Get the free ADOR Outlines Executive Order and 2025 Tax Year ...

Get, Create, Make and Sign ador outlines executive order

How to edit ador outlines executive order online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ador outlines executive order

How to fill out ador outlines executive order

Who needs ador outlines executive order?

ADOR Outlines Executive Order Form: A Comprehensive How-To Guide

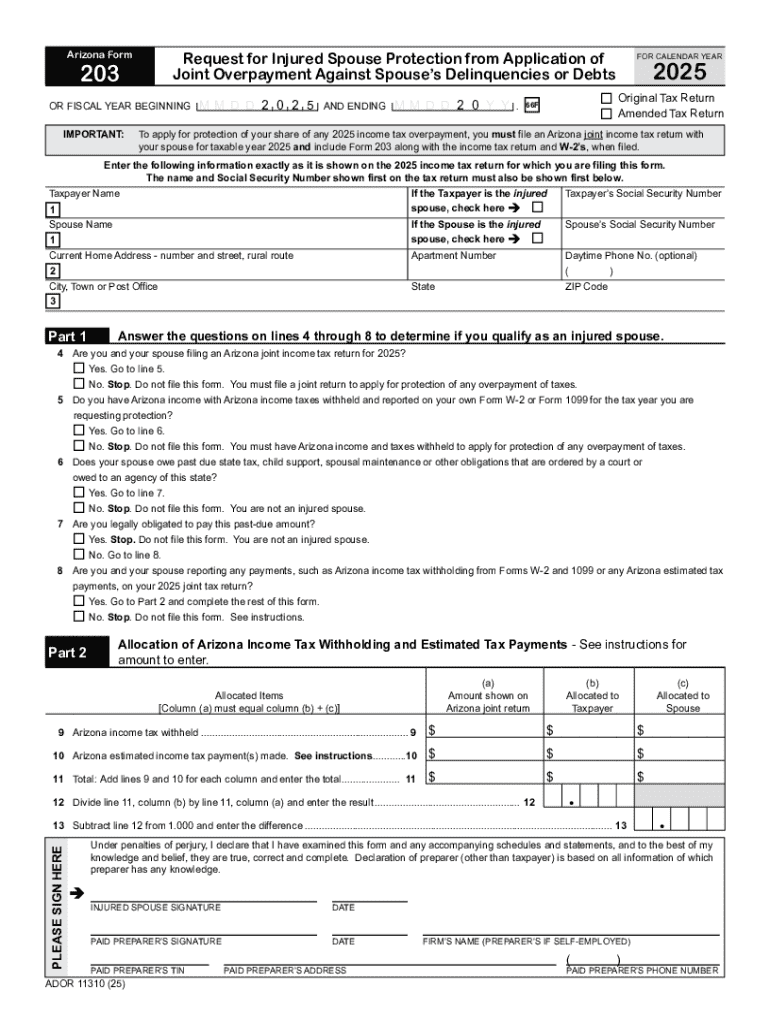

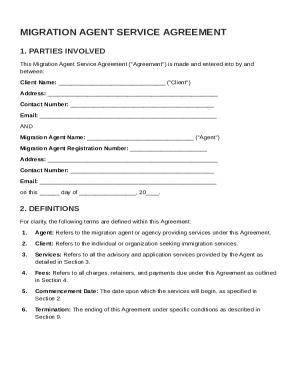

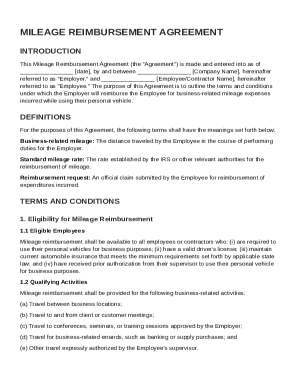

Understanding the ADOR executive order form

An Executive Order Form is a crucial document utilized within various administrative frameworks to implement directives or actions initiated by the Governor or designated authorities. In the context of the Alabama Department of Revenue (ADOR), this form acts as a formal request or instruction to manage and regulate tax-related matters effectively. ADOR plays a vital role in overseeing tax compliance, enforcing revenue laws, and promoting economic stability, serving the citizens of Alabama and fostering a transparent relationship between taxpayers and state agencies.

