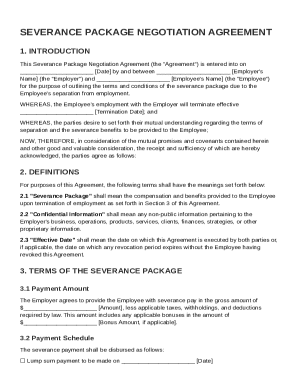

Get the free ***If filing jointly, both spouses need to be present to sign ...

Get, Create, Make and Sign if filing jointly both

How to edit if filing jointly both online

Uncompromising security for your PDF editing and eSignature needs

How to fill out if filing jointly both

How to fill out if filing jointly both

Who needs if filing jointly both?

If filing jointly both form: A comprehensive guide for couples

Understanding the married filing jointly status

Married Filing Jointly (MFJ) is a popular tax status chosen by many couples during tax season. This filing status allows spouses to combine their income and expenses, submitting a single tax return. With MFJ, couples can benefit from potentially lower tax rates and higher income thresholds compared to those who file separately. This combined approach can lead to significant tax savings, making it an advantageous choice for most married couples.

The primary benefits of choosing the MFJ status include lower tax rates, which are particularly appealing for couples whose combined income may push them into a higher tax bracket if filing separately. Furthermore, couples filing jointly can qualify for various tax credits and deductions, which can further reduce taxable income. This makes MFJ not just a status but a strategic financial decision.

Eligibility criteria for married filing jointly

To file as married filing jointly, couples must meet certain eligibility criteria. They must be legally married under state law as of the last day of the tax year. This status can be beneficial for heterosexual as well as same-sex couples. Common scenarios where couples can file jointly include those who were married throughout the tax year or those who were married on the last day of the tax year.

Interestingly, couples can also file jointly even if one spouse has no income. Similarly, couples in civil unions are also eligible to file jointly, depending on the state laws. However, it’s essential to note that if one spouse is subject to certain legal obligations, like tax liens or prior debts, it might not be in the couple's best interest to file jointly.

The process of filing jointly: Step-by-step

Filing your taxes jointly doesn't have to be a daunting task. Here’s a step-by-step guide to navigate through the process seamlessly.

