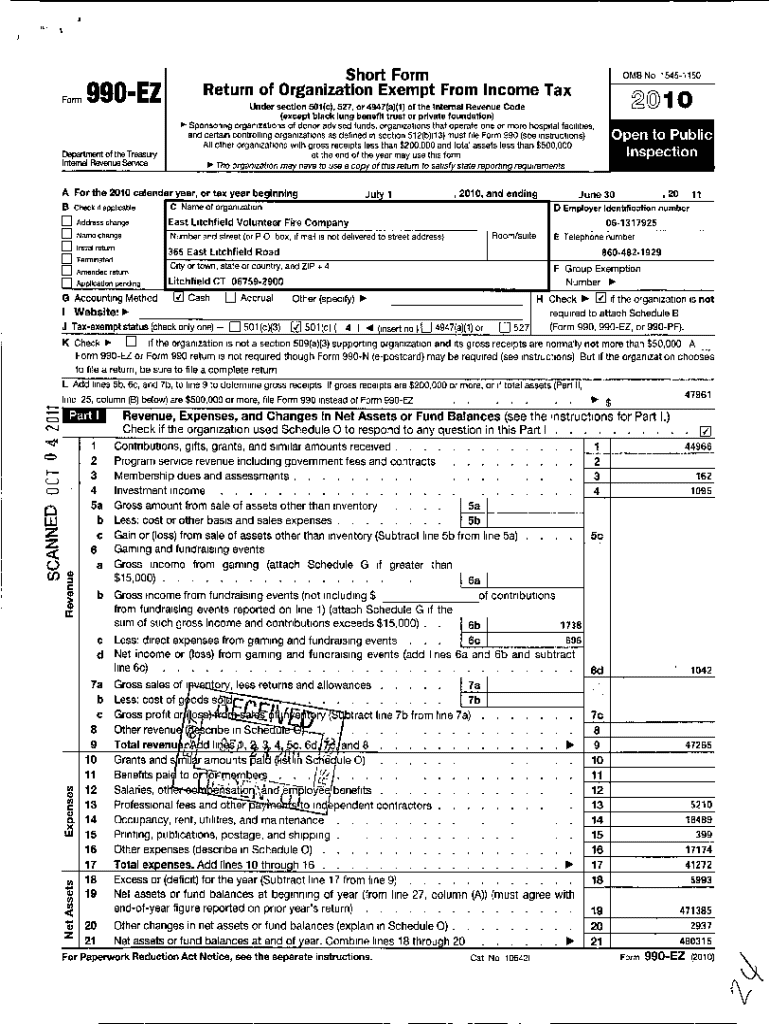

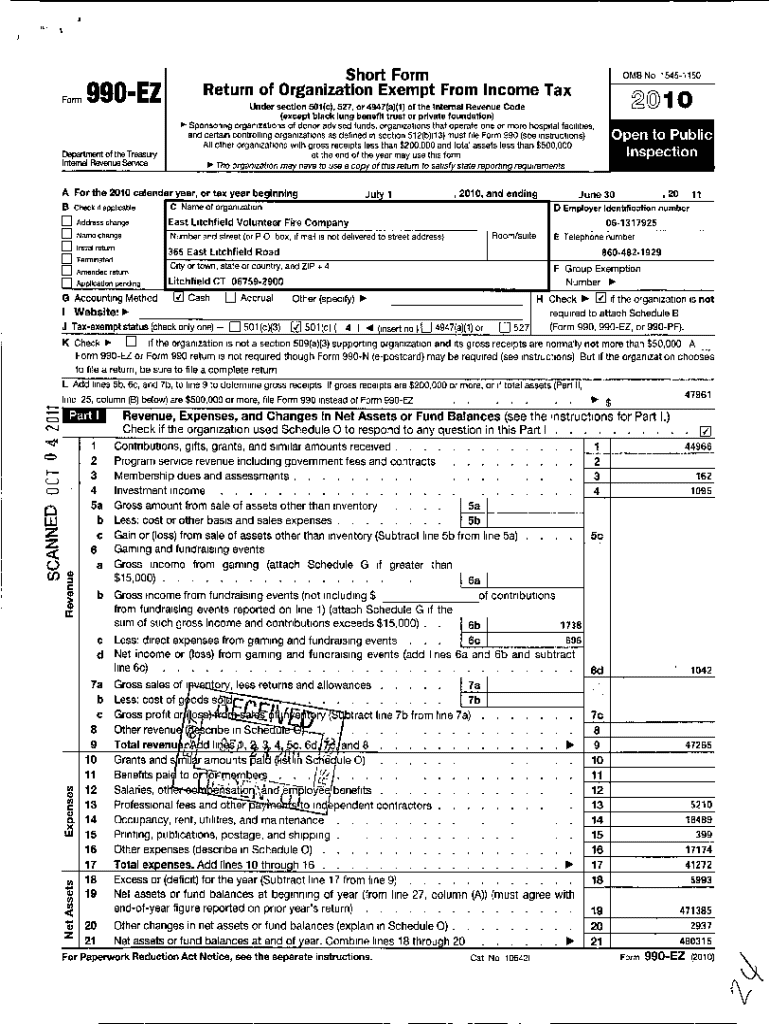

Get the free Short Form Return of Organization Exempt From Income ax

Get, Create, Make and Sign short form return of

How to edit short form return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out short form return of

How to fill out short form return of

Who needs short form return of?

