Get the free 2024 Tax Organizer Personal Information - Tom Baker, PA

Get, Create, Make and Sign 2024 tax organizer personal

How to edit 2024 tax organizer personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax organizer personal

How to fill out 2024 tax organizer personal

Who needs 2024 tax organizer personal?

Mastering the 2024 Tax Organizer Personal Form

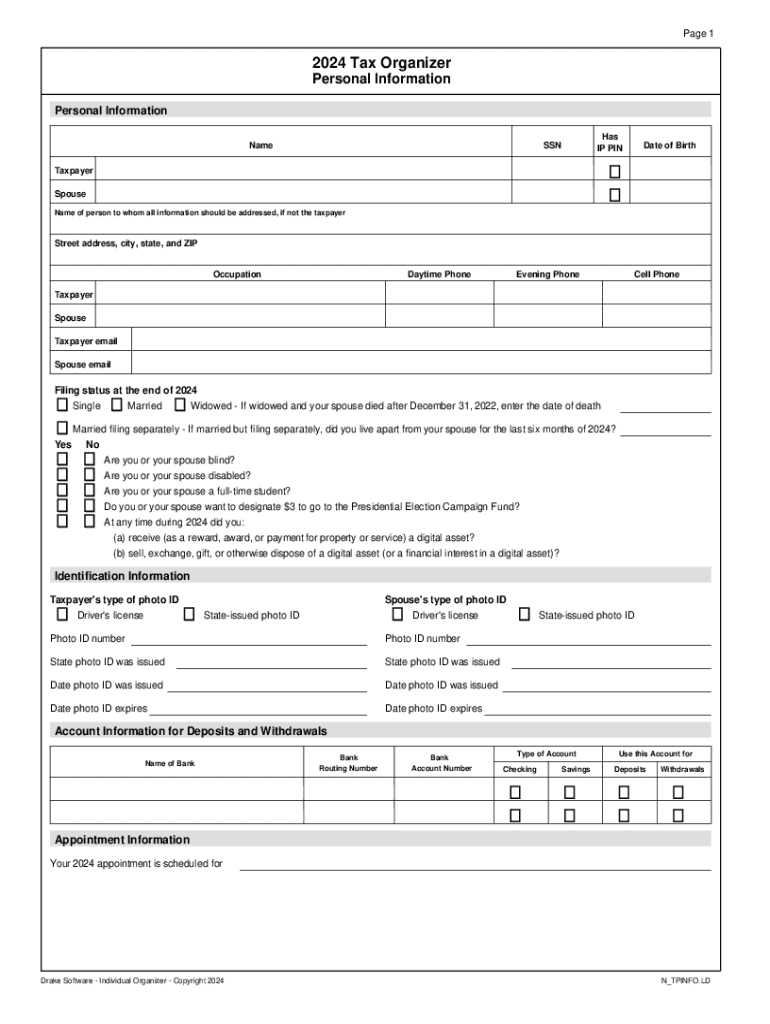

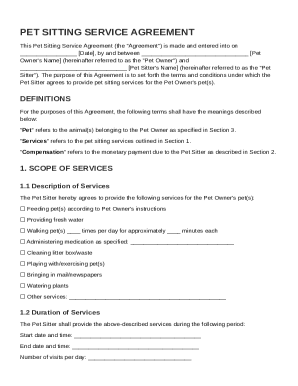

Overview of the 2024 tax organizer personal form

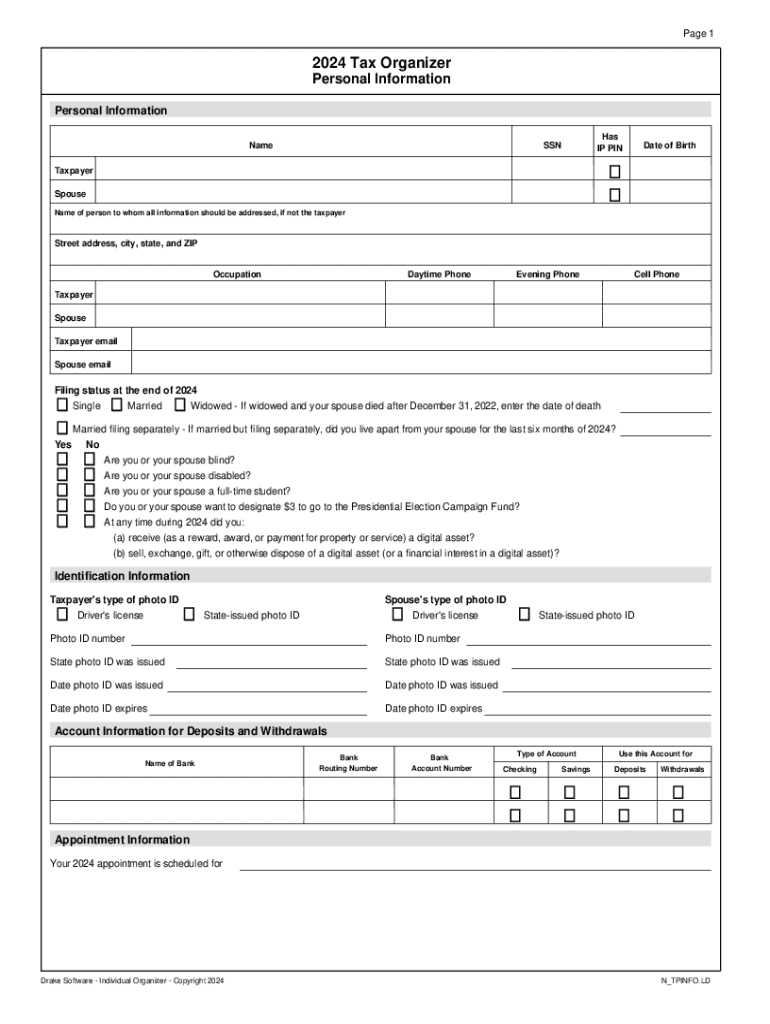

The 2024 tax organizer personal form is an essential tool for individuals seeking to simplify their tax preparation process. This form serves as a comprehensive checklist, ensuring that all necessary documentation and information are accounted for before filing. By utilizing this form, taxpayers can gather important details regarding income, deductions, and credits, ultimately making the filing process more efficient.

Using the 2024 tax organizer offers several key benefits that can enhance your tax filing experience. The most significant advantages include a streamlined tax preparation process, organized documentation, and the potential to maximize deductions and credits. By having all relevant information gathered in one place, you reduce the risk of overlooking valuable tax breaks.

Understanding the components of the 2024 tax organizer

The 2024 tax organizer is divided into several sections, each catering to specific aspects of your finances. Section A collects personal information, including your name, address, and Social Security Number. This foundational data is crucial since it establishes your identity for the IRS and avoids any mismatches on your tax return.

Section B focuses on income sources, where you will input details about your employment income as well as other types of revenue, such as freelance income or investment returns. Finally, Section C addresses your deductions and credits, highlighting itemized deductions and providing a checklist for tax credits you may qualify for. This structure allows for a comprehensive overview of your financial situation, ensuring no vital details are missed.