The significance of the ADOR Executive Order Form cannot be understated; it streamlines administrative operations, ensures compliance with state regulations, and facilitates the timely execution of necessary actions that impact Alabama residents. This form's utility extends across various sectors, encompassing relief measures, adjustments in tax filing procedures, and the provision of necessary clarity on specific tax laws.

Key features of the ADOR executive order form

The ADOR Executive Order Form serves multiple purposes, primarily focused on addressing urgent tax matters lacking clear legislative guidelines. It assists in enacting vital changes to tax structures or processes, ensuring that Arizonans can avail of necessary relief or adjustments without delay. Some notable attributes of this form include its multifaceted usability, allowing for adaptations to income tax forms, and directives that directly impact taxpayer obligations.

Additionally, compliance with this form is governed by legal standards, ensuring that all executive orders uphold the law’s integrity. Users must consider the legal implications of their requests, as non-compliance can lead to complications or penalties, affecting both the state and its taxpayers. Therefore, understanding the requirements associated with the ADOR Executive Order Form is crucial for all involved.

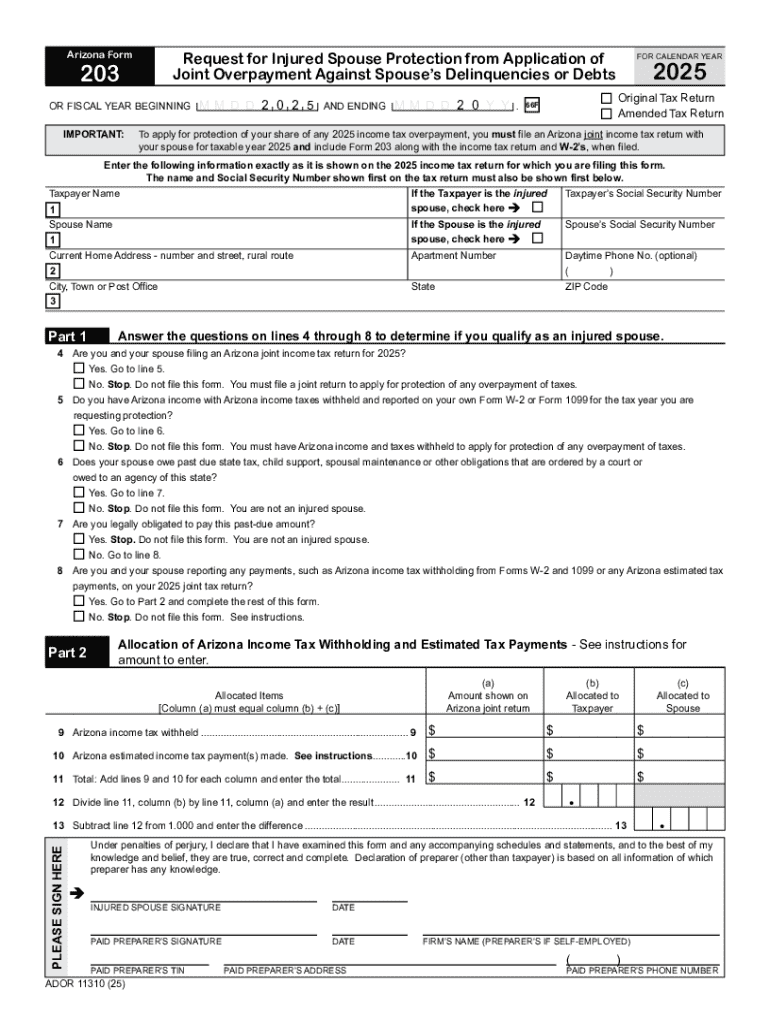

Step-by-step guide to filling out the ADOR executive order form

Filling out the ADOR Executive Order Form requires careful preparation and attention to detail. Start by gathering all necessary documents, such as prior executive orders, tax-related forms, and supporting documentation that clarifies the purpose of your request. Familiarity with the terminology used in the form is also helpful, enabling you to complete it accurately and competently.

