Get the free Louisiana Department of Revenue Corporation Income Tax ...

Get, Create, Make and Sign louisiana department of revenue

How to edit louisiana department of revenue online

Uncompromising security for your PDF editing and eSignature needs

How to fill out louisiana department of revenue

How to fill out louisiana department of revenue

Who needs louisiana department of revenue?

Your Complete Guide to Louisiana Department of Revenue Forms

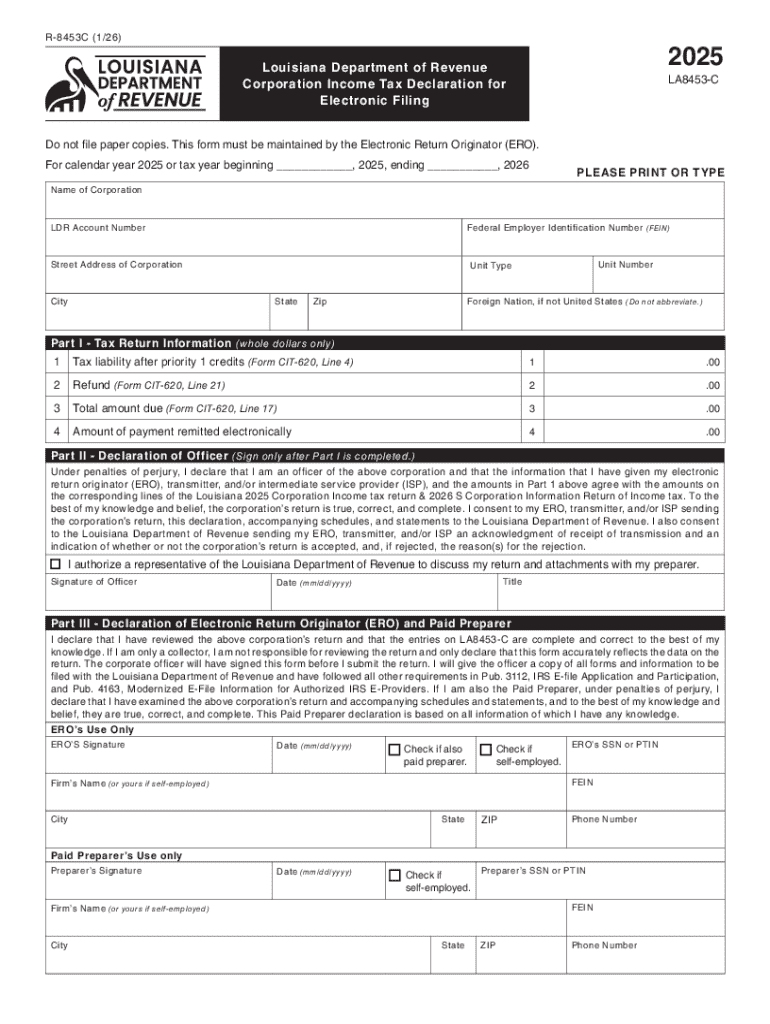

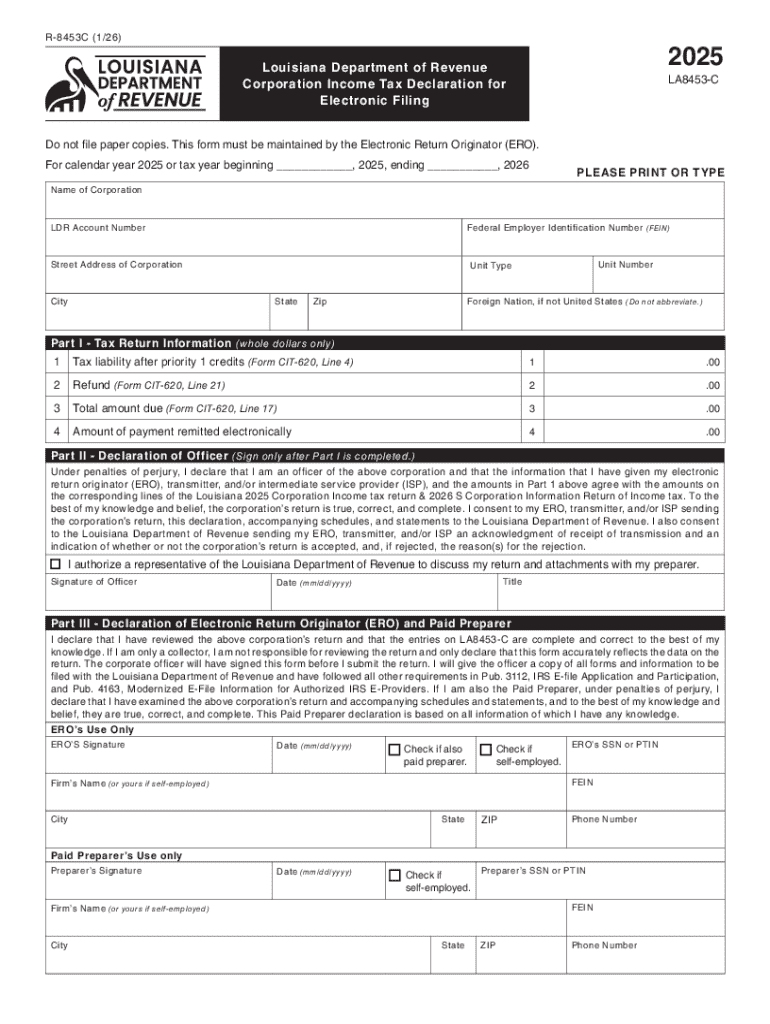

Overview of Louisiana Department of Revenue forms

Accurate submission of Louisiana Department of Revenue forms is vital for ensuring compliance with state tax regulations. These forms are not only necessary for reporting income and sales but also play a key role in determining tax liabilities and entitlements to any refunds. Understanding the various forms available can simplify the often daunting tax preparation process.

The Louisiana Department of Revenue offers a plethora of forms to cater to different taxpayers' needs. From individual income tax forms to business and corporate tax structures, these forms cover a wide array of tax situations. Gathering accurate and timely documentation can prevent common mistakes that lead to issues such as delayed refunds or penalties.

Navigating the online portal for forms

