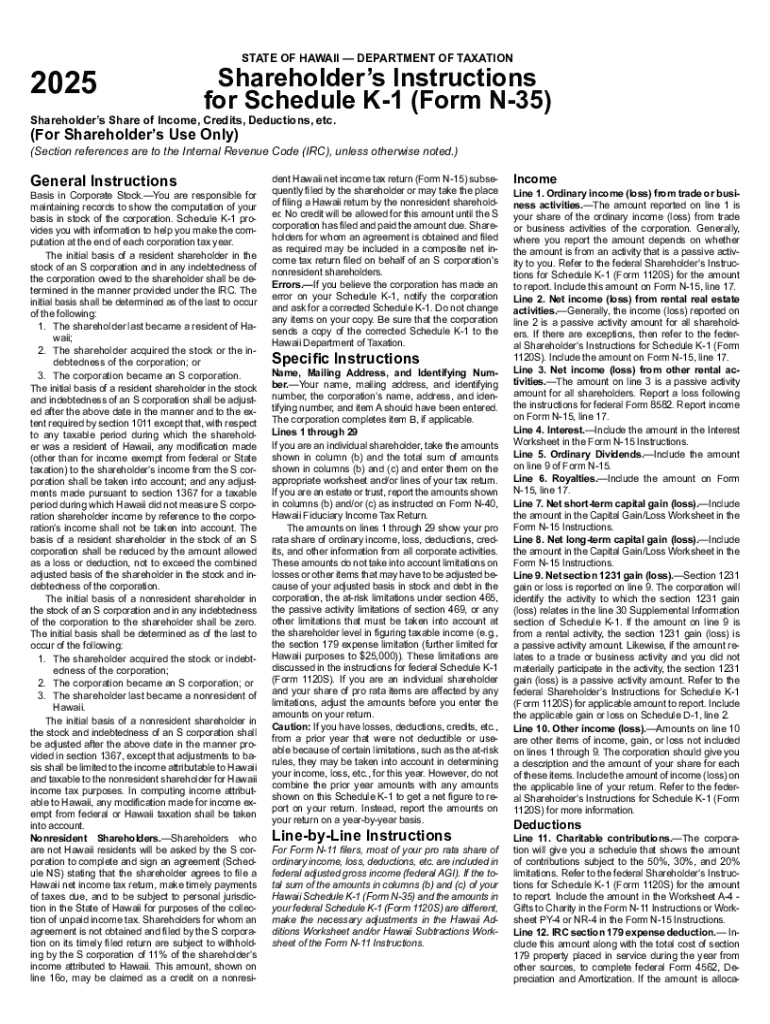

Get the free Instructions for Schedule K-1 Form N-35 Rev. 2025 Shareholder's Share of Income...

Get, Create, Make and Sign instructions for schedule k-1

How to edit instructions for schedule k-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for schedule k-1

How to fill out instructions for schedule k-1

Who needs instructions for schedule k-1?

