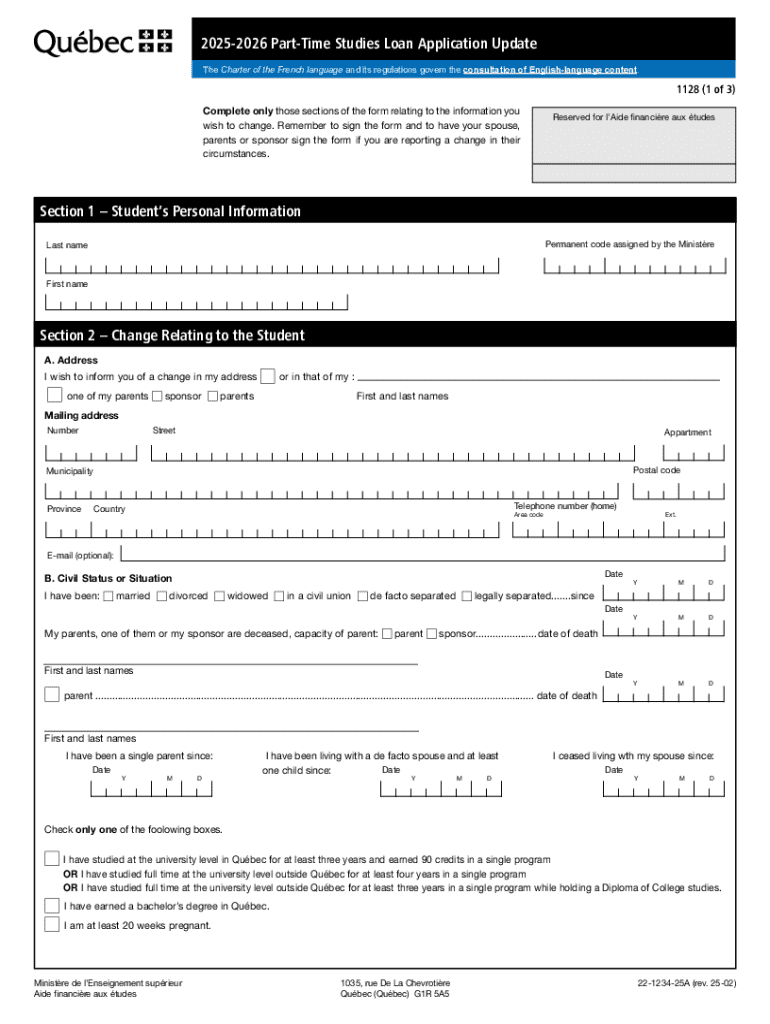

Get the free 1128 - Update - Part-Time Education Loan Application. Form to update your part-time ...

Get, Create, Make and Sign 1128 - update

Editing 1128 - update online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1128 - update

How to fill out 1128 - update

Who needs 1128 - update?

1128 - Update Form: A Comprehensive How-to Guide

Understanding the 1128 update form

The 1128 Update Form is a critical document utilized by businesses to request a change in their accounting period. Essentially, this form allows organizations to alter the tax year for reporting purposes, aligning financial reporting with internal operations or strategic goals.

Updating the accounting period is vital because changes in a business's operations might require a different fiscal year for more accurate tax reporting and compliance. For instance, if a company merges or undergoes significant restructuring, switching the accounting period may better reflect its new operational reality.

Any business entity eligible under IRS regulations can use the 1128 Update Form. This includes corporations, partnerships, and entities taxed as corporations, ensuring that they can efficiently manage their tax obligations in a way that suits their unique circumstances.

Key features of the 1128 update form

The 1128 Update Form includes several key areas that require users to provide information about their current accounting period and the reasons for the change. Form fields typically include the entity’s name, address, EIN, and specifics of the current and requested periods. Users must detail the reasons prompting the change and confirm their compliance with IRS guidelines.

Common scenarios for filing this form include changes due to mergers, shifts in business focus, or even attempts to synchronize accounting periods with industry standards. By addressing these scenarios, companies can maintain better financial management and aligned tax reporting.

Integrating the 1128 Update Form into your business operations is crucial. It not only supports compliance with IRS regulations but also simplifies the accounting processes across various departments, ensuring that finance, payroll, and reporting activities are in sync.

