Get the free T4A(OAS), Statement of Old Age Security

Get, Create, Make and Sign t4aoas statement of old

Editing t4aoas statement of old online

Uncompromising security for your PDF editing and eSignature needs

How to fill out t4aoas statement of old

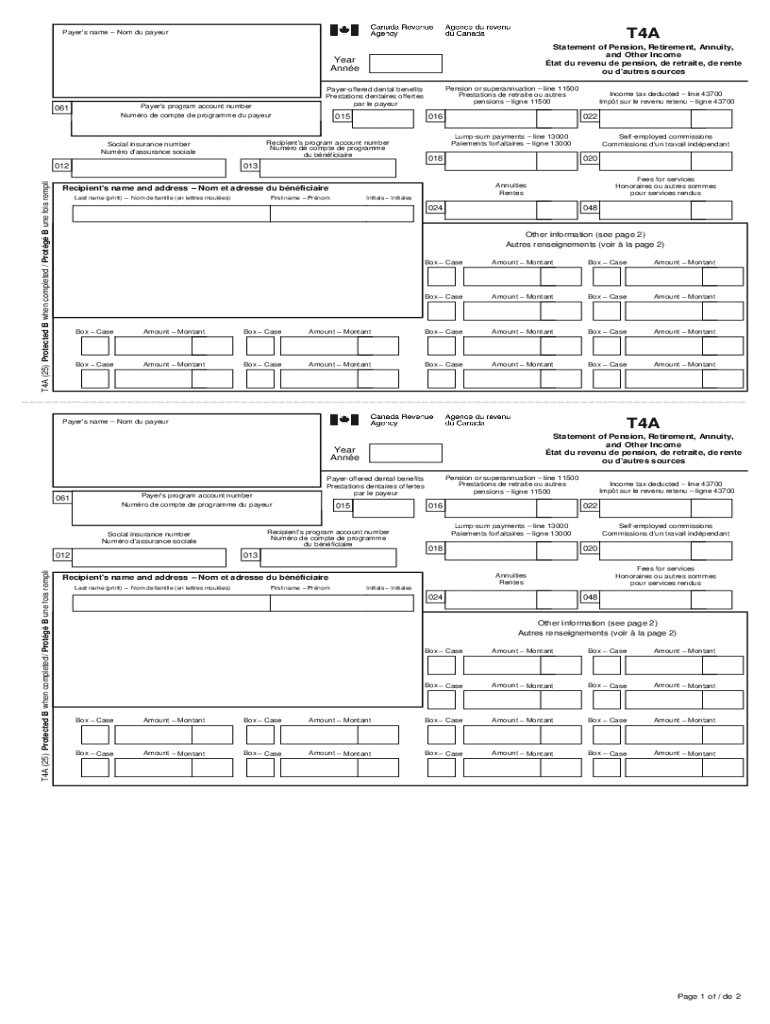

How to fill out statement of pension retirement

Who needs statement of pension retirement?

