Get the free Form N-35, Schedule D print requirements

Get, Create, Make and Sign form n-35 schedule d

How to edit form n-35 schedule d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form n-35 schedule d

How to fill out form n-35 schedule d

Who needs form n-35 schedule d?

Everything You Need to Know About Form N-35 Schedule Form

Understanding Form N-35 and its purpose

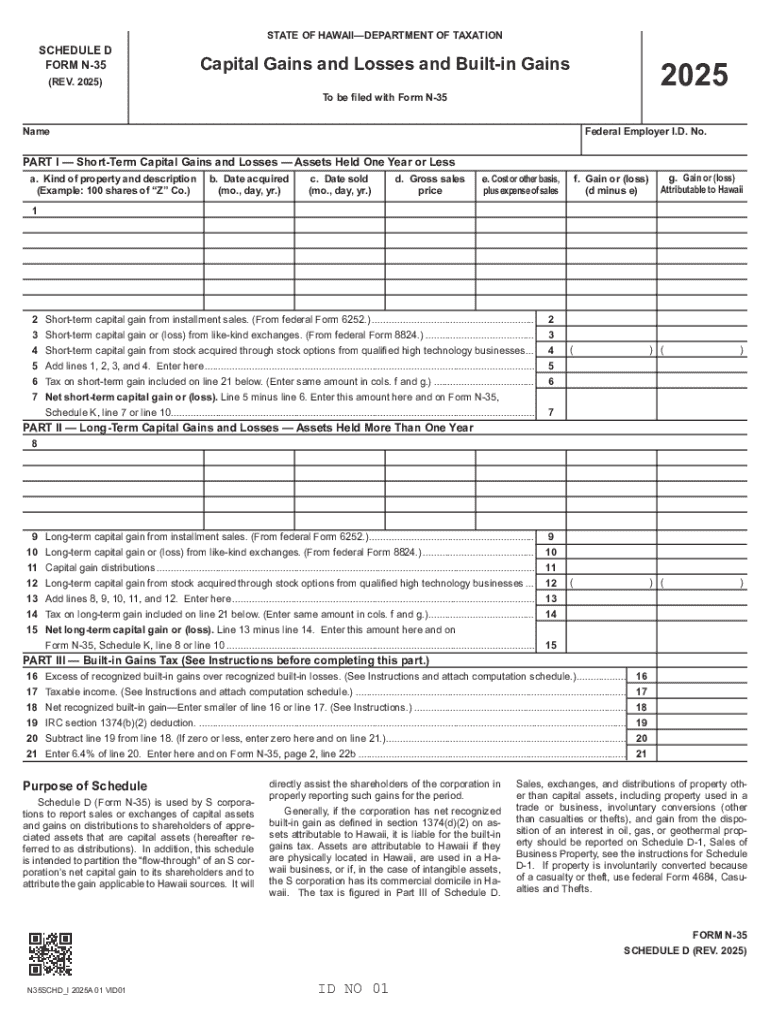

Form N-35 is a crucial document for taxpayers in certain jurisdictions, specifically designed for entities that need to report specific types of income and allowances. This form plays a significant role in ensuring that taxpayers provide comprehensive financial information to tax authorities, facilitating proper tax computation and compliance.

Unlike standard tax forms, Form N-35 goes beyond mere income reporting; it incorporates detailed data regarding allowable deductions and credits, thus impacting the overall tax liability. A deep understanding of its structure and requirements can help taxpayers avoid costly errors.

Who needs to file Form N-35?

Typically, Form N-35 is required for businesses and individuals who have specific sources of income, such as partnerships, corporations, or certain self-employed persons. Eligibility extends to anyone who has engaged in business activities that require compliance with local or federal tax regulations.

Essential components of Form N-35 Schedule

Form N-35 Schedule D consists of several sections, each with its own requirements and instructions. It's imperative to understand how each section contributes to an accurate filing. Errors can lead to penalties or audits, making it crucial to ensure accuracy at every turn.

