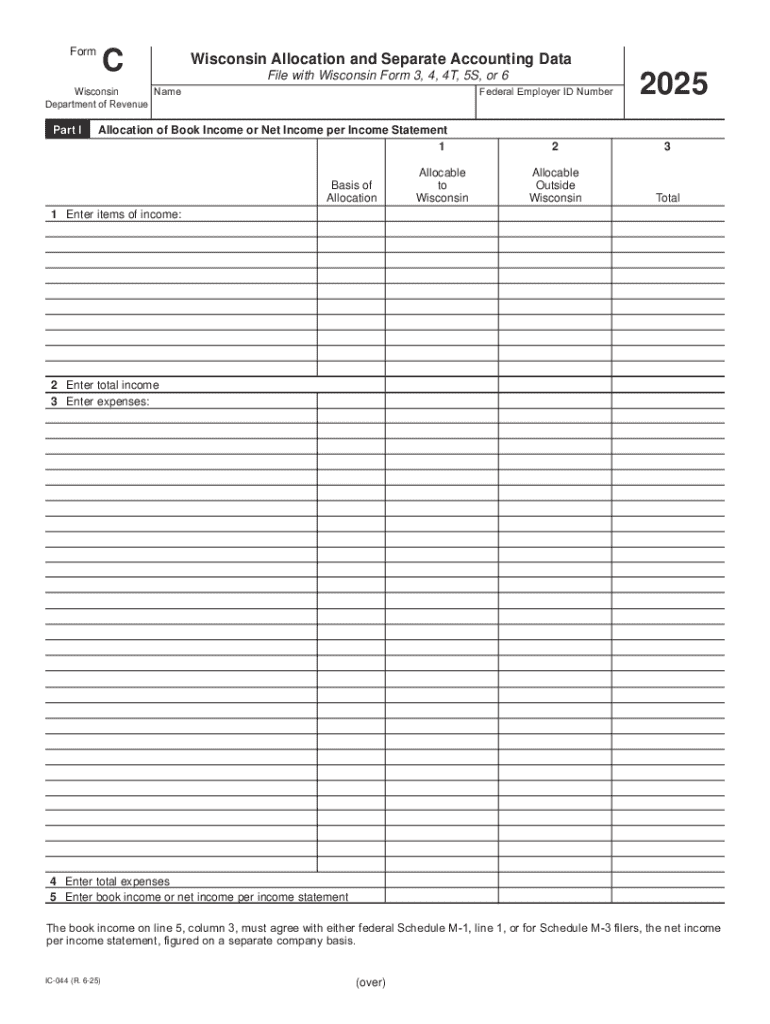

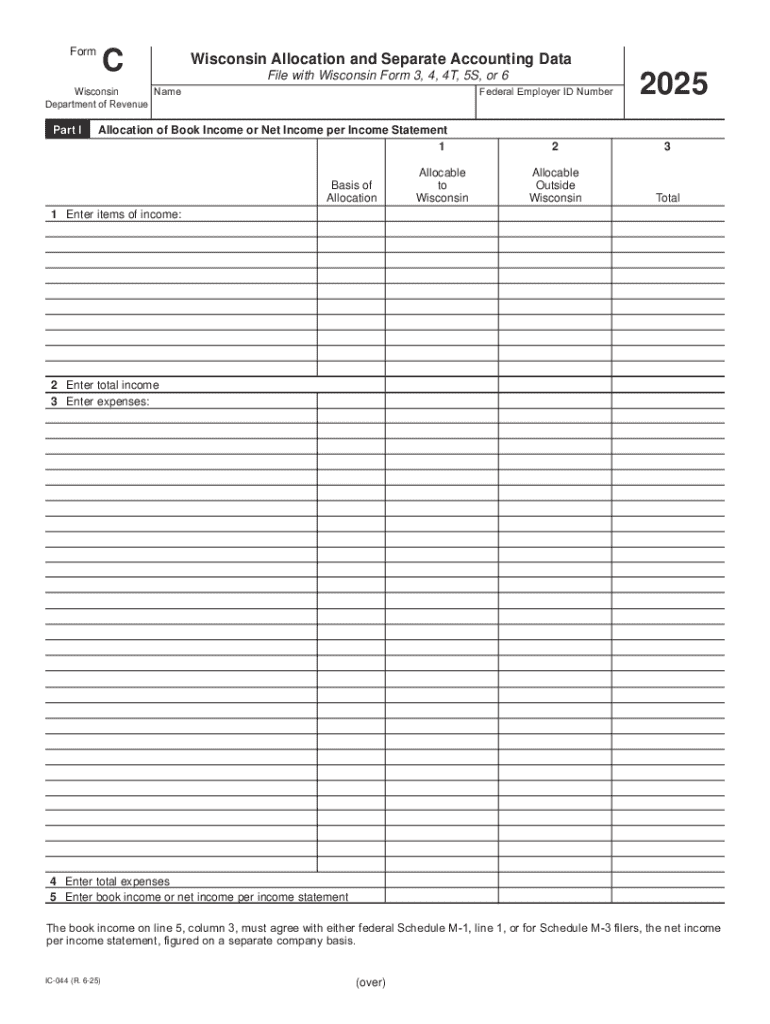

Get the free 2025 IC-044 Form C Wisconsin Allocation and Separate Accounting Data (fillable)

Get, Create, Make and Sign 2025 ic-044 form c

Editing 2025 ic-044 form c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 ic-044 form c

How to fill out 2025 ic-044 form c

Who needs 2025 ic-044 form c?

2025 -044 Form : Complete Guide to Filing and Management

Overview of the 2025 -044 Form

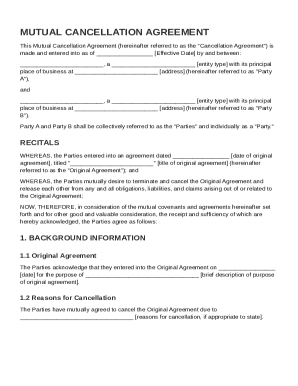

The 2025 IC-044 Form C is a crucial tax document that individuals and businesses use to report their taxable income and claim relevant deductions. The primary purpose of this form is to provide a detailed account of income and expenses, ensuring accurate tax liability calculation. Understanding its importance cannot be overstated; it's vital for compliance with tax regulations and for maximizing potential refunds.

In 2025, taxpayers will notice significant changes compared to previous years due to tax law updates. These adjustments may influence how taxpayers report income, claim deductions, and engage with tax authorities. It's essential to be aware of these changes, as they may affect long-standing strategies for tax filings.

Preparing to fill out the 2025 -044 Form

Preparation is key when filing the 2025 IC-044 Form C. Start by gathering all necessary documents, which typically include your W-2 forms, 1099s, bank statements, and any records of deductions or credits you intend to claim. These documents ensure that the information provided on the form is accurate.

