Get the free Instructions for Form 990-PF (2025)

Get, Create, Make and Sign instructions for form 990-pf

Editing instructions for form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 990-pf

How to fill out instructions for form 990-pf

Who needs instructions for form 990-pf?

Instructions for Form 990-PF: A Comprehensive Guide

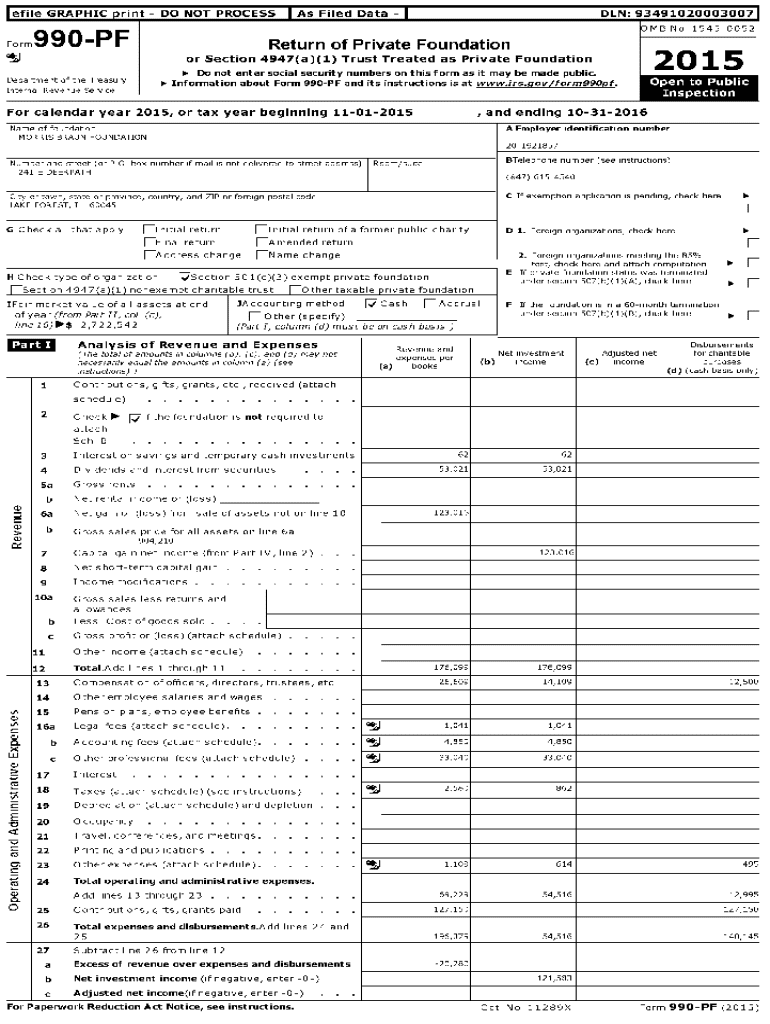

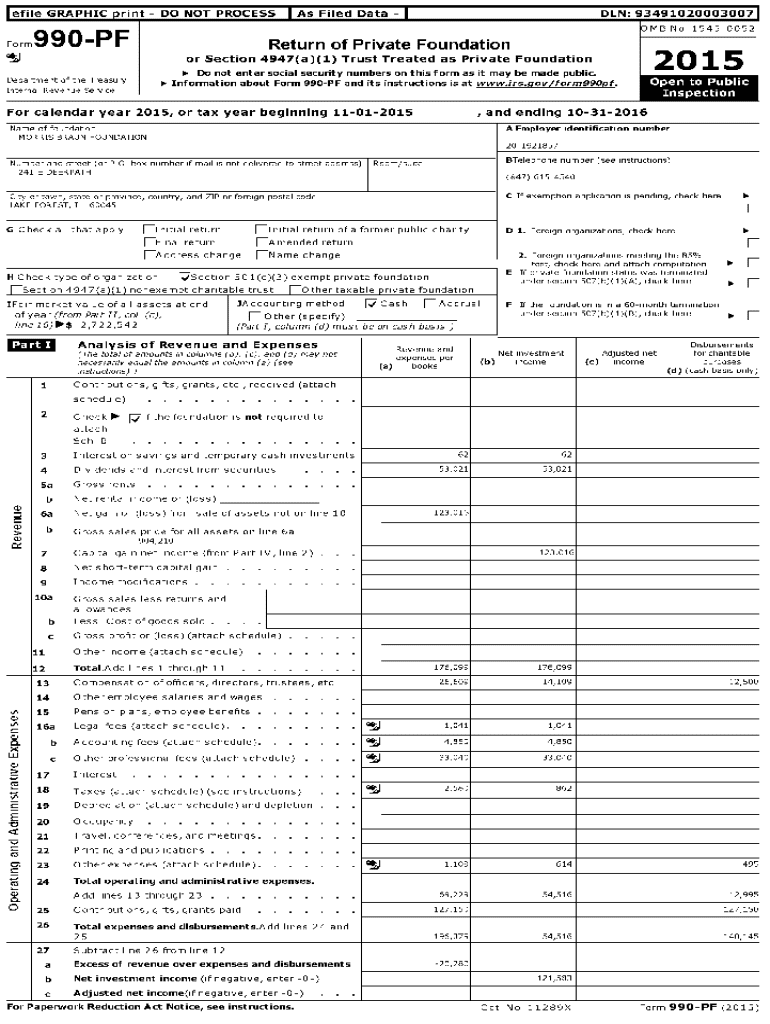

Understanding Form 990-PF

Form 990-PF is specifically designed for private foundations to report their financial activities to the Internal Revenue Service (IRS). This form serves as a critical tool that enhances the public's understanding of a foundation's operations, including its sources of income and types of expenditures. Unlike other IRS forms, which may pertain to different types of nonprofits or businesses, Form 990-PF encompasses unique requirements tailored for private foundations.

Filing this form accurately is not merely a matter of compliance; it is essential for maintaining trust with the public, donors, and beneficiaries. Failure to submit Form 990-PF can significantly harm a foundation's reputation and lead to penalties or even a loss of tax-exempt status. Thus, meticulous attention to detail in completing this form is not only advisable but necessary.

Key components of Form 990-PF

Understanding the key components of Form 990-PF is vital for effective completion. The form is divided into various sections, each serving a unique purpose in detailing a private foundation's activities and financial health. The main sections include:

Key terms such as ‘qualifying distributions’ and ‘unrelated business income’ are essential to grasp. A qualifying distribution refers to the funds a foundation must distribute for charitable purposes within a given year, whereas unrelated business income may be taxable and requires special reporting.

Step-by-step instructions to complete Form 990-PF

Filling out Form 990-PF can seem daunting. However, with careful preparation and an organized approach, the process is manageable. Here's a step-by-step guide.

Start with a preparation checklist to ensure you have all necessary documents at hand, such as financial statements and prior IRS filings. Establish a timeline to keep the filing process on track, ideally completing the form well ahead of the deadline.

Common mistakes often include overstating expenses or misclassifying distributions, which can lead to penalties from the IRS. Attention to detail is crucial here.

Interactive tools to assist with Form 990-PF

Utilizing tools like pdfFiller can significantly streamline the completion of Form 990-PF. With features specifically designed for easy filling, users can edit PDFs directly within their web browsers, ensuring efficiency and accuracy throughout the process.

Collaboration features enhance teamwork by allowing multiple team members to access, review, and comment on the document simultaneously, thereby reducing errors and improving efficiency.

Filing requirements for Form 990-PF

