Get the free 12-426-1. Resale certificates - Connecticut eRegulations System

Get, Create, Make and Sign 12-426-1 resale certificates

How to edit 12-426-1 resale certificates online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 12-426-1 resale certificates

How to fill out 12-426-1 resale certificates

Who needs 12-426-1 resale certificates?

Understanding the 12-426-1 Resale Certificates Form

Overview of the 12-426-1 resale certificates form

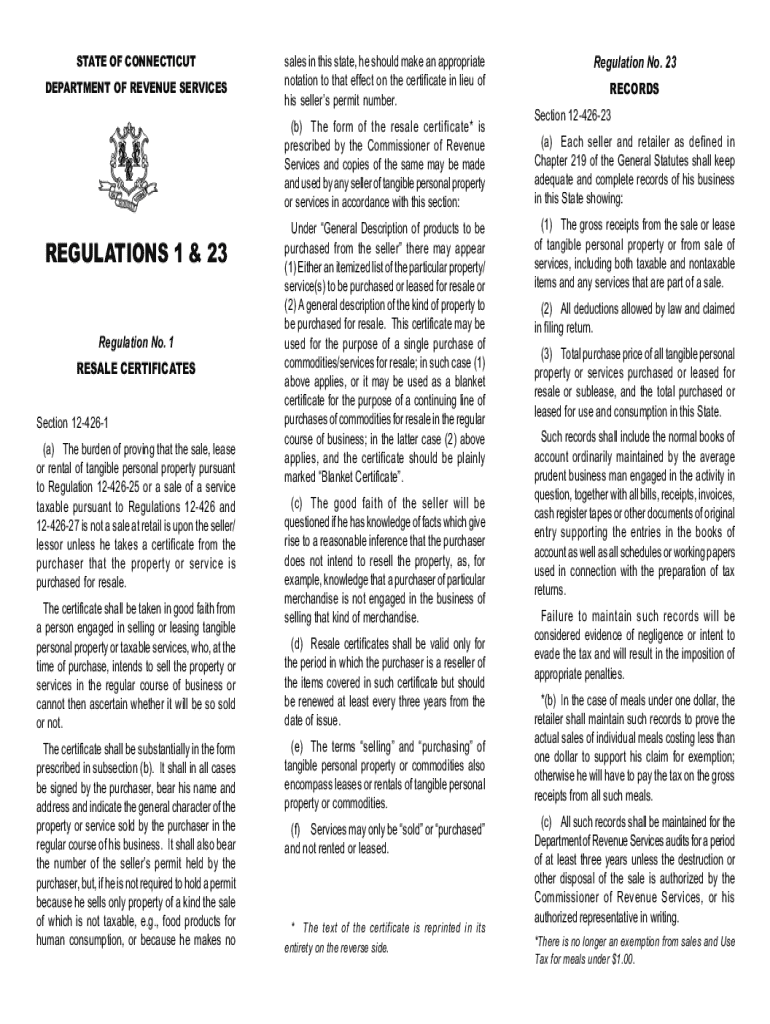

A resale certificate serves as a crucial document for businesses that buy items to sell to customers. The 12-426-1 resale certificates form specifically allows purchasers to claim tax exemption on items purchased for resale. This means that when a business buys goods intended solely for resale, they do not have to pay sales tax on those goods at the time of purchase.

Having the 12-426-1 form is essential as it ensures compliance with tax regulations. By providing this certificate to vendors, businesses can prevent unnecessary taxation on inventory meant for resale, thus optimizing their cash flow and profit margins.

Eligibility for obtaining the 12-426-1 resale certificates form

To obtain the 12-426-1 resale certificates form, specific criteria must be met. Primarily, the applicant must be a registered business intending to purchase items exclusively for resale purposes. This includes retailers, wholesalers, and any entity whose business model revolves around selling products to consumers.

When applying for the form, the following information is typically required: business name, address, sales tax identification number, and a description of the types of goods your business sells. Ensuring accurate and complete information on the form is vital to avoid delays or complications.

Detailed instructions for completing the 12-426-1 resale certificates form

Filling out the 12-426-1 resale certificates form requires careful attention to detail. Here’s a step-by-step guide to navigating each section successfully. Begin with the business name—ensure it matches exactly with how it is registered with tax authorities. Next, provide your business address, including city, state, and zip code, as this ensures your certificate is linked to the correct location.

When entering your sales tax identification number, double-check for accuracy; a wrong number can lead to processing issues. Additionally, clearly describe the nature of your business and the types of goods you plan to resell. One common mistake is omitting details or providing vague descriptions, which can result in the form being rejected. Aim for clarity to avoid confusion.

