Get the free Instructions for Form IT-196 New York State Tax

Get, Create, Make and Sign instructions for form it-196

Editing instructions for form it-196 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form it-196

How to fill out instructions for form it-196

Who needs instructions for form it-196?

Instructions for Form IT-196: A Comprehensive Guide

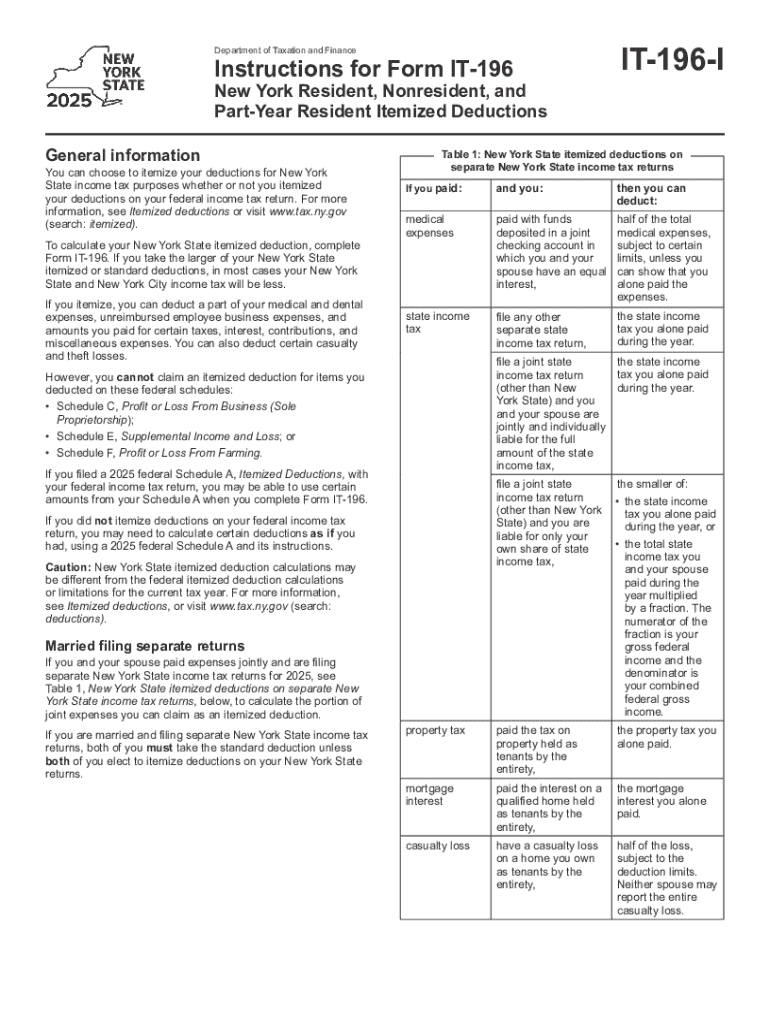

Overview of Form IT-196

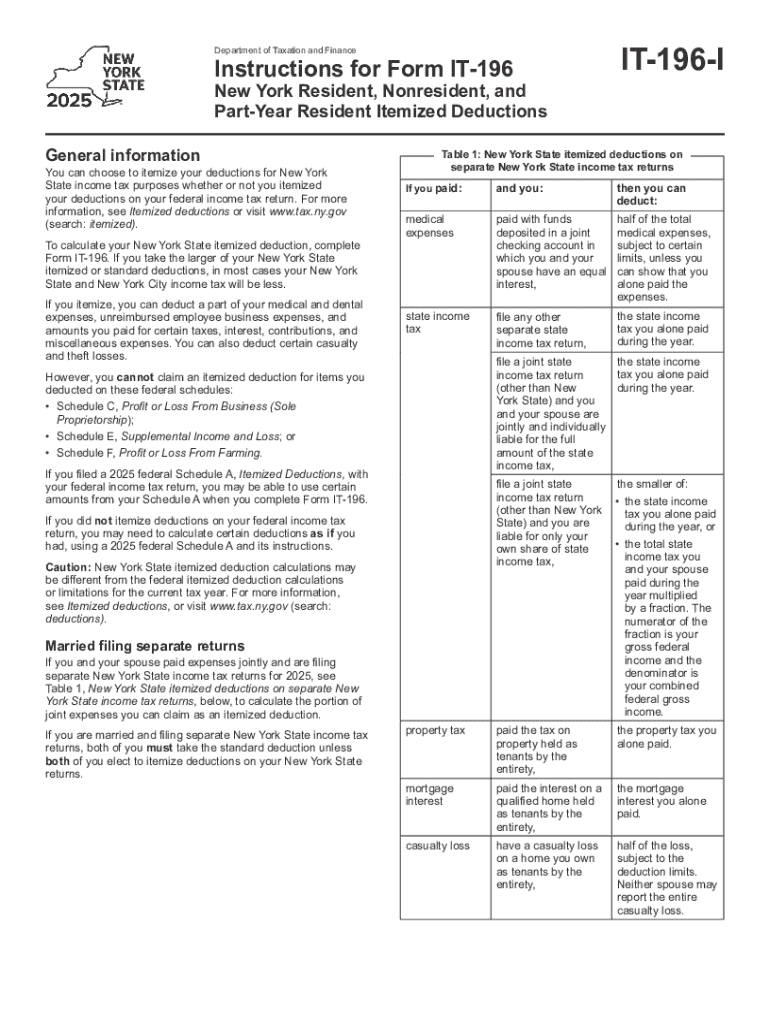

Form IT-196 is an essential document for residents of New York State who wish to itemize deductions on their tax returns. The significance of this form lies in its ability to allow taxpayers to reduce their taxable income through various deductions, potentially leading to a lower overall tax liability. By accurately filing this form, individuals can maximize their refund or minimize the amount owed.

Eligible filers include residents, nonresidents, and part-year residents of New York. Each group must meet specific criteria to qualify for itemized deductions, and understanding these criteria is crucial to avoid unnecessary complications during tax season. Filing Form IT-196 correctly is vital for ensuring compliance with tax regulations and taking advantage of possible tax benefits.

Key components of Form IT-196

Understanding the structure of Form IT-196 is crucial for successful completion. The form is divided into several key sections that need meticulous attention. The main sections include Personal Information, Residency Status, and Itemized Deductions.

Each of these sections plays a pivotal role in determining eligibility for various deductions and ensuring the information provided is comprehensive. Moreover, within the itemized deductions section, specific categories such as Medical and Dental Expenses, Taxes Paid, Mortgage Interest, and Contributions to Charitable Organizations are detailed to give filers a clearer understanding of what can be claimed.