Generally, Form N-35 will require taxpayers to report various types of income, including wages, interests, dividends, and business profits. The amount of detail required can vary significantly based on the complexity of the individual’s or business's financial situation.

Step-by-step guide to filling out Form N-35 Schedule

Filling out Form N-35 Schedule D requires careful preparation and meticulous attention to detail. Begin by gathering all necessary documents that pertain to your financial activities throughout the year.

Here’s how to organize your paperwork effectively before diving into the form:

To fill out the form, you will go through multiple sections, beginning with Section 1, where you enter basic information like your name and tax identification number. Ensuring accuracy in this segment sets the foundation for the following sections.

Then, in Section 2, you will report your income. Common pitfalls at this stage include miscalculating totals from multiple income sources or forgetting to include some black or passive income. Regularly referencing your income documentation can aid in mitigating these errors.

When reaching Section 3, focus on deductions and credits. Identify which deductions you qualify for, such as business-related expenses or education credits. Properly documenting these can significantly lower your taxable income. Before submitting, Section 4 serves as your final checkpoint—review each entry for accuracy and completeness to avoid unnecessary audits or corrections.

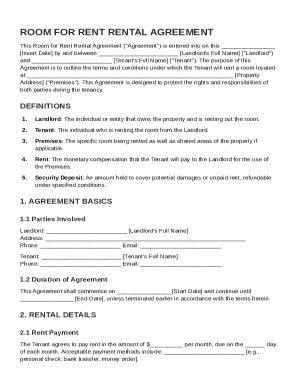

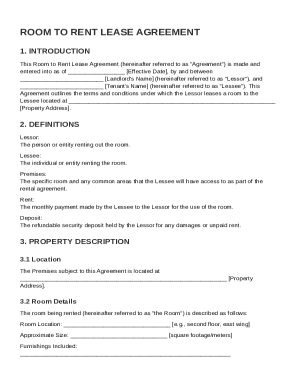

How to edit and sign your Form N-35 with pdfFiller

Using pdfFiller streamlines the process of editing and signing your Form N-35. The platform is designed for user-friendliness, offering essential tools to enhance your document preparation experience.

To begin, access pdfFiller and upload your completed Form N-35. The editing features allow you to modify any part of the form easily. This digital platform provides tools such as a text editor, checkbox for submitting, and the ability for real-time revisions.

The eSigning process is straightforward; simply drag your signature to the designated area and confirm its placement. Notably, eSignatures hold legal validity, allowing you to submit Form N-35 confidently.

Submitting your Form N-35 Schedule

Once your Form N-35 is complete and signed, it’s time to submit. Depending on your jurisdiction, you may have the option to file electronically or mail a physical copy. Each method has advantages, so familiarity with your specific requirements is essential.

To submit electronically, navigate to the designated tax authority website and follow the prompts to upload your document securely. Ensure that you keep digital copies or screenshots confirming that you’ve submitted your form to maintain a record in case of inquiries.

Common mistakes to avoid when filing Form N-35

Filing Form N-35 can be complex, and many people fall into traps that lead to submission errors. Some of the most frequent mistakes involve reporting inaccuracies and incomplete documentation.

Misreporting income is a common error—taxpayers often neglect to include all sources of income or miscalculate totals. Additionally, missing required documentation can cause delays or result in rejected submissions. Always double-check to ensure that you have included all necessary financial statements.

Frequently asked questions about Form N-35 Schedule

After submitting Form N-35, many individuals have questions regarding amending or correcting their filings. Understanding your options is vital for maintaining compliance.

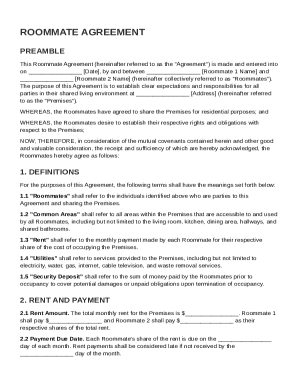

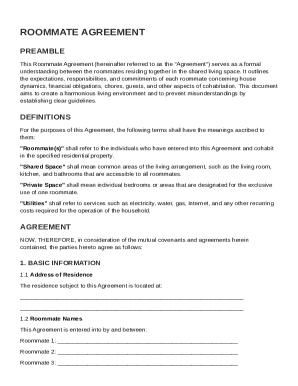

Leveraging pdfFiller for document management

Using pdfFiller for your tax forms greatly enhances document management efficiency. With features allowing you to access, edit, and share documents from anywhere with an internet connection, managing Form N-35 is easier than ever.

