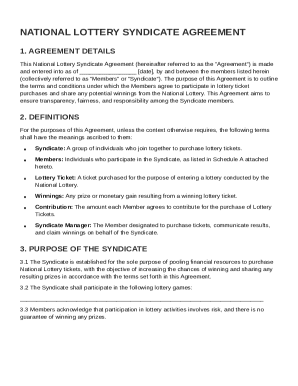

Get the free Form 1065US Return of LLC Income Engagement Letter

Get, Create, Make and Sign form 1065us return of

How to edit form 1065us return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1065us return of

How to fill out form 1065us return of

Who needs form 1065us return of?

Form 1065: Your Comprehensive Guide to the US Return of Partnership Income

Understanding Form 1065

Form 1065 serves as the official document for reporting partnership income in the United States. It is essential for all partnerships to file this form to ensure proper compliance with federal tax laws. Not only does it help the IRS track income generated by partnerships, but it also divides those profits and losses among the partners, providing them with a clear overview of their individual tax liabilities.

This form plays a critical role in the context of small business taxes, as it outlines how partnership income should be allocated to each partner based on their share. Whether a partnership is made up of two individuals running a small business or a larger group with multiple members, understanding Form 1065 is vital for accurate tax reporting.

Key components of Form 1065

Form 1065 comprises several essential sections that need attention. The main elements include income reported by the partnership, deductions that affect the taxable income, and the partners' share of profits or losses. Each of these sections is pivotal in determining the financial state of the partnership and understanding each partner's tax position. Comprehensive knowledge of these components will equip partnerships to navigate through their tax obligations with ease.

Who must file Form 1065?

Form 1065 is primarily required for various types of partnerships, including general partnerships, limited partnerships, and limited liability companies (LLCs) treated as partnerships for tax purposes. All partnerships operating as businesses must submit this return each year, regardless of whether the partnership made a profit or generated any income. Understanding your eligibility is crucial to ensure compliance and avoid potential penalties.

There are, however, exceptions to this filing requirement. For instance, single-member LLCs are not required to file Form 1065, as they are taxed as sole proprietorships. Moreover, certain joint ventures that do not meet specific criteria may also be exempt. Partners in multi-member LLCs should always examine their need to file based on their operational structure to remain compliant with tax laws.

Filing requirements and deadlines

Form 1065 has a specific due date, which generally falls on March 15 of each tax year. Partnerships must ensure their return is filed on or before this date to avoid late fees or penalties. If more time is needed, partnerships have the option to file for an extension by submitting Form 7004. This extension generally allows an additional six months for filing but does not extend the time for payment of taxes, if applicable.

To prepare for filing, it's crucial to compile necessary documents including income statements, balance sheets, and details of all partners' contributions. Having these records organized will facilitate accurate reporting and potentially streamline the tax filing process.

Step-by-step guide to completing Form 1065

Accurate financial information is the backbone of Form 1065. Begin by gathering all financial statements such as profit and loss statements and bank statements that reflect the business's income. It is also wise to maintain organized records of deductions, as these will significantly influence the total tax liability.

Filling out the form requires a line-by-line approach. Partners must ensure that they accurately report business income on page one, followed by specific deductions on the following sections. Partners should be cautious and deliberate here, as misreporting could lead to compliance issues with the IRS. Additionally, thorough reviews of the completed form are vital before signatures are gathered from all partners.

Common mistakes to avoid

Filers often encounter pitfalls when completing Form 1065. One of the most frequent errors involves misreporting income or claiming deductions inaccurately. This could stem from insufficient documentation or misunderstanding of what constitutes allowable expenses. Another common issue arises from incorrect or missing information about partners, which can lead to complications in the distribution of income and possible disputes.

If errors are discovered post-filing, partnerships can amend their Form 1065 by filing Form 1065-X, which is specifically designed for correcting previously submitted returns. It’s important to act quickly upon identifying discrepancies to minimize further penalties and maintain compliance.

Tips for successfully managing your partnership’s tax obligations

Effective tax management begins with consistent bookkeeping practices. Maintaining detailed and organized records throughout the year simplifies the tax filing process, helping to ensure that all income, expenses, and applicable deductions are recorded accurately. Utilizing tools such as pdfFiller can enhance your workflow by facilitating the creation, editing, and signing of necessary documents, making compliance much easier.

Furthermore, collaborating with partners during the annual tax reporting process is crucial. Each partner should contribute their information accurately. Establishing a solid communication channel ensures that everyone is on the same page regarding their responsibilities and the necessary documentation needed.

Utilizing pdfFiller for streamlined form completion

pdfFiller offers a comprehensive suite of features tailored for filling out and managing tax documents such as Form 1065. With interactive tools available online, users can efficiently edit, review, and electronically sign forms, eliminating the need for cumbersome paper processes and mailing. Its user-friendly interface allows for easy navigation, ensuring that even those unfamiliar with technology can take advantage of its capabilities.

Moreover, pdfFiller’s collaboration features support partners in reviewing and finalizing forms together. This ensures that all contributions are considered and modifications are made seamlessly, making the tax filing process much more efficient and reducing the likelihood of errors.

