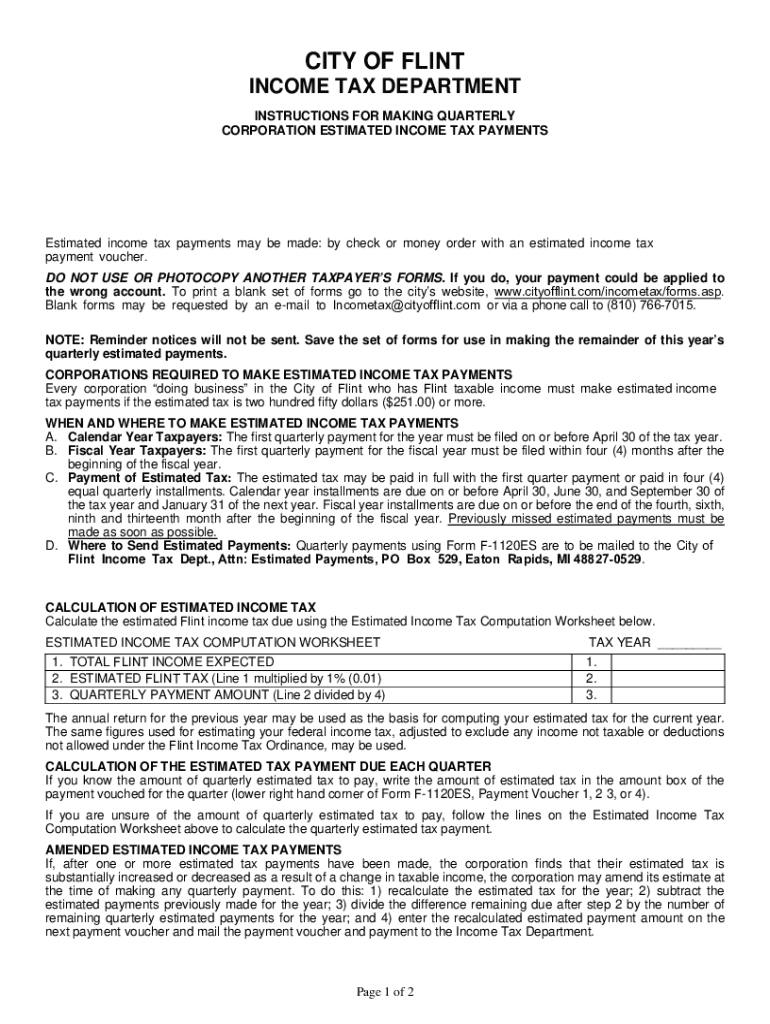

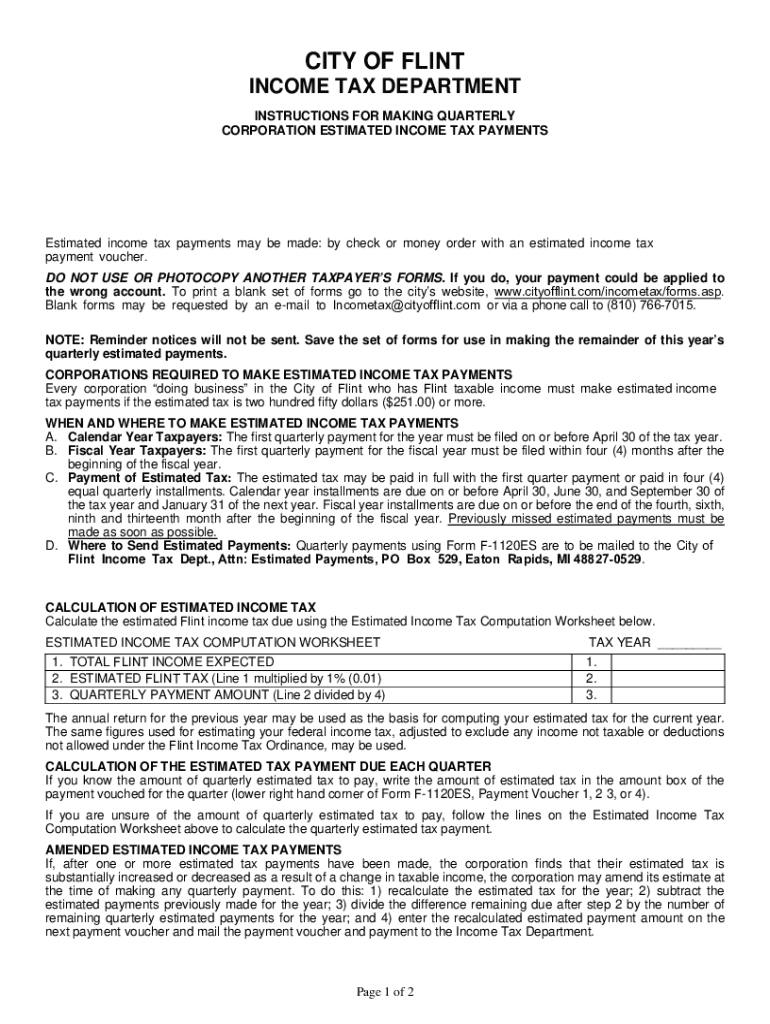

Get the free Estimated income tax payments may be made: by check or money order with an estimated...

Get, Create, Make and Sign estimated income tax payments

How to edit estimated income tax payments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out estimated income tax payments

How to fill out estimated income tax payments

Who needs estimated income tax payments?

Understanding the Estimated Income Tax Payments Form

Overview of estimated income tax payments

Estimated income tax payments are prepayments made toward your anticipated annual tax liability, typically required for individuals who do not have sufficient withholding from their regular income. This includes various forms of income such as self-employment earnings, dividends, rents, and interest. Understanding these payments is crucial for maintaining financial health and complying with tax regulations.

The importance of timely estimated income tax payments cannot be overstated. Late payments can lead to penalties and interest charges from the IRS, which can significantly increase your tax burden over time. By making these payments on schedule, you not only avoid penalties but also better manage cash flow throughout the year.

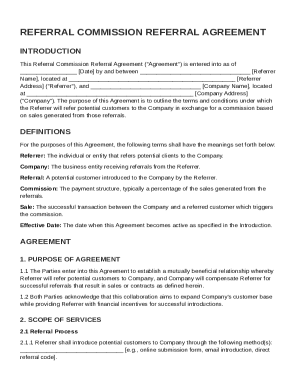