Preparation for filling out the form

Filling out the form

Next, focus on filling out the form itself. The form typically comprises four key sections:

Reviewing the completed form

Once filled, review the completed form thoroughly. This step is critical to avoid rejections that can arise from simple inaccuracies. Common mistakes include missing signatures, incorrect dates, and incomplete sections. Incorporating a checklist for each section can help you ensure all necessary information is present and accurate.

Editing and managing your ADOR executive order form

After filling out the form, you might find that you need to make edits or revisions. Utilizing pdfFiller's tools for editing PDF forms can streamline this process. With its intuitive interface, you can quickly make necessary changes, ensuring your document remains current and accurate.

When managing your ADOR Executive Order Form, best practices include saving your documents in organized folders and using version control to keep track of changes over time. This structure not only aids in easy retrieval but also ensures you have access to previous drafts if needed.

Signing the ADOR executive order form

Properly signing the ADOR Executive Order Form is integral to its legitimacy. Understanding electronic signatures and their validity is essential, especially as digital documentation becomes increasingly prevalent. pdfFiller provides a straightforward platform for eSigning the document, ensuring compliance with legal standards while maintaining the document’s integrity.

To eSign using pdfFiller, simply follow the prompts to create your signature and place it on the designated line. This process not only simplifies signing but also speeds up submission timelines, which can be crucial when deadlines loom.

Collaborating on the ADOR executive order form

For teams involved in submitting the ADOR Executive Order Form, collaboration is key. pdfFiller offers collaboration features that make it easy for multiple individuals to work on a single document simultaneously. Setting up these features encourages real-time editing, allowing you to incorporate feedback and make necessary adjustments promptly.

Managing permissions and access for team members is also essential. Ensure that all collaborators have the appropriate rights to edit, review, or comment on the document, fostering a cooperative environment that enhances productivity during the submission process.

Submitting the ADOR executive order form

Once your ADOR Executive Order Form is completed and signed, the next step is submission. You have options for both online and offline submission, catering to diverse preferences. It's vital to adhere to any deadlines or timelines set for submitting the form; these dates can be integral to the effective implementation of the executive actions requested.

After submission, ensure you receive confirmation of your application's status. Many organizations provide tracking systems to monitor the progress of your executive order, which can be beneficial for managing expectations and following up on outstanding requests.

FAQs about the ADOR executive order form

Frequently asked questions regarding the ADOR Executive Order Form often center around the application process, submission troubleshooting, and clarifications on specific terminology. Common inquiries include the timeline for order processing, the possibility of modification post-submission, and understanding the legal language used in the forms.

Users may also seek guidance on resolving submission issues, such as errors in the application or questions about documentation requirements. Addressing these FAQs helps streamline the process, allowing taxpayers to move forward confidently.

Recent updates and relevant news

Staying informed about ongoing changes to Executive Order processes is crucial for stakeholders. Recent updates from the ADOR may include reforms in the executive order submission guidelines, adjustments in processing times, and alterations in required documentation. Awareness of these changes can significantly impact the efficiency and effectiveness of your submissions.

Forthcoming deadlines or changes stemming from ADOR regulations could also affect users, so keeping an eye on official announcements or news releases is advisable. Regular updates ensure that you remain compliant and prepared for any shifts in the legal landscape governing executive orders in Alabama.

Additional tools and resources available via pdfFiller

pdfFiller offers a vast array of additional forms and resources that can facilitate your documentation needs beyond the ADOR Executive Order Form. With interactive tools allowing for easy document creation, management, and collaboration, you can streamline your paperwork processes.

User testimonials provide insight into the efficiency and ease of using pdfFiller for handling executive orders and other administrative forms, offering a solid case for its effectiveness as a cloud-based solution for document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ador outlines executive order online?

Can I create an electronic signature for signing my ador outlines executive order in Gmail?

Can I edit ador outlines executive order on an Android device?

What is ador outlines executive order?

Who is required to file ador outlines executive order?

How to fill out ador outlines executive order?

What is the purpose of ador outlines executive order?

What information must be reported on ador outlines executive order?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.