Understanding the Statement of Pension Retirement Form

Understanding the statement of pension retirement form

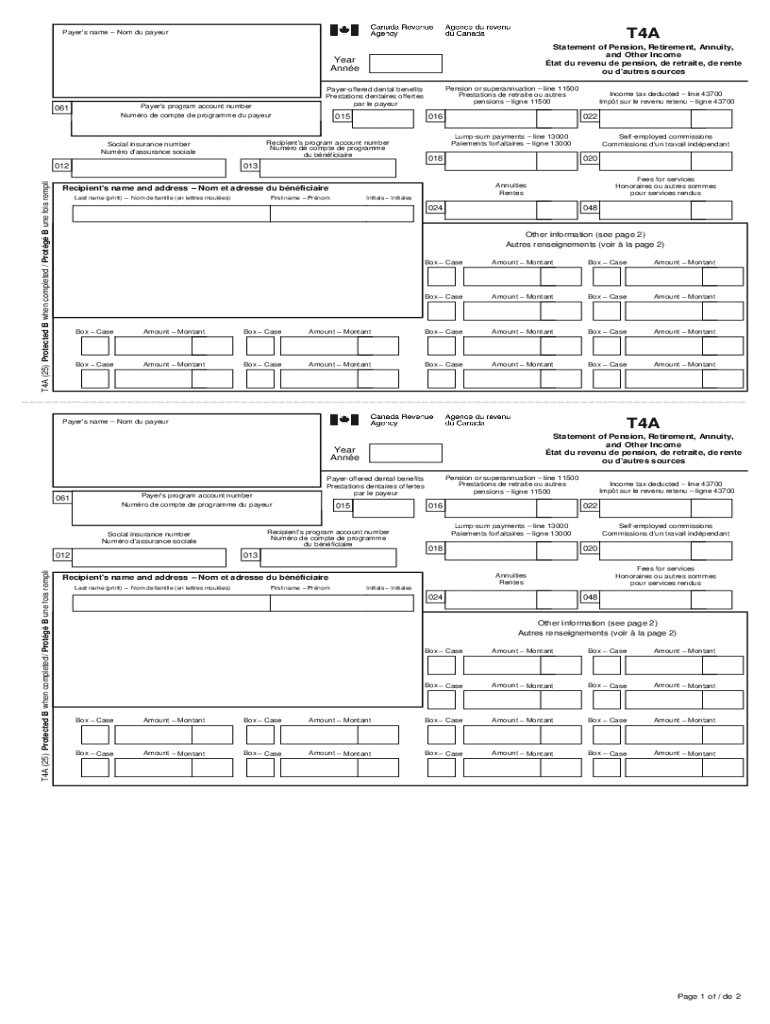

The Statement of Pension Retirement Form serves as a crucial document for individuals planning to retire and access their pension benefits. Essentially, it is a formal application submitted to the relevant retirement system, allowing members to inform their employer or pension authority of their intent to retire. This document outlines various details related to an individual's employment and eligibility for benefits, making it a cornerstone in facilitating a smooth transition from active work life to retirement.

The importance of this form cannot be overstated. It not only initiates pension payout processes but also clarifies the options members have regarding their retirement plans. Understanding key terms such as 'eligibility requirements,' 'beneficiary designation,' and 'pension options' is essential for ensuring that applicants can accurately complete and submit their forms without issues.

Preparing to fill out your statement of pension retirement form

Before you start filling out the Statement of Pension Retirement Form, it is vital to gather all necessary information. This preparation not only simplifies the process but also reduces the chance of errors that could delay your retirement benefits. Typically, you'll need to compile personal information including your name, address, and Social Security number. Additionally, you'll want to list your employment history details, such as your employer's name and length of service—critical factors in determining your pension eligibility.

Furthermore, having a documentation checklist can prove invaluable. Make sure you have all required documents such as identification, tax forms, and any previous statement copies that reflect your pension contributions and benefits accrued. This proactive step can save a lot of frustration down the line.

Detailed step-by-step guide to completing the form

Completing the Statement of Pension Retirement Form involves several critical steps, ensuring you provide all the necessary information. Each section is designed to capture specific details that collectively determine your eligibility and the amount of benefits you will receive.

Step 1 focuses on the personal information section, where you will need to enter basic identification details. This includes your full name, address, telephone number, and Social Security number. It's vital to ensure that all information is accurate and matches what is on official documents to avoid verification delays.

In Step 2, the employment history section requires you to accurately report your employment details. Make sure to include the full names of your employers, dates of employment, job titles, and any relevant pension contribution details. Omitting or misreporting information here can impact your benefits.

Step 3 requests information about your pension plan. Clearly specify the type of pension plan you are part of—this could be a state employer pension, a 401(k), or another retirement option. Understanding the specifics of your plan is critical, as this affects the benefits available to you.

Step 4 emphasizes the importance of beneficiary designation. This part of the form allows you to name individuals who will receive your benefits upon your passing. It's essential to review the implications of your choices here, particularly regarding survivor benefits.

Finally, in Step 5, reviewing and verifying the completed form is crucial. Take time to check for accuracy in all sections before submission, as errors can lead to delays or complications in processing your retirement application.

Common mistakes to avoid when filling out the form

While filling out the Statement of Pension Retirement Form, applicants often make common mistakes that can complicate their retirement process. One frequent error is providing incorrect personal information, such as misspelling names or entering an incorrect Social Security number. Such inaccuracies can lead to significant delays in processing your application.

Another common mistake arises during the employment history reporting. Failing to record complete dates of service or omitting previous employers can result in an incomplete application, affecting eligibility for certain pension plans. Additionally, misunderstanding the pension plan section and selecting the wrong benefits can lead to disappointing outcomes later on.

