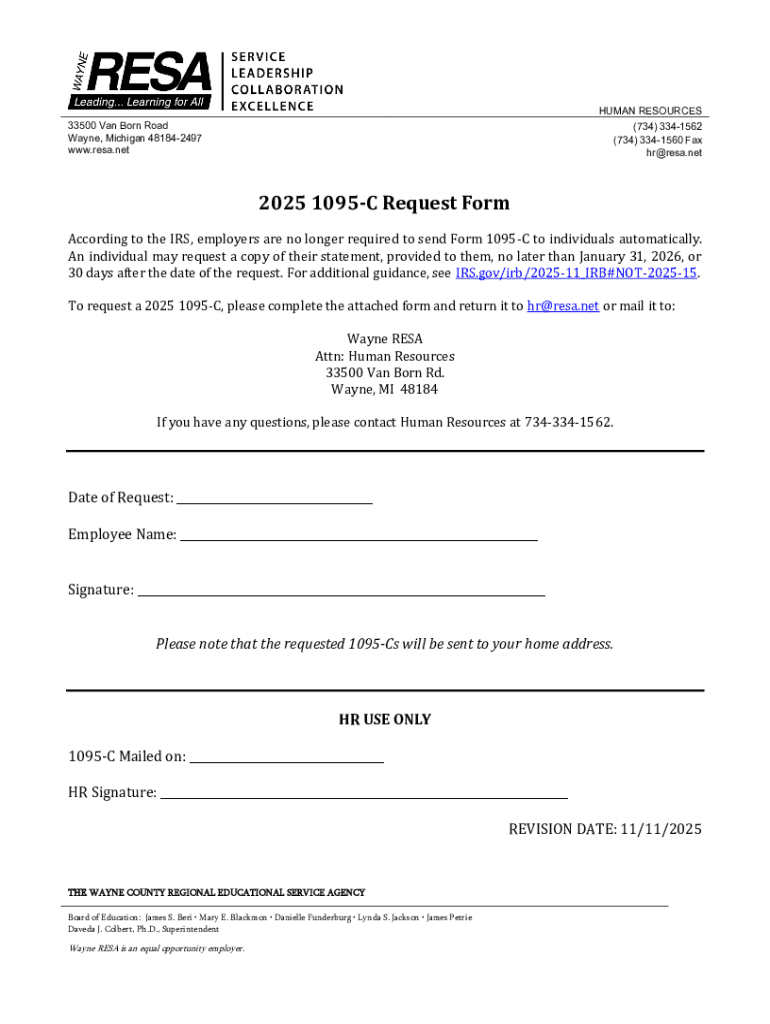

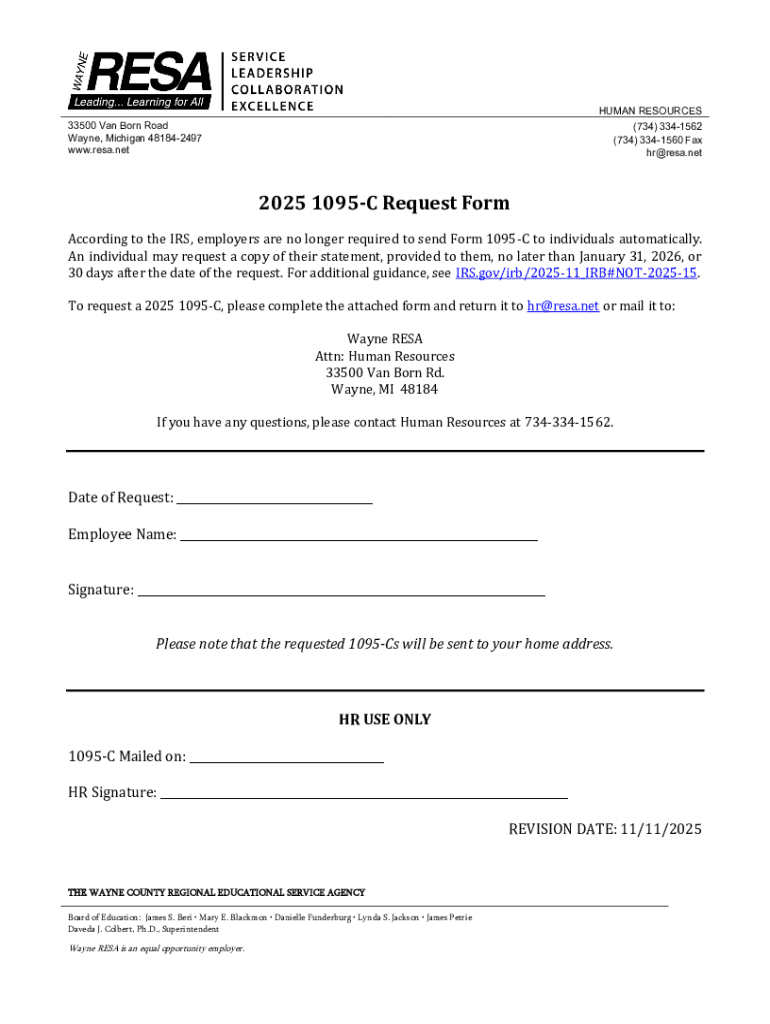

Get the free 2025 1095-C Request Form

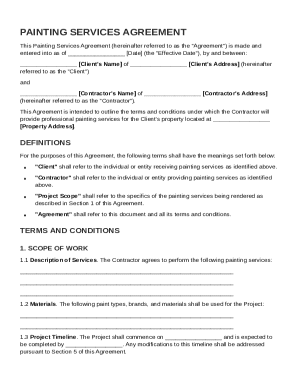

Get, Create, Make and Sign 2025 1095-c request form

How to edit 2025 1095-c request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 1095-c request form

How to fill out 2025 1095-c request form

Who needs 2025 1095-c request form?