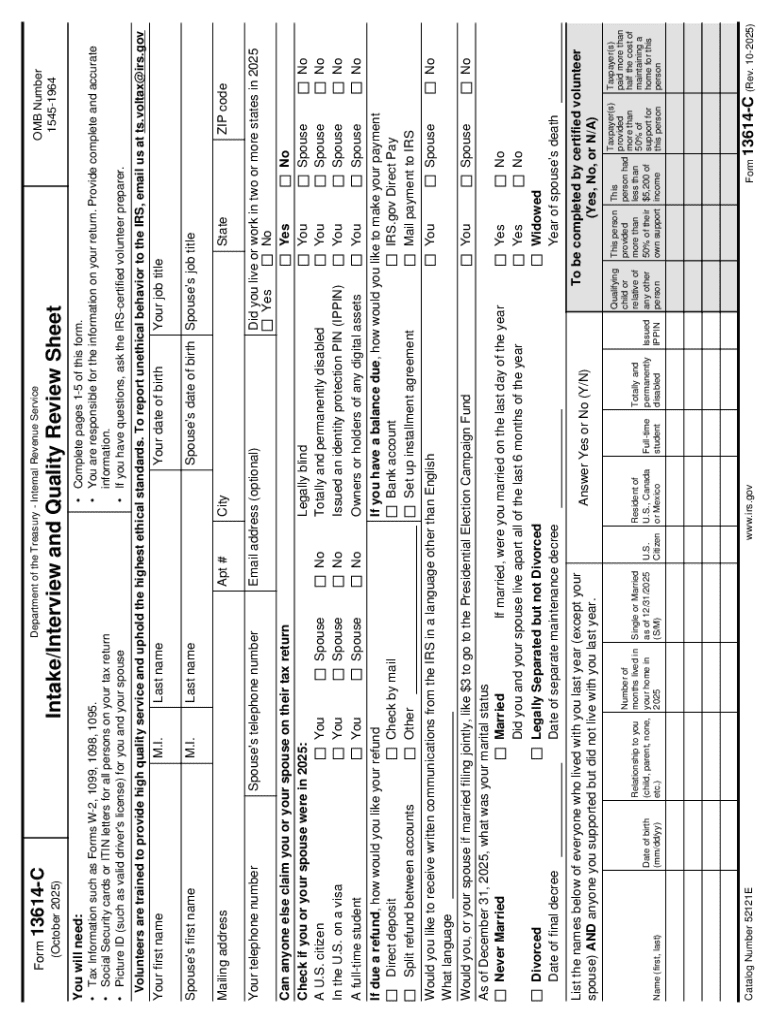

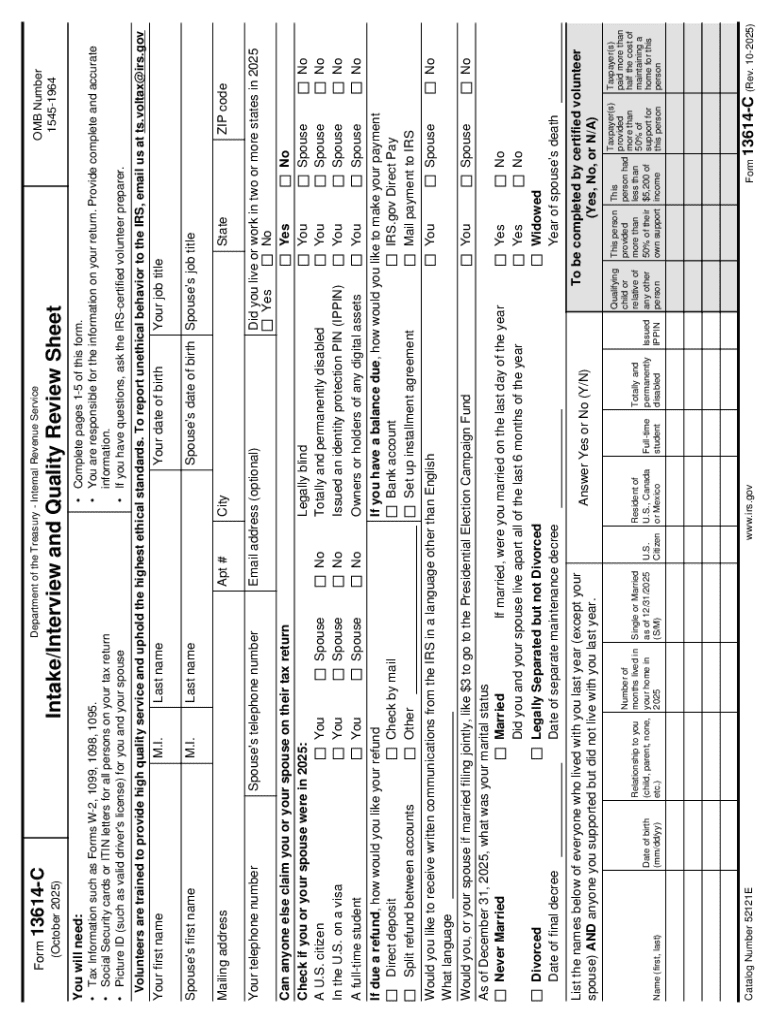

Forms required for married filing jointly

When filing jointly, there are several essential forms that you’ll need to complete. The primary form is the IRS Form 1040, which is the Individual Income Tax Return. Additionally, depending on your financial situation, you may also need to fill out other forms like Schedule A for itemized deductions and Schedule B for reporting interest and ordinary dividends. Having all these forms completed and ready is crucial for an accurate filing.

For convenient access to these forms, consider using pdfFiller. The platform allows users to manage their tax documents effortlessly, including filling out, editing, signing, and sharing these necessary files securely.

Key tax credits and deductions available

Filing jointly opens the door to various tax credits and deductions that can significantly reduce your taxable income. The Child Tax Credit, for example, can provide a substantial tax break for eligible families. Similarly, the Earned Income Tax Credit is a refundable credit for low to moderate-income working individuals and families.