Accessing the Louisiana Department of Revenue forms online can significantly streamline the process of tax preparation. The online portal is user-friendly, allowing individuals to locate and download the necessary forms efficiently.

To log into the Louisiana Department of Revenue website, follow these steps: First, open your preferred web browser and enter the web address for the Louisiana Department of Revenue. Once on the homepage, look for the 'Forms' section. This will guide you through a series of listings for various tax forms, where you can easily search for the correct document based on your tax situation.

For additional support, utilize the interactive tools available, such as the FAQs and help pages that answer common inquiries. Furthermore, the live chat support feature provides real-time assistance for any specific issues you may encounter.

Key Louisiana forms you need to know

Several key forms are essential for taxpayers in Louisiana. Understanding each one’s purpose is critical for seamless tax filing.

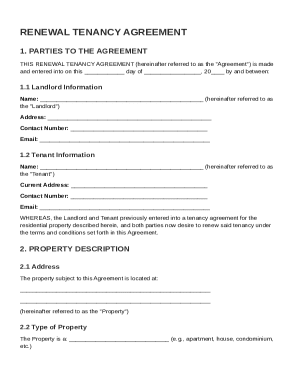

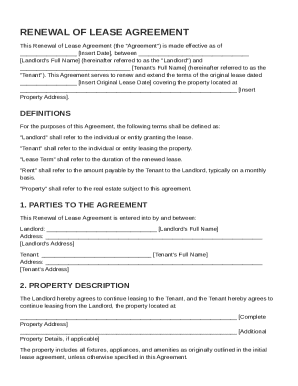

For individuals, forms like the IT-540 cater to residents filing personal income tax returns. Detailed instructions are provided on the form, making it essential to read thoroughly before proceeding. Business owners in Louisiana should familiarize themselves with the CIFT-620, which is the form used for corporations to report and calculate their taxes.

