Get the free Sample Form 990.pdf

Get, Create, Make and Sign sample form 990pdf

Editing sample form 990pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sample form 990pdf

How to fill out sample form 990pdf

Who needs sample form 990pdf?

Sample Form 990 PDF Form: A Comprehensive Guide for Nonprofit Organizations

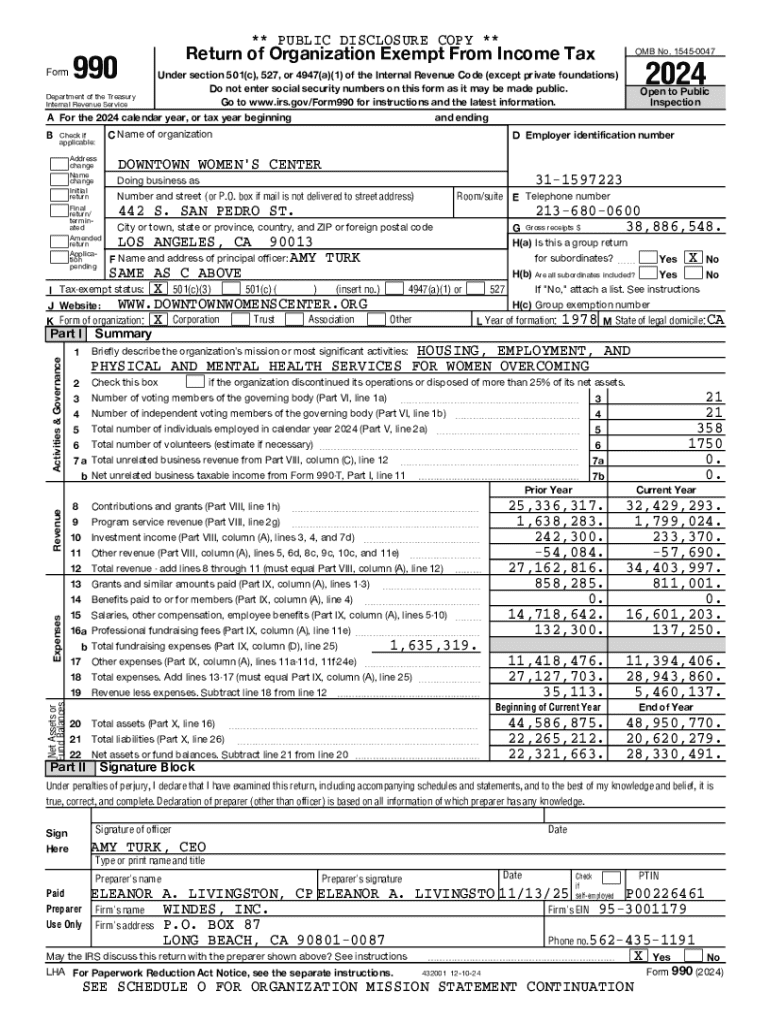

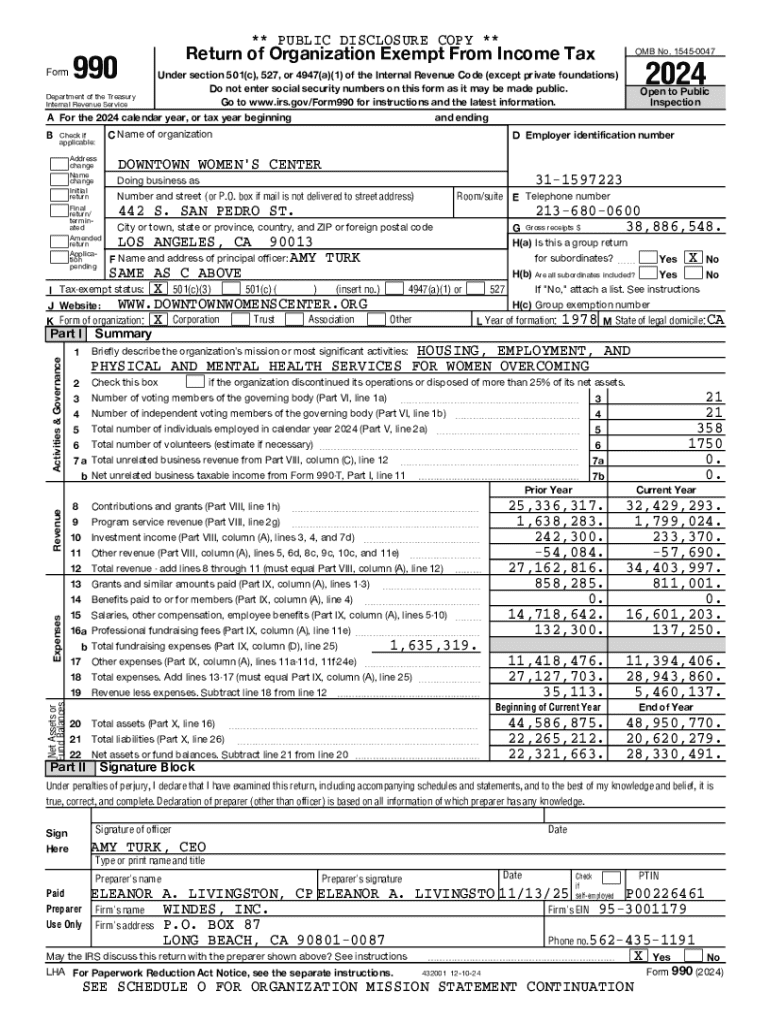

Understanding Form 990: An overview

Form 990 is vital for nonprofit organizations as it provides transparency and accountability in how they manage their operations and finances. This form is used by the IRS to collect data on nonprofit organizations, ensuring the public can assess their financial health and adherence to nonprofit standards. Understanding this form is crucial for nonprofits because it not only meets regulatory requirements but also fosters trust among donors and stakeholders.

