Get the free 2025 PA Fiduciary Income Tax Return/PA Schedule OI - Other Information (PA-41/PA-41 ...

Get, Create, Make and Sign 2025 pa fiduciary income

How to edit 2025 pa fiduciary income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 pa fiduciary income

How to fill out 2025 pa fiduciary income

Who needs 2025 pa fiduciary income?

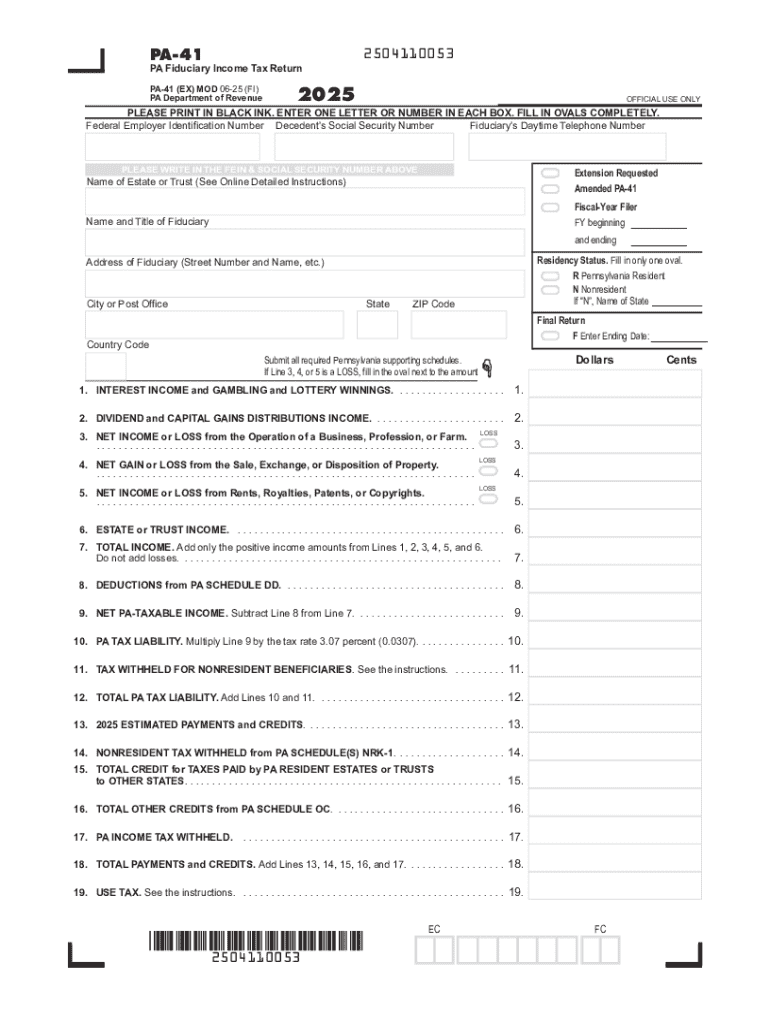

2025 PA Fiduciary Income Form: A Comprehensive Guide

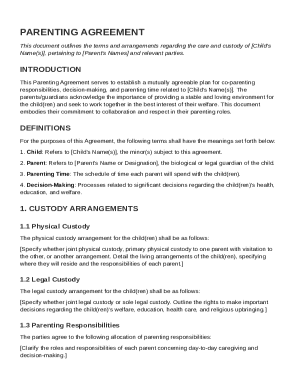

Understanding the 2025 PA fiduciary income form

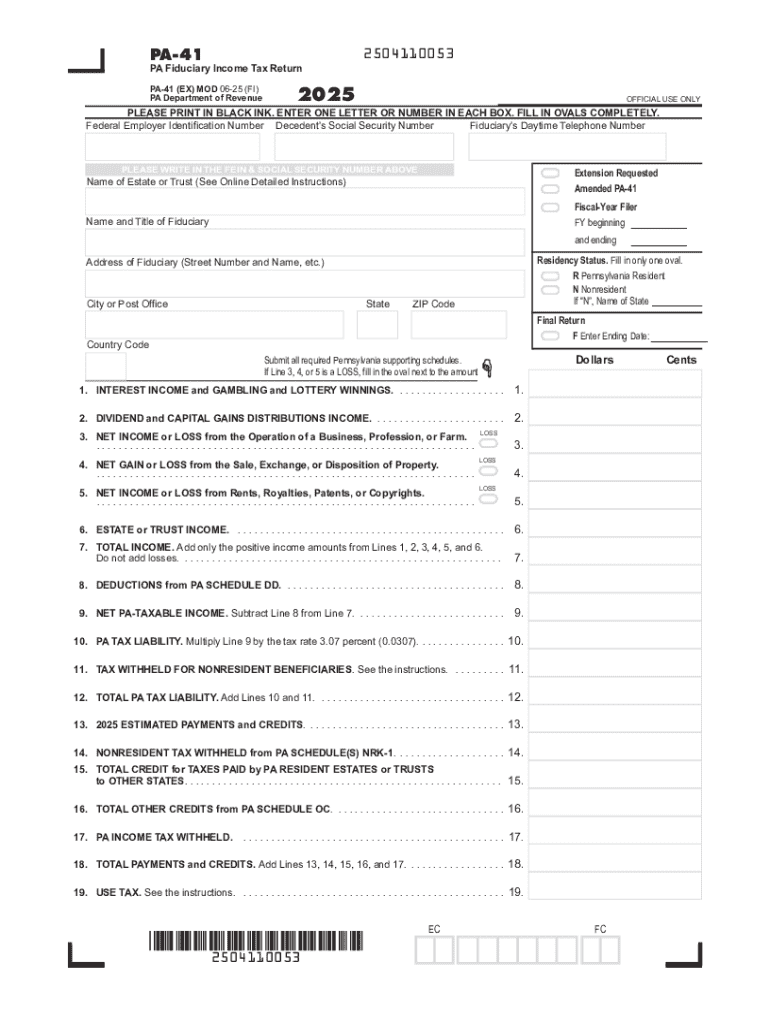

The 2025 PA Fiduciary Income Form is a critical document utilized to report income earned by estates, trusts, and partnerships within Pennsylvania. This form acts as a medium through which fiduciaries—those responsible for managing an estate or trust—report taxation liabilities on behalf of the estate or trust. Understanding this form is essential, as it ensures compliance with state tax laws, helps avoid penalties, and ensures that all parties involved receive their fair share of income.

The significance of filing this form cannot be overemphasized. For estates and trusts, accurately reporting income ensures that tax obligations are met, and beneficiaries can receive their distributions without undue delay. Furthermore, changes in tax laws may necessitate alterations in reporting standards, making understanding the latest form vital for all fiduciaries.

Notably, the 2025 form introduces key changes compared to its predecessors, primarily aimed at simplifying reporting requirements and enhancing clarity for users. These adjustments, including modifications to tax rates and reporting thresholds, require fiduciaries to be especially diligent in their preparation.