Filling out Louisiana Department of Revenue forms

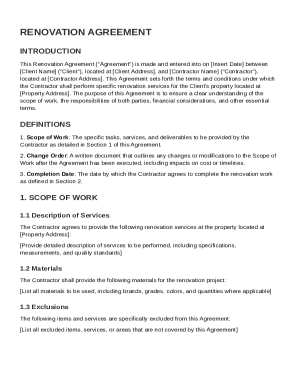

Before diving into filling out forms, ensure you gather all necessary documentation. This can include W-2s, 1099s, and any other proof of income or deductions you plan to claim. By being organized, you'll minimize errors while filling out forms.

Utilizing tools like pdfFiller can streamline the filling process of your forms. Upload your existing forms to pdfFiller, which provides an intuitive interface for editing. With pre-defined templates available, it becomes easy to fill out your documents accurately and efficiently.

The signing process: eSigning your Louisiana forms

Understanding the eSigning process is crucial as it adds an extra layer of convenience. Using pdfFiller’s eSignature feature, you can quickly sign your forms electronically, eliminating the hassle of printing and mailing. This not only speeds up your submission but also helps to ensure compliance with state requirements.

To eSign your Louisiana forms, follow these simple steps using pdfFiller’s features. First, upload your filled form onto the platform, navigate to the eSignature section, and follow the prompts to add your signature. After completing this process, your forms are ready to be submitted digitally.

Managing your Louisiana tax forms easily

Managing taxes can often feel overwhelming, but utilizing pdfFiller’s cloud-based features can simplify this task tremendously. You can share and collaborate with team members on filling out forms, ensuring everyone has access to the same information and can contribute effectively.

Additionally, pdfFiller allows you to store historically filed forms for easy access in the future. This capability not only provides peace of mind but also can help track changes and version control, reducing the likelihood of errors in future filings.

FAQs about Louisiana Department of Revenue forms

Many users have questions when it comes to filling out Louisiana Department of Revenue forms. Common queries include understanding if forms are filled out correctly and the repercussions of submitting incorrect forms.

If you're uncertain about whether you filled out your form correctly, reviewing the provided instructions or consulting someone familiar with tax practices in Louisiana can help clarify. If you submit the wrong form, it's crucial to act quickly to rectify the mistake, potentially filing an amended return or providing the correct documentation to the department.

State specific considerations

Louisiana tax law has unique aspects that may affect your form submissions. Familiarizing yourself with these idiosyncrasies can save time and hassle during the filing season.

For instance, knowing critical deadlines to submit forms can avoid penalties. Louisiana typically requires that individual income tax returns be filed by May 15, with specific extensions available for businesses. Keeping track of these dates is pivotal for ensuring compliance.

Conclusion: empowering document management with pdfFiller

In conclusion, the powerful features of pdfFiller can transform the way users handle Louisiana Department of Revenue forms. By using pdfFiller for editing, eSigning, and managing documents, individuals and teams can significantly reduce the stress associated with tax returns.

Efficient document management is key to compliance, and with resources readily available online, you'll find it easier than ever to navigate the complexities of Louisiana tax forms. Embrace the digital approach with pdfFiller to empower your workflow and simplify tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my louisiana department of revenue in Gmail?

How can I fill out louisiana department of revenue on an iOS device?

How do I complete louisiana department of revenue on an Android device?

What is louisiana department of revenue?

Who is required to file louisiana department of revenue?

How to fill out louisiana department of revenue?

What is the purpose of louisiana department of revenue?

What information must be reported on louisiana department of revenue?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.