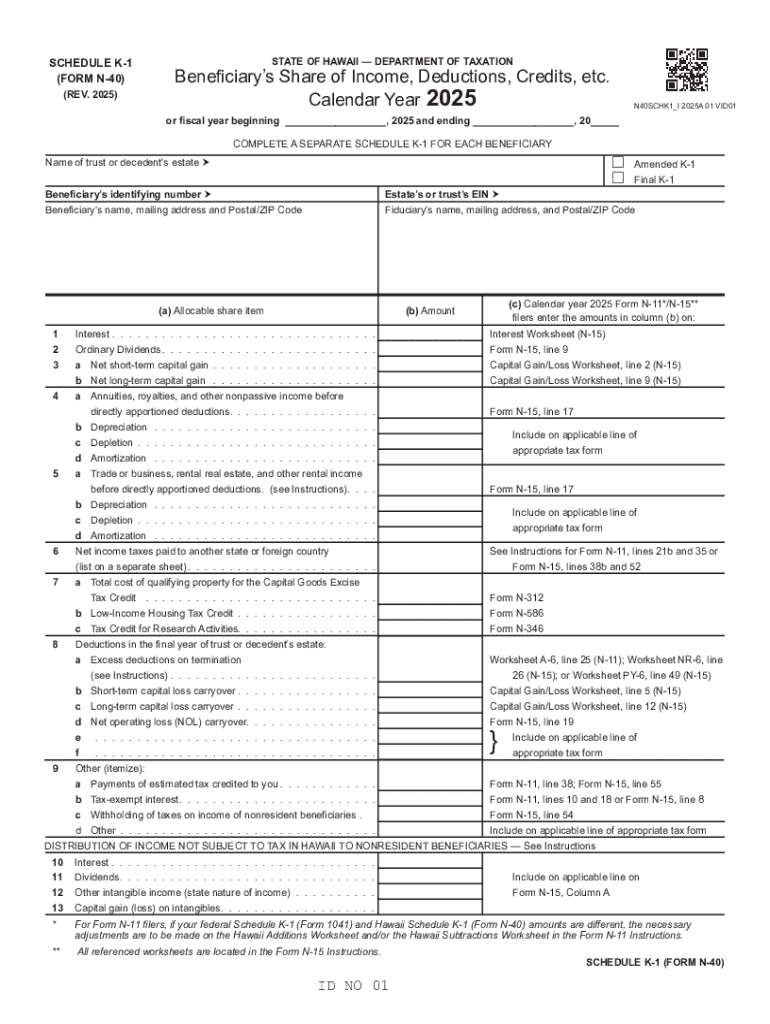

Get the free SCHEDULE K-1 (FORM N-40): Fill out & sign online

Get, Create, Make and Sign schedule k-1 form n-40

How to edit schedule k-1 form n-40 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule k-1 form n-40

How to fill out schedule k-1 form n-40

Who needs schedule k-1 form n-40?

Schedule K-1 Form and N-40 Form How-to Guide

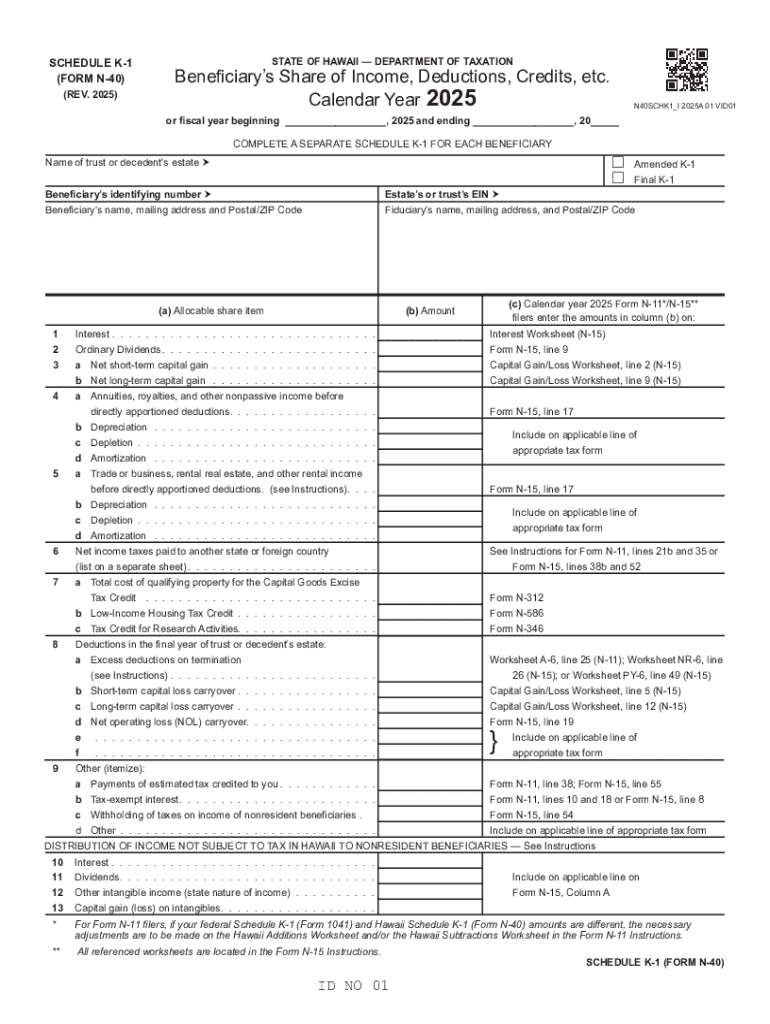

Overview of Schedule K-1 Form

The Schedule K-1 form is an essential tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Unlike traditional tax forms, which first collect data on the entire income of a taxpayer, K-1 forms focus on income that aligns with specific entities, making their accurate preparation crucial for both individuals and businesses.