It's beneficial to create a strategy for double-checking all information. Consider having a family member or friend review the form after you've completed it. A fresh set of eyes can catch details you might miss.

Editing and managing your pension retirement form

After completing your Statement of Pension Retirement Form, utilizing tools for editing and managing the form can greatly enhance your efficiency. At pdfFiller, users can effortlessly edit PDFs, ensuring all details are correct before finalizing. The platform’s user-friendly interface allows easy navigation through forms, enabling users to make any necessary revisions swiftly.

Saving and managing multiple versions of your Form is also a crucial feature. Keeping a record of previous versions can help track changes and ensure that you always have access to the most current information. Moreover, in case you need to revisit or reissue the form in the future, having organized files will be incredibly beneficial.

Signing and notarizing the form

The signing and notarization process for your Statement of Pension Retirement Form is essential for adhering to legal requirements. A signature affirms your understanding and agreement with the information provided on the form, signifying your official request to retire. Failing to sign could result in the form being deemed incomplete.

Through pdfFiller, users can e-sign documents quickly and efficiently. The process offers a straightforward and secure method for signing forms electronically, eliminating the need for physical paperwork. Additionally, if notarization is required, users have various alternatives, such as local notary services or online notarization platforms.

Submitting your completed statement of pension retirement form

Once you have completed and signed your Statement of Pension Retirement Form, the next step is submission. It's essential to follow the specific submission methods outlined by your retirement system. Common methods include online submission through a secure portal or mailing the completed form directly to the relevant authority.

After submission, you can expect a confirmation notification from the retirement system, indicating that your form has been received. Some systems may provide a tracking option, allowing you to monitor the status of your submitted application throughout the review process. Keeping a record of your submission will offer peace of mind and ensure you can follow up if needed.

Interactive tools and resources available on pdfFiller

pdfFiller offers a suite of interactive tools and resources that enhance the experience of completing the Statement of Pension Retirement Form. From collaborative features that allow family members or financial advisors to give input, to document management capabilities that help keep track of all your retirement-related paperwork, pdfFiller covers multiple needs.

Utilizing templates and the form filling feature can also streamline the document creation process. If you need to recreate this form or any related retirement documentation, having access to easy-to-use templates can save time and effort in managing your retirement plans.

Frequently asked questions about the statement of pension retirement form

Many individuals have questions about the Statement of Pension Retirement Form and its associated processes. One common query is what to do if a copy of the form is lost. In such cases, the best course of action is to contact your retirement system directly for a replacement form, as they can provide the most accurate documentation based on your account.

Another frequent question pertains to making changes after submission. It's not uncommon for individuals to realize they need to update a detail or correct an error post-submission. If this happens, promptly contact your retirement system to understand the process for submitting corrections or amendments to your existing application.

User testimonials and success stories

User testimonials reveal the transformative impact that pdfFiller has had on individuals navigating retirement forms. Many users share experiences of how pdfFiller simplified their journey, allowing them to complete the Statement of Pension Retirement Form with ease. One user, a police officer recently retired, remarked, 'Thanks to pdfFiller, submitting my retirement form felt seamless. I was guided through each step, and I was able to double-check my details effortlessly.'

Another satisfied client shared, 'I was overwhelmed with paperwork, but the templates and editing features saved me time and ensured I didn’t miss any critical details. My application was processed without delay!' These testimonials speak to how pdfFiller not only streamlines the documentation process but also boosts the confidence of its users to complete important applications smoothly.

Exploring related forms and resources

In addition to the Statement of Pension Retirement Form, there are several other related documents that you may need to consider during your retirement planning. Forms such as retirement plan change forms and beneficiary update forms are often essential to ensure that your retirement strategy remains aligned with your personal goals and circumstances.

pdfFiller provides access to a range of these necessary documents, helping users to easily transition through their retirement planning phases. By exploring these additional resources, you can ensure that all aspects of your retirement are covered adequately, allowing for a secure financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send t4aoas statement of old to be eSigned by others?

How do I edit t4aoas statement of old online?

How do I edit t4aoas statement of old straight from my smartphone?

What is statement of pension retirement?

Who is required to file statement of pension retirement?

How to fill out statement of pension retirement?

What is the purpose of statement of pension retirement?

What information must be reported on statement of pension retirement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.