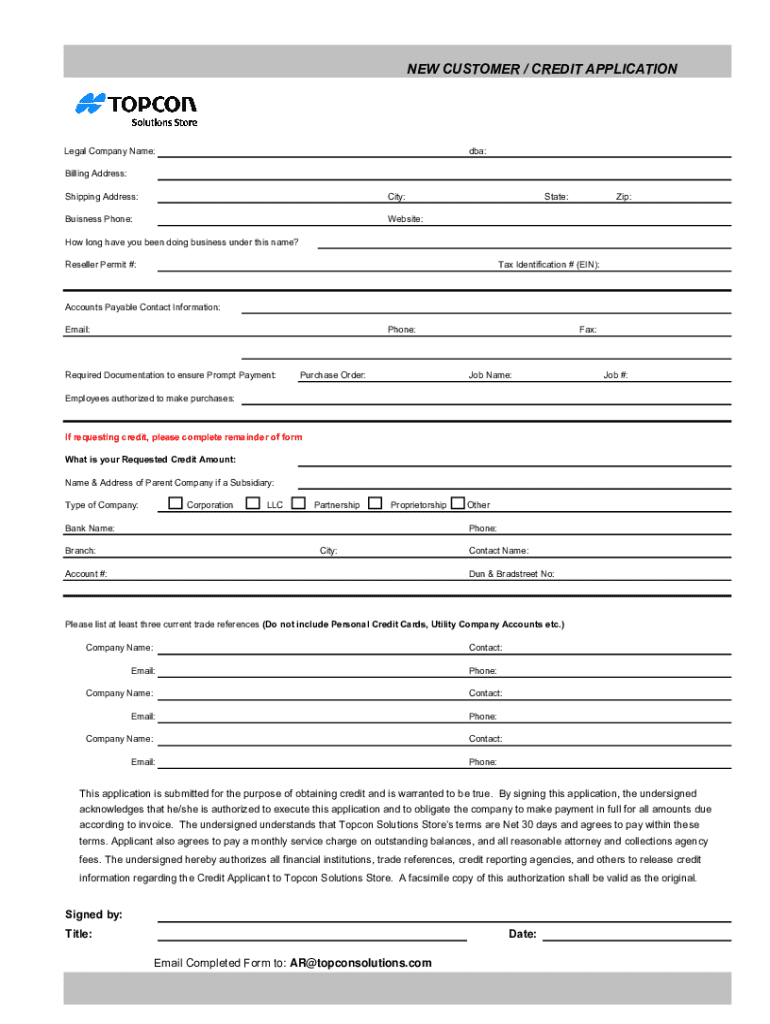

Get the free Copy of TSS Credit Application.xlsx

Get, Create, Make and Sign copy of tss credit

How to edit copy of tss credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out copy of tss credit

How to fill out copy of tss credit

Who needs copy of tss credit?

Comprehensive Guide to the Copy of TSS Credit Form

Understanding the TSS Credit Form

The TSS Credit Form is an essential document used within financial systems to apply for and track tax credits available to eligible individuals. This form primarily focuses on providing a clear structure for applicants to supply necessary information regarding their eligibility and financial details for tax credits applicable under specific government programs.

TSS credits are instrumental in mitigating tax liabilities for eligible taxpayers, enhancing their financial stability. These credits can be applied to various tax obligations, thereby potentially increasing disposable income, encouraging economic activity, and promoting adherence to government regulations. For individuals who meet certain criteria, TSS credits provide a pathway to financial relief and benefit.

Typically, the TSS Credit Form is used by individuals or businesses looking to take advantage of tax credits offered at state or federal levels. Eligibility criteria often include income thresholds, employment status, and participation in specific government programs. Understanding how these credits function can empower applicants to make informed decisions about their financial planning.

Accessing the TSS Credit Form

Obtaining a copy of the TSS Credit Form is straightforward, with several avenues available to access this critical document. First, official government websites often host the most recent versions of the TSS Credit Form. Users can navigate to these sites to download the form directly from a secured and verified source.

Additionally, PDF document repositories provide a range of government forms, including the TSS Credit Form. These repositories can be particularly useful when looking for specific versions or outdated forms for comparison purposes. Users should ensure they are accessing a reputable site to avoid errors or outdated information.

Downloading the TSS Credit Form from pdfFiller is another efficient method to access this document. pdfFiller offers an intuitive platform that not only provides access to forms but also features various tools to assist in filling out and editing documents.

To ensure you are using the most current version, regularly check official sources or pdfFiller for updates, as tax forms can change from year to year. Having the right version is crucial to avoid complications during submission.

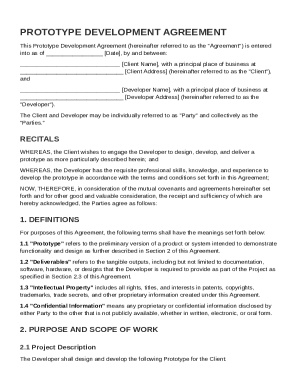

Filling Out the TSS Credit Form

Completing the TSS Credit Form accurately is vital for ensuring a successful application. The form consists of several key sections, including personal information, financial details, and supporting documentation. Providing accurate data in each of these sections will avoid delays or rejections.

The personal information section typically includes details such as your name, address, and Social Security number. The financial details segment requires information about your income, tax obligations, and any previous credits claimed. Supporting documentation may include tax returns or letters from the government verifying participation in programs.