How to submit the 12-426-1 resale certificates form

Once the 12-426-1 resale certificates form is filled out correctly, businesses have a few options for submission. You can submit the form online through your state tax department’s website, which is often the most efficient method. Alternatively, the form can be mailed to the designated address for processing or delivered in person, depending on local regulations.

Typically, the processing time for the form can vary. Expect a turnaround time of 2 to 4 weeks if mailed. Online submissions may be processed more quickly, sometimes within a few days. It’s advisable to keep a copy of the submitted form for your records, regardless of the submission method.

Proper use of the 12-426-1 resale certificate

Using the 12-426-1 resale certificate correctly is critical to leveraging its benefits. When presenting the certificate to vendors, ensure that the purchase is genuinely for resale. Always provide a copy of the certificate at the point of sale to avoid being charged sales tax on items purchased under this exemption.

Misuse of the resale certificate can lead to serious consequences, including tax audits and potential penalties. If a vendor finds that the certificate was misused, they may also be compelled to charge you for past taxes owed, leading to unexpected financial burdens.

Record-keeping and compliance for resale certificates

Maintaining accurate records of all transactions involving the 12-426-1 resale certificates form is essential for compliance and tax audit purposes. This includes retaining copies of the resale certificates provided to vendors and documenting the transactions where the certificate was used. Proper record-keeping ensures that your business can provide evidence of tax-exempt purchases.

Recommended practices include creating a dedicated folder for resale certificates, both in paper and electronic format, keeping records up to seven years. Additionally, regularly review transaction records to confirm that they align with your inventory purchases to prevent discrepancies during audits.

Renewal and expiration of the 12-426-1 resale certificate

The 12-426-1 resale certificate is not a one-time document; it must be renewed periodically, as per state regulations. Typically, businesses are required to renew their resale certificates every few years. The exact timeline can vary, so it’s essential to stay informed about your state’s rules regarding renewal.

Once the certificate expires, businesses must cease to use it until renewed to avoid penalties. To renew, completing the same form or a renewal form provided by the state is usually necessary. Submit the renewal application in a timely manner to prevent disruptions in your purchasing processes.

Interactive tools for filling out the 12-426-1 resale certificates form

Utilizing online platforms like pdfFiller can streamline the process of completing the 12-426-1 resale certificates form. pdfFiller offers a host of interactive tools that facilitate easy editing and filling out of the form digitally, ensuring a more efficient experience. Users can fill out the form directly on their device without needing to print it out first.

Additionally, the platform includes eSignature capabilities, allowing users to securely sign their documents online. This feature enhances cooperation between business partners, vendors, and clients by enabling quick and secure sharing of signed certificates without the hassle of paper.

Case studies: real-world applications of the 12-426-1 resale certificates form

Several businesses have successfully leveraged the 12-426-1 resale certificates form to enhance their operational efficiency and save on taxes. For instance, a local clothing retailer utilized the resale certificate to procure large quantities of inventory without incurring sales tax payments upfront. This practice allowed them to maintain better cash flow while investing in marketing and store development.

Another example is a small electronics reseller who reported substantial savings by using the document to purchase refurbished items from wholesalers. They capitalized on the tax-exempt status, enabling them to offer competitive pricing without the overhead of sales tax. Such case studies highlight the practical benefits of using the certificate effectively.

FAQs about the 12-426-1 resale certificates form

Here are answers to some common questions regarding the 12-426-1 resale certificates form: First, does a resale certificate cover services? No, it only applies to tangible goods purchased for resale. Secondly, can it be used for all purchases? No, the certificate should only be used for items intended to be resold, not for personal use or gifts.

Lastly, how long is a resale certificate valid? The validity period depends on state regulations, and it is critical to monitor renewal requirements to maintain compliance.

Troubleshooting common issues with the 12-426-1 resale certificates form

Many users encounter challenges while dealing with the 12-426-1 resale certificates form. One common issue includes submission errors, such as incorrect tax ID numbers or missing information. A good practice is to review the form multiple times before submission and have a second pair of eyes check for any overlooked details.

Additionally, if a vendor rejects your resale certificate, ensure you understand the reason. It may require a conversation with the vendor or possibly providing additional documentation. This proactive approach can save you time and effort when handling resale transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 12-426-1 resale certificates?

How do I complete 12-426-1 resale certificates online?

How can I fill out 12-426-1 resale certificates on an iOS device?

What is 12-426-1 resale certificates?

Who is required to file 12-426-1 resale certificates?

How to fill out 12-426-1 resale certificates?

What is the purpose of 12-426-1 resale certificates?

What information must be reported on 12-426-1 resale certificates?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.