There are several types of K-1 forms, including Form 1065 K-1 for partnerships, Form 1120S K-1 for S corporations, and Form 1041 K-1 for estates and trusts. Each K-1 form provides unique information relevant to the taxpayer’s income received from these entities during the tax year, thus ensuring compliance with federal tax laws.

Introduction to N-40 Form

The N-40 form is pertinent for certain non-resident taxpayers who need to report income earned in specific states or countries. It is primarily used for filing tax returns related to dividends, interest, and certain business income received while not residing in the taxation jurisdiction of the filing state.

The N-40 form is crucial for non-residents who earn income from investments, as it ensures proper tax reporting and compliance. Unlike standard forms that cater mainly to residents, the N-40 takes into account unique tax scenarios that non-residents face, thus reducing complexities in tax management.

Preparing to use the Schedule K-1 and N-40 forms

Before filling out the Schedule K-1 and N-40 forms, it is vital to gather all necessary information, including identification details, and details about your income sources. Ensure you have your taxpayer identification number, the entity's details (where applicable), and any corresponding financial statements.

For easier completion, numerous online resources and tools are available. Tax software can greatly facilitate the process by guides to ensure accurate entries. Furthermore, maintain a checklist of required documents, such as previous tax returns for reference.

Step-by-step guide to filling out Schedule K-1

Completing the Schedule K-1 involves a series of steps. The first segment requires entering your personal information accurately. Provide your full name, address, and social security number in the appropriate sections to establish your identity clearly.

In the income section, report your earnings as outlined on the K-1 form. This generally includes dividends, interest, capital gains, and deductions. Use the amounts provided by the entity to ensure precise reporting.

For partnerships, additional partnership information must be included, such as the partnership's name and identification number. It’s important to double-check for correctness to avoid errors. Finally, sign and date the form where indicated before submission.

Common challenges in filling out Schedule K-1

Filling out the Schedule K-1 can present several challenges. Mistakes like inaccurate income reporting, missing partner details, or wrong identification numbers can lead to tax complications. Understanding common pitfalls and properly troubleshooting them is vital to streamline the process.

Frequently asked questions often include inquiries about how to recover from errors or what to do if a K-1 is missing. Its complexity emphasizes the need for detailed attention to each segment of the form.

Incorporating N-40 form with Schedule K-1

Understanding how the K-1 income interacts with the N-40 is crucial for non-resident taxpayers. If you're a non-resident earning income reported on both Schedule K-1 and the N-40, you need to ensure that you're correctly reporting all income while evaluating any applicable tax implications.

Key differences include the way income is characterized; K-1 focuses on income from entities, while N-40 is geared towards capturing taxable activities of non-residents. Thus, maintaining clarity on how these forms complement or influence each other is imperative.

Digital solutions for managing your schedules

Utilizing digital platforms can significantly enhance your experience with the Schedule K-1 and N-40 forms. Solutions like pdfFiller empower users to fill out, edit, and manage these forms seamlessly. The platform's user-friendly interface allows for easy entry, reducing the time spent on tax preparation.

Collaboration features mean that teams or tax professionals can work together within the document, leading to quicker resolutions of issues and ensuring accuracy. Going digital not only simplifies the process but also protects against the hassle of traditional paperwork.

Finalizing your K-1 and N-40 filing

Once you have completed the Schedule K-1 and N-40 forms, it’s crucial to focus on the submission aspect. Different forms have specific filing requirements and deadlines. Submit your completed K-1 and N-40 forms to the respective tax authorities, ensuring you're meeting all deadlines to avoid penalties.

Verification of receipt is also paramount; tracking your submissions ensures that your forms were successfully received. Establish a follow-up practice to confirm the status of your tax filing, thus bolstering your confidence in compliance.

Seeking help or professional assistance

Engaging with a tax professional can be beneficial, especially if complexities arise or if you are navigating both the K-1 and N-40 forms. Their expertise can clarify ambiguities and enhance your compliance strategies.

For those seeking assistance, numerous resources and directories exist to find qualified help in your vicinity. Additionally, utilizing the support from platforms like pdfFiller can provide valuable insight and guidance as you work through your tax documentation.

Future considerations and updates

Tax regulations can change frequently, affecting how you manage your Schedule K-1 and N-40 forms. Staying informed about updates in tax laws is crucial for accurate reporting. Regularly consult tax professionals or official resources to remain compliant.

Additionally, consider enrolling in ongoing education programs that clarify the nuances of tax filing during changes. Utilizing platforms like pdfFiller grants access to the latest updates and trends, assisting in your tax preparation effectively.

Conclusion

Accurate completion of tax forms like the Schedule K-1 and N-40 significantly affects your financial responsibilities. By leveraging available tools and understanding each step in the process, taxpayers can ensure compliance while minimizing potential liabilities. Engage with resources actively to manage your documentation effectively, turning tax season into a manageable process.

Through proper education and the use of efficient platforms such as pdfFiller, staying on top of your tax duties becomes a more constructive experience. Embrace these resources to enhance your tax management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete schedule k-1 form n-40 online?

How do I edit schedule k-1 form n-40 straight from my smartphone?

Can I edit schedule k-1 form n-40 on an iOS device?

What is schedule k-1 form n-40?

Who is required to file schedule k-1 form n-40?

How to fill out schedule k-1 form n-40?

What is the purpose of schedule k-1 form n-40?

What information must be reported on schedule k-1 form n-40?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.