Short form return of form: A comprehensive guide

Understanding the short form return

A short form return is a simplified version of a standard return form specifically designed for certain entities or individuals. It typically includes fewer sections and fields, making it more accessible and less time-consuming to complete. The primary purpose of a short form return is to streamline the reporting process for those whose financial details are straightforward and don't require extensive documentation compared to long forms.

Compared to long forms, short forms are concise and target users who do not have complex financial situations. For instance, while a long form might require detailed financial disclosures and supporting documents, a short form may only ask for basic identification and summary financials.

Importance of short form returns

Short form returns are particularly valuable in various scenarios. For example, self-employed individuals or small business owners with uncomplicated financial situations benefit greatly from this format. The benefits of utilizing a short form return include reduced preparation time, less paperwork, and a lower likelihood of errors, making it ideal for individuals and teams looking to save resources.

Who should use the short form return

Eligibility for short form returns primarily applies to individuals and certain business entities meeting specified criteria. For example, small businesses with straightforward income and expenses, or freelancers with minimal deductions, often qualify for this simplified process. It effectively serves those whose financial situations do not require a detailed examination, making the filing less burdensome.

Common scenarios include independent contractors who have limited income sources, making it easy for them to provide a short overview of their earnings without additional complexities. Case studies show that many small business owners have successfully leveraged the short form return to streamline their reporting process and minimize compliance headaches.

Case studies

One effective example is a freelance graphic designer whose yearly income fluctuates but remains below the threshold for detailed reporting. By utilizing the short form return, they managed to save hours in preparing their return while still meeting all requirements. Another notable case includes a small e-commerce store owner whose inventory and transactions are straightforward, enabling them to file their taxes efficiently using short forms.

Key components of the short form return

When completing a short form return, certain essential sections must be filled. These typically include identification information, which captures your name, address, and taxpayer identification number. Additionally, you'll need to provide financial details such as total income and deductible expenses, ensuring a comprehensive yet concise overview.

While the primary sections are mandatory, you may also include optional information based on your specific circumstances, such as additional income types or unique deductions you are claiming. This additional detail can be beneficial in providing clarity to your submission.

Step-by-step guide to completing the short form return

Completing a short form return involves several steps that, when followed correctly, can simplify the process significantly. First, gather all necessary documents such as income statements, previous year’s tax returns, and any receipts for deductible expenses. This preparation ensures that you have all pertinent information at your fingertips before starting the form.

Common mistakes while filling out the return can lead to rejections or delays in processing. Therefore, it is crucial to double-check your entries for accuracy, ensuring that all figures are correct and all required sections are completed.

Editing and managing your short form return

Editing your short form return can be a seamless process when using tools like pdfFiller, which allows users to easily access and manipulate their forms. The platform offers intuitive features that facilitate collaboration, enabling teams to work together effectively on a single document for streamlined submission.

Digital storage options are crucial for ensuring easy access to your short form return. Whether through cloud storage solutions or PDF compression tools, keeping a safe and easily retrievable copy of your form is essential for future reference.

eSigning your short form return

The importance of eSigning cannot be overstated, as it provides legal validity alongside the convenience of submitting documents digitally. eSignatures are recognized under various digital signature laws, ensuring that your signed return is binding and compliant with both federal and state regulations.

Using pdfFiller for eSigning is straightforward. The platform guides users through the steps to add an eSignature, which not only enhances security but also accelerates the signing process. This feature is especially beneficial when collaborating across teams, enabling quick collection of signatures without needing to print out documents.

Submitting your short form return

Once your short form return is complete and signed, it's time to submit it. There are a couple of primary submission methods: electronic submission—which is becoming increasingly popular—and traditional physical submission through the mail. Ensure that you follow the specific guidelines for your jurisdiction, as these can vary.

After submission, you can expect a review period during which the tax authority processes your return. It's essential to watch for any correspondence, as this may include requests for additional information or notifications about your submission status.

Frequently asked questions about short form returns

When it comes to short form returns, many individuals have general inquiries regarding their purposes and benefits. Common questions often include how the short form compares to the long form, eligibility criteria, and processing times.

Technical questions often arise as well, especially regarding filling out the form or using PDF editing tools like pdfFiller. Issues such as how to correct entries once submitted or dealing with system errors can prompt users to seek guidance.

Troubleshooting errors

To address errors that may lead to rejections, it is vital to carefully review all information submitted. Should you receive a notification requesting further details, timely action is crucial to avoid unnecessary delays.

Related content and tools

For those interested in exploring additional resources, pdfFiller provides a variety of guides and templates which complement the short form return. An income tax return checklist can help ensure you don’t miss any crucial elements while preparing your return.

Utilizing these resources not only simplifies document preparation but also enhances collaborative efforts, improving the overall efficiency of your tax filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find short form return of?

How do I execute short form return of online?

How do I edit short form return of on an Android device?

What is short form return of?

Who is required to file short form return of?

How to fill out short form return of?

What is the purpose of short form return of?

What information must be reported on short form return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.