Deductions are another vital factor to consider. Joint filers can benefit from deductions such as mortgage interest and student loan interest. Identifying what credits and deductions apply to your situation can maximize your tax savings when filing jointly.

Special considerations when filing jointly

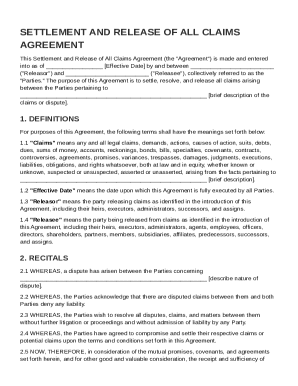

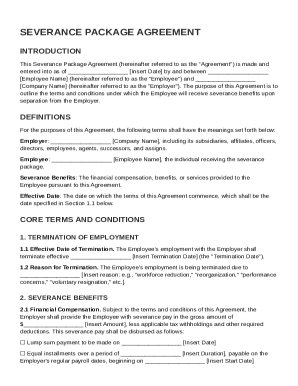

Filing jointly can have specific implications based on your financial situation. For instance, couples with significant investment income need to be cautious about how capital gains are reported. Moreover, if one spouse has unresolved tax issues, it may affect the joint filing status, resulting in potential IRS liability for both partners.

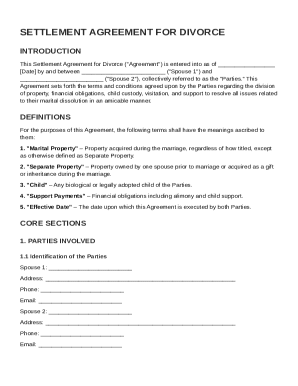

Additionally, understanding the implications of filing after marriage or even separation can be complex. For newlyweds, filing jointly can be straightforward, but separations can complicate the process depending on financial agreements and legal obligations. It’s essential to consider these factors carefully.

Common mistakes to avoid when filing jointly

Filing jointly is beneficial, but it’s essential to avoid common pitfalls. One major mistake is overlooking deductions and credits you may qualify for, which could result in overpayment of taxes. Misreporting income from separate sources is another frequent error that can lead to significant misunderstandings with the IRS.

Furthermore, incorrectly choosing between filing statuses is a common issue that could result in unfavorable tax outcomes. pdfFiller can help mitigate these mistakes by providing a user-friendly platform that guides you through the filing process, ensuring that all necessary information is accurately reported.

Tools and resources for efficient filings

Utilizing the right tools can make tax filing a breeze. With pdfFiller’s interactive tools, users can access tax calculators and estimators to help gauge their tax obligations. Document management features also allow for easy sharing and collaboration on tax-related documents.

Organizing your tax documents is crucial. Develop a system that includes categorizing income statements, deductions, and any receipts necessary for your tax return. Leveraging templates within pdfFiller can expedite the process of form completion, ensuring accuracy and compliance.

Final steps in the filing process

Before submitting your tax return, having a review checklist can be beneficial. Ensure all calculations are correct and that all required documents are included. After filing, it’s vital to keep records securely organized; best practices dictate retaining copies of tax returns and other significant documents for at least three years.

Post-filing, you can expect to receive notifications regarding your refund timeline. Utilize IRS tracking tools to monitor the status of your return, ensuring transparency in the process.

Frequently asked questions

It’s common for taxpayers to have questions about the married filing jointly status. Queries often revolve around eligibility requirements, potential pitfalls, and strategic benefits. Many find confusion around the specific forms required or the timeline for refund processing. Accessing resources that detail these concerns can provide clarity and confidence as you navigate through your tax season.

For personalized assistance, consider reaching out to tax professionals or utilizing platforms like pdfFiller that offer comprehensive guides and support tailored to users’ needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify if filing jointly both without leaving Google Drive?

How can I send if filing jointly both to be eSigned by others?

How do I fill out the if filing jointly both form on my smartphone?

What is if filing jointly both?

Who is required to file if filing jointly both?

How to fill out if filing jointly both?

What is the purpose of if filing jointly both?

What information must be reported on if filing jointly both?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.