2- Request Form: Your Comprehensive Guide

Understanding the 1095- Form

The 1095-C Form is a crucial document for employers in the context of the Affordable Care Act (ACA). This form provides information about the health insurance coverage offered to employees, allowing the IRS to assess compliance with the ACA’s employer mandate. Essentially, the 1095-C serves as proof that employees either received health coverage that meets ACA requirements or that they were eligible for such coverage.

The importance of the 1095-C in the ACA cannot be overstated. It helps ensure that employees are protected through employer-sponsored insurance and directly supports the goals of the ACA in expanding healthcare coverage across the United States. For the tax year 2025, there are a few key updates to this form that both employers and employees should be aware of.

Detailed insights into the 1095- form components

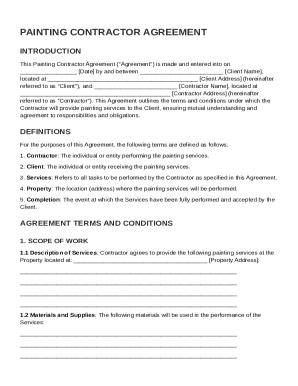

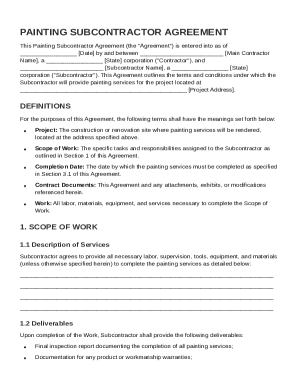

Understanding each section of the 1095-C Form is essential for accurate completion. The form consists of multiple parts that detail the health coverage provided to employees. The first section typically includes employer information such as the employer's name, EIN, address, and contact numbers. Following that, you'll find detailed sections requiring information about each employee's coverage status.

To avoid common mistakes while filling out the 1095-C, it's critical to review the details carefully. Employers must ensure that the correct codes are used to represent the type of coverage offered and that employee data matches existing records. These details must also be concise, as errors can lead to compliance issues and penalties.

Navigating the 2025 forms for employers

For employers, completing the 1095-C in an organized and timely manner is paramount. Begin by gathering necessary employee data and ensuring your HR systems are up-to-date with current health coverage records. The step-by-step process for submitting the 1095-C generally follows the order of collecting information, filling out required sections of the form, and finally distributing copies to employees and the IRS.

To ensure compliance and avoid fines, employers should adhere to best practices for timely submission, including setting internal deadlines well ahead of the IRS due date. Understanding who qualifies for receiving a 1095-C is especially important, as not all employees may need this form, especially those who worked during short periods and are classified differently.

Interactive tools for filling out the 1095- Form

Utilizing tools like pdfFiller can streamline the completion of the 1095-C Form significantly. pdfFiller offers features specifically tailored for this form, such as easy editing functionalities and e-signature capabilities. These tools minimize the risk of errors and facilitate rapid completion, allowing business managers to focus on other pressing matters.

When accessing and using templates for the 1095-C form on pdfFiller, customizing the template to fit your organization’s needs is effortless. Users can save time by editing previously completed forms for returning employees, ensuring that every submission remains relevant and accurate.

Insights on managing 1095- compliance

Accurate record-keeping is essential for compliance with the ACA. Implementing systematic practices for maintaining records can prevent future complications during audits. Employers should keep detailed logs of each employee's coverage, including copies of all submitted 1095-C forms, for at least three years — in line with IRS guidelines.

Responding efficiently to IRS inquiries regarding the 1095-C Form is vital. Common questions may relate to discrepancies in employee data or coverage reported. Preparing for these types of audits and inquiries requires a proactive approach to tracking submissions and employee communications regarding health coverage.

Downloadable resources and tools

To assist employers and employees, having resources readily available can be extremely beneficial. A free ACA 1095-C Form Cheat Sheet, for example, can offer key codes and explanations valuable for completing the form accurately. pdfFiller also provides links to additional templates and tools to aid in filing other related forms that every employer should know about.

Utilizing these downloadable resources can reduce the learning curve associated with the 1095-C Form and aids in building comprehensive knowledge around ACA compliance.

FAQs regarding the 1095- request form

If you did not receive your 1095-C, it is essential to contact your employer’s HR department as soon as possible. They must ensure that all eligible employees receive their forms in a timely manner, as this can affect your tax filings. Additionally, understanding the process for correcting errors post-submission is critical. Mistakes can occur, and knowing how to rectify them quickly can prevent further complications.

When preparing for tax filing with the 1095-C Form, ensure you have all relevant documentation that reflects your health coverage. This includes knowing the codes that appear in your form, as these will directly influence your tax situation. Familiarity with these details will provide you with a smoother and more efficient tax filing experience.

Conclusion

Being informed and prepared about the 2-C request form is vital for both employers and employees. Utilizing resources like pdfFiller not only simplifies the completion process but also helps maintain compliance with ACA requirements. Engaging proactively with these tools means you can manage document creation, editing, and submission effectively, ensuring full adherence to all reporting obligations.

By following the outlined practices and utilizing the interactive tools available, you will mitigate risks associated with ACA compliance and enhance your organizational efficiency in managing health coverage reporting. Take advantage of pdfFiller’s offerings to make your experience with the 1095-C Form as seamless as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2025 1095-c request form online?

How do I make changes in 2025 1095-c request form?

Can I create an eSignature for the 2025 1095-c request form in Gmail?

What is 2025 1095-c request form?

Who is required to file 2025 1095-c request form?

How to fill out 2025 1095-c request form?

What is the purpose of 2025 1095-c request form?

What information must be reported on 2025 1095-c request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.