Understanding the filing categories is equally essential. Not everyone needs to file the IC-044 Form C; typically, self-employed individuals, freelancers, and certain business entities must submit this form. There are specific exemptions available, which you may qualify for, so it’s important to review your circumstances.

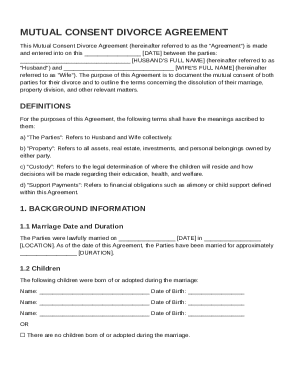

Step-by-step instructions for completing the 2025 -044 Form

Completing the 2025 IC-044 Form C requires attention to detail. Begin with Section 1, which gathers personal information. Ensure accuracy by double-checking names, addresses, and social security numbers, as this can prevent processing delays.

In Section 2, you will report your income. Be diligent when reporting sources of income, as underreporting can lead to audits or penalties. Common mistakes include missing out on side income or mixing personal and business earnings, so separate documentation is crucial.

Section 3 will cover deductions and credits. As a filer, it's important to familiarize yourself with what deductions are available. For example, educational expenses, certain medical expenses, and business-related costs can often be deducted. Calculating and entering these correctly can lower your tax liability significantly.

Finally, in Section 4, ensure you follow the guidelines for signatures. If e-filing, follow the platform's instructions for electronic signatures carefully. Verifying your form before submission helps avoid future issues; check for completeness and consistency.