Organizations required to file Form 990 include charities, foundations, and other types of nonprofits earning over a specific threshold. Each organization's mission influences how it navigates the complexities of reporting financials and governance on this essential document.

Accessing the sample form 990 PDF

To simplify the process, pdfFiller offers a downloadable Sample Form 990 PDF that serves as a template for filing. Users can easily access the form on the pdfFiller platform and utilize interactive features to complete it efficiently. To download the sample, simply go to the pdfFiller website and search for 'Sample Form 990 PDF'.

The PDF includes several interactive tools that enhance the user experience, allowing for easy navigation and filling out of different sections. Being well-versed with these features can save significant time during the reporting process.

Step-by-step instructions for filling out form 990

Filling out Form 990 can seem daunting. However, by breaking it down into sections, completing it becomes manageable. Below is a detailed guide on how to fill out each section.

Section 1: Basic organization information

In this section, you need to provide essential details about your organization such as its name, address, and the mission statement. Be precise; common pitfalls include incorrect tax identification numbers and inaccurate descriptions of your organization’s activities. This information establishes the context for the entire form.

Section 2: Financial statements

Here, organizations report their financial data, including revenue, expenses, and net assets. Ensure these figures are accurate, and consult an experienced accountant if needed. This section gives a snapshot of your organization’s overall financial health, which is crucial for transparency.

Section 3: Governance and management

This section focuses on the governance structure of your organization. It’s essential to report on your board of directors, key management personnel, and governance policies. Accurate reporting can highlight compliance with regulations and strong governance practices, enhancing credibility with stakeholders.

Section 4: Revenue data collection

Categorizing the sources of your revenue correctly is essential for compliance. This includes donations, grants, and program service revenue. Clearly stating these categories helps the IRS and your stakeholders understand where your organization’s funding originates and how effectively it's deployed.

Section 5: Functional expenses

In this section, reporting on expenses correctly is crucial. Nonprofits typically categorize expenses into program services, management, and fundraising costs. Ensure accuracy to reflect your organization’s spending and alignment with its mission, as more detailed insights can enhance donor trust and potential funding.

Editing and customizing your sample form 990 pdf

Once you have filled out the Sample Form 990 PDF, you might need to make adjustments or updates. Utilizing pdfFiller’s editing tools makes this process seamless. Users can add comments, adjust written content, or modify the layout directly within the PDF interface.

These functionalities facilitate a user-friendly experience, ensuring that organizations can adapt the form as needed without starting from scratch. Additionally, you can save multiple versions while editing to track changes or revert to previous entries if necessary.

eSigning and sharing your completed form 990

Digital signatures enhance the document management process. pdfFiller allows users to add eSignatures easily, making it efficient for board members or other stakeholders to review and sign the completed Form 990. This feature not only streamlines the approval process but also ensures compliance with digital signature laws.

Sharing your Form 990 with stakeholders is straightforward using pdfFiller. You can send the document securely via email or generate a shareable link, ensuring the confidentiality and integrity of your information throughout the sharing process.

Managing your form 990 files with pdfFiller

Effective document management is crucial for nonprofits, especially during filing season. pdfFiller provides tools to organize your Form 990 files efficiently. Utilizing folders and tags, organizations can categorize their documents, making retrieval easy and ensuring that all necessary files are at hand when needed.

Moreover, pdfFiller’s version control features enable tracking changes over time. This means that revisions can be managed effectively, ensuring that everyone involved knows the latest updates. Collaboration among team members is simple, facilitating a streamlined workflow.

Best practices for filing form 990

When filing Form 990, avoiding common mistakes is paramount. Clarity in financial reporting, particularly with respect to revenue and expenses, can significantly affect the organization’s credibility. Organizations should double-check figures and ensure that all relevant documentation is included to prevent any potential issues with the IRS.

Timeliness is another critical factor; filing late can incur penalties, damaging relationships with donors and other stakeholders. Nonprofits should remain aware of changes in tax laws that might affect their reporting requirements. Staying informed is essential for maintaining compliance and trust in your organization.

Troubleshooting common issues with sample form 990 pdf

Encountering issues while completing Form 990 isn’t uncommon. Common questions often revolve around specific line items or requirements, and understanding these can ease the filing process. pdfFiller provides a comprehensive FAQ section addressing these common queries, offering a reliable resource for users.

For personalized concerns, users can reach out to pdfFiller's support team, who are ready to assist with specific filing questions or technical issues related to the Sample Form 990 PDF.

Leveraging pdfFiller for ongoing document management

Beyond just completing Form 990, pdfFiller offers additional features that can aid nonprofit organizations in managing other essential documentation. These capabilities promote efficiency and a cohesive workflow, allowing organizations to manage policies, reports, and other vital documents seamlessly.

Adopting a cloud-based document solution like pdfFiller has numerous benefits. It promotes accessibility, collaboration, and organizational efficiency, which are essential for nonprofits striving to maintain transparency and effectiveness in their operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out sample form 990pdf using my mobile device?

How do I complete sample form 990pdf on an iOS device?

How do I complete sample form 990pdf on an Android device?

What is sample form 990pdf?

Who is required to file sample form 990pdf?

How to fill out sample form 990pdf?

What is the purpose of sample form 990pdf?

What information must be reported on sample form 990pdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.