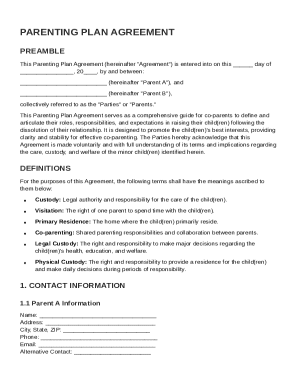

Eligibility and filing requirements

Not everyone is required to file the 2025 PA Fiduciary Income Form. Generally, fiduciaries responsible for estates, trusts, or partnerships that have taxable income must complete this form. This includes individuals handling estates resulting from intestate or testate successions, as well as trustees overseeing trusts that generate revenue. Additionally, partnerships must also file if they have a presence or generate income within Pennsylvania.

Specific criteria must be established to determine whether a fiduciary needs to file. Beneficiaries, vested or contingent, or even those receiving distributions, can impact the requirement. For example, if an estate generated convertible securities or dividends, the fiduciary must file accordingly, ensuring all income sources are reported.

Key deadlines for filing

Awareness of key deadlines is crucial for compliance when it comes to the 2025 PA Fiduciary Income Form. The general deadline for filing is typically the 15th day of the fourth month following the end of the tax year. For estates and trusts on a calendar year basis, this translates to April 15, 2026. Missing these deadlines can result in severe penalties, including fines and additional interest on unpaid taxes.

There is also an option for filing for an extension, which allows fiduciaries to extend their time up to six months, providing a continuous opportunity to file accurately with the IRS. However, it’s important to note that this extension only applies to the filing of the form itself; any owed taxes are still due by the original deadline to avoid penalties.

