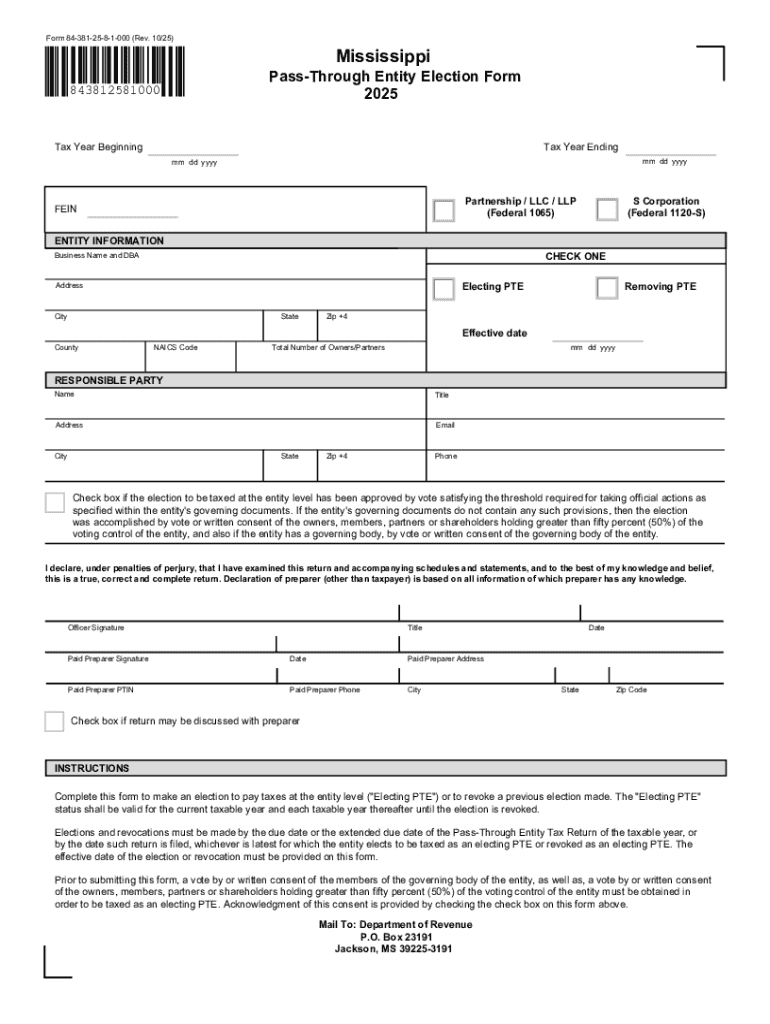

Get the free Pass-Through Entity Tax Return 2021 - Mississippi -MS.GOV

Get, Create, Make and Sign pass-through entity tax return

How to edit pass-through entity tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pass-through entity tax return

How to fill out pass-through entity tax return

Who needs pass-through entity tax return?

Understanding the Pass-Through Entity Tax Return Form

Understanding pass-through entities

A pass-through entity is a business structure where income is not taxed at the corporate level. Instead, the earnings 'pass through' to the individual owners or members, who report the income on their personal tax returns. This setup avoids the double taxation typically associated with traditional corporations.

The primary types of pass-through entities include:

Understanding pass-through entities is critical in taxation, as they influence how income is reported and taxed, affecting individual tax liabilities.

