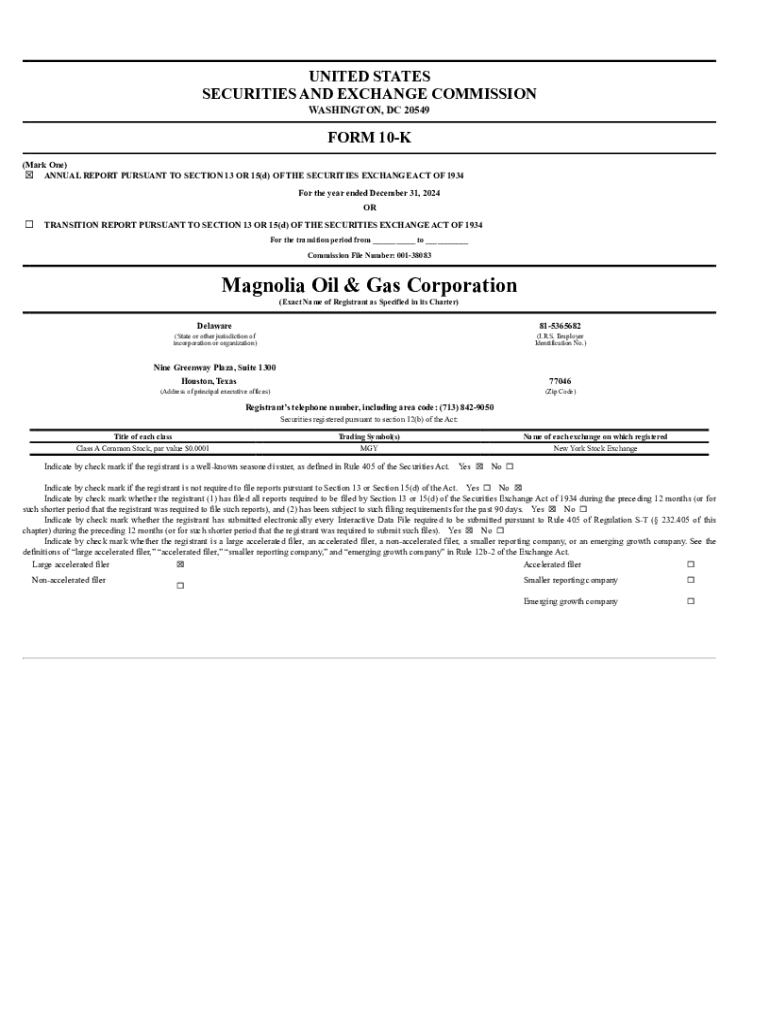

Get the free 0001698990-25-000006. Form 10-K filed on 2025-02-19 for the period ending 2024-12-31

Get, Create, Make and Sign 0001698990-25-000006 form 10-k filed

How to edit 0001698990-25-000006 form 10-k filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 0001698990-25-000006 form 10-k filed

How to fill out 0001698990-25-000006 form 10-k filed

Who needs 0001698990-25-000006 form 10-k filed?

Understanding the 0001698990-25-000006 Form 10-K Filed Form

Understanding the Form 10-K

The Form 10-K is an essential document required by the United States Securities and Exchange Commission (SEC) that provides a comprehensive overview of a publicly traded company's financial performance. It serves as an annual report that includes detailed information about the company’s operations, financials, and subsidiary insights. The primary purpose of this form is to promote transparency among investors and uphold regulatory compliance, ensuring that the company adheres to necessary legal standards.

All publicly traded companies in the USA must file Form 10-K annually, typically within 60 to 90 days after the end of the fiscal year. This requirement fosters a culture of accountability, allowing stakeholders to make informed investment decisions based on reliable data.

Structure of the Form 10-K

The Form 10-K comprises several key components, each providing critical insights into the company’s financial health and operational activities. These components include a detailed overview of the business and properties, identification of risk factors that could affect future performance, management's discussion and analysis (MD&A), and the financial statements along with supplementary data. Each section plays a vital role in painting a clearer picture of the company's overall standing.

Starting with the business section, it outlines what the company does, markets served, and its competitive position. The risk factors section details potential challenges, particularly in unforeseen economic environments, such as fluctuating natural gas prices or property impairments. The MD&A section provides a narrative from the management perspective, addressing strategies, results, and future outlook without compromising transparency.

Filling out the Form 10-K

Filling out the 0001698990-25-000006 Form 10-K involves a detailed and organized approach to ensure accuracy and compliance. The first step is gathering necessary financial and operational data, including previous fiscal reports, revenue figures, expenses related to oil and natural gas, cash flows, and asset valuations. A meticulous approach to documenting all required sections will aid in creating a comprehensive filing.

Common pitfalls during this process include neglecting to provide adequate details in the MD&A, misreporting financial performance, or failing to include all necessary disclosures about reserves and impairments. To avoid such challenges, companies should conduct a thorough data validation process. Utilizing automated tools can streamline the data collection and filing process, providing additional efficiency while reducing the potential for human error.

Editing and modifying the Form 10-K

After generating the initial draft of the 0001698990-25-000006 Form 10-K, review and editing are crucial to ensure accuracy and clarity. Best practices include multiple rounds of internal reviews and incorporating feedback from various stakeholders within the company. Companies should use version control and document tracking systems to keep a record of changes made, which is essential for maintaining compliance and for referencing past versions if needed.