Detailed instructions for each section

Personal Information

To fill out the Personal Information section accurately, begin by entering your name exactly as it appears on your Social Security card. Follow this by providing your Social Security number, avoiding common errors such as transposing numbers. Next, input your permanent address, ensuring that it's complete and matches IRS records to prevent delays in processing.

Among the common pitfalls here are forgetting to specify apartment numbers or using nicknames instead of full legal names. Always double-check your spelling and number entries for errors.

Residency Status

Determining your residency status requires understanding the definitions provided by New York State tax regulations. Residents are those who maintained a permanent address in the state for 12 months or more. Nonresidents earn income sourced from New York but do not maintain a permanent residence here.

To document your residency, ensure that you have a clear record of your residency timeline. If you moved during the year, maintain documentation that reflects your prior and current residences to substantiate your claim.

Itemized Deductions

Calculating your itemized deductions accurately is the heart of maximizing your refund potential. Begin by gathering all receipts and documentation relevant to your deductions, including medical bills, tax payment records, and mortgage statements. For each category of deduction, record the amounts separately.

It's essential to maintain thorough documentation to validate your claims in case of an audit. Moreover, each type of deduction, such as Medical and Dental Expenses, Taxes Paid (including real estate taxes), and Mortgage Interest, has its own set of guidelines that you must follow diligently.