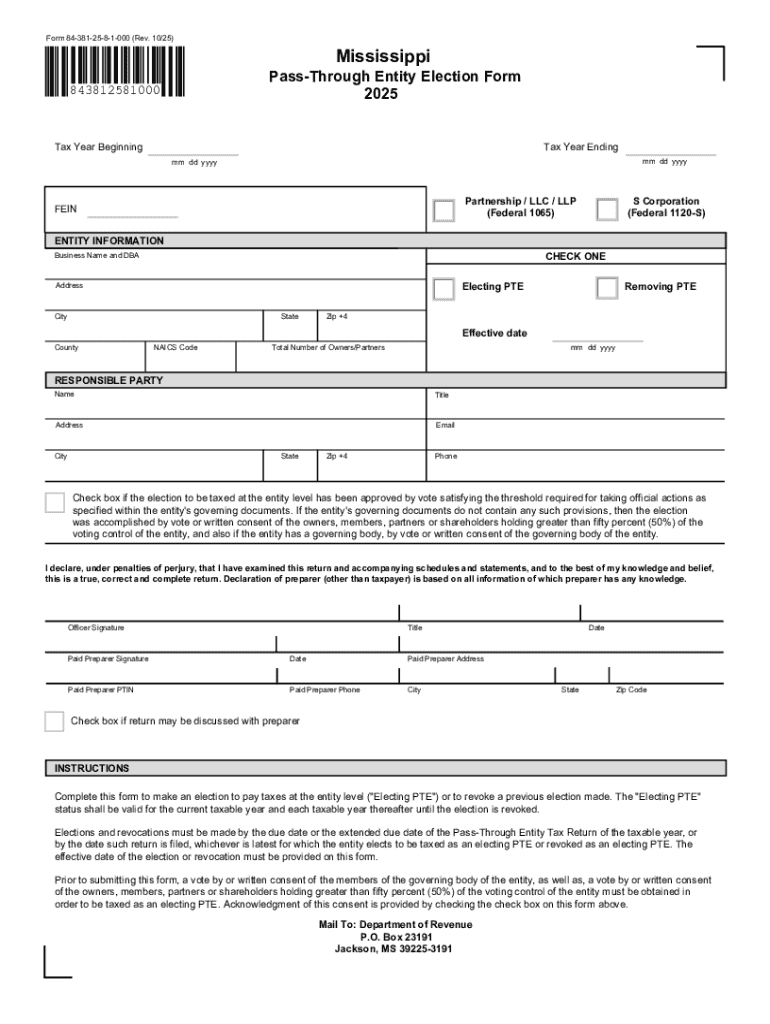

Overview of the pass-through entity tax return form

The pass-through entity tax return form is a crucial document used by partnerships, S Corporations, and LLCs to report their financial activities to the IRS. This form captures income, deductions, and credits for the business, ensuring compliance with federal tax regulations.

Key features of the form include:

Typically, this form is required annually, and the due date aligns with the entity's tax year end.

Who needs to file the pass-through entity tax return form?

Not all businesses need to file. Partnerships, S Corporations, and LLCs must complete the pass-through entity tax return form if they have income, deductions, or credits to report. Here are various scenarios that necessitate filing:

Filing requirements can vary by state as well, so it's essential to check local regulations to ensure compliance.

Step-by-step instructions for completing the form

To accurately fill out the pass-through entity tax return form, follow these steps carefully. Start by collecting all necessary documentation, such as financial statements, owner agreements, and prior year tax returns if applicable.

Once you have your documents ready, proceed with filling out the form:

Completing each of these steps meticulously will help ensure your pass-through entity tax return form is submitted correctly.

Common errors to avoid

Filing a pass-through entity tax return can be complex, and mistakes can lead to unnecessary headaches. Here are common errors to avoid:

Avoiding these pitfalls requires careful attention to detail throughout the filing process.

Interactive tools for managing your tax return

Leveraging technology can significantly streamline the process of managing and filing your pass-through entity tax return form. Consider utilizing these helpful tools:

By integrating these interactive tools, you can navigate your tax responsibilities with greater ease and efficiency.

Tips for efficient tax management

Effective tax management is crucial for pass-through entities looking to maximize their financial efficiency. Here are some tips:

By following these tips, you can manage your tax responsibilities more efficiently and effectively.

Resources for further help

Many resources are available to assist with understanding and completing the pass-through entity tax return form. Here are some valuable references:

Taking advantage of these resources can lay a stronger foundation for navigating tax obligations.

Frequently asked questions

The complexity of tax filings often raises questions. Here are answers to some frequently asked questions regarding the pass-through entity tax return form:

Clarifying these questions can help alleviate some of the concerns surrounding tax filings.

Examples of completed pass-through entity tax return forms

To provide clarity on filling out the pass-through entity tax return form, reviewing completed examples can be beneficial. Here are sample forms:

Reviewing these examples will offer practical insights into completing your own pass-through entity tax return form accurately.

Final checklist before submission

Before submitting your pass-through entity tax return form, it’s essential to conduct a final check to ensure accuracy and compliance. Here’s a checklist to guide you:

By following this checklist, you can submit your form with confidence, minimizing the risk of errors or omissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pass-through entity tax return in Gmail?

How do I make edits in pass-through entity tax return without leaving Chrome?

How do I fill out pass-through entity tax return using my mobile device?

What is pass-through entity tax return?

Who is required to file pass-through entity tax return?

How to fill out pass-through entity tax return?

What is the purpose of pass-through entity tax return?

What information must be reported on pass-through entity tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.