Step-by-step instructions for completing the 2024 tax organizer

Completing the 2024 tax organizer starts with gathering necessary documents. Collect your W-2 forms from your employer, 1099 forms for any freelance work, and receipts for deductible expenses such as medical bills or charitable contributions. Having these documents prepared ahead of time will facilitate a smoother filling experience.

Next, begin filling out the organizer. Each section requires distinct information, so take your time to input the data carefully. Use the provided fields to fill in your name, address, and income sources, ensuring accuracy to prevent delays later in the filing process. It’s helpful to review each entry for completeness before moving on. Lastly, make sure to double-check your organizer for any common pitfalls, such as missing income entries or overlooked deductions.

Tips for efficient tax preparation

Creating a solid document management system is fundamental to efficient tax preparation. Organize your documents into digital and paper formats, and use tags and folders within platforms like pdfFiller to ensure easy retrieval. This organization will save time and reduce stress as tax deadlines approach. Furthermore, it’s beneficial to establish a timeline for completing your taxes, noting down key dates like when to gather documents or when your tax form is due.

Set clear deadlines for each stage of your tax preparation to keep yourself on track. Aim to complete your organizer well before the filing deadline, allowing for revisions and consultations if needed. Key tax season dates to remember include the filing deadline and the start of the tax-filing season. Planning accordingly ensures you stay ahead of potential last-minute issues.

Leveraging interactive tools for the 2024 tax organizer

pdfFiller provides interactive tools that enhance the utility of the 2024 tax organizer personal form. With pdfFiller, users can easily edit and sign their completed organizer directly on the platform. This feature speeds up the process, reducing the time needed to finalize paperwork. A step-by-step guide for signing your completed organizer is readily available on pdfFiller, allowing you to quickly navigate this essential step.