Understanding the estimated income tax payments form

The Estimated Income Tax Payments Form is a crucial document facilitated by the IRS that allows taxpayers to report estimated taxes due on various types of income. This form simplifies the process of calculating how much you owe and helps ensure you stay compliant while avoiding any potential pitfalls associated with underestimating your tax obligations.

Who needs to complete this form? Primarily, it targets individuals who earn income that is not subject to withholding, including self-employed workers, landlords, and freelancers. Each of these groups can encounter situations where their earnings from services, investments, or rents require them to make tax prepayments to avoid surprises at year-end.

Key components of the form typically include your personal information, breakdown of income sources, and method to calculate payments. Completing these sections accurately is crucial for ensuring the correctness of your estimated payments.

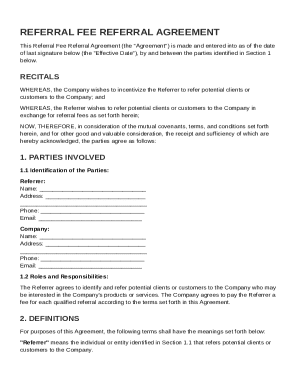

Step-by-step instructions for completing the form

Before filling out the Estimated Income Tax Payments Form, gather necessary information such as your past tax returns and income projections for the upcoming year. Accurate projections not only ensure correct payment amounts but also save you from potential penalties for underpayment.

