Get the free Schedule H (Form 5500) Financial Information

Get, Create, Make and Sign schedule h form 5500

Editing schedule h form 5500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule h form 5500

How to fill out schedule h form 5500

Who needs schedule h form 5500?

Complete Guide to Schedule H Form 5500

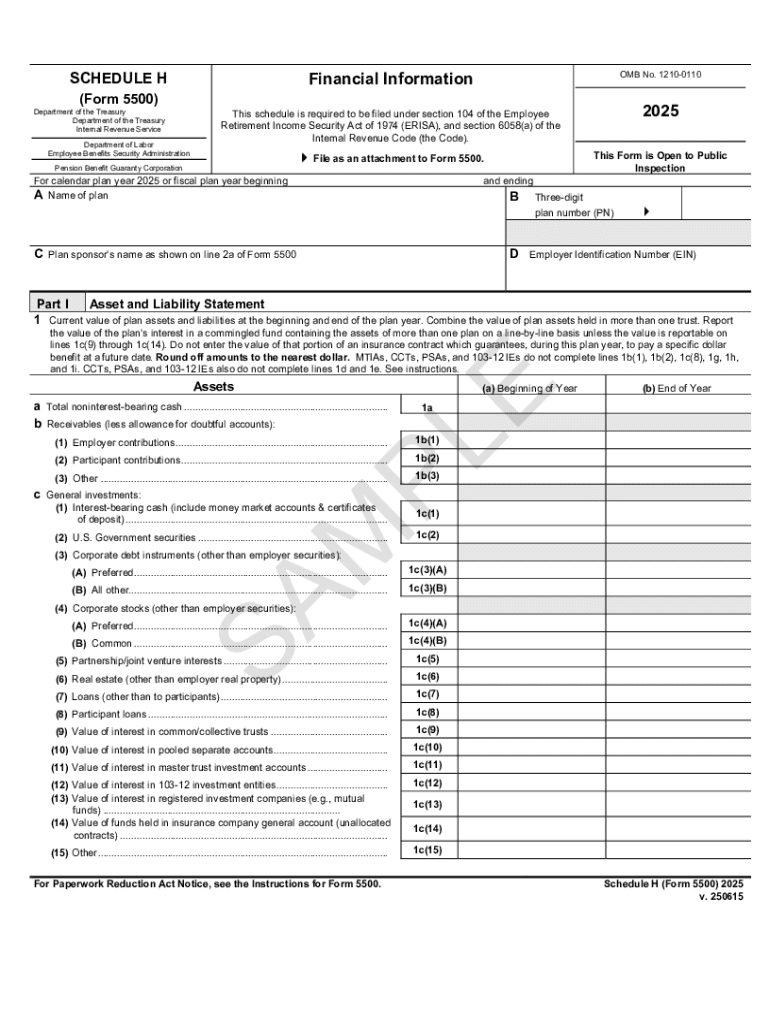

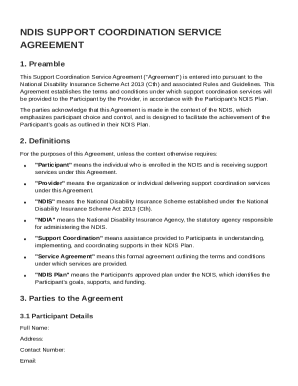

Overview of Schedule H Form 5500

The Schedule H Form 5500 serves as a crucial document for employee benefit plans in the United States. It is specifically designed to provide the government with comprehensive data about the financial condition, investments, and operations of certain retirement and welfare plans. By requiring plan sponsors to report significant information, this form plays an essential role in ensuring compliance with federal regulations.

Filing the Schedule H is vital not only for legal compliance but also for transparency regarding how employee benefits are managed. When companies accurately report their plan operations, it helps foster trust with employees and regulators. The key benefits of using tools like pdfFiller for managing Form 5500 include ease of filling, secure document signing, and simplified submission workflows.

Who needs to file Schedule H?

Certain plans must file Schedule H Form 5500 based on their size and the number of participants they serve. Specifically, plans that cover 100 or more participants at the beginning of the plan year typically fall into this category. An eligible plan is defined as one that is subject to the Employee Retirement Income Security Act (ERISA).

Moreover, large plans are characterized by their substantial participant counts, often exceeding 100 employees. It's important to note that smaller or seasonal plans may have specific considerations that exempt them from filing. For example, plans with fewer than 100 participants can file a simpler Form 5500-SF instead of the more detailed Schedule H.

