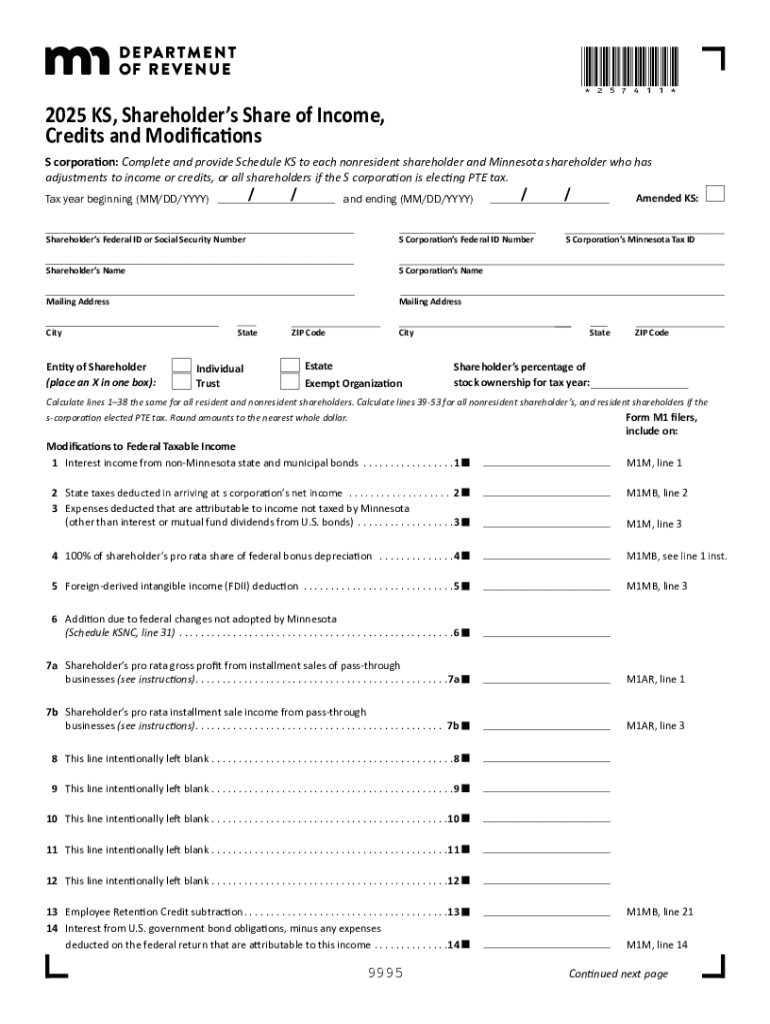

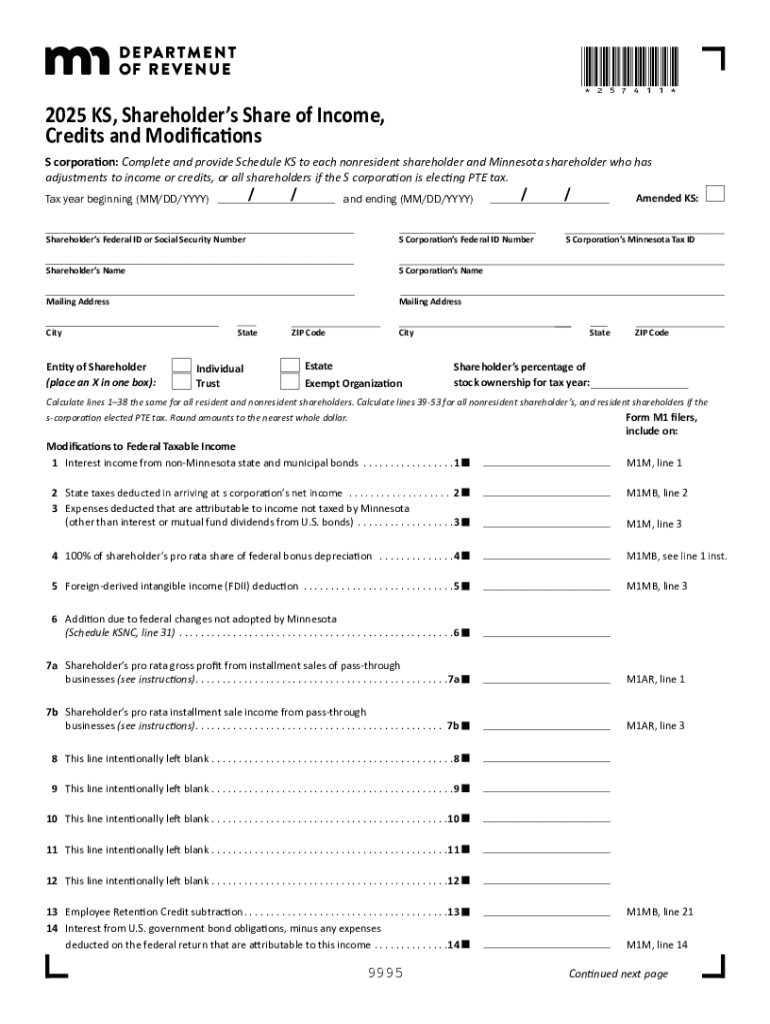

Get the free 2025 KS, Shareholder's Share of Income, Credits and Modifications

Get, Create, Make and Sign 2025 ks shareholder039s share

Editing 2025 ks shareholder039s share online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 ks shareholder039s share

How to fill out 2025 ks shareholder039s share

Who needs 2025 ks shareholder039s share?

