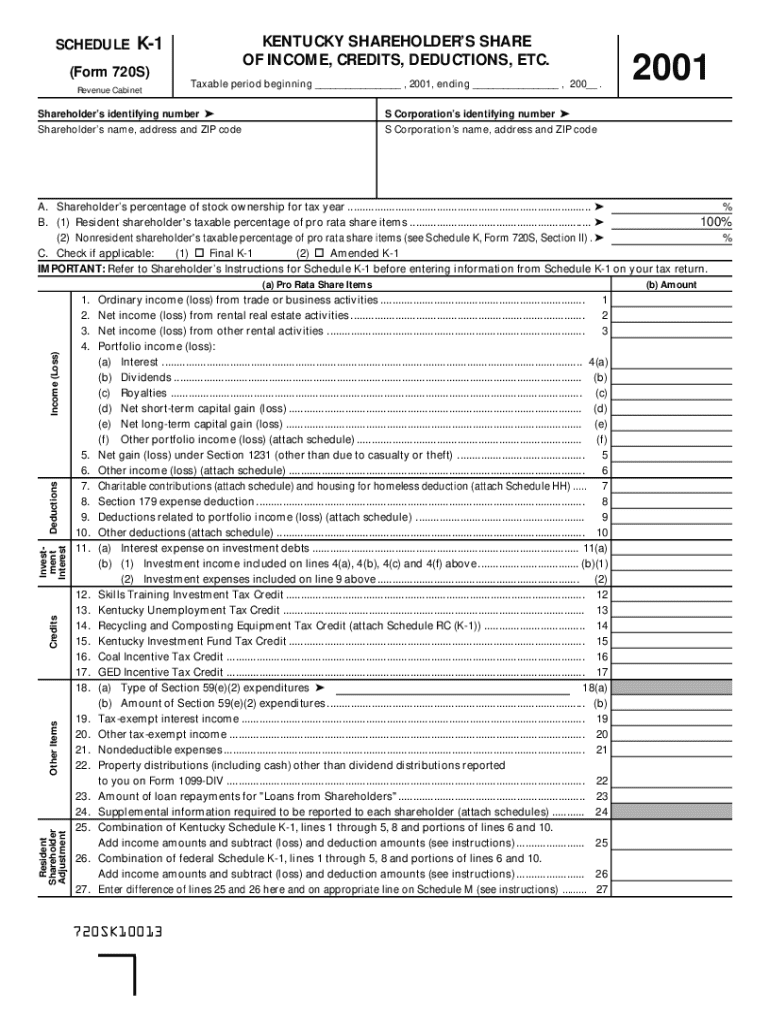

The Schedule K-1 form is a vital document used in tax reporting, reflecting the income, deductions, and credits passed through to individual partners or shareholders from partnerships, S Corporations, and certain trusts. Its significance lies in its function as a means for taxpayers to report income that isn’t directly earned as wages. For many investors, particularly those involved in energy transfer partners or similar entities, understanding the K-1 is crucial, as it impacts their personal tax returns.

There are three primary variants of the Schedule K-1 form: the Partnership K-1 (Form 1065), the S Corporation K-1 (Form 1120S), and the Trust Beneficiary K-1 (Form 1041). Each of these serves a specific purpose and is crucial for different types of entities. While partnerships use K-1 to distribute income to partners, S corporations utilize it for reporting distributions to shareholders, and trusts use it to report income to beneficiaries.

Who needs to fill out the Schedule K-1?

Individual taxpayers who are part of a partnership or S Corporation must complete the Schedule K-1 to report their share of income, deductions, and credits. Eligible individuals typically include those with an ownership stake in an entity, such as investors in energy transfer partnerships. It’s essential for them to understand the details of what is included in their K-1, as it directly influences their tax obligations.

On the other hand, businesses need to issue a Schedule K-1 if they are recognized as partnerships or S Corporations. Failing to distribute K-1 forms and accurately report this information can cause complications for both the entities and their investors during tax season. Tax professionals and advisors also rely heavily on K-1 forms to accurately advise their clients on required filings and tax obligations.

How to access the online Schedule K-1 form

Accessing the online Schedule K-1 form has been simplified through platforms like pdfFiller. To find the K-1 form template, users can navigate to the pdfFiller website and use the search bar to locate the specific K-1 variant they need. This user-friendly platform allows for quick access to the forms without the hassle of searching through multiple websites.