Staying informed: tax resources and ongoing support

For partnerships, staying informed about tax obligations and changes is vital. The IRS provides an array of invaluable resources related to Form 1065, including instructions, FAQs, and updated tax laws. Direct access to these official resources will guide partnerships in staying compliant and preparing adequately.

Participating in webinars and workshops on Form 1065 can also empower partners with knowledge about best practices and legislative changes. Continuous learning ensures that partnerships can navigate tax laws effectively and make informed decisions year after year.

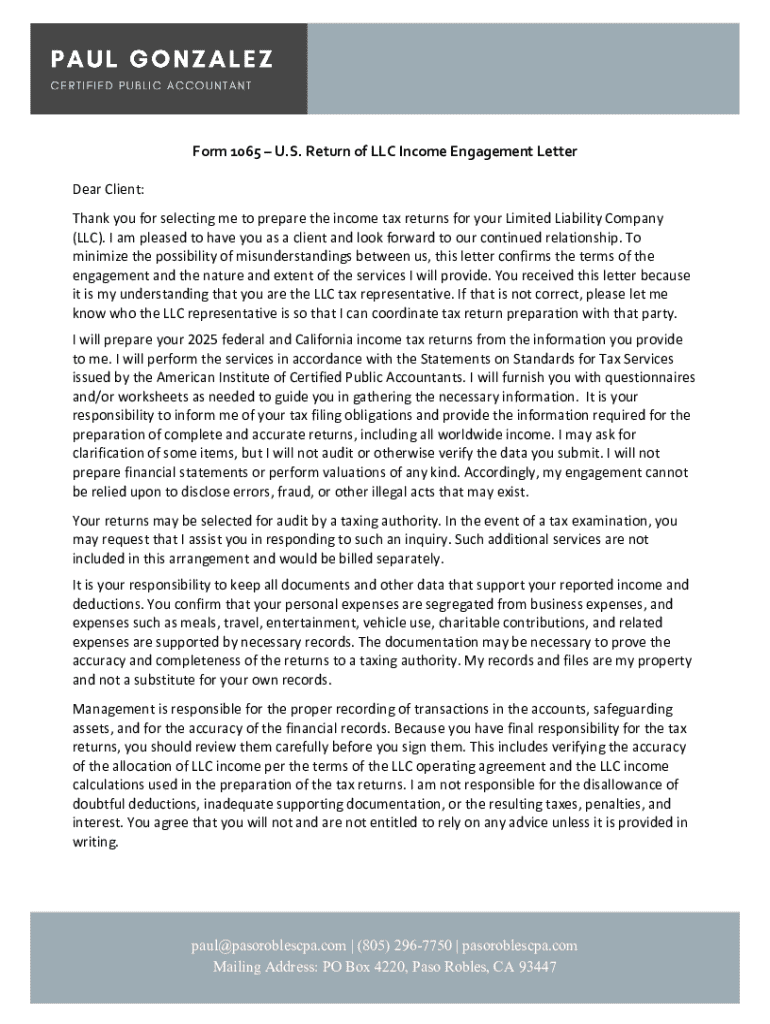

Building a relationship with your tax professional

Recognizing when to seek help from a tax professional can greatly enhance a partnership's filing process. Signs that indicate it's time to consult include complex revenue structures, the presence of multiple partners, or significant changes in tax laws that may affect your filing. Advisors can offer tailored guidance, ensuring that partnerships can tackle their tax obligations efficiently.

When choosing a tax professional for your partnership, look for qualifications such as familiarity with partnership taxation, excellent communication skills, and a proactive approach to tax planning. Establishing a solid working relationship can foster an environment where all partners feel secure in their financial decisions and reporting.

Tax resources and tips for partnerships

In addition to Form 1065, partnerships commonly encounter related forms, such as Schedule K-1, which details each partner's share of income and losses. Understanding these additional requirements is crucial for comprehensive tax reporting. Partners should familiarize themselves with the intricacies of these forms to ensure accurate and timely submissions.

For partnerships navigating tax obligations, educational resources and online communities can provide much-needed support. Engaging in discussions on forums and following specialized blogs can give insights into common challenges and strategies for filing effectively. This supportive environment can enhance understanding and foster best practices among partners.

Keeping your partnership compliant year-round

Successful partnerships maintain organized records throughout the year, not just during tax season. Best practices for record-keeping include documenting every transaction, retaining receipts, and regularly updating financial statements. Using cloud-based solutions, like pdfFiller, can help ensure that records are safe, accessible, and easily reviewable when needed.

Planning for the next year’s filing begins as soon as the current return is submitted. Partnerships should consider tax strategies that can minimize liabilities and maximize deductions in future filings. Regular consultations with tax professionals can provide direction and ensure partnerships are leveraging all available resources efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 1065us return of in Chrome?

Can I create an electronic signature for the form 1065us return of in Chrome?

How do I edit form 1065us return of on an iOS device?

What is form 1065us return of?

Who is required to file form 1065us return of?

How to fill out form 1065us return of?

What is the purpose of form 1065us return of?

What information must be reported on form 1065us return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.