Following a step-by-step approach will facilitate the filling process. Start by carefully entering your data into each section, ensuring accuracy. Common mistakes to avoid include typos in personal information, misreporting income figures, or failing to attach required documents. Utilizing interactive tools on pdfFiller can significantly ease this process, offering real-time validations and suggestions.

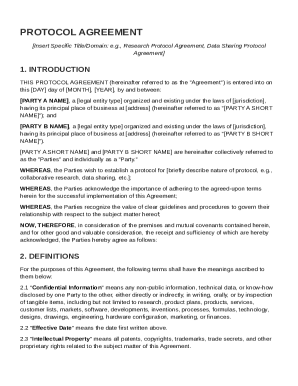

Editing the TSS Credit Form

Editing the TSS Credit Form can be done easily on pdfFiller, which hosts a range of features designed to streamline document editing. Users can edit text directly, adjust field sizes, or add new fields as necessary, facilitating customizable document adjustments.

Should you find inaccuracies after initial submission, pdfFiller allows for seamless corrections without starting from scratch. Take advantage of its editing features to rectify any mistakes promptly, ensuring your document maintains its integrity and remains eligible for processing.

Maintaining document integrity is crucial. When making edits, clearly highlight changes made, and maintain a version history if necessary. This is particularly important if the document requires multiple submissions over time.

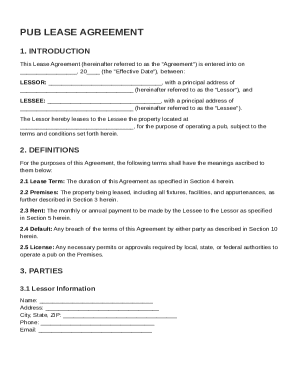

Signing the TSS Credit Form

Understanding the requirements for eSignatures is fundamental when submitting your TSS Credit Form. An electronic signature may be the only method acceptable for submitting your paperwork promptly, so it’s critical that users familiarize themselves with this process.

Signing the form electronically using pdfFiller is a straightforward task. Users can drag and drop their signatures into a designated area on the form or use the platform’s eSignature tools to create a secure digital signature that complies with legal standards.

Moreover, if your form requires signatures from multiple parties, pdfFiller provides effective solutions to facilitate this process. Coordinated efforts can save time and streamline document finalization.

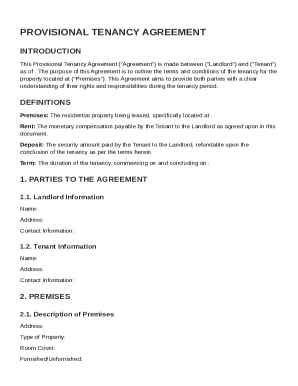

Submitting the TSS Credit Form

Once the TSS Credit Form is completed, submitting it appropriately is the next step. There are various channels available: online submission through dedicated government portals, mailing the physical form, or in-person delivery at specified government offices.

When submitting online, ensure you follow the guidelines provided on the respective government site to avoid mistakes. For mailed submissions, be meticulous regarding any required cover letters or supporting documents to ensure that everything is properly received. You should also send it via a traceable method to confirm its delivery, ensuring peace of mind.

After your submission, expect confirmation from the relevant authority; this may be a receipt or confirmation email. Additionally, tracking the status of your submission through online tools available on the government portal can help you monitor its progress.

Managing your TSS Credit Form records

Once you have submitted the TSS Credit Form, managing copies of your form is crucial. Utilizing pdfFiller's document management system allows you to organize and store copies securely in a cloud-based environment, ensuring they are easily retrievable when needed.

Retaining important documents for future reference involves maintaining copies of past submissions, receipts, and any correspondence related to your application. This is vital in case of audits or discrepancies. Furthermore, if you need to share your TSS Credit Form with stakeholders, pdfFiller provides tools for seamlessly sharing documents, ensuring that all involved parties have access to the correct version.

Troubleshooting common issues with the TSS Credit Form

Encountering issues with your TSS Credit Form is not uncommon. If your form is rejected, it is essential to read feedback carefully to understand the reasons for denial. In many cases, rejections stem from incomplete information or missing documentation.

In instances of discrepancies during submissions, promptly contact the relevant authority to clarify and rectify any misunderstandings. Don’t hesitate to seek assistance from pdfFiller’s support team for technical issues or questions related to document submissions. They can guide you effectively to resolve any concerns.

Advantages of using pdfFiller for the TSS Credit Form

Utilizing pdfFiller for the TSS Credit Form offers significant advantages. The cloud-based platform allows for seamless document management, making it easy to access, edit, and store forms from anywhere. This accessibility is especially beneficial for individuals and teams who work remotely or are often on the go.

Collaboration capabilities within pdfFiller enable teams to work on documents simultaneously, streamlining the form completion process. Additionally, eSigning through pdfFiller is more efficient compared to traditional methods, reducing time spent on physical signatures and increasing overall response time to applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in copy of tss credit without leaving Chrome?

Can I create an electronic signature for the copy of tss credit in Chrome?

How do I fill out copy of tss credit using my mobile device?

What is copy of tss credit?

Who is required to file copy of tss credit?

How to fill out copy of tss credit?

What is the purpose of copy of tss credit?

What information must be reported on copy of tss credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.