Get the free Health Savings Account (HSA) Information

Get, Create, Make and Sign health savings account hsa

How to edit health savings account hsa online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health savings account hsa

How to fill out health savings account hsa

Who needs health savings account hsa?

Understanding the Health Savings Account (HSA) Form

Understanding health savings accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help individuals save money for medical expenses. The primary goal of HSAs is to provide a financial safety net for individuals with high-deductible health plans (HDHPs), enabling them to cover out-of-pocket medical costs without incurring significant debt.

Individuals are eligible to open an HSA if they meet specific requirements associated with HDHPs, including minimum deductible levels and maximum out-of-pocket limits. As of 2023, the IRS sets annual contribution limits for HSAs—$3,650 for individuals and $7,300 for families. Those aged 55 or older may contribute an additional $1,000, allowing for greater financial flexibility.

The health savings account HSA form

The HSA form serves as a critical document for managing your Health Savings Account. It is essential for documenting contributions to the account and facilitating tax reporting during tax season. The IRS mandates the completion of specific forms to ensure compliance with tax regulations and proper usage of HSA funds.

There are several types of HSA forms, including contribution forms, distribution forms, and beneficiary designation forms, each serving distinct purposes. It's vital to know which forms to use and how to fill them out correctly to avoid tax penalties associated with erroneous submissions.

Detailed instructions on filling out the HSA form

Filling out the HSA form accurately is essential to derive full benefits from your Health Savings Account. A misstep in any section can result in complications with the IRS or restrictions on withdrawals. Below, we break down the sections in detail for clarity.

Section-by-section breakdown of the HSA form

Completing the HSA form correctly is crucial, as common mistakes include failing to report all contributions, leading to excess contributions, and providing incorrect beneficiary information, which can lead to delays or loss of benefits.

