Get the free PIS 1

Get, Create, Make and Sign pis 1

Editing pis 1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pis 1

How to fill out pis 1

Who needs pis 1?

Understanding and Managing the pis 1 Form: A Comprehensive Guide

Understanding the pis 1 form

The pis 1 form is a critical document often associated with portfolio investment scheme frameworks. This form plays a pivotal role in financial reporting and regulation compliance, particularly for individuals and teams engaged in investments. Knowing what the pis 1 form entails is essential for accurate submissions and meeting legal obligations.

Its significance cannot be overstated. The pis 1 form serves multiple purposes including capturing detailed financial information, which is necessary for tax calculations, compliance checks, and ensuring that any deductions or tax credits are appropriately claimed. Therefore, understanding this form's purpose and its application in various scenarios can significantly impact an individual's financial strategy.

Step-by-step instructions for completing the pis 1 form

Completing the pis 1 form correctly is paramount to ensure that your financial records are accurate and compliant. To do this, follow our step-by-step guide to navigate the complexities of this document.

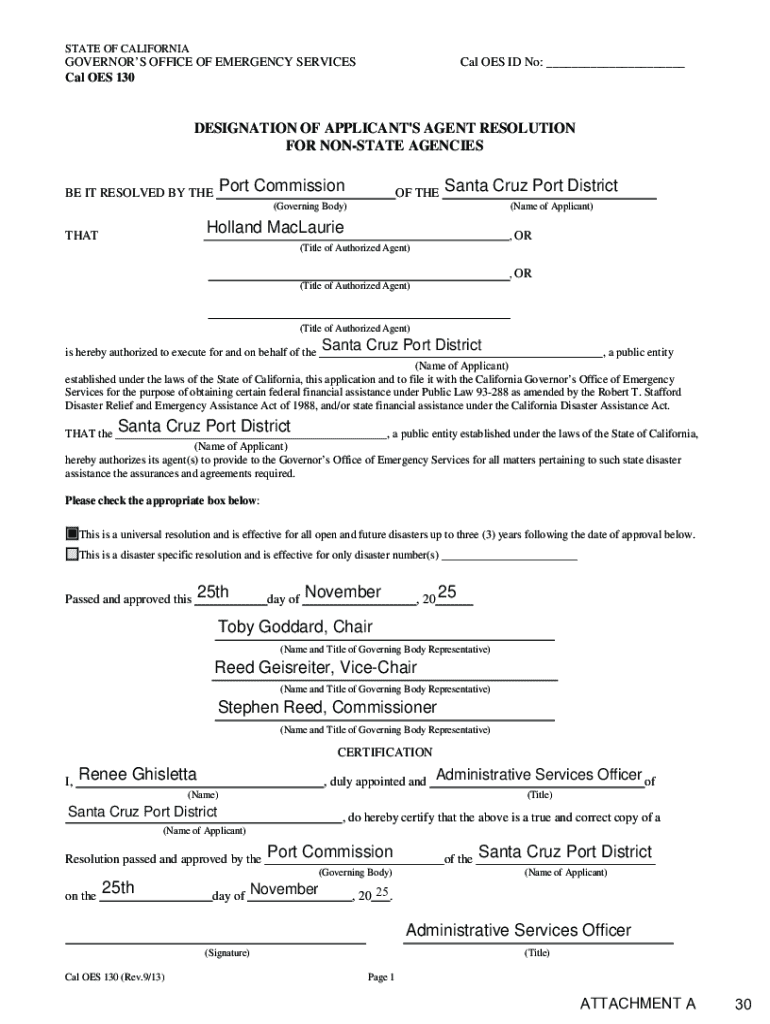

First, review the required information that goes into each section of the form. This includes personal information, employment details, income reporting, deductions, and the all-important signature.

Personal information

In this section, include your full name, address, contact information, and social security number. This information should be current and verifiable.

Common mistakes include using outdated details or inconsistent naming (e.g., nicknames). Double-check all entries for accuracy to avoid complications.

Employment details

You will need to specify your employer's name and address as well as your job title and employment duration. Include any necessary documentation, such as your employment contract or recent pay stubs, to substantiate your claims.

Ensure that information is consistent with your employment records and that you disclose any side projects or contracts correctly.

Income reporting

Calculate your total income, including salaries, bonuses, and any other cash inflows. Use recent paystubs or tax returns to ensure accuracy. Don’t forget to report additional income sources, such as investments or freelance work, as this will provide a more comprehensive picture of your financial status.

Deductions and exemptions

Look for ways to maximize eligible deductions, including retirement contributions or educational expenses. Knowing which deductions apply can save you considerable tax money. Consult tax regulations for specifics to ensure you are not missing out.

Signature and date

Finally, ensure you sign and date the form appropriately. Your signature verifies that the information contained within the pis 1 form is accurate and truthful. Also, if you’re submitting digitally, familiarize yourself with the differences and security features of digital versus physical signatures.

Editing and reviewing the pis 1 form

Thorough editing and reviewing of your completed pis 1 form is essential to maintain accuracy and completeness. Use best practices in document review, such as checking for spelling and numerical errors, as these can have serious ramifications.

Utilizing tools like pdfFiller can make this process smoother. With pdfFiller, you can easily access interactive features to add comments or corrections before finalizing your form.

eSigning the pis 1 form

The increasing reliance on digital forms has made eSignatures a crucial aspect of submitting your pis 1 form. eSignatures play a significant role in confirming both the integrity and authenticity of your document.

Using pdfFiller's eSigning functionalities, you can easily sign your document digitally. Not only does this simplify the process, but it also adds layers of security to your submission.

Managing your pis 1 form

Once you have completed and signed your pis 1 form, managing the document is the next step. Best practices include saving your form in multiple formats, such as PDF and JPEG, and choosing cloud storage options for easy access.

pdfFiller provides various sharing and collaboration features to streamline this process. Whether emailing the form directly or using cloud storage solutions, you can ensure your form is readily available whenever needed.

Common issues and FAQs related to the pis 1 form

Handling the pis 1 form may come with its share of challenges. Knowing potential issues can mitigate errors in the submission process. Common mistakes often include miscalculations in income reporting or omission of required signatures.

If your form is rejected, promptly review the specifications provided by the approving authority to make necessary adjustments. Familiarize yourself with typical questions that arise related to deadlines or documentation needed to submit your form correctly.

Advanced tips for using pdfFiller with the pis 1 form

For those looking to streamline their documentation process, integrating the pis 1 form into your workflow can enhance productivity significantly. pdfFiller allows users to create templates for future use, which saves time and reduces repetitive tasks.

Automating your document processes gives you peace of mind knowing that compliance and security are built into your workflows. Understanding how to leverage these advanced features can significantly enhance your experience.

Real-life examples of successfully completed pis 1 forms

Case studies and testimonials from pdfFiller users highlight the importance of accurately completing the pis 1 form. Real-life examples illustrate not only effective usage scenarios but also the pitfalls to avoid.

Users who successfully navigated the complexities of this form often cite attention to detail and utilization of pdfFiller's resources as key factors in their success.

Getting started with pdfFiller for your pis 1 form

Starting with pdfFiller to manage your pis 1 form is a straightforward process. First, create an account on pdfFiller’s platform and familiarize yourself with its key features.

Navigating the user interface is user-friendly, making it easy for individuals and teams to find and fill forms. Explore the various tools available for editing, sharing, and securely storing your completed documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pis 1?

How do I complete pis 1 online?

How do I make edits in pis 1 without leaving Chrome?

What is pis 1?

Who is required to file pis 1?

How to fill out pis 1?

What is the purpose of pis 1?

What information must be reported on pis 1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.