Get the free JUDA KALLUS, EA - New York, NY Tax Experts

Get, Create, Make and Sign juda kallus ea

How to edit juda kallus ea online

Uncompromising security for your PDF editing and eSignature needs

How to fill out juda kallus ea

How to fill out juda kallus ea

Who needs juda kallus ea?

Comprehensive Guide to the Juda Kallus EA Form

Understanding the Juda Kallus EA form

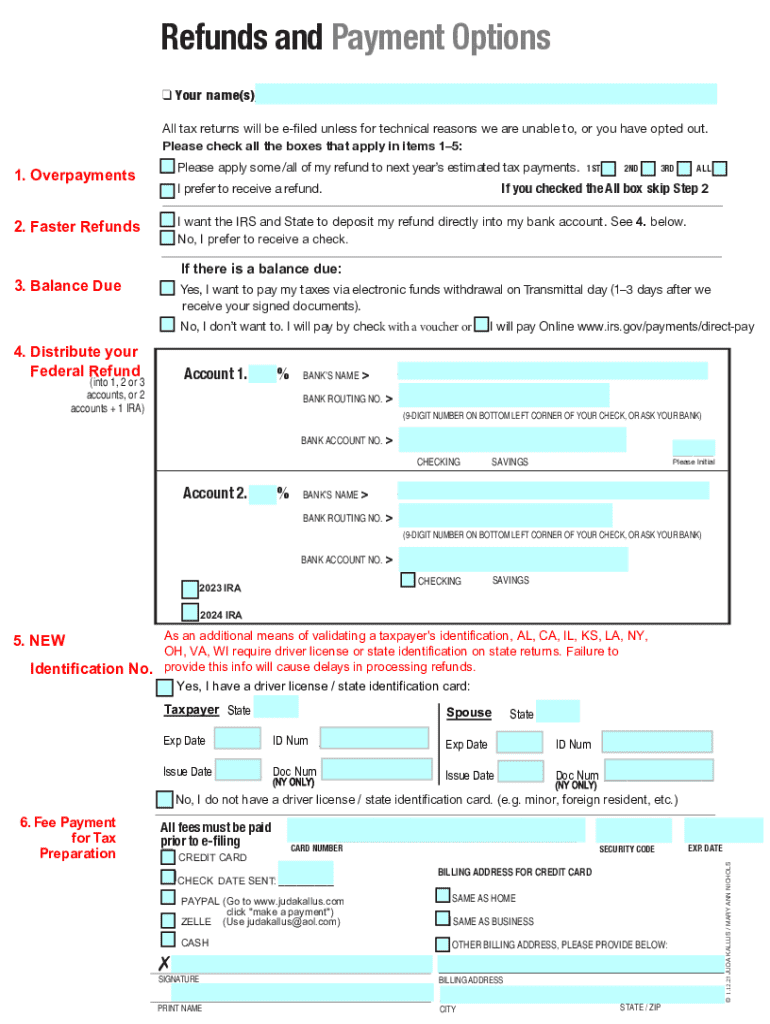

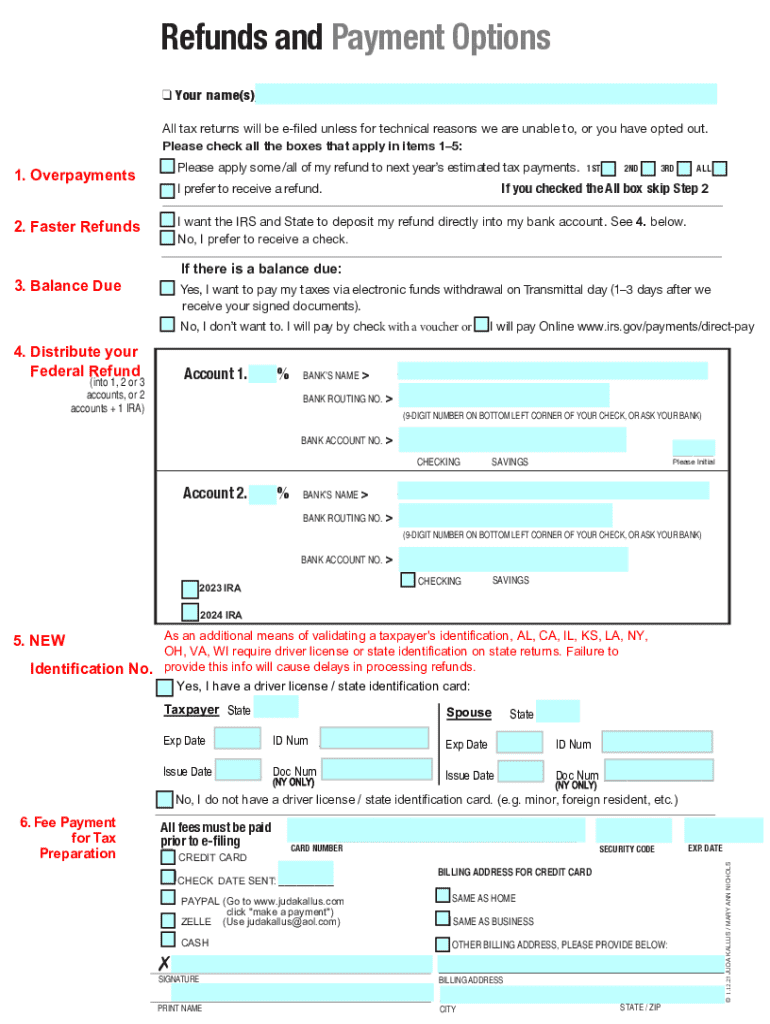

The Juda Kallus EA form is a crucial document for individuals and teams involved in tax reporting, particularly for those navigating the complexities of self-employment taxes and various allowable deductions. The primary purpose of this form is to provide a structured way to report income, expenses, and other relevant information necessary for tax filing purposes. Understanding the significance of this form can streamline tax preparations and ensure compliance with IRS regulations.