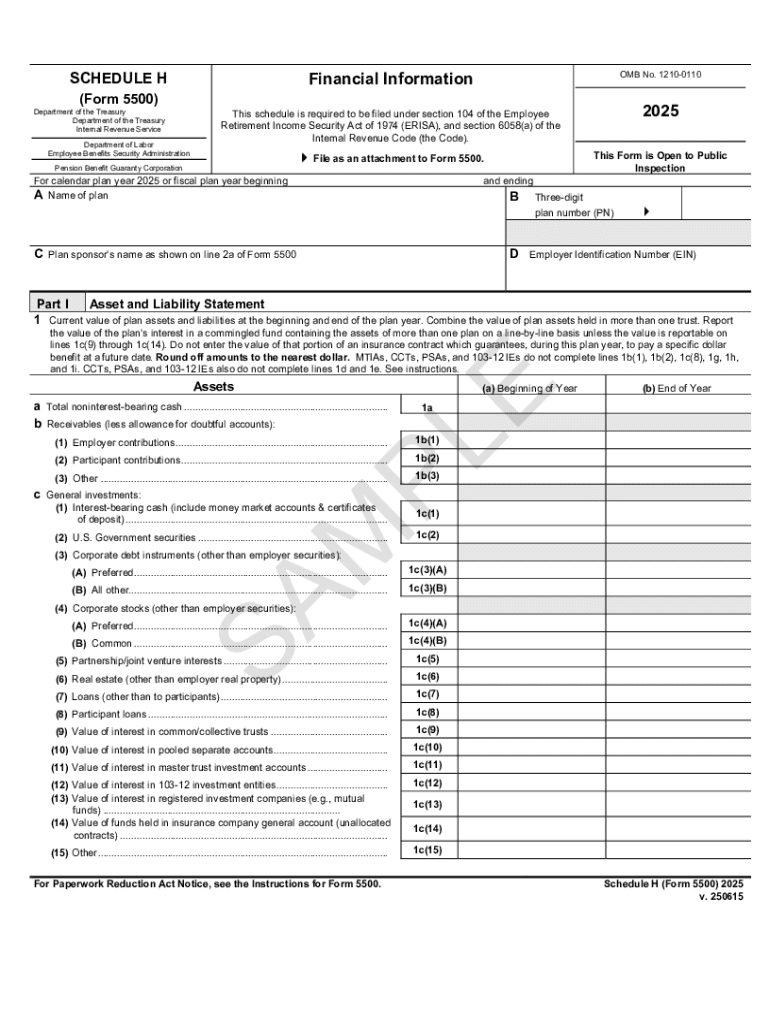

Understanding the structure of the Schedule H form

The Schedule H is structured into multiple sections, each focusing on different facets of a plan's financial health. The major sections include a General Information section, where basic details about the plan are disclosed, and a Financial Highlights section that summarizes the plan's fiscal status.

Additionally, this form includes sections for detailed asset and liability reporting. Each part plays a pivotal role in ensuring comprehensive disclosure of financial data, allowing for accurate assessment and compliance evaluation by regulatory bodies.

Detailed instructions for completing Schedule H

Completing Schedule H requires careful attention and a systematic approach. Generally, all filers should prepare the necessary documents in advance and maintain accurate records of financial transactions. Common pitfalls include overlooking important data or failing to meet compliance deadlines.

Specific instructions on key sections include: In Part I, report detailed asset information, including cash accounts, stocks, and real estate. In Part II, delineate revenue sources and expenses incurred during the year, ensuring all calculations are transparent. Part III involves the accountant's opinion on the financial statements, crucial for verifying compliance and accuracy. Part IV covers compliance questions that need to address adherence to regulatory requirements.

Utilizing pdfFiller for efficient form management

pdfFiller enhances the experience of filling out Schedule H by offering interactive tools that facilitate document completion. Users can edit their forms easily within the platform, ensuring that all data is current and accurate.

To edit PDFs using pdfFiller, follow a simple step-by-step guide: Upload your Schedule H form into the platform, utilize the editing tools to modify text and fields, and save changes securely. Additionally, pdfFiller offers secure eSigning options, allowing users to quickly review and submit their documents without the hassle of printing and scanning.

Common mistakes to avoid when filing Schedule H

Filing Schedule H can be a straightforward process, but there are common errors that filers often make. Frequent mistakes include inaccurate reporting of asset and liability amounts, failure to provide required signatures, and submitting the form after the due date.

To improve accuracy, double-check your work by using a checklist that outlines all required information. Compliance checks are essential to make sure all filings adhere to the standards set by the government. Taking the time to verify details can save significant stress and potential penalties.

FAQs about Schedule H Form 5500

Addressing frequently asked questions is vital for filers to feel confident in their submissions. Common questions include aspects of eligibility for filing, deadlines for submission, and the particulars of compliance penalties for inaccurate reporting.

Clarifications often touch on misconceptions surrounding who is obligated to file and how seasonal workers impact those obligations. For first-time filers, it's recommended to consult resources provided by the government site and professional services to ensure compliance.

Real-life scenarios and case studies

Examining real-life scenarios can illustrate the practical implications of filing Schedule H Form 5500. For instance, a company that successfully used pdfFiller reported improved efficiency, demonstrating how digital solutions simplify the paperwork involved in compliance.

On the other hand, case studies of lessons learned from mistakes emphasize the importance of thorough reviews. Firms that failed to capture accurate financial data faced increased scrutiny and penalties, illustrating how leveraging tools like pdfFiller can mitigate such risks and enhance overall filing experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule h form 5500 in Gmail?

How do I make changes in schedule h form 5500?

How do I fill out schedule h form 5500 using my mobile device?

What is schedule h form 5500?

Who is required to file schedule h form 5500?

How to fill out schedule h form 5500?

What is the purpose of schedule h form 5500?

What information must be reported on schedule h form 5500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.