Get the free Rental WorksheetSchedule E - Template - Organizers

Get, Create, Make and Sign rental worksheetschedule e

Editing rental worksheetschedule e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rental worksheetschedule e

How to fill out rental worksheetschedule e

Who needs rental worksheetschedule e?

A Comprehensive Guide to the Rental Worksheet Schedule E Form

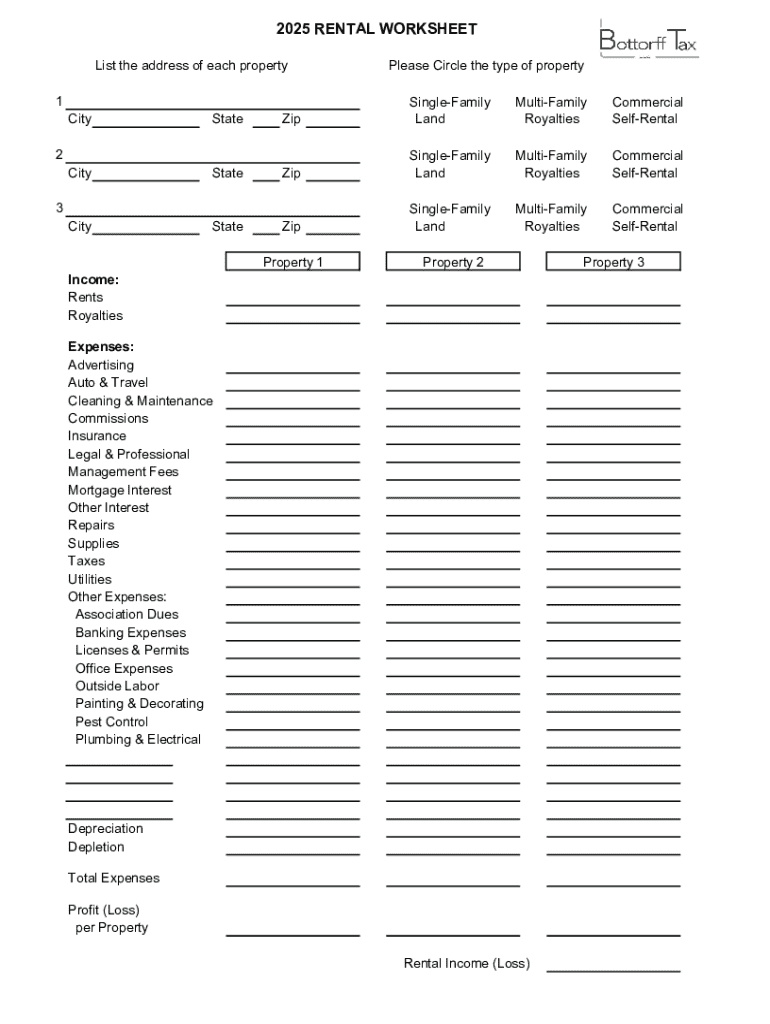

Overview of rental worksheet schedule E

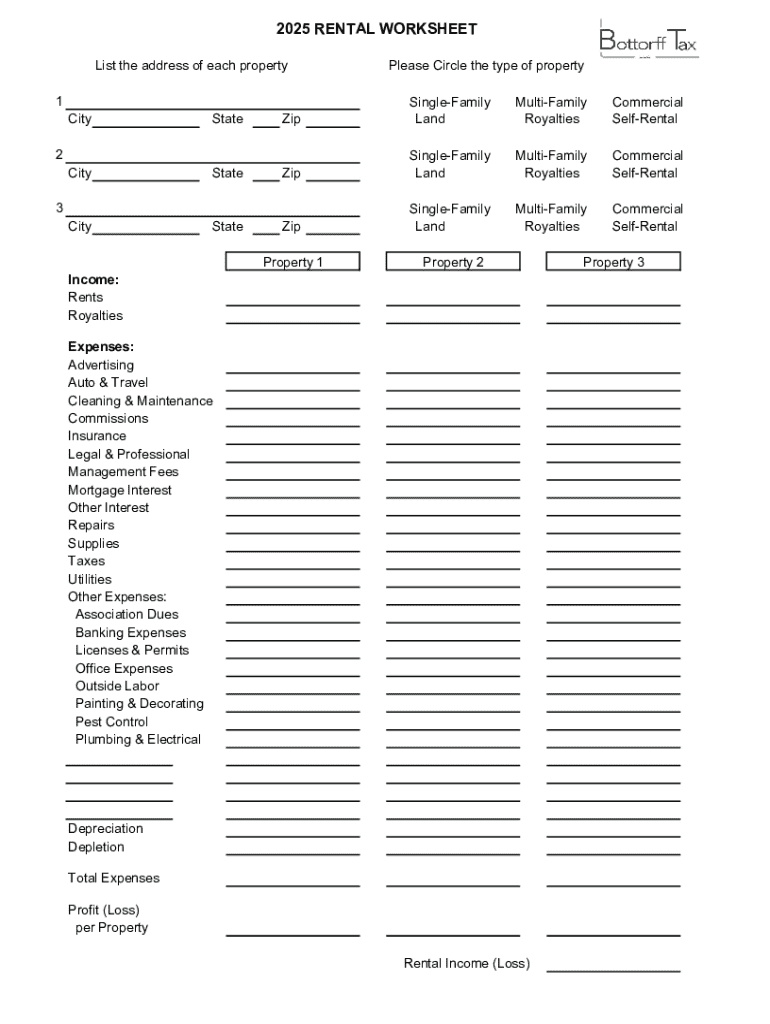

The Rental Worksheet Schedule E is a crucial document used by property owners to report income or loss from rental real estate on their tax returns. This schedule is part of the IRS Form 1040 series and plays a significant role in tax documentation for landlords and real estate investors. Understanding how to correctly fill out this form is essential to ensuring compliance with tax regulations and optimizing tax refunds.

The importance of the Rental Worksheet Schedule E cannot be overstated. It allows taxpayers to outline all income generated from rental properties while providing a structured format to report related expenses. This consolidation not only prepares landlords for their tax obligations but also assists in risk management regarding IRS audits and inquiries.

Essentially, anyone who rents out property — whether it's a part-time rental, a full-time rental operation, or even seasonal rentals — is required to file the Rental Worksheet Schedule E. This includes individuals, couples, and businesses engaged in rental activities.

Key components of the rental worksheet schedule E

The Rental Worksheet Schedule E is divided into distinct sections that cater to different aspects of rental income and expenses. Understanding these sections is key to effectively utilizing the form.

Step-by-step instructions for filling out the rental worksheet schedule E

