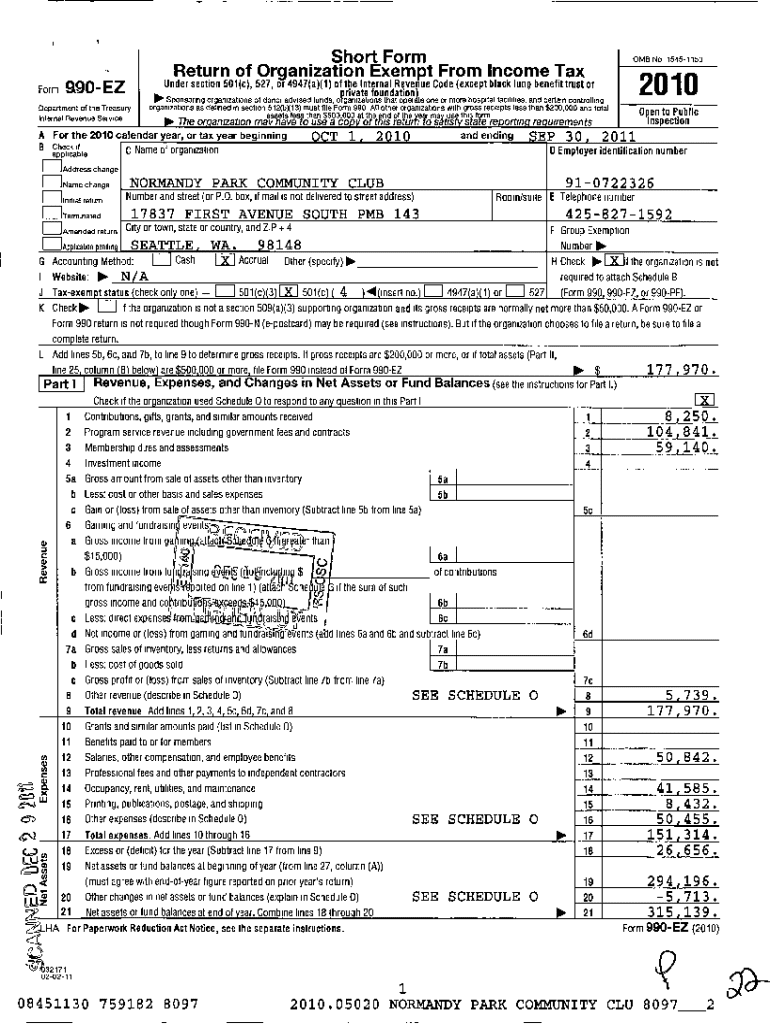

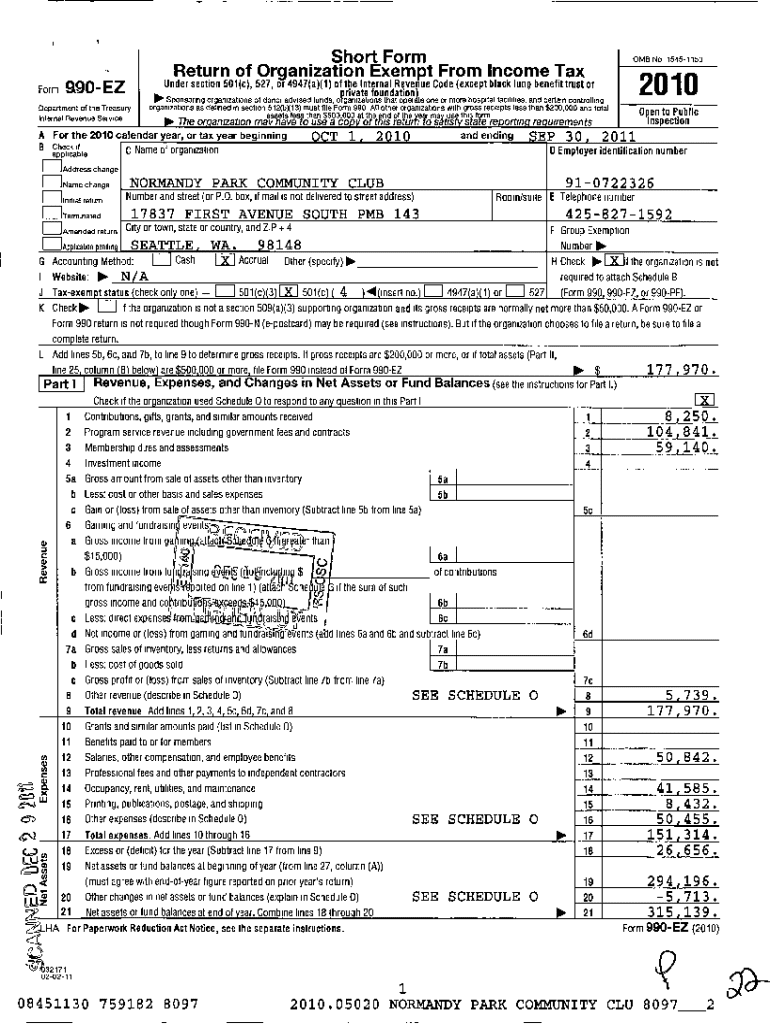

Get the free Short Form Return of Organization Exempt From Income Tax 201

Get, Create, Make and Sign short form return of

Editing short form return of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out short form return of

How to fill out short form return of

Who needs short form return of?