Beyond Form N-35, pdfFiller enables users to brainstorm, gather signatures, and collaborate on various other forms securely in the cloud, ensuring you have organized access whenever you need it.

Conclusion of the filing process

Navigating through the intricacies of Form N-35 is vital for compliance with tax regulations. Following accurate guidelines and being informed about tax deadlines will not only help in avoiding potential penalties but also contribute positively to your financial management.

As tax regulations can change, staying updated and using reliable platforms like pdfFiller for managing your forms can provide peace of mind and efficiency in the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form n-35 schedule d form on my smartphone?

Can I edit form n-35 schedule d on an iOS device?

How do I complete form n-35 schedule d on an iOS device?

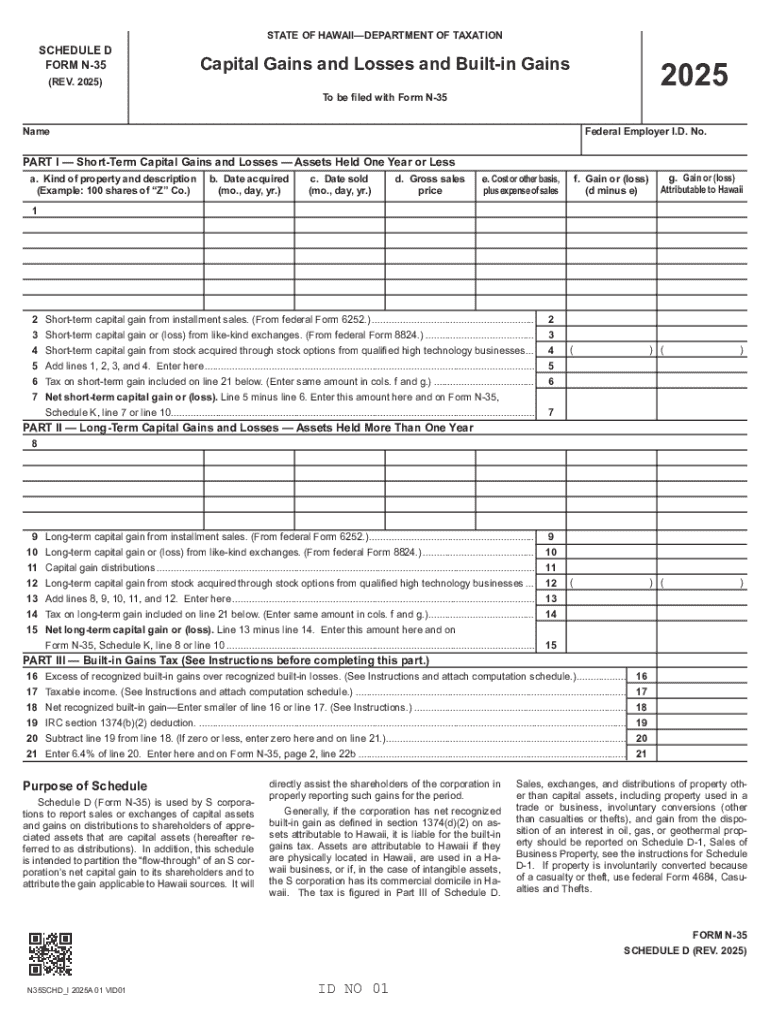

What is form n-35 schedule d?

Who is required to file form n-35 schedule d?

How to fill out form n-35 schedule d?

What is the purpose of form n-35 schedule d?

What information must be reported on form n-35 schedule d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.