Get the free 2026 Form OW-8-ES-SUP Annualized Estimated Tax Worksheet

Get, Create, Make and Sign 2026 form ow-8-es-sup annualized

Editing 2026 form ow-8-es-sup annualized online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 form ow-8-es-sup annualized

How to fill out 2026 form ow-8-es-sup annualized

Who needs 2026 form ow-8-es-sup annualized?

Your Comprehensive Guide to the 2026 Form OW-8-ES-SUP Annualized Form

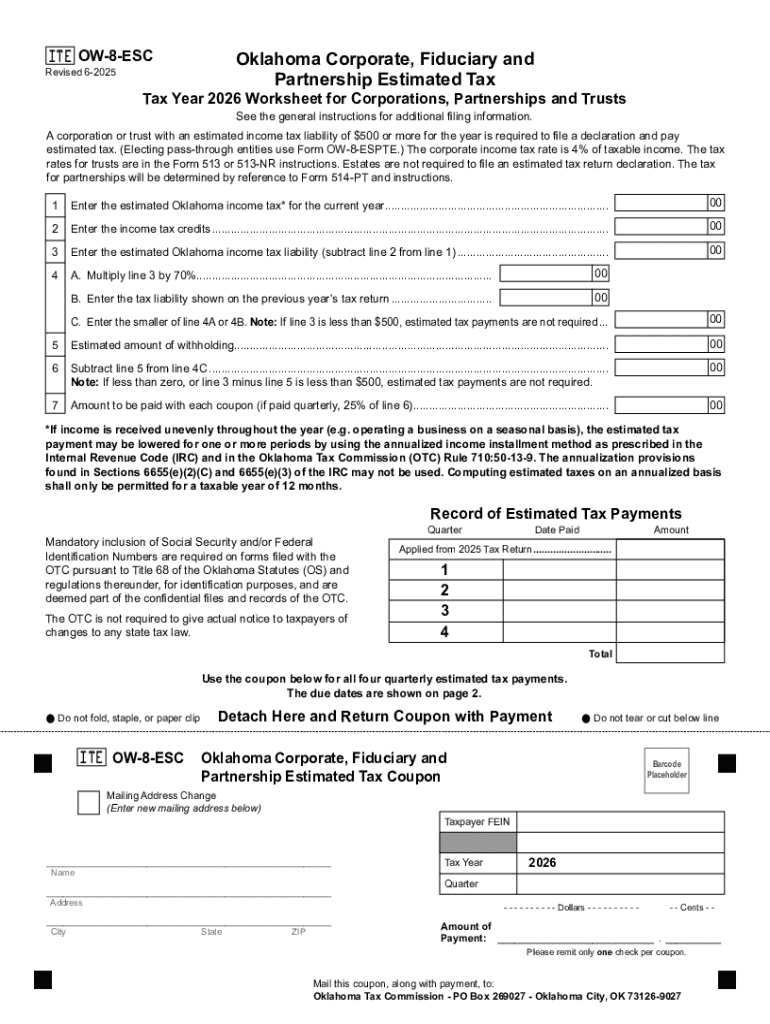

Overview of the 2026 form OW-8-ES-SUP

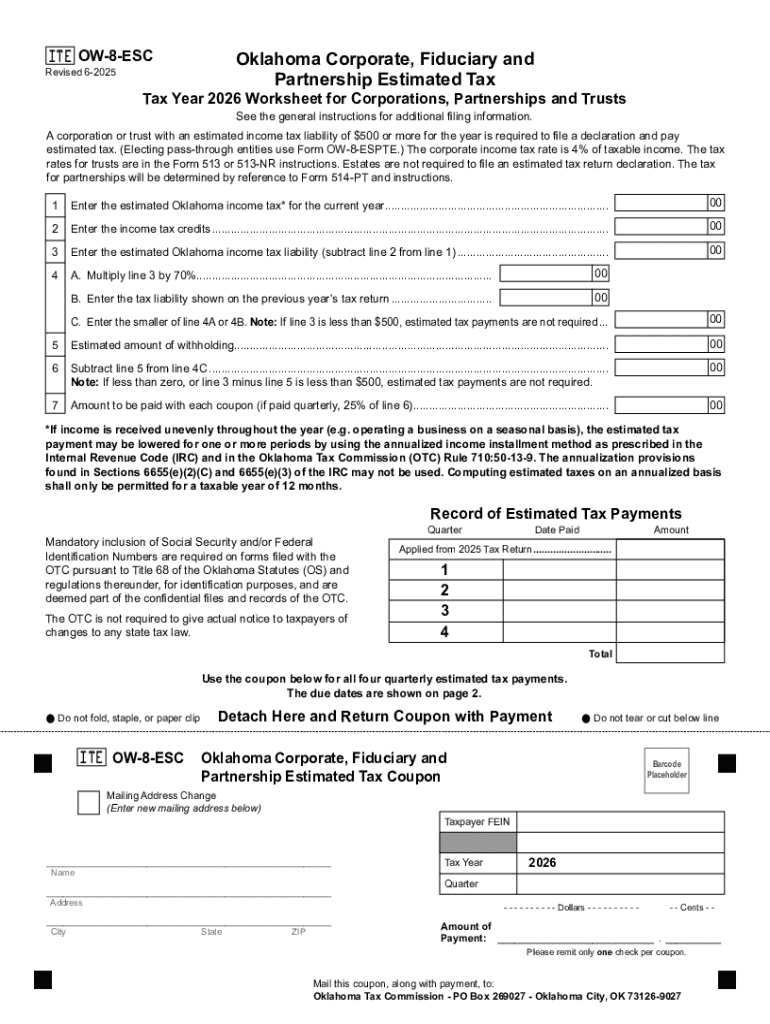

The 2026 form OW-8-ES-SUP is a critical document for individuals and entities required to report various forms of income and deductions for the tax year. This annualized form is designed to help taxpayers accurately compute their estimated tax payments while aligning their income and deductions with the tax obligations set forth by the IRS. Understanding its purpose is vital for anyone navigating the tax landscape.

Primarily, the OW-8-ES-SUP is necessary for those who anticipate variations in their income throughout the year, as it allows them to annualize their earnings. This is essential for self-employed individuals, freelancers, as well as businesses that may experience seasonal fluctuations. Accurate reporting ensures compliance and aids in avoiding unnecessary penalties.

Accurate filing is crucial as errors can lead to penalties, interest on unpaid taxes, and potential audits. Missing deadlines further complicates the process, emphasizing the importance of being thorough and timely.

Key features of the 2026 form OW-8-ES-SUP

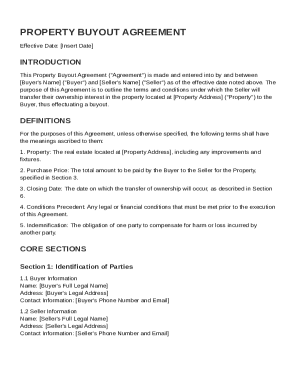

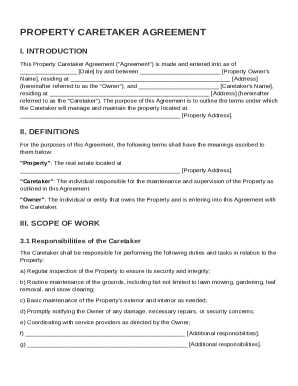

The layout of the 2026 form OW-8-ES-SUP comprises several key sections designed to capture vital information effectively. Each section has a specific purpose and ensuring that all fields are completed correctly is imperative to achieving a valid submission. The typical sections include personal information, income details, and deductions and credits.

Eligibility to use this form typically involves understanding your income patterns and identifying whether you hold self-employed status or operate a business with fluctuating income. Additionally, certain thresholds must be met regarding income levels to ensure proper use of the form.

For the 2026 tax year, important deadlines must be adhered to, ensuring that forms are submitted on time to avoid penalties. Keeping track of these deadlines can greatly simplify tax responsibilities.

Step-by-step guide to completing the form

Before diving into the completion of the 2026 form OW-8-ES-SUP, ensure that you have collected all necessary information. Essential documents include previous tax returns, income statements, and any additional documentation outlining deductions that you plan to claim. Having a complete set of documents minimizes confusion as you fill in the form.

When filling out the form, start with Section A: Personal Information, where you will input your name, address, and social security number. Accuracy here is crucial as discrepancies can lead to processing delays. In Section B: Income Details, you will be tasked with detailing your estimated income, broken down by category, and accurately reporting it. Each source of income must be documented clearly to avoid issues.

