Get the free Uniform Residential Appraisal Report From 1004 .pdf

Get, Create, Make and Sign uniform residential appraisal report

Editing uniform residential appraisal report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uniform residential appraisal report

How to fill out uniform residential appraisal report

Who needs uniform residential appraisal report?

Comprehensive Guide to the Uniform Residential Appraisal Report Form

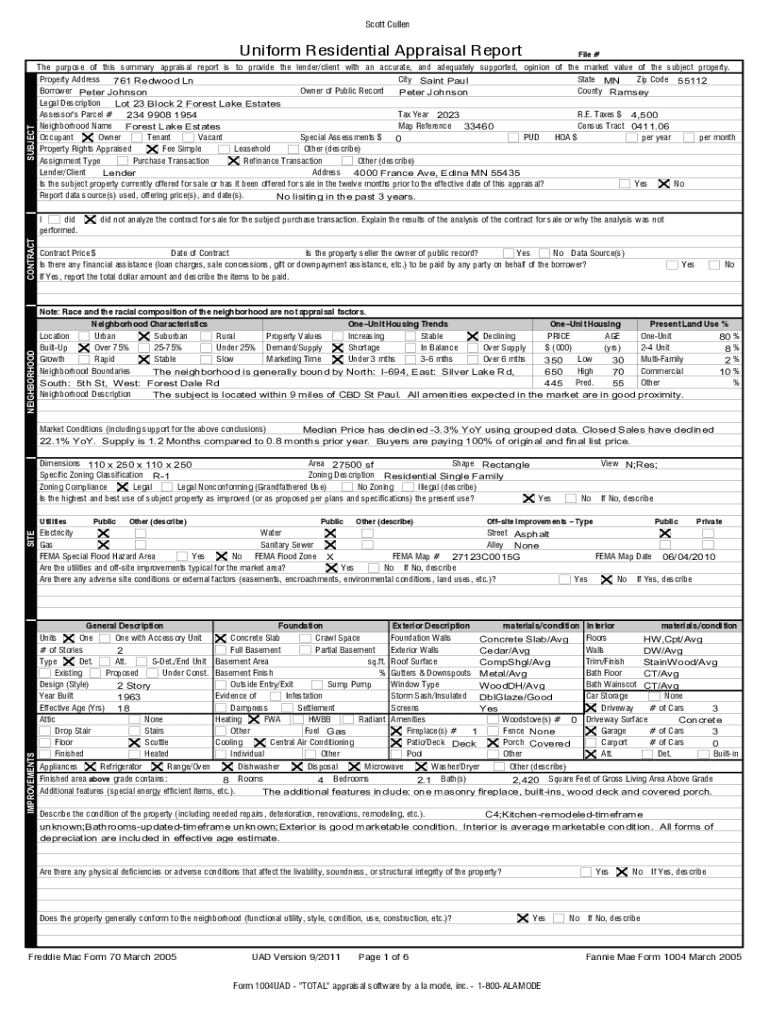

Overview of the uniform residential appraisal report form

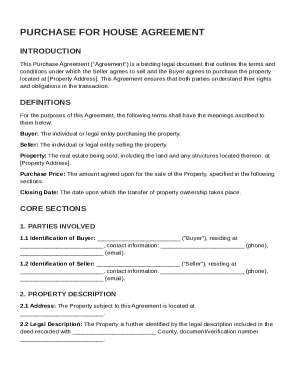

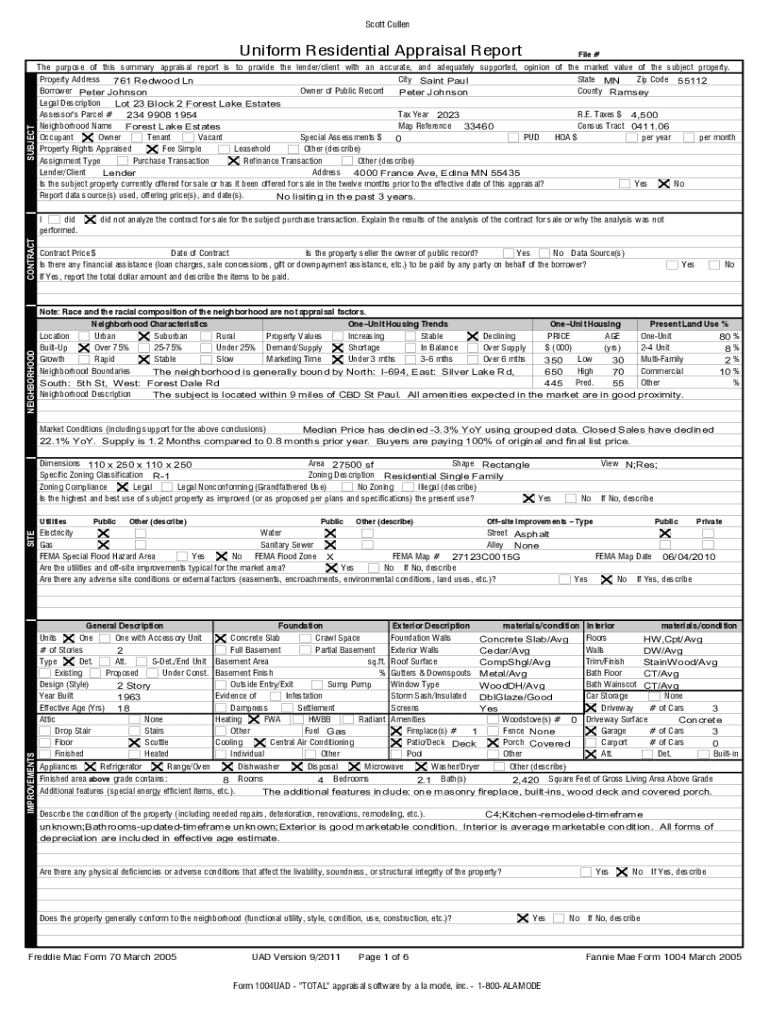

The Uniform Residential Appraisal Report (URAR) is a standardized document employed by real estate appraisers to provide a detailed assessment of a residential property. Its primary purpose is to ensure consistency and reliability in the appraisal process, allowing lenders to make informed decisions during real estate transactions. Given that appraisals play a crucial role in securing loans, the integrity of the URAR is paramount.

In real estate, the URAR serves multiple stakeholders including lenders, buyers, and sellers by providing a clear valuation of the property based on its characteristics and the surrounding market conditions. It not only aids in pricing but also helps in legal matters tied to property ownership and financial assessments.

History and standardization

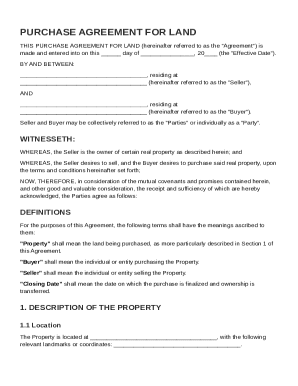

The development of the Uniform Residential Appraisal Report form can be traced back to the need for a standardized approach in the appraisal industry. Its origins lie in the efforts of federal agencies such as Fannie Mae and Freddie Mac, which recognized the necessity for uniformity in data collection to aid in risk assessment and underwriting. Since its introduction, the URAR has undergone revisions to reflect changes in market trends and appraisal methods.

Government standards, particularly the guidelines set forth by the Uniform Standards of Professional Appraisal Practice (USPAP), help in maintaining the reliability and credibility of the URAR. This regulation ensures appraisers adhere to ethical practices and uphold the integrity of the documentation process.