Using tools like pdfFiller to edit the Form 10-K simplifies the entire process, allowing for real-time collaboration and efficient management of document changes. The cloud-based platform offers features that make it easy to modify text, add comments, and ensure all necessary signatures are included, enhancing the overall workflow.

eSigning and securing your Form 10-K

The eSignature process is a significant part of filing the 0001698990-25-000006 Form 10-K, ensuring that it is officially submitted by authorized representatives of the company. The individuals required to sign typically include key executives, like the CEO and CFO, who can be held accountable for the data presented. Legal implications of eSigning must be acknowledged since improper execution can lead to compliance issues.

pdfFiller’s eSigning capabilities offer a streamlined signing process, enhancing efficiency and securing document integrity. The electronic signature ensures that all necessary parties can sign the document regardless of their locations, which is particularly beneficial for companies with remote operations or multiple stakeholders involved in the signing process.

Submitting your Form 10-K

Once the 0001698990-25-000006 Form 10-K is complete and signed, submission is the final step. Companies can file electronically through the SEC's EDGAR system or opt for paper filing, though electronic filing is encouraged for its efficiency. Compliance with SEC regulations is paramount, ensuring all necessary disclosures are clearly laid out and that the document has been filed within the stipulated deadlines.

After submission, tracking the status is crucial. Companies should regularly check the EDGAR system to confirm receipt and to monitor any issues that may arise post-filing. In the case of any discrepancies or errors, immediate action is required to correct the filings to avoid potential penalties.

Common challenges in filing Form 10-K

Despite efforts to ensure a smooth filing process, several common challenges may arise when completing the 0001698990-25-000006 Form 10-K. Companies often face compliance discrepancies with SEC standards, difficulties in gathering accurate data, or misreporting financial figures related to oil and gas reserves or property impairments. These challenges can significantly affect company credibility and investor relations.

Addressing these challenges effectively requires employing strategic solutions. For instance, using pdfFiller can greatly reduce errors through its structured document management features. Additionally, teams can benefit from the platform’s tools that facilitate data entry checks and compliance adjustments, thereby streamlining the filing process.

FAQs about Form 10-K filing

Many companies have questions regarding the intricacies of filing the 0001698990-25-000006 Form 10-K, especially relating to late submissions or the process for amendments. If a company finds itself in a position of filing late, it is crucial to communicate promptly with the SEC and provide a rationale for the delay to avoid penalties. Additionally, if amendments are necessary, they should be filed on a Form 10-K/A, ensuring that new information is disclosed effectively.

Filing amendments can be straightforward if a company employs resources properly. Engaging with SEC support or utilizing pdfFiller’s support services can ensure that the amendments are submitted correctly, maintaining compliance.

The value of Form 10-K in business strategy

Beyond compliance, the 0001698990-25-000006 Form 10-K can serve as a strategic tool for businesses. Analyzing the Form 10-K provides investment insights, helping stakeholders understand a company's financial trajectory or challenges, such as fluctuations in natural gas prices or unexpected property impairments. Furthermore, the information within this document can be pivotal in guiding the communication strategies with investors and clients.

In real-world scenarios, companies have effectively used their Form 10-K filings to pivot strategies and attract investments. Stakeholders analyze these reports to glean updates on company performance, revealing not only profits but effectively aligning future business strategies with market dynamics.

Staying updated on SEC regulations

Remaining compliant with SEC regulations surrounding Form 10-K is a continuous process, as legal requirements can shift. It’s essential for companies to stay informed about evolving regulations and recent changes in reporting requirements to avoid lapses in compliance. Engaging with reliable resources, including industry publications, SEC updates, and platforms like pdfFiller, can provide critical updates that influence compliance practices.

By leveraging pdfFiller’s capabilities, companies can streamline compliance processes through updates provided directly on its platform, ensuring that all documents stay relevant and up-to-date.

Features of pdfFiller for Form management

pdfFiller stands out with features tailored for document organization and management which makes completing the 0001698990-25-000006 Form 10-K a more efficient process. Interactive tools allow users to create and customize documents specifically for their needs, while collaborative capabilities foster effective team engagements. Teams can work simultaneously, facilitating an integrated workflow that minimizes miscommunication and optimizes time management.

Additionally, case studies reflecting successful implementations show how businesses improved their document management systems using pdfFiller. By adopting this platform, companies have reported tangible results in team collaboration, execution speed, and ultimately, the accuracy of their filings.

User testimonials and success stories

Users of pdfFiller have expressed how the platform has transformed their Form 10-K filing processes. Testimonials highlight streamlined workflows and enhanced team collaboration that led to quicker turnarounds in filing legal documents. Engagement with pdfFiller has allowed users to gain greater control over their documentation processes, ensuring all forms, including the 0001698990-25-000006 Form 10-K, are filed accurately and punctually.

Additionally, organizations reported quantitative improvements in their operational efficiency, illustrating that investing in a comprehensive document management solution ultimately pays off in both time saved and compliance ensured.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 0001698990-25-000006 form 10-k filed in Gmail?

How can I get 0001698990-25-000006 form 10-k filed?

How do I fill out the 0001698990-25-000006 form 10-k filed form on my smartphone?

What is 0001698990-25-000006 form 10-k filed?

Who is required to file 0001698990-25-000006 form 10-k filed?

How to fill out 0001698990-25-000006 form 10-k filed?

What is the purpose of 0001698990-25-000006 form 10-k filed?

What information must be reported on 0001698990-25-000006 form 10-k filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.