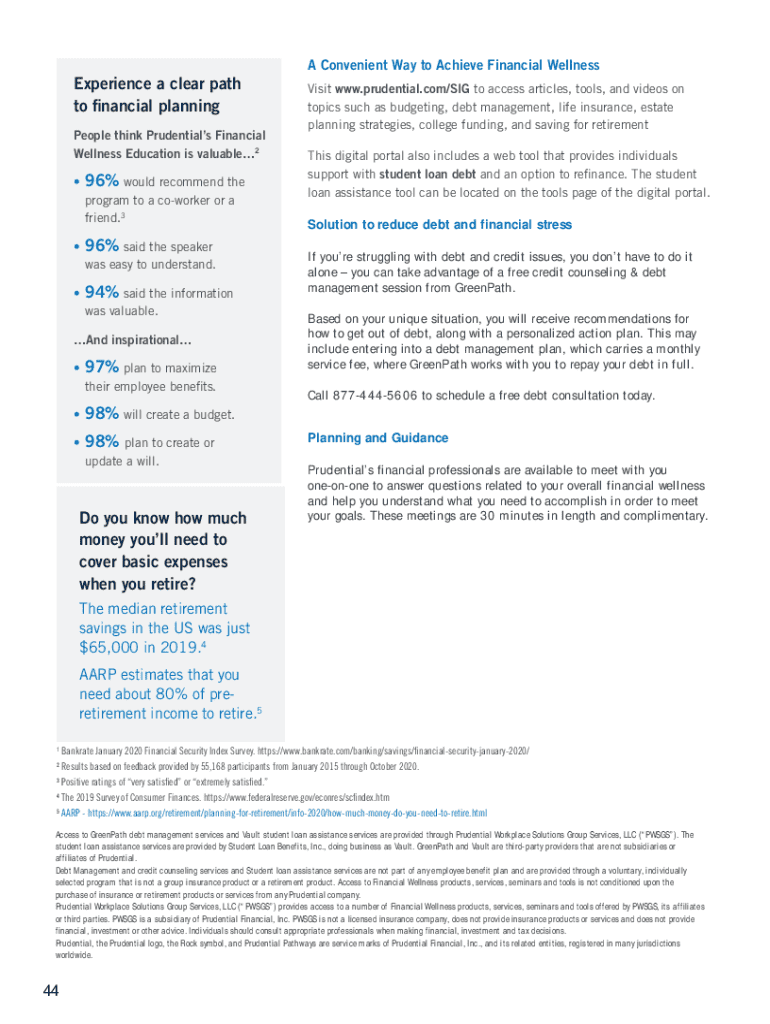

Interactive tools for simplifying the HSA form process

To alleviate the burden of filling out the HSA form and ensure everything is completed correctly, several interactive tools are available. These tools help streamline the process of form preparation, editing, and signing.

Document creation tools

Using platforms like pdfFiller, users can create and edit their HSA forms effortlessly. A dedicated document creation tool simplifies navigation through complex forms, ensuring all necessary information is captured accurately.

eSignature features

The legal validity of electronic signatures on HSA forms is recognized, which means that you can sign your documents online without needing to print them out. This convenience saves time and offers a secure method of completing and submitting essential tax documents.

Collaboration tools

Sharing documents with financial advisors or tax preparers using collaborative tools can ensure that your HSA form is accurate and compliant with regulations. This is especially vital when preparing for tax season.

Managing your HSA after form submission

Once you have submitted your HSA form, it's essential to maintain oversight of your contributions and withdrawals. Proper management can maximize the benefits of your account and ensure you’re ready for any health expenses that may arise.

Tracking contributions and withdrawals

Keeping track of your contributions and withdrawals helps users avoid exceeding annual limits, thus minimizing the risk of incurring tax penalties. Many online platforms enable easy tracking of these transactions, making it simple to verify your account’s status.

Utilizing online platforms for HSA management

Cloud-based solutions offer significant advantages for ongoing health expense tracking. These platforms often provide features that categorize expenses and help users identify eligible withdrawals, simplifying the process while ensuring compliance with IRS regulations.

Periodic review of HSA funds and health plans

Conducting a periodic review of your HSA funds allows for better insights into your long-term financial strategy. It is important to align your HSA usage with your overall health plan strategy to ensure you meet both healthcare needs and financial goals.

Frequently asked questions (FAQs) about HSA forms

Many individuals have questions regarding their Health Savings Account forms, especially concerning excess contributions and withdrawals. Understanding these questions can alleviate common concerns and help ensure compliance with IRS guidelines.

Resources for further assistance

If you need support regarding your HSA forms or require more detailed guidance, numerous resources are available. Engaging with customer service or utilizing online tutorials can help clarify any uncertainties surrounding the form-filling process.

Contacting support

pdfFiller offers assistance with HSA forms through customer support that can guide you through the process of filling out and managing your forms effectively.

Additional learning materials

Consider accessing tutorials and webinars that offer valuable information regarding HSAs, tax documents, and document management strategies.

Latest updates and changes in HSA regulations

Keeping abreast of the latest changes in HSA regulations is essential to ensure compliance and maximize benefits. Recent tax law changes may affect contribution limits and qualification requirements.

Recent tax law changes affecting HSAs

The IRS frequently updates the laws surrounding HSAs, including contribution limits. Monitoring these adjustments is crucial for effective planning and compliance.

Upcoming contribution limit adjustments

As we approach the new tax year, staying informed about upcoming adjustments regarding contribution limits and their implications for your HSA can facilitate better financial planning.

Links to official IRS publications and guidelines

Refer to official IRS publications on HSAs for detailed information and guidelines that can help ensure proper usage and compliance with all relevant tax regulations. These materials are vital for anyone managing an HSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send health savings account hsa for eSignature?

How do I edit health savings account hsa in Chrome?

How do I fill out health savings account hsa on an Android device?

What is health savings account hsa?

Who is required to file health savings account hsa?

How to fill out health savings account hsa?

What is the purpose of health savings account hsa?

What information must be reported on health savings account hsa?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.