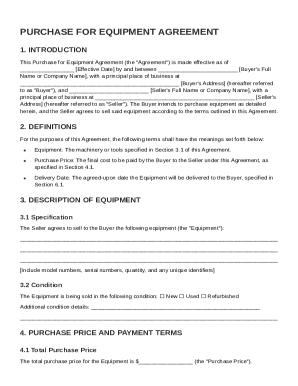

Key components of the form

Understanding the key components of the Uniform Residential Appraisal Report is essential for effective usage. The form is structured into several major sections, each tailored to gather specific information necessary for the appraisal process. These include the Subject Property Section, Neighborhood Section, Market Data Section, and valuation approaches such as Cost and Income Approaches, if applicable.

Each of these components is crucial in delivering a comprehensive evaluation of a property. The Subject Property Section captures essential details of the property itself; the Neighborhood Section provides context regarding the surroundings and demographics; the Market Data Section evaluates comparable properties; while the Cost and Income Approaches present a systematic method of valuation.

Completing each section accurately is vital for ensuring that the assessment reflects the property's true market value.

How to fill out the uniform residential appraisal report form

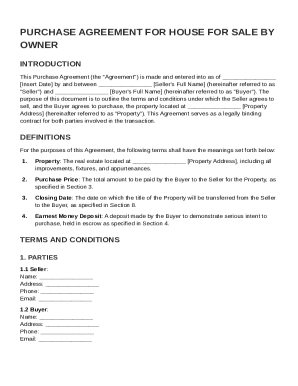

Filling out the Uniform Residential Appraisal Report form may seem daunting at first; however, following a step-by-step guide can simplify the process. Start by gathering all the necessary property data including previous appraisals, inspection reports, and relevant neighborhood studies.

Next, accurately fill in the property details, ensuring that all fields are completed. This can include dimensions, total rooms, lot size, and amenities. It’s also important to analyze comparables—properties with similar features that have recently sold—to support your valuation findings. Finally, summarize your analysis in the valuation sections, providing a clear rationale for your final opinion on the property’s value.

By adhering to these steps, reducing error margins becomes a more achievable goal.

Tips for accurate appraisal

To enhance the reliability of your appraisal report, it is essential to steer clear of common mistakes. One prevalent error involves failing to update property details or inaccurately recording comparable data, which can skew the valuation. Thoroughly reviewing the form for completeness can mitigate these risks.