Next, Section C focuses on Deductions and Credits. This section allows you to report applicable deductions, such as business expenses, home office deductions, and other relevant credits. Common deductions include those for education and health-related expenses, which can significantly influence your taxable income.

Lastly, ensure to review your form before submission. Double-check all entries for accuracy, confirm that all required fields are filled, and make sure your calculations are correct. Simple mistakes can lead to complications later on.

Interactive tools for form completion

Utilizing digital tools can significantly enhance your experience with the 2026 form OW-8-ES-SUP. One valuable tool is the Form Preview Tool, available on pdfFiller. This feature allows you to visualize the entire form, making it easier to understand where to input your information and ensuring that all necessary sections are addressed.

Additionally, live support features can be a lifesaver during the completion process. With real-time assistance, you can ask questions and receive immediate guidance leaving no room for confusion. pdfFiller's support makes completing forms like the OW-8-ES-SUP much less daunting.

Editing and signing the form

Editing forms can sometimes be cumbersome, but pdfFiller has made it easy with its array of tools. If you need to modify any details after filling out the 2026 form OW-8-ES-SUP, simply use the editing options provided within your account. You can adjust your entries without hassle by clicking on the desired section and making the necessary changes.

Once you've completed all sections of the form and are satisfied with your entries, the next step is to sign it. pdfFiller's eSignature feature allows you to electronically sign your completed form directly on the platform. Simply follow these steps: navigate to the signature section, click to add your signature, and confirm the signing process. This functionality ensures that your form is securely sent out and valid.

Managing your form submissions

After submitting the form, proper management of your document is essential. First and foremost, be sure to save your completed form. pdfFiller provides various options for saving and exporting your document in multiple formats, ensuring you have a copy for your records.

Moreover, tracking the status of your submission can help keep you informed of any next steps or required actions. With pdfFiller, you can access the submission status easily, understanding where your form stands in the processing queue and if any additional information is necessary.

Common FAQs regarding the 2026 OW-8-ES-SUP form

One of the most pressing concerns regarding the 2026 form OW-8-ES-SUP is what to do in case of mistakes. If you've discovered an error after submission, the first step is to amend your filings by following the appropriate IRS procedures. Amending early may save you from facing additional penalties.

Additionally, confusion may arise concerning where to send the completed form. Typically, you would submit the OW-8-ES-SUP to specific IRS addresses based on your location, so be sure to double-check the submission guidelines to ensure your form reaches the right destination.

Testimonials and user experiences

User experiences with the 2026 form OW-8-ES-SUP reflect a general trend toward positive engagement. For many, the convenience of pdfFiller's platform has streamlined the filing experience. Users have expressed satisfaction with the clarity of the interface and the ease of navigating the form preparation.

Many individuals noted that prior to using pdfFiller, they experienced challenges with traditional filing methods, leading to delays and errors. By comparing their before and after scenarios, countless users have reported reduced stress and increased efficiency in completing crucial tax documents like the OW-8-ES-SUP.

Additional support for tax filers

Staying informed about tax regulations is a must for every taxpayer. Accessing tax resources through pdfFiller provides users with links to relevant guides, tutorials, and detailed articles that help deepen your understanding of the tax system. Being well-informed can positively influence your filing decisions.

Moreover, keeping an eye on tax changes through notifications and alerts can prevent unexpected situations during tax season. pdfFiller's educational resources can keep you one step ahead, ensuring that your filings remain compliant with current laws and thresholds.

Engaging with the community

Feedback from users plays an essential role in enhancing the pdfFiller experience. By encouraging users to leave their thoughts and suggestions on the platform, pdfFiller continuously optimizes its service to better meet user needs. Sharing experiences helps build a knowledgeable community that can assist each other during the tax filing process.

To stay connected, users can follow pdfFiller on social media or subscribe to newsletters, ensuring they receive updates on new features, resources, and helpful tips that can simplify the form filing experience in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2026 form ow-8-es-sup annualized to be eSigned by others?

How do I make changes in 2026 form ow-8-es-sup annualized?

How do I edit 2026 form ow-8-es-sup annualized straight from my smartphone?

What is 2026 form ow-8-es-sup annualized?

Who is required to file 2026 form ow-8-es-sup annualized?

How to fill out 2026 form ow-8-es-sup annualized?

What is the purpose of 2026 form ow-8-es-sup annualized?

What information must be reported on 2026 form ow-8-es-sup annualized?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.