Interactive tools for easy completion

pdfFiller offers a suite of interactive tools specifically designed for Form IT-196, simplifying the entire process of completion. One notable feature is the fill-in capabilities for the form itself, which automatically formats your entries for optimal readability. This removes the headache often associated with handwritten entries and allows for a professional submission.

The tool also provides real-time calculations for deductions, which can help you see the potential impact of your deductions on your overall tax liability as you fill out the form. Users often appreciate the instant feedback and error-checking features that guide them through the process, ensuring that any mistakes are caught before the form is submitted.

Editing and managing your Form IT-196

After filling out your form, you may need to edit previously filled sections. With pdfFiller, editing is straightforward; simply access your saved documents, make the necessary changes, and ensure that the updates are reflected correctly throughout the form.

It's crucial, however, to maintain version control when updating documents. Save previous versions for your records, allowing you to refer back if needed. Additionally, securely storing and managing your forms in the cloud can guard against data loss, ensuring your important documents remain accessible anytime.

eSigning your Form IT-196

Adding an electronic signature is a simple process with pdfFiller. Navigate to the eSigning feature, where you can sign your document digitally. This option not only facilitates the signing process but also ensures that the signature is legally binding within New York State.

Utilizing pdfFiller's eSigning features offers several advantages, including a faster turnaround in document processing, especially when compared to traditional methods. You eliminate the need for printing, signing, and scanning, which can save time and streamline your filing experience.

Filing Form IT-196

Once you've completed your Form IT-196, it's time to submit it. Depending on your preference, you can choose to e-file or submit a paper filing. E-filing is often faster, as it allows you to submit your form directly to the tax authority, minimizing processing time.

However, some individuals prefer paper filing. While this method may seem more traditional, it often involves delays in review and may increase processing time. Regardless of your chosen method, be mindful of important deadlines to ensure timely submission and avoid potential late fees.

Getting help with your Form IT-196

If you encounter difficulties while filing your Form IT-196, there are various resources available for assistance. pdfFiller provides customer support that can guide you through common dilemmas or technical issues. You can reach out directly via their support portal for tailored assistance.

Additionally, community forums where users discuss common issues and FAQs can provide valuable insight. For more complex situations, such as legal interpretations of tax law, consulting with a professional tax advisor may be beneficial to ensure you’re filing correctly.

Frequently asked questions

Understanding common questions regarding Form IT-196 can help alleviate stress during tax season. For example, if you realize you've made a mistake on your form, promptly reach out to the tax authority for guidance on corrective actions. They can provide instructions on submitting an amended return if necessary.

Another common query is how to update your residency status if it changes mid-year. In such cases, keep thorough documentation to demonstrate your domicile status and report this change on your subsequent tax filings.

Lastly, many filers inquire about what to do if they lack all supporting documents on hand. It's advisable to gather as much documentation as possible and file your Form IT-196 with the information you currently have. However, be prepared to produce additional documents upon request.

About pdfFiller

pdfFiller empowers users to streamline their document management processes. Offering unique tools for hosting dynamic forms and templates such as Form IT-196, the platform caters to both individuals and teams seeking comprehensive solutions for document creation and collaboration. User-friendly features make completing, signing, and managing forms a straightforward endeavor.

User testimonials reveal how pdfFiller has significantly improved their tax filing experiences. With real-world success stories, users share their seamless transitions to digital document management, emphasizing the ease with which they can now complete Form IT-196 and other important documents.

Language assistance

Recognizing the diversity within its user base, pdfFiller offers various language support options for non-English speakers to ensure everyone can access resources necessary for completing Form IT-196 successfully. Users can find translated resources that guide them through the filing process in multiple languages.

This commitment to inclusivity further reinforces pdfFiller's dedication to ensuring all users have equal opportunities to navigate the complexities of tax documentation, regardless of their primary language or proficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in instructions for form it-196?

How do I make edits in instructions for form it-196 without leaving Chrome?

How do I fill out instructions for form it-196 using my mobile device?

What is instructions for form it-196?

Who is required to file instructions for form it-196?

How to fill out instructions for form it-196?

What is the purpose of instructions for form it-196?

What information must be reported on instructions for form it-196?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.