Additionally, it’s beneficial to leverage technology and tools that support data accuracy. Use platforms like pdfFiller that enable real-time collaboration and document sharing, ensuring all parties can review and provide input efficiently. Regular training on appraisal updates and market changes can also foster best practices among appraisal professionals.

Tools and resources for appraisers

In the ever-evolving real estate market, leveraging technological tools can greatly enhance the appraisal process. pdfFiller’s solutions enable appraisers to seamlessly edit and manage the Uniform Residential Appraisal Report form. Features such as eSigning and cloud storage facilitate easier collaboration among stakeholders.

Moreover, other software applications equipped with market analysis tools can further aid appraisers in gathering comprehensive insights into pricing trends and neighborhood data, especially in competitive areas.

Common questions about the uniform residential appraisal report

As with any specialized field, questions frequently arise regarding the use of the Uniform Residential Appraisal Report form. For instance, appraisers often wonder about the protocol following a mistake on the form. Correcting inaccuracies can usually be achieved by issuing an amended report, but checking with the client or lender beforehand is recommended.

Apprising clients about the frequency of necessary updates to appraisals is crucial, especially in fluctuating markets. Generally, appraisals should be revisited every 6 to 12 months based on market dynamics. Lastly, attempting to reuse a form for distinctly different properties is inadvisable, as unique characteristics greatly influence valuation and necessitate tailored assessments.

Understanding appraisal value differences

Many factors contribute to the fluctuations in appraisal values. Market conditions, such as demand and supply imbalances, play a pivotal role. Changes in neighborhood dynamics, like the introduction of new development projects or alterations in school district ratings, can also affect property valuations profoundly.

Thus, having regular updates in appraisals isn't just a procedural necessity; it's a proactive method of ensuring accurate and relevant property evaluations. Familiarity with the local market trends can greatly enhance an appraiser's effectiveness in reflecting the true value of a property within the community.

Legal and regulatory considerations

Compliance with appraisal standards, such as USPAP and FIRREA, is crucial in the sphere of residential appraisals. These regulations ensure that the appraisal process is conducted ethically and with rigor, providing protection to all parties involved, from lenders to homeowners.

Failing to adhere to these standards can lead to severe consequences, including legal repercussions for appraisers and potential financial liabilities for property owners. Violating ethical practices or failing to provide accurate reporting can undermine market trust and lead to long-term ramifications.

Consequences of poor appraisal practices

Issues related to inaccurate reporting can severely impact the credibility of appraisal professionals. If an appraisal is found to be egregiously misleading, it can diminish an appraiser's reputation and result in disciplinary actions from regulatory bodies or even legal challenges from buyers and sellers.

Moreover, property owners can face significant financial losses if inaccurate valuations lead to incorrect pricing or financing decisions. Being diligent about compliance and ethical practices is not only crucial for personal integrity but essential for ensuring a stable and reliable real estate market.

Case studies and real-life examples

To illustrate the practical applications of the Uniform Residential Appraisal Report form, consider scenarios involving diverse property types. For example, in a suburban neighborhood where market demand is surging, an appraisal reporting higher comparative sales can significantly influence a seller's pricing strategy.

Conversely, market slowdowns in urban areas often mean appraisers must rely more heavily on meticulous data analysis to arrive at accurate valuations. By reviewing case studies where appraisers utilized the URAR effectively, one can gain insights into how to navigate complex appraisal situations successfully.

Success stories using pdfFiller

Numerous appraisers have turned to pdfFiller for proficient management of their appraisal reports. Users report a streamlined experience when completing Uniform Residential Appraisal Reports, emphasizing features such as real-time collaboration and easy document retrieval. This enhances workflow efficiency and reduces processing times.

One notable success story involved an appraisal team that increased its accuracy and speed by leveraging pdfFiller’s digital tools. Sharing documents amongst team members became simple, allowing for a comprehensive review process that helped catch errors before final submissions.

Conclusion on the importance of the uniform residential appraisal report

The Uniform Residential Appraisal Report form stands as an integral component of a functional real estate ecosystem, enabling consistent property evaluations that cater to various stakeholders' needs. Understanding how to efficiently manage this form through intuitive tools like pdfFiller can lead to enhanced accuracy, security, and accessibility in the appraisal process.

Ultimately, the role of strong document management practices cannot be overstated. They pave the way for a reliable and transparent appraisal system that benefits buyers, sellers, and lenders alike in the ever-evolving real estate landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in uniform residential appraisal report without leaving Chrome?

Can I create an electronic signature for the uniform residential appraisal report in Chrome?

How do I edit uniform residential appraisal report on an Android device?

What is uniform residential appraisal report?

Who is required to file uniform residential appraisal report?

How to fill out uniform residential appraisal report?

What is the purpose of uniform residential appraisal report?

What information must be reported on uniform residential appraisal report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.