Determining the filing requirements is essential for compliance. The due date for Form 990-PF is generally May 15th following the end of the foundation's fiscal year. Filing late can result in penalties, which can accumulate quickly if not addressed.

Foundations can file Form 990-PF electronically or through traditional paper submissions. Each method has its advantages, but electronic filing is encouraged due to expediency and reduced chance for manual errors.

Frequently asked questions about Form 990-PF

Many queries arise regarding Form 990-PF, especially concerning deadlines and amendments. If you miss the filing deadline, it’s imperative to file as soon as possible to minimize penalties. Extensions can be requested, but the foundation must still pay any taxes owed.

Handling amendments is also a common concern. If errors are found after submission, it is necessary to file an amended form with corrections. Up-to-date IRS guidelines can help you navigate these changes effectively.

Effective management of your 990-PF filings

Best practices for record-keeping are crucial for organizations managing Form 990-PF. Maintaining detailed financial records and logs of all significant transactions can safeguard against the risk of audits and potential penalties.

Utilizing tools offered by pdfFiller for ongoing document management is a strategic way to enhance organizational efficiency. Cloud storage allows easy access to essential documents, and customizable forms can be reused for future filings.

How pdfFiller simplifies your Form 990-PF experience

pdfFiller provides significant advantages for individuals and teams looking to streamline their Form 990-PF filing process. With intuitive user interfaces and features designed explicitly for private foundations, users can expect seamless edits, quick turnaround times, and a collaborative environment that promotes efficiency.

Customer testimonials highlight the positive impact pdfFiller has had on clients' filing efficiency, showcasing improved document management and reduced stress during the tax filing season.

Looking ahead: Changes to Form 990-PF for 2025

Staying informed about potential changes to Form 990-PF is crucial for foundations. Anticipated updates in 2025 may include revisions to reporting requirements or additional schedules for enhanced transparency.

To prepare for these changes, foundations should reevaluate their reporting procedures regularly and incorporate feedback about compliance and accuracy in the tax filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit instructions for form 990-pf from Google Drive?

How do I execute instructions for form 990-pf online?

Can I create an electronic signature for the instructions for form 990-pf in Chrome?

What is instructions for form 990-pf?

Who is required to file instructions for form 990-pf?

How to fill out instructions for form 990-pf?

What is the purpose of instructions for form 990-pf?

What information must be reported on instructions for form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.