Utilizing pdfFiller offers considerable advantages, including cloud-based convenience and cross-device accessibility. Whether accessing the K-1 form from your desktop at home or your smartphone on the go, pdfFiller ensures you can fill out, edit, and store your documents without being tied to one location.

Step-by-step guide to filling out the Schedule K-1 form

Filling out the Schedule K-1 form accurately is crucial to ensure correct tax reporting. Required information includes details about the partnership or S Corporation, such as its name, address, and EIN (Employer Identification Number), as well as the individual's financial details, including distributions, share of income, and applicable deductions. This information helps ensure that each party's tax responsibilities are accurately conveyed.

Each box on the K-1 serves a specific purpose: Box 1 generally reflects ordinary business income, while boxes 2 and 3 include rental income and other types of income, respectively. Careful attention is required to ensure accurate reporting, as mistakes can lead to tax discrepancies.

Editing the Schedule K-1 form

One of the remarkable features of pdfFiller is its comprehensive editing tools, which allow users to modify the Schedule K-1 form as needed. Users can easily add or remove fields, adjusting the document to meet their specific needs. This flexibility is particularly beneficial for those managing multiple tax returns or consulting with others, as it allows for seamless customization.

Incorporating digital signatures and approvals is also effortless with pdfFiller, ensuring compliance and authenticity in document handling. The collaboration features enable users to invite team members for input, fostering teamwork and ensuring all inputs are accurately reflected in the final document. This level of cooperation significantly enhances the document preparation process.

Managing and storing your Schedule K-1 form

Effective document management is crucial when dealing with important tax forms like the Schedule K-1. pdfFiller offers best practices for organizing forms, such as tagging and categorizing documents to ensure quick retrieval. Secure storage options within pdfFiller allow users to store sensitive information safely, mitigated through advanced encryption technologies, making sure your data is protected.

Furthermore, pdfFiller enables easy sharing of K-1 forms with tax professionals, which expedites the consultation process. Users can download forms in various formats, including PDF and DOCX, accommodating different needs and preferences for handling tax documentation.

Common challenges when completing the Schedule K-1

Completing a Schedule K-1 can be challenging, especially when it comes to reporting income and deductions accurately. The allocation of credits and the characterization of income items can lead to misunderstandings, often causing misreporting on tax returns. It is crucial to review each element of the form to avoid pitfalls that could trigger audits or additional tax liability.

Frequently asked questions can help clarify complex reporting scenarios. For example, individuals often wonder about the tax implications of losses reported on their K-1, as well as how distributions are taxed. Addressing these questions can streamline the tax preparation process.

Support for Schedule K-1 form users

For users navigating the complexities of the Schedule K-1 form, accessing customer support through pdfFiller is invaluable. Users can reach out for assistance with technical issues or queries regarding form completion. Additionally, the availability of expert tax advice is a tremendous resource for those who may find themselves overwhelmed by the intricacies of tax reporting.

Engaging with community forums also provides a platform for users to seek insights and tips from others. The shared experiences and expertise from a network of users can significantly enhance understanding and build confidence in handling K-1 forms.

Updates and changes in Schedule K-1 reporting

Staying updated on recent tax law changes affecting the Schedule K-1 form is essential for both taxpayers and businesses. Changes in tax laws can impact how income is reported and can also influence various deductions and credits available. For example, changes in merger regulations may affect how energy transfer partnerships report their income, requiring adjustments in K-1 allocations.

Users can remain informed by subscribing to tax news updates or following dedicated resources related to K-1 reporting. These proactive measures can help ensure compliance with the latest regulations and enable taxpayers to take advantage of any new tax benefits that arise.

Utilizing pdfFiller for other tax forms

Beyond the Schedule K-1 form, pdfFiller offers a diverse range of tax forms, making it a versatile solution for document management. Users can access additional forms pertinent to their needs, ensuring they can handle all aspects of their tax filings through one comprehensive platform. This consolidation aids in maintaining organization and efficiency in tax preparation.

The benefits of using pdfFiller across multiple document types include streamlined processes, accessibility, and the ability to manage everything from a single, cloud-based platform. Particularly for individuals and teams seeking a comprehensive, access-from-anywhere document creation solution, pdfFiller provides unparalleled convenience and effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find online schedule k-1 form?

How do I edit online schedule k-1 form straight from my smartphone?

How do I fill out online schedule k-1 form using my mobile device?

What is online schedule k-1 form?

Who is required to file online schedule k-1 form?

How to fill out online schedule k-1 form?

What is the purpose of online schedule k-1 form?

What information must be reported on online schedule k-1 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.