Short form return of form: A comprehensive how-to guide

Understanding the short form return of form

A short form return is a simplified version of the standard income tax return, designed to streamline the filing process for eligible individuals and organizations. Unlike its longer counterpart, which often requests extensive documentation and detailed financial data, the short form focuses on essential information, allowing for a less cumbersome experience. Understanding the distinctions between short and long form returns is critical to ensuring compliance with tax regulations and maximizing efficiency.

The importance of using the correct form cannot be overstated. Filing the wrong form can lead to delays, errors, and potential penalties. It's crucial for taxpayers to assess their eligibility carefully and choose the form that best suits their financial situation.

Who should use the short form return?

The short form return is ideally suited for individuals and organizations with straightforward financial situations. Generally, this includes those with a limited variety of income sources, minimal deductions, and no complex financial transactions. Common scenarios where the short form is advantageous include straightforward wages, limited investment income, and few deductible expenses.

Benefits of opting for the short form return over longer forms include reduced preparation time, lower likelihood of errors in filing, and a simpler submission process. Individuals who meet the criteria can take advantage of these aspects, allowing them to focus on other essential financial obligations.

Key components of the short form return

The short form return typically consists of several essential sections aimed at capturing the necessary information succinctly. The primary components include personal details such as name, address, and Social Security number, followed by financial data that summarizes income and applicable deductions. The form may also require supporting documentation to verify income sources or claims for deductions.

Taxpayers should be aware of any additional schedules or attachments that may be necessary. For instance, specific credits or deductions may require supplemental forms. Having a checklist can ensure that all required information is included, leading to smoother processing and fewer queries from tax authorities.

Interactive tools for completing your short form return

pdfFiller provides an array of features tailored for editing and filling out forms seamlessly. Using this platform, users can enhance their productivity when completing a short form return. The first step involves uploading the document to pdfFiller’s user-friendly interface, where various tools can be utilized.

Once uploaded, users can take advantage of fillable fields for entering personal and financial data, ensuring accuracy and clarity. The platform’s electronic signature feature simplifies the finalization process. By allowing for collaborative sharing of documents, pdfFiller fosters a team environment that minimizes errors and facilitates efficient document management.

Filling out the short form return: A step-by-step guide

Filling out the short form return accurately is essential for a smooth filing experience. Start with the Personal Information section, ensuring all details are complete and correct, including your name, address, and Social Security number. Double-check each entry for typos that could cause processing delays or raise red flags with tax authorities.

Next, move on to the Financial Information section. Avoid common mistakes such as leaving income fields blank or misreporting numbers. Carefully review your income sources and confirm that all relevant data is correctly captured. After filling in all sections, reviewing the entire form for accuracy is equally crucial. Develop a checklist to ensure each component is addressed, including specific financial figures and supporting evidence.

When it comes to submission, knowing the deadlines is vital. Ensure that you submit the completed form either online or in person, depending on the requirements specific to your situation. Be aware of the implications of late submissions, which can include penalties and interest accrual.

Common pitfalls when filing the short form return

Understanding the common pitfalls associated with filing a short form return can significantly improve your experience. For example, frequent issues include inaccurate reporting of income or neglecting to include necessary supporting documentation. Such mistakes can prolong processing times and lead to penalties, including fines.

If you're uncertain during the preparation process, seek help from professionals or use comprehensive resources available through platforms like pdfFiller. Their assistance can help you navigate complexities efficiently and keep your submission on track.

Managing your document post-submission

After submitting your short form return, it’s crucial to know how to manage your documentation effectively. Tracking the status of your return is essential so that you can promptly respond if any further information is requested. pdfFiller offers tools to assist in monitoring your documents, enabling you to stay informed about your submission status.

In cases where additional information is requested, maintain open lines of communication with the relevant tax authorities. Ensure you have all documentation organized and easily accessible. Moreover, make use of pdfFiller’s secure document storage to safeguard your completed returns, ensuring that you can access them as needed in the future.

FAQs about the short form return process

Filing your short form return can bring about several questions, especially regarding errors or amendments post-submission. If a mistake is discovered after the submission, you may need to file an amendment using the recommended procedures by tax authorities. It's important to act quickly to limit potential penalties.

Amendments to your short form return can typically be done using the same platform where you initially filed. Utilizing pdfFiller may also streamline this process, allowing you to make necessary changes efficiently. Understanding how pdfFiller facilitates these adjustments can enhance your overall experience.

Leveraging the pdfFiller platform for document management

pdfFiller is not just a tool for filling out forms; it offers comprehensive document management capabilities that can enhance overall productivity. This includes organizing varied types of documents with ease, ensuring you have quick access to your most critical files when needed. Creating an organized filing system within pdfFiller can significantly reduce time spent searching for important documents.

Using the platform effectively means embracing features such as templates for different forms, engagement letters, and practice guides tailored to the specific requirements of clients. This approach can simplify the process for tax professionals managing multiple clients who need to complete diverse documentation.

User testimonials and success stories

Numerous individuals and teams have shared their success stories after utilizing pdfFiller for their documentation needs. For instance, small business owners have reported drastically improving their operations by adopting pdfFiller for not only income tax return management but for various essential documents, leading to time efficiency and reduced stress.

Such testimonials highlight the transformative impact pdfFiller can have on documentation processes. Whether it’s for tax returns or daily business operations, having a reliable, accessible platform aids users in focusing on what matters most: driving their businesses forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit short form return of from Google Drive?

How do I complete short form return of online?

How do I fill out short form return of using my mobile device?

What is short form return of?

Who is required to file short form return of?

How to fill out short form return of?

What is the purpose of short form return of?

What information must be reported on short form return of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.