Additionally, collaborating with team members is effortless through pdfFiller's sharing features. You can share your organizer with tax advisors or family members for real-time feedback, enabling quicker adjustments and collective decision-making on deductions and investments. Using these collaborative tools provides an added layer of confidence that your tax preparation is thorough and accurate.

Frequently asked questions about the 2024 tax organizer

Common questions arise during the tax preparation process, and it's essential to address them to alleviate any concerns. One frequent inquiry is, 'What if I make mistakes on my form?' If you identify an error after filing, the IRS allows for amendments through Form 1040-X. For the best outcome, keep clear records of communications and revisions.

Another common question is about submitting the completed organizer. You can submit your organizer alongside your tax form, either electronically or by mail. Some may wonder if the organizer can be used for state taxes as well; generally, yes, but it's crucial to check if your state has specific forms or guidelines that differ from the federal level. Lastly, you can access previous years’ organizers for reference through pdfFiller, streamlining your preparation for the current tax year.

Spotlight on unique features of pdfFiller for tax management

One of the most notable aspects of pdfFiller is its cloud-based accessibility, which allows users to edit and sign documents from anywhere with an internet connection. This feature is particularly advantageous during tax season, when quick access to your documents can be crucial. Additionally, pdfFiller offers comprehensive management capabilities, enabling users to track document versions and histories, ensuring that they are always using the most up-to-date forms.

Security is another vital consideration, especially when dealing with sensitive tax information. pdfFiller emphasizes enhanced security features to protect your data, offering encryption and secured access to your documents. This is a strong reassurance in today’s digital landscape, where data breaches are increasingly common.

Real-life scenarios and case studies

User experiences often highlight the efficiency benefits of utilizing the 2024 tax organizer. For instance, one small business owner reported saving significant time during tax season by organizing their finances through the pdfFiller tax organizer. The owner noted that having everything consolidated into one form minimized the time spent searching for receipts and relevant documents.

Another case study focuses on a team of freelancers. By collaboratively filling out the 2024 tax organizer using pdfFiller's sharing features, they streamlined their preparation process. Team members could provide real-time feedback, leading to shared deductions that they might’ve overlooked individually. Testimonials like these underscore how the 2024 tax organizer personal form positively impacts users, allowing for a smoother tax filing experience.

Additional considerations for 2024

As we prepare for 2024, it's vital to stay informed about updates to tax laws that may affect personal filers. Changes can occur annually, influencing allowable deductions, credits, and filing requirements. Proactively researching these updates will empower you to make informed decisions regarding tax strategies. Moreover, strategic tax planning is advisable to optimize your financial situation throughout the year, rather than waiting until tax season.

Consider consulting with tax professionals or utilizing educational resources to ensure that you are capitalizing on every opportunity available to you. Simple adjustments in your filing approach today can lead to substantial savings and a smoother experience when taxes are due.

Interactive templates and tools available on pdfFiller

To access the 2024 tax organizer template, visit pdfFiller's extensive library of tax documents. The platform offers customizable templates that you can tailor to your specific needs. This adaptability means you’re not constrained to a standard format; instead, you can modify the organizer to fit your financial situation precisely.

Moreover, pdfFiller incorporates interactive features that enhance the functionality of your tax organizer. Users can instantly edit their templates and save them for future reference, ensuring a simplified filing process every year. This ongoing accessibility is instrumental for individuals and teams alike, eliminating redundancies and maximizing efficiency.

Next steps after completing the 2024 tax organizer

After meticulously filling out the 2024 tax organizer personal form, it's time to consider filing options. You can choose between e-filing and paper filing, each offering distinct advantages. E-filing is often more efficient and can facilitate quicker refunds, while paper filing may be preferred by those who seek a tangible record of their submission.

Additionally, if your organized form indicates that you owe taxes, take immediate action to arrange your payment. Understanding your obligations early on can help you avoid late fees or other penalties. Record-keeping is vital; ensure you keep copies of both your tax return and the organizer for future reference, which can aid in subsequent years' preparations or any potential audits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2024 tax organizer personal in Chrome?

How do I complete 2024 tax organizer personal on an iOS device?

How do I fill out 2024 tax organizer personal on an Android device?

What is 2024 tax organizer personal?

Who is required to file 2024 tax organizer personal?

How to fill out 2024 tax organizer personal?

What is the purpose of 2024 tax organizer personal?

What information must be reported on 2024 tax organizer personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.