The importance of the Juda Kallus EA form cannot be overstated. It acts as a consolidated avenue for taxpayers to declare their financial activities, ensuring that all income is accounted for and that eligible deductions are systematically organized. This ultimately helps in accurate tax reporting, minimizes errors, and reduces the risk of audits due to omitted or misreported data.

Key features of the Juda Kallus EA form

A standout feature of the Juda Kallus EA form is its user-friendly design, which aims to make the tedious task of tax preparation as seamless as possible. The layout is intuitive, allowing users of all experience levels to navigate through the sections with ease. This minimizes the learning curve and enhances overall efficiency.

Interactive elements are integrated into the form to aid in better navigation and data entry. Features like drop-down menus, checkboxes, and tooltips offer real-time assistance, guiding users on how to fill out each part of the form accurately. Moreover, its compatibility with various file formats—such as PDFs and Excel sheets—enables users to adapt the form to their preferred format or integrate it into their existing data organizers.

Steps to fill out the Juda Kallus EA form

Filling out the Juda Kallus EA form can be a straightforward process when approached methodically. Here’s a breakdown of the necessary steps:

Electronic signing of the Juda Kallus EA form

eSigning has become a vital component of modern document handling, including the Juda Kallus EA form. The ability to add your signature electronically not only saves time but also ensures that documents can be processed quickly and efficiently. Using pdfFiller, eSigning is straightforward. You can choose from various signature styles or upload your own, making the process customizable.

Security measures for eSigning are of utmost priority. pdfFiller employs encryption and authentication protocols to ensure that your signature is securely captured and stored, preventing unauthorized access or alterations to your signed documents. This system reassures users that their financial information remains safe and compliant.

Collaborating on the Juda Kallus EA form

Collaboration is an integral part of successfully managing the Juda Kallus EA form, particularly for teams working together on tax submissions. pdfFiller allows users to share the form with team members, making it easy to delegate sections or solicit input. This enhances the overall quality of the submissions as different perspectives and expertise come into play.

Commenting and feedback features facilitate effective communication among team members. Users can leave comments directly on the form, allowing for note-taking and suggestions specific to various sections. Additionally, leveraging version control ensures that all collaborators are working from the most current version of the document, significantly reducing the risk of errors.

Managing the Juda Kallus EA form

Proper management of the Juda Kallus EA form is crucial for ensuring that users can easily retrieve their documents when needed. pdfFiller makes saving and storing this form simple. Users can categorize their forms by tags or folders, making it easier to find specific documents later.

Integrating the Juda Kallus EA form with other software tools, such as Excel or accounting software, enhances functionality. This can allow for better tracking of financial data, making tax preparation a more predictable and organized process.

Troubleshooting common issues with the Juda Kallus EA form

Encountering issues while filling out the Juda Kallus EA form can be frustrating, but recognizing common errors can help in finding quick resolutions. For example, users often misplace decimal points in financial entries or forget to include necessary attachments like rental expense sheets or cover letters.

To resolve potential errors, ensure you review each section thoroughly and validate data against your originals, such as information from data organizers. Should issues persist, consider seeking professional assistance if you face complex tax situations or uncertainties regarding your entries.

Advanced tips for maximizing your use of the Juda Kallus EA form

Beyond the basic functionalities of the Juda Kallus EA form, utilizing pdfFiller's advanced features can offer even more efficiency and security. For instance, leveraging automated data imports can save time previously spent on manual entries, especially when dealing with multiple forms or high volumes of data.

It's also best practice to periodically update yourself on tax regulations to stay compliant. Tax laws can change annually, affecting how certain items are reported on the Juda Kallus EA form. Regularly consulting reputable sources or tax professionals can ensure your practices remain current.

Learning from real-life scenarios

Examining case studies can provide invaluable insights into how individuals successfully navigate the complexities associated with the Juda Kallus EA form. For instance, one scenario might involve a freelancer who skillfully utilized the form to categorize their diverse income streams and avoid misreporting, ultimately resulting in a favorable audit outcome.

Common challenges often include managing extensive financial data or balancing different rental properties to maximize deductions. These scenarios tend to highlight the importance of meticulous data entry and the effective use of collaboration features available in pdfFiller.

Additional options for document management with pdfFiller

Beyond the Juda Kallus EA form, pdfFiller offers a variety of related forms that users might find useful. This includes forms for submitting comprehensive tax returns, various financial sheets, and organizers that integrate seamlessly with the capabilities of the Juda Kallus EA form.

Leveraging pdfFiller’s multi-form management features allows users to consolidate their document workflows, enhancing productivity. Integration with tax preparation software further extends flexibility, providing an all-in-one solution for efficient tax handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete juda kallus ea online?

Can I sign the juda kallus ea electronically in Chrome?

How do I edit juda kallus ea straight from my smartphone?

What is juda kallus ea?

Who is required to file juda kallus ea?

How to fill out juda kallus ea?

What is the purpose of juda kallus ea?

What information must be reported on juda kallus ea?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.