Get the free Kentucky k 1 form: Fill out & sign online

Get, Create, Make and Sign kentucky k 1 form

How to edit kentucky k 1 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kentucky k 1 form

How to fill out kentucky k 1 form

Who needs kentucky k 1 form?

Comprehensive Guide to the Kentucky K-1 Form

Overview of the Kentucky K-1 Form

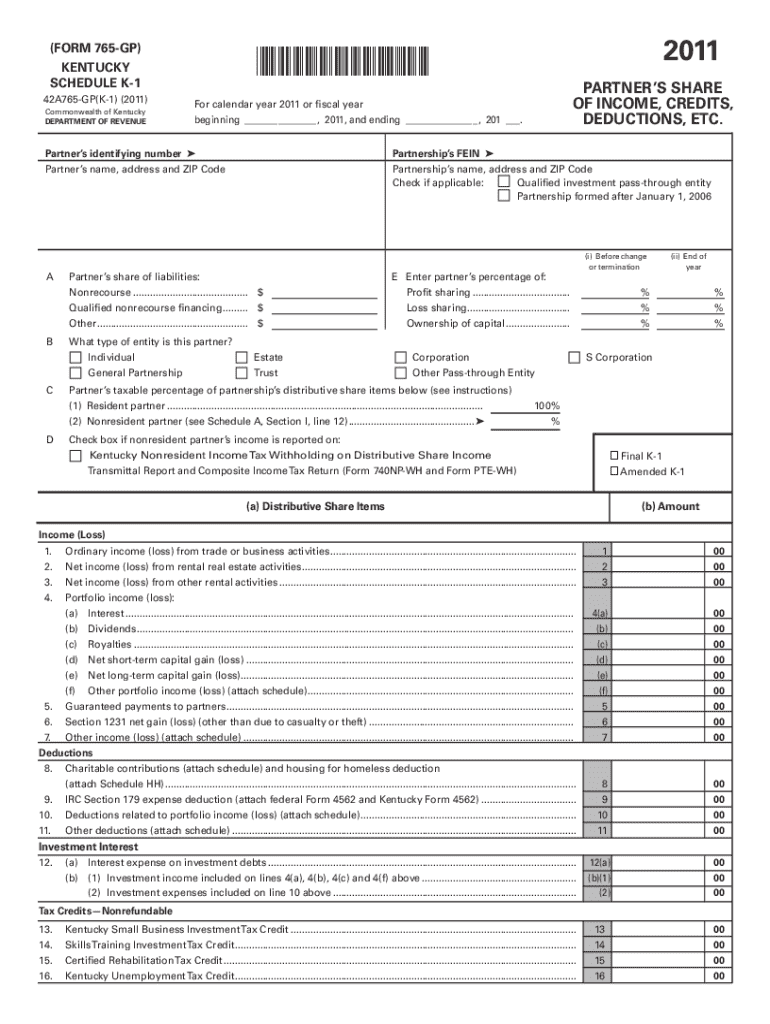

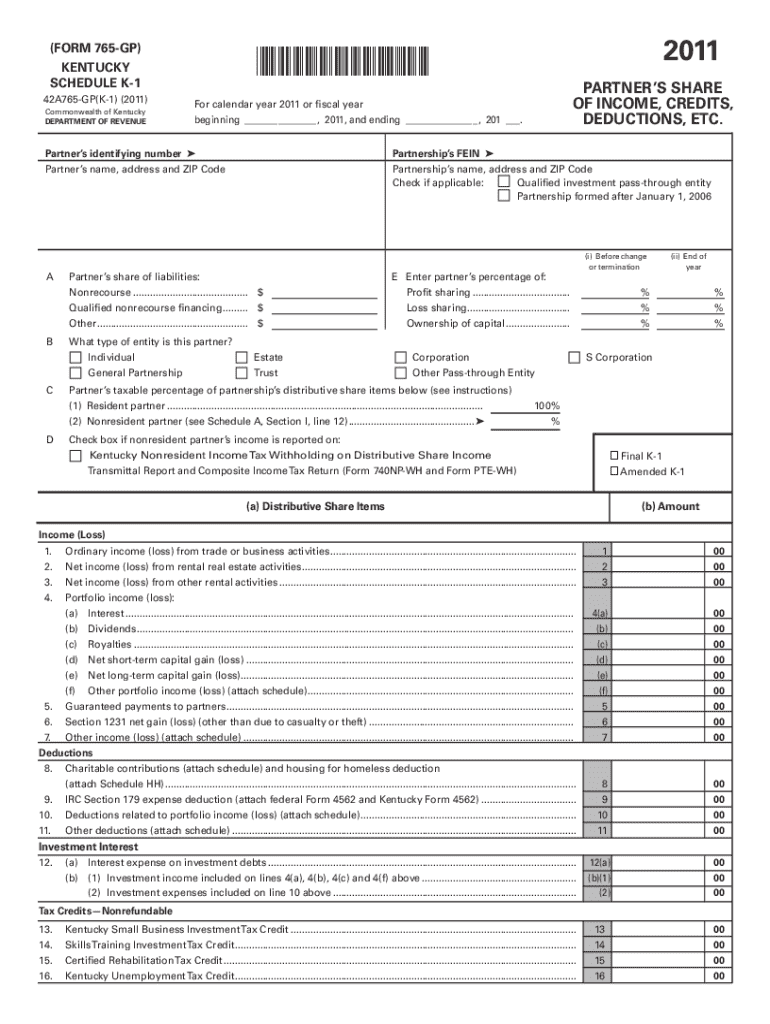

The Kentucky K-1 Form is a crucial document issued by partnerships, S corporations, estates, and trusts to report the income, deductions, and credits allocated to each partner or shareholder for the tax year. It serves a similar purpose to the federal K-1 form but is specifically tailored to meet Kentucky's tax requirements.

This form is important during tax filing because it provides detailed records of each individual’s share of the entity’s income, which is necessary for both state and federal tax returns. Understanding and properly filling out this form can ensure compliance and maximize deductions.

Understanding the structure of the Kentucky K-1 Form

The Kentucky K-1 Form consists of several distinct sections, each vital for providing the state tax authority with necessary information regarding income and deductions. Familiarizing yourself with these sections will greatly enhance the accuracy of your filings.

The primary sections of the form include personal information, income distribution details, and tax credits and deductions. Personal information includes the names, addresses, and taxpayer identification numbers of both the issuer and recipient. Income distribution details encompass various forms of income such as ordinary income, dividends, and capital gains.

Step-by-step guide to filling out the Kentucky K-1 Form

Filling out the Kentucky K-1 Form can be straightforward if you follow a structured approach. Proper preparation and attention to detail can simplify the process significantly.

Step 1: Gathering necessary information

Before starting, gather all required documents, including prior year K-1s, partnership agreements, and financial statements. Ensure you have the appropriate tax identification number (TIN) and any IRS forms that impact your state tax return.

Step 2: Completing personal information section

Accuracy is key in this section. Double-check names, TINs, and addresses to avoid discrepancies that could delay your filings.

Step 3: Reporting income distributions

Different types of income should be reported here, such as rental income, dividends, and interest. Ensure to differentiate between ordinary income and capital gains, as they are taxed at different rates.

Step 4: Calculating tax credits and deductions

You can optimize your tax liability by carefully reviewing eligible deductions and tax credits. This includes any credits associated with investments or contributions made to Kentucky-specific programs.

Step 5: Reviewing and finalizing the form