Common errors with the 2025 -044 Form and how to avoid them

Many filers encounter frequent errors when completing their 2025 IC-044 Form C. One common mistake is entering incorrect information, which can lead to processing delays or rejections. Omissions, such as failing to report all forms of income or missing signatures, can also have significant impacts.

These steps not only help avoid errors but also give peace of mind, knowing your form is as accurate as possible.

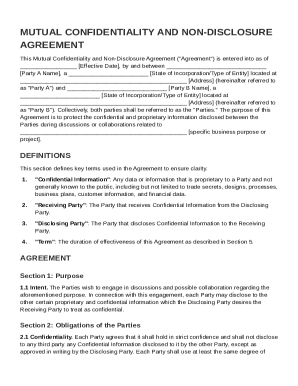

Interactive tools for completing the 2025 -044 Form

Utilizing online fillable PDFs can greatly simplify the process of completing the 2025 IC-044 Form C. pdfFiller’s interactive tools enhance user experience, allowing you to fill, edit, and sign directly within the platform, which eliminates the hassle of printing and scanning. The intuitive layout guides you through each section smoothly.

Additionally, the e-signature features provided by pdfFiller streamline the signing process. Understanding the legal implications of e-signatures is crucial, as they are accepted on par with traditional signatures in most jurisdictions, thereby maintaining the form's validity.

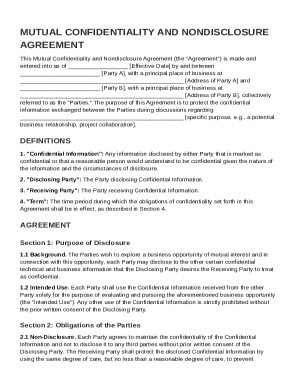

Filing and submission options for the 2025 -044 Form

When it comes to filing the 2025 IC-044 Form C, you have two primary options: electronic filing (e-filing) and paper submission. E-filing is generally more efficient and is recommended due to its speed and convenience.

The advantages of e-filing through platforms like pdfFiller include real-time error checking and confirmation upon submission. To e-file, simply follow these steps:

If you choose to submit a paper form, ensure that you print and sign it properly. Mail it to the designated address provided by your tax authorities and consider using delivery confirmation for peace of mind.

What to do after submitting the 2025 -044 Form

After submitting the 2025 IC-044 Form C, it's essential to track your submission. Many tax authorities provide tools or platforms for tracking submission status, which can help you stay informed about any updates or processing times associated with your filing.

It's also crucial to understand what to expect following your submission. Occasionally, tax authorities may reach out for further information or clarification. Knowing how to address potential queries can save you time and stress, enabling you to respond quickly and efficiently.

Resources for further assistance with the 2025 -044 Form

Should you have questions or require assistance, familiarize yourself with the FAQs about the IC-044 Form C. This resource addresses common concerns and provides clarity on intricacies associated with the form. Moreover, don't hesitate to contact support services offered by tax institutions or professional consultants.

Engaging in online communities or forums can also be beneficial. These platforms allow you to share experiences, gain insights from others who have filed, and ask questions concerning specific issues.

Related documents and forms

While filing the IC-044 Form C, you may come across other forms that often accompany it. Some common forms include the IC-045 for detailing specific deductions or the IC-046 for specific business-related income. Having these forms handy can streamline your filing process.

Accessing related templates on pdfFiller can provide immediate assistance by allowing for convenient editing, signing, and overall document management.

Linked topics for in-depth understanding

Understanding how the 2025 IC-044 Form C relates to other tax forms is essential. It often connects with forms like the IC-045, which can provide a clearer picture of your finances and tax obligations. State-specific filing instructions may also apply, with variations based on residence, making it essential to review local regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 ic-044 form c without leaving Google Drive?

How do I make edits in 2025 ic-044 form c without leaving Chrome?

How do I edit 2025 ic-044 form c on an iOS device?

What is 2025 ic-044 form c?

Who is required to file 2025 ic-044 form c?

How to fill out 2025 ic-044 form c?

What is the purpose of 2025 ic-044 form c?

What information must be reported on 2025 ic-044 form c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.