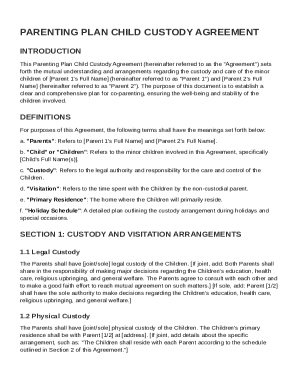

Step-by-step guide to completing the 2025 PA fiduciary income form

Completing the 2025 PA Fiduciary Income Form may seem daunting, but following a structured approach can simplify the process. Here’s a detailed guide to help you through the steps.

Step 1: Gather necessary documentation

Begin by collecting all necessary documentation such as previous returns, income statements, and any relevant deductions. It's crucial to maintain accurate records of income sources—such as interest, dividends, and rental income—along with receipts for eligible deductions. This initial step will ensure that you have everything you need to complete the form accurately.

Step 2: Detailed instructions for each section of the form

Each section of the 2025 PA Fiduciary Income Form has specific requirements. Pay close attention to mandatory fields and gather supporting documentation for everything you report. Carefully itemize income reporting, ensuring totals are accurate. It's imperative to differentiate between ordinary income and capital gains, as they may have different tax implications.

Step 3: Review and validate your entries

Before submission, take the time to review your entries critically. Common mistakes include miscalculating income totals or forgetting to include deductions. Cross-check figures against your gathered documentation to ensure everything aligns, thus significantly reducing error margins.

Step 4: Sign and file the form electronically

When you’re ready to submit, consider utilizing e-filing options. Platforms like pdfFiller allow for easy electronic submission of your 2025 PA Fiduciary Income Form. Electronic filing increases efficiency and enhances security, providing a reliable method of submission while ensuring you receive confirmation of your filing.

Common scenarios and FAQs

Understanding the nuances of filing can play a significant role in compliance and efficiency. Here are some frequently asked questions regarding the 2025 PA Fiduciary Income Form.

Interactive tools for simplifying form management

To enhance your filing experience, pdfFiller offers a range of interactive tools designed for ease of use. These features simplify the process of document management, ensuring greater efficiency in completing the 2025 PA Fiduciary Income Form.

With pdfFiller, users can edit, sign, and collaborate on the fiduciary income form directly within a cloud-based platform. This accessibility allows you to manage your documents anytime, anywhere, which is particularly advantageous given the complexities associated with fiduciary responsibilities.

Real-life examples and case studies

Real-life scenarios illustrate the common challenges fiduciaries might face. Consider an estate with both real estate and investment income; managing the reporting of multiple income sources can be overwhelming. Learning from past tax filings can guide fiduciaries in improving their strategies for the upcoming tax year.

Case studies of teams successfully managing fiduciary forms demonstrate the importance of thorough preparation and efficient tools. Using platforms like pdfFiller allowed many teams to streamline their filing process, leading to timely submissions and minimized errors.

Social engagement and community insights

Engaging with a community of peers adds value to the often complicated process of fiduciary income reporting. Social media platforms and forums provide a space for fiduciaries to ask questions, share experiences, and gain insights from one another.

Highlighting community contributions can inspire others to engage, making it easier to navigate common questions regarding income forms. Regular discussions pave the way for a better understanding of shared challenges and success stories in tackling the intricacies of tax filing.

More about pdfFiller’s comprehensive document solutions

PdfFiller offers numerous advantages when managing tax-related documentation, particularly the 2025 PA Fiduciary Income Form. With functionality designed specifically for document management, the platform stands out due to its robust features that increase efficiency and ensure compliance.

Additionally, users have access to resources that help them manage various forms, including instructional materials for completing tax-related forms. This comprehensive approach positions pdfFiller as an invaluable partner for individuals and teams facing the complexities of fiduciary income reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025 pa fiduciary income without leaving Google Drive?

Can I create an electronic signature for signing my 2025 pa fiduciary income in Gmail?

How do I complete 2025 pa fiduciary income on an iOS device?

What is 2025 pa fiduciary income?

Who is required to file 2025 pa fiduciary income?

How to fill out 2025 pa fiduciary income?

What is the purpose of 2025 pa fiduciary income?

What information must be reported on 2025 pa fiduciary income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.