Before submission, review all entries to catch typos or miscalculations. Common mistakes include incorrect TINs, misreporting income types, and omitting relevant deductions. Ensure you have the correct number of copies for distribution.

Tips for editing and managing your Kentucky K-1 Form

Using digital tools can streamline the process of managing your Kentucky K-1 Form. pdfFiller offers a comprehensive suite of editing tools that simplify this task.

Consider utilizing pdfFiller's features for editing, which allow you to modify the form directly. After completing the form, eSigning can be done seamlessly, with options for secure sharing options to send the document to partners or accountants.

Interactive tools for Kentucky K-1 Form management

pdfFiller provides various interactive features to assist you in managing your Kentucky K-1 Form effectively. This platform enhances accessibility and usability.

With fillable fields, you can quickly enter your data without having to print out the form. Additionally, cloud storage options ensure you can access your documents from anywhere, making it easier for teams working remotely.

Common challenges and solutions in filing the Kentucky K-1 Form

Filing the Kentucky K-1 Form can present various challenges for filers. Common issues include difficulty in calculating income distributions and understanding the nuances of tax credits.

A helpful way to address these challenges is by consulting available FAQs that cover common concerns and solutions regarding K-1 form filing. This can also be complemented by seeking further support from tax professionals.

Best practices for filing your Kentucky K-1 Form

To ensure a smooth filing experience, it’s essential to adhere to specific best practices. Keep track of important deadlines to avoid penalties, and establish an organized record-keeping system to facilitate the retrieval of relevant documents.

Staying informed about changes to tax laws that may affect the Kentucky K-1 Form is also crucial. This knowledge will allow for the timely adjustment of your strategies to maximize deductions and credits.

Case studies: real-life scenarios involving the Kentucky K-1 Form

Real-life examples highlight the practical application of the Kentucky K-1 Form in various scenarios. These insights may provide valuable lessons for others facing similar tax situations.

For instance, a partnership faced delays in filing due to incorrect entries in the income distribution section. By reviewing a checklist before submission, they were able to rectify their filing approach, resulting in a smoother process during subsequent tax years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send kentucky k 1 form to be eSigned by others?

How do I edit kentucky k 1 form in Chrome?

Can I create an eSignature for the kentucky k 1 form in Gmail?

What is kentucky k 1 form?

Who is required to file kentucky k 1 form?

How to fill out kentucky k 1 form?

What is the purpose of kentucky k 1 form?

What information must be reported on kentucky k 1 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.