Filling out the Rental Worksheet Schedule E can be straightforward if done systematically. Follow these steps for effective completion.

Interactive tools and resources for rental worksheet schedule E

Managing the Rental Worksheet Schedule E effectively also involves utilizing digital tools that enhance the experience of filling out and submitting the form.

Tips for maximizing deductions on rental properties

Maximizing deductions on rental properties is crucial for financial success and effective tax management. Adopting best practices for record-keeping can significantly enhance your deductible amounts.

Common questions about the rental worksheet schedule E

Property owners often have questions surrounding the implications of the Rental Worksheet Schedule E and how it fits into broader tax strategy.

Updates and changes to the rental worksheet schedule E for 2025

Keeping abreast of updates to the Rental Worksheet Schedule E is fundamental for tax compliance. Significant changes from the IRS can affect reporting and allowable deductions.

Using pdfFiller to manage your rental worksheet schedule E

Managing your Rental Worksheet Schedule E can be made much more efficient with pdfFiller's suite of tools designed for landlords and real estate professionals.

Tax preparation strategies for rental property owners

Tax preparation strategies are essential for rental property owners looking to minimize liability and ensure compliance with IRS requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get rental worksheetschedule e?

How do I edit rental worksheetschedule e in Chrome?

How do I fill out rental worksheetschedule e using my mobile device?

What is rental worksheetschedule e?

Who is required to file rental worksheetschedule e?

How to fill out rental worksheetschedule e?

What is the purpose of rental worksheetschedule e?

What information must be reported on rental worksheetschedule e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.