Instructions for Schedule K-1 Form

Understanding Schedule K-1

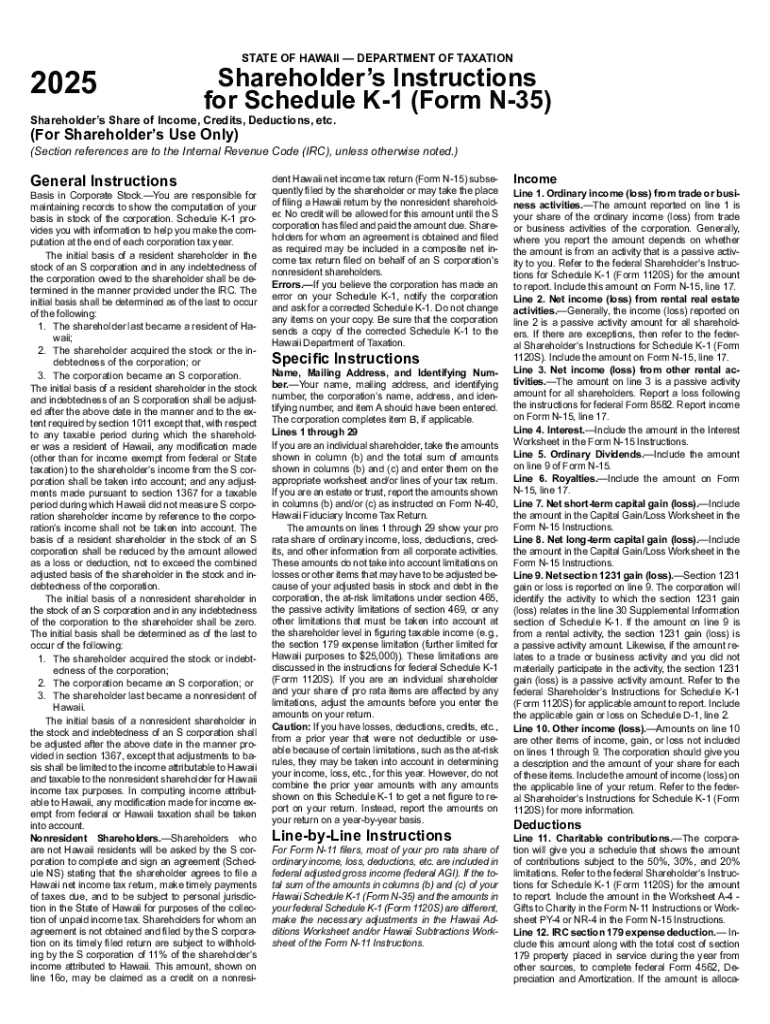

Schedule K-1 is a crucial tax document utilized in the United States to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Each Schedule K-1 form differs based on the entity type, making it essential for individuals to understand which version they are dealing with, such as Schedule K-1 (Form 1065) for partnerships, Schedule K-1 (Form 1120S) for S corporations, and Schedule K-1 (Form 1041) for estates and trusts.

These forms serve the dual purpose of informing both the taxpayer and the IRS about the income earned and taxes due from pass-through entities, meaning the entities themselves typically do not pay income taxes. Instead, the tax obligation is passed through to their owners or beneficiaries, necessitating a firm grasp of how to accurately complete and utilize these forms.

Why is Schedule K-1 Important?

Understanding the significance of Schedule K-1 is vital for taxpayers involved in partnerships, S corporations, or trusts. Each K-1 form provides essential details that personalize tax situations, reflecting unique income sources, deductions, and potential credits. By accurately reporting this information, taxpayers can navigate tax obligations efficiently.

Additionally, tax implications vary significantly depending on what a K-1 reports, making it imperative for individuals to integrate this document into their tax returns correctly. Failure to do so can result in discrepancies that may attract audit scrutiny, interest, and penalties, emphasizing the high stakes of K-1 accuracy.

Key components of Schedule K-1

A complete understanding of the structure of Schedule K-1 is crucial for effective tax filing. The K-1 generally comprises several main sections: income, deductions, and various other items. Each section provides specific types of information that taxpayers must carefully interpret and report on their tax returns.

The income section usually includes ordinary business income, rental income, guaranteed payments, and interest. The deductions part encompasses a wide range of write-offs, which might include business expenses and charitable contributions. Understanding how to navigate these sections ensures one maximizes their potential tax benefits and minimizes liabilities.

Understanding each box

Navigating the intricacies of each box on the Schedule K-1 is essential for accurate reporting. Key boxes — each labeled from 1 to 20 — capture different types of information. Understanding common entries can help prevent errors when completing tax returns.

For example, Box 1 typically reports ordinary business income, while Box 2 accounts for net rental income. Understanding variations in these entries allows taxpayers to align their reported K-1 income with their corresponding line items on their Form 1040 effectively.

Step-by-step instructions for filling out Schedule K-1

Before tackling the form, gather personal information, including Social Security numbers, the entity's details, and previous tax returns. Familiarizing yourself with the required documents, such as your and the entity’s financial statements and tax records, is essential. When starting the filling process, a systematic approach is advisable.