Step-by-step guide to completing the 1128 update form

Completing the 1128 Update Form requires careful attention to detail. The first step is to determine your eligibility. Businesses must ensure that they qualify to make a change to their accounting year by examining their current reporting practices and understanding the IRS criteria.

Step 1: Determine your eligibility

Step 2: Gather required documentation

Next, gather all required documentation, which typically includes existing financial statements, previous tax returns, and any agreements that reflect business changes. Organizing these documents efficiently can streamline the application process.

Step 3: Detailed walkthrough of each part of the form

Step 4: Review and confirm your entry

Before submission, it’s imperative to review your form. Create a checklist for accuracy to ensure all entries are correct and comply with IRS requirements. Double-checking this information is crucial to avoid potential delays or rejections.

Step 5: Submit your 1128 update form

Finally, submit your completed 1128 Update Form. The submission methods can vary based on your business's circumstances. Electronic submission is becoming more common, enhancing tracking and efficiency.

Common pitfalls to avoid with the 1128 update form

Avoiding errors while filling out the 1128 Update Form is crucial. Common pitfalls include incorrect EIN or failing to properly justify the reason for the accounting period change. Both can lead to significant delays in processing or even rejection of your application.

To prevent these mistakes, create a systematic approach to how you fill out the form. Use templates or checklists to ensure all necessary information is included and accurate.

If mistakes are made, promptly file for an amendment to rectify the errors, and be prepared to provide additional documentation if needed.

Advanced considerations when filing the 1128 update form

Certain unique scenarios may require specialized knowledge when filing the 1128 Update Form. For instance, merging large corporations or transitioning from a partnership to a corporation can present unique challenges. Consulting with tax professionals ensures that your filing meets all necessary requirements and reflects the correct data.

The impact of timing also cannot be overlooked. Filings made at the beginning of a tax year may have different implications than those made mid-year. Therefore, it’s essential to consult with financial advisors to assess the best timing for your submission.

Collaborating with your team using the 1128 update form

Collaboration is key when multiple team members are involved in filling out the 1128 Update Form. Establishing best practices such as clear communication about roles and responsibilities can significantly enhance the completion process. Utilizing tools like pdfFiller allows multiple users to view and edit the document in real-time.

Specific features within pdfFiller, such as shared access modes, integrated comments, and version history, can further streamline collaboration. Teams can efficiently manage and track any changes made to the document, ensuring everyone stays aligned.

Leveraging technology for a streamlined filling process

Technology can significantly enhance the process of filling out the 1128 Update Form. Platforms like pdfFiller offer advanced tools for document management, allowing users to fill, edit, and sign forms directly within a cloud-based system. This not only improves efficiency but also ensures that you have access to the latest documents no matter where you are.

Cloud-based solutions come with various benefits, including automatic updates and enhanced security for your sensitive information. The eSigning features in pdfFiller ensure quick approvals, which can further expedite the submission process.

Feedback and future updates to your accounting period

Continuously keeping your documentation current is crucial for compliance and operational efficiency. Businesses should regularly review their filing requirements and stay updated on any changes from the IRS regarding the 1128 Update Form.

Implementing a routine for reviewing financial practices is essential. This practice ensures that your accounting periods align with your business changes, regulatory requirements, and industry standards.

Case studies: Success stories with the 1128 update form

Several businesses have successfully navigated the process of filing the 1128 Update Form, resulting in more streamlined operations and tax compliance. For example, a tech startup that merged with a larger firm strategically adjusted its accounting period to align with its parent company, allowing for unified reporting and strategic planning.

Lessons from such implementations highlight the importance of timely submissions and the need to engage with professional tax services to navigate complex situations effectively.

Troubleshooting and support for filling out the 1128 update form

If you encounter any issues while filling out the 1128 Update Form, several resources are available to assist. Support from your tax advisor is invaluable, as they can provide guidance tailored to your specific business needs.

pdfFiller offers extensive resources for users, including instructional materials and customer support options, ensuring that any challenges you face can be addressed quickly and effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 1128 - update for eSignature?

How do I execute 1128 - update online?

Can I edit 1128 - update on an Android device?

What is 1128 - update?

Who is required to file 1128 - update?

How to fill out 1128 - update?

What is the purpose of 1128 - update?

What information must be reported on 1128 - update?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.