To fill out the form, follow these steps: First, enter your personal information accurately. Next, report your income sources thoroughly, detailing all streams of income including wages, earnings from self-employment, dividends, and interest. Finally, calculate your estimated payments by accurately assessing your taxable income and applying the relevant tax rates.

Be mindful of common mistakes to avoid during this process. Underestimating your income can result in insufficient payments, while ignoring applicable deductions can lead to overpayments. Thoroughly review your data to avoid these pitfalls.

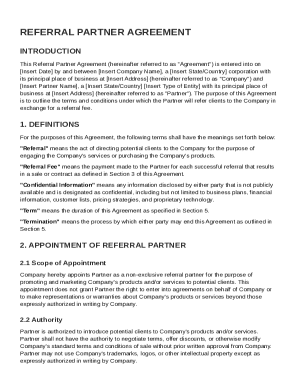

Payment options for estimated taxes

You have several payment options available for your estimated taxes, which include electronic payments and traditional check payments. Electronic payments are generally faster and more secure, allowing for immediate processing through various digital platforms. However, if you prefer to pay by check, ensure you mail your payment on time to avoid penalties.

Keeping track of deadlines is critical. Typically, estimated income tax payments are due quarterly. The IRS sets specific dates every year, so make sure to mark your calendar. Remember, additional payments and adjustments may also be necessary if your income significantly changes during the year, requiring an update to your estimated payments.

Monitoring and adjusting your estimated tax payments

Regular monitoring of your estimated tax payments is essential to avoid underpayments. You should reassess your projections whenever there is a significant change in your income or tax situation, such as a new job or major investments. Staying proactive helps you manage your tax burden effectively.

Making changes to your payments is a straightforward process. You can update your form whenever your financial situation changes, ensuring your estimates remain accurate. Notify the IRS of these updates through the same channels used for your original submission.

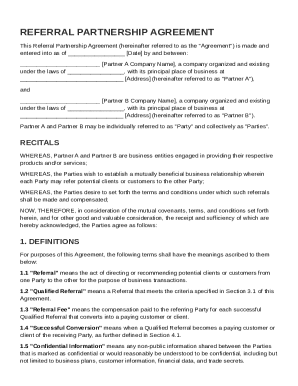

Utilizing pdfFiller for efficient form management

Managing your estimated income tax payments form can be simplified with pdfFiller. The platform provides seamless editing options for your documents, allowing you to access the Estimated Income Tax Payments Form online and fill it out without any hassle. Its interactive tools assist in accurate calculations, minimizing errors in reporting.

The eSigning capabilities offered by pdfFiller enable quick submission of your form, which is crucial for meeting payment deadlines. Additionally, collaborative features allow you to easily share your forms with advisors or team members, facilitating real-time feedback and edits for better accuracy.

FAQs regarding the estimated income tax payments form

Understand the common questions surrounding the estimated income tax payments form to clarify your concerns. For instance, you may wonder what happens if you underpay your estimated taxes—typically, this results in penalties based on the amount underpaid and the length of time it remains unpaid.

Another frequent question relates to amending your estimated payments. Yes, you can amend your payments, as an increase or decrease in income can affect your tax responsibilities. Make sure to communicate any changes promptly to the IRS.

Conclusion: Enhancing your financial planning with proper tax management

Accurate estimated income tax payments are crucial for effective financial planning. They ensure that as your income evolves, your tax obligations are proactively managed, preventing unforeseen liabilities come tax season. Using tools like pdfFiller can streamline this process, allowing for easier management of documents and deadlines.

By leveraging the features offered by pdfFiller, individuals and teams can enhance their financial strategies, ensure compliance with tax laws, and ultimately achieve greater financial success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my estimated income tax payments directly from Gmail?

How do I execute estimated income tax payments online?

Can I sign the estimated income tax payments electronically in Chrome?

What is estimated income tax payments?

Who is required to file estimated income tax payments?

How to fill out estimated income tax payments?

What is the purpose of estimated income tax payments?

What information must be reported on estimated income tax payments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.