Begin by accurately entering identifiable information at the top part of the form. Follow this by systematically filling out income, deductions, and other items, paying close attention to the details in the corresponding boxes. Double-checking entries helps to mitigate errors, ultimately saving you from potential tax issues.

Using Schedule K-1 for tax filing

Incorporating Schedule K-1 into your tax return is paramount for correctly reporting income from multiple sources. When filling out your personal tax return (Form 1040), the numbers reported on Schedule K-1 flow into specific lines, such as the Individual Income Tax Return sections for business income or dividends.

For efficient integration, many tax filing software platforms now accommodate Schedule K-1 entries directly, helping streamline the entire process. This integration not only simplifies calculations but also eases the overall preparation of tax documents by reducing the manual data entry workload.

Dealing with multiple K-1s

For individuals receiving multiple Schedule K-1 forms, organization and tracking become paramount. Each K-1 pertains to a unique income source, necessitating careful record-keeping to ensure accuracy and mitigate reporting errors. It is advisable to keep a master list that details each K-1’s origin, income reported, and relevant tax implications.

This organization not only facilitates accurate reporting but also simplifies the process of filling out taxes, as it provides a single reference for all income sources and taxes owed, thus streamlining tax preparation significantly.

Common challenges when working with Schedule K-1

Common pitfalls related to Schedule K-1 include misunderstanding box entries, misreporting income, or failure to include all K-1 forms received. These misunderstandings can arise from the complexity of the tax system and the varied formats of K-1s according to different entity types, causing frustration for even seasoned taxpayers.

To mitigate these challenges, familiarizing oneself with typical questions and answers, including clarifications on any tax law changes affecting K-1 reporting, is beneficial. Proactive research can save time and reduce errors during the tax preparation process.

Dealing with errors on your Schedule K-1

If inaccuracies are identified on a Schedule K-1, it is crucial to take immediate corrective action. Start by contacting the entity that issued the K-1 to request a corrected version. This may involve providing documentation or explanations of the discrepancy.

Once a corrected K-1 is obtained, it is essential to revise your tax return to accurately reflect the updated information. This process can be simplified by utilizing pdfFiller's tools, which allow easy editing and filing of the updated tax documents.

Interactive tools and additional features

Utilizing pdfFiller's document management tools can significantly streamline the process of filling out a Schedule K-1. Their user-friendly interface allows individuals to enter data directly into PDFs, digitally sign documents, and share completed forms with tax professionals for review.

Collaboration features within pdfFiller enable users to manage tax documentation seamlessly, allowing easy sharing and feedback from accountants or tax advisors. This ensures that any issues can be resolved swiftly and accurately, maintaining compliance with tax regulations.

Conclusion: simplifying your Schedule K-1 filing experience

In summary, understanding and accurately completing Schedule K-1 forms is essential for any taxpayer involved in partnerships, S corporations, or trusts. Highlighting the importance of precision can help avoid common pitfalls, allowing taxpayers to benefit from their share of income, deductions, and credits without prospective tax issues.

Continuing to learn and utilize tools like pdfFiller for document management can further simplify this process. By embracing technology and being thorough in your approach, tax filing can transition from being a stressful task to a manageable one.

Additional support and resources

Taxpayers can access resources to download Schedule K-1 templates directly from the IRS website, which offers guidance on filling them out accurately. pdfFiller's customer support can assist with any document troubleshooting, ensuring users have the necessary support to manage their tax forms efficiently.

Exploring related tax forms, guides, and enhancements through pdfFiller allows users to stay informed on any updates or changes in tax law that could affect their filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the instructions for schedule k-1 electronically in Chrome?

How do I edit instructions for schedule k-1 on an iOS device?

How do I complete instructions for schedule k-1 on an Android device?

What is instructions for schedule k-1?

Who is required to file instructions for schedule k-1?

How to fill out instructions for schedule k-1?

What is the purpose of instructions for schedule k-1?

What information must be reported on instructions for schedule k-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.