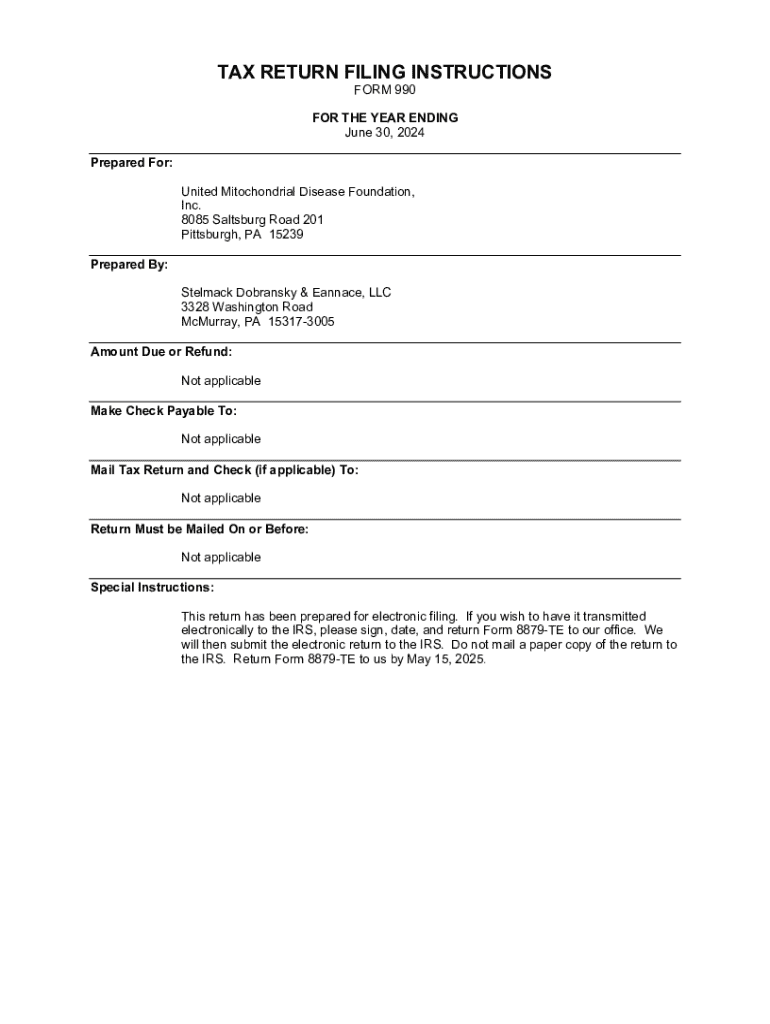

Get the free UMDF Financial Statements

Get, Create, Make and Sign umdf financial statements

Editing umdf financial statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out umdf financial statements

How to fill out umdf financial statements

Who needs umdf financial statements?

UMDF Financial Statements Form: A Comprehensive How-to Guide

Understanding UMDF financial statements

The United Mitochondrial Disease Foundation (UMDF) plays a crucial role in supporting individuals and families affected by mitochondrial disorders. Financial statements are essential tools for non-profit organizations like UMDF, as they provide a clear picture of the organization's financial health, which is vital for transparency and accountability.

These statements enable potential donors, grant-makers, and stakeholders to assess how effectively their contributions are being utilized. Therefore, understanding what these documents entail is essential for anyone involved with UMDF.

UMDF financial statements form overview

UMDF requires several types of financial statements to present a comprehensive overview of its financial state. Among these are the Statement of Financial Position, Statement of Activities, Statement of Functional Expenses, and Statement of Cash Flows. Each statement serves a distinct purpose, contributing to the overall narrative of the organization's financial situation.

The Statement of Financial Position illustrates the assets, liabilities, and equity, providing a snapshot of what the organization owns versus what it owes. Meanwhile, the Statement of Activities presents revenue sources and expenditures, highlighting the organization's operational performance over the fiscal year.

How to access the UMDF financial statements form

Finding the UMDF financial statements form is straightforward. Start by visiting pdfFiller. Once there, you can navigate through the user-friendly interface to locate the specific form you need.

After locating the form, you have the option to download it in PDF format or use the interactive online version provided by pdfFiller. This flexibility allows you to choose how you wish to fill out and manage your financial statements.

Filling out the UMDF financial statements form

Filling out the UMDF financial statements form entails a step-by-step approach to ensure accuracy and compliance. Begin by reviewing the guidance for each section of the form. Common pitfalls include entering incorrect figures or not providing sufficient explanations where necessary.

Moreover, pdfFiller offers interactive tools designed to enhance the completion process. These tools can help clarify fields and ensure that all applicable information is captured correctly. By utilizing collaborative features, teams can work together more effectively on completing the form.

Editing and customizing your financial statements

One of the powerful features of pdfFiller is its editing capabilities, which allow users to add, delete, or modify information in the financial statements form easily. Maintaining professional formatting is essential, as it reflects the organization's commitment to meticulousness.

Furthermore, collaboration tools are available, allowing team members to provide input and suggestions throughout the editing process. This collaborative effort ensures that the form is comprehensive and reflects the views and data from multiple stakeholders.

Signing and submitting your financial statements

Once the UMDF financial statements form is filled out and reviewed, it’s time to finalize it with signatures. pdfFiller allows users to eSign documents securely, streamlining the signing process significantly. You can also collect additional signatures from other relevant parties as needed.

Understanding the submission guidelines is essential for ensuring that your financial statements are accepted without issues. It’s advisable to check the necessary formats and be aware of any upcoming deadlines to avoid last-minute hassles.

Managing your financial statements

Managing your financial statements is an ongoing process. Keeping track of changes and updates is crucial for maintaining accurate records over time. Regularly revisiting your statements will ensure that they reflect the current state of your organization’s financial health.

Utilizing cloud storage solutions, such as those provided by pdfFiller, can enhance the accessibility and organization of your documents. By storing all financial statements in a centralized cloud library, you can easily retrieve and review them whenever necessary.

FAQs about UMDF financial statements

It's common to have questions when dealing with the UMDF financial statements form. Frequently asked questions often cover what constitutes sufficient documentation, how to handle discrepancies, and where to find additional resources. Being prepared with answers to these inquiries can smooth the process.

Moreover, troubleshooting submission issues is vital to ensure that everything goes seamlessly. Common problems may involve format errors or missing signatures, which can easily be rectified with the right guidance.

Related forms and resources

Aside from the UMDF financial statements form, there are several related financial documentation that non-profits may need. Understanding similar forms can provide a more well-rounded perspective on non-profit financial practices.

Additionally, various articles, tools, and workshops are available to help individuals and teams enhance their understanding of non-profit financial management, aiding in better organizational practices.

Recent updates and changes in UMDF financial reporting

Keeping abreast of current trends in non-profit financial reporting is critical. Recent regulatory changes can impact how UMDF prepares its financial statements, influencing transparency and stakeholder trust.

Looking ahead, organizations must be prepared for forthcoming changes in financial reporting requirements or practices. Staying informed about these updates is crucial for compliance and effective financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the umdf financial statements in Chrome?

Can I create an eSignature for the umdf financial statements in Gmail?

Can I edit umdf financial statements on an Android device?

What is umdf financial statements?

Who is required to file umdf financial statements?

How to fill out umdf financial statements?

What is the purpose of umdf financial statements?

What information must be reported on umdf financial statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.