Understanding the 2025 KS Shareholder's Share Form: A Comprehensive Guide

Understanding the 2025 KS Shareholder's Share Form

The 2025 KS Shareholder's Share Form is an essential document for shareholders of companies registered in Kansas. This form plays a crucial role in capturing accurate shareholder information, particularly for tax-related purposes. Ensuring precision when filling out this form can have significant implications on tax credits, modifications, and compliance with state regulations.

Proper completion of the 2025 KS Shareholder's Share Form is not just a procedural necessity; it's a legal requirement that helps to maintain transparency and accountability within corporate structures. Moreover, it aids in the accurate distribution of dividends and the identification of shareholders eligible for various tax benefits. This form encompasses several key terms that shareholders should familiarize themselves with, such as 'shareholder credits,' 'qualified income,' and 'distributive shares.'

Eligibility criteria for the form

Determining who must fill out the 2025 KS Shareholder's Share Form is fundamental for compliance. Any individual or entity that holds shares in a Kansas corporation during the tax year 2025 is required to complete this form. It's particularly relevant for shareholders receiving dividends that may impact their tax obligations.

Additionally, specific income thresholds may apply based on the shareholder's category—individuals, corporations, or partnerships. For instance, shareholders who have received income above certain levels are mandated to report the corresponding information accurately. Therefore, understanding whether you fall within these income brackets can help prioritize filling the form without unnecessary complications.

Step-by-step instructions to complete the form

Completing the 2025 KS Shareholder's Share Form requires careful attention to detail. The process can be broken down into three key steps for clarity and efficiency.

Step 1: Gathering required information

Before you begin filling out the form, gather all necessary personal information and documentation. You'll need your Social Security number, details of shares owned, and possibly prior tax returns. Having these documents handy streamlines the process and reduces the chance for errors.

Step 2: Completing the form

When you start filling out the form, ensure you fill in each section methodically. Common pitfalls include transposing numbers and overlooking income sources that must be reported. Systematically double-check each entry, as inaccuracies can lead to complications down the line.

Step 3: Reviewing your submission

After completing the form, take a moment for thorough review. Create a checklist to cross-verify the information entered—this step can catch simple errors before submission. Consider seeking a second pair of eyes for proofreading to ensure clarity and accuracy in your submission.

Tips for using pdfFiller with the 2025 KS Shareholder's Share Form

pdfFiller offers an intuitive and efficient way to manage the 2025 KS Shareholder's Share Form. Users can easily navigate through the pdfFiller platform, enhancing the document-filling experience with its edit and eSignature tools.

How to utilize pdfFiller for efficient completion

Begin by uploading the 2025 KS Shareholder's Share Form to pdfFiller. Utilizing pdfFiller's robust editing tools allows for seamless modifications without permanent changes to the original document. This flexibility makes it easy to make adjustments as necessary.

eSigning the completed form

After the form is filled, consider using pdfFiller's eSignature feature for a hassle-free solution to signing documents. Follow clear steps to create and apply your electronic signature, ensuring that your submission is legitimate and recognized. The security measures implemented by pdfFiller provide assurance regarding the integrity of your signed document, allowing you to submit with confidence.

Common mistakes and how to avoid them

Filling out the 2025 KS Shareholder's Share Form can present challenges, but awareness of common mistakes can guide individuals toward more accurate submissions. Simple errors like misreporting income amounts or failing to include all necessary documents are frequent issues faced by many filers.

Strategies for ensuring accuracy include using tools like pdfFiller, conducting thorough reviews as mentioned, and keeping records of all documentation submitted. Comprehensive record-keeping helps mitigate misunderstandings with tax authorities and reinforces your claims regarding income and credits.

Resources for further assistance

If you encounter difficulties while filling out the 2025 KS Shareholder's Share Form, assistance is available through various channels. Support services specifically related to the KS Shareholder's Share Form are prepared to provide guidance across various inquiries.

Moreover, government websites often provide downloadable resources and detailed guidelines regarding the form. Community forums and discussion groups can also offer firsthand experiences and tips tailored to your specific needs.

Alternative options and updates

As regulations evolve, it's crucial for shareholders to stay updated on any changes involving the 2025 KS Shareholder's Share Form and associated policies. Alternative options may arise soon, including different forms or document subsets that specifically cater to distinct shareholder situations.

Moreover, recent updates for the 2025 tax year have included modifications to income thresholds and qualifying criteria, emphasizing the need for due diligence when accessing relevant tax benefits. Being informed about these changes will help ensure that shareholders remain compliant and can maximize their eligible credits accurately.

Conclusion and next steps

Submitting the 2025 KS Shareholder's Share Form with accuracy is paramount for individual shareholders and corporations alike. Review your information diligently and utilize pdfFiller to enhance document management efficiency. This cloud-based solution empowers users to edit, sign, and manage forms effortlessly, ensuring your submissions always meet the required standards.

Approaching the completion of the 2025 KS Shareholder's Share Form with preparedness and the right tools will facilitate seamless submissions, paving the way for advantageous engagement with tax credits and fulfilling shareholder responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 ks shareholder039s share without leaving Google Drive?

How do I execute 2025 ks shareholder039s share online?

How do I complete 2025 ks shareholder039s share on an iOS device?

What is 2025 ks shareholder039s share?

Who is required to file 2025 ks shareholder039s share?

How to fill out 2025 ks shareholder039s share?

What is the purpose of 2025 ks shareholder039s share